Wanting Some Small Denomination Silver Bars?

LIMITED STOCK – Just 70 Remaining

Sunshine Mint (USA) 10oz .999 Silver Minted Bars

$266 each pick up

(Insured delivery price add $9.20 when purchasing 1-12 bars)

Note: Locally refined 10oz bars are $273.40 each – pick up

(and they are only cast versus these minted bars)

Ph 0800 888 465 or simply reply to this email to secure them

This Week:

- How Does Gold Compare to Shares For the Past 100 Years?

- Silver Flash Crash Signals Market Bottom?

- Dissent within the Fed?

- Silver + June = More Ounces for Your Currency!

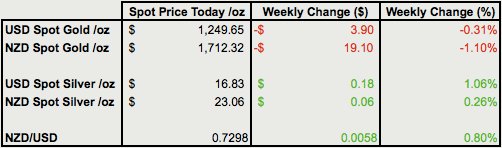

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1646 |

| Buying Back 1kg NZ Silver 999 Purity | $703 |

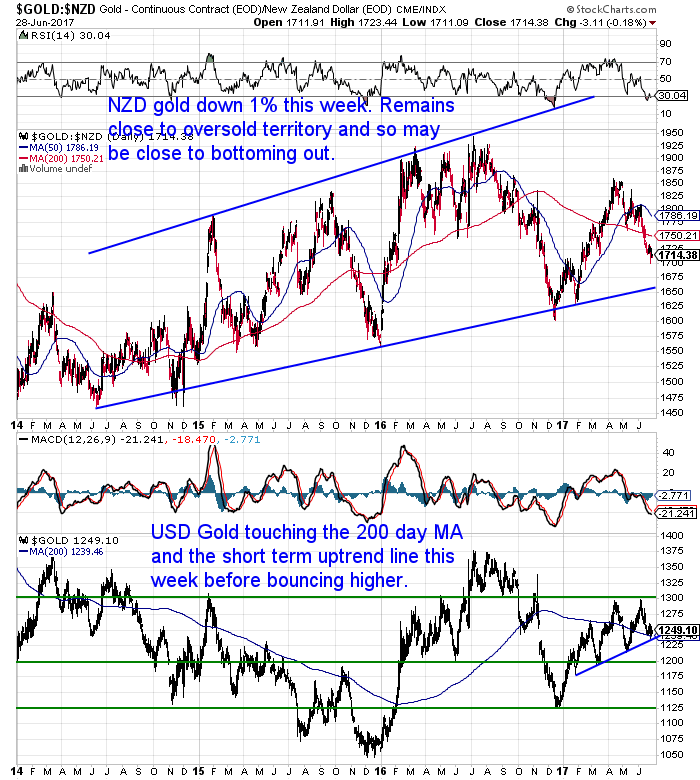

Gold Down – But Silver Up – Just

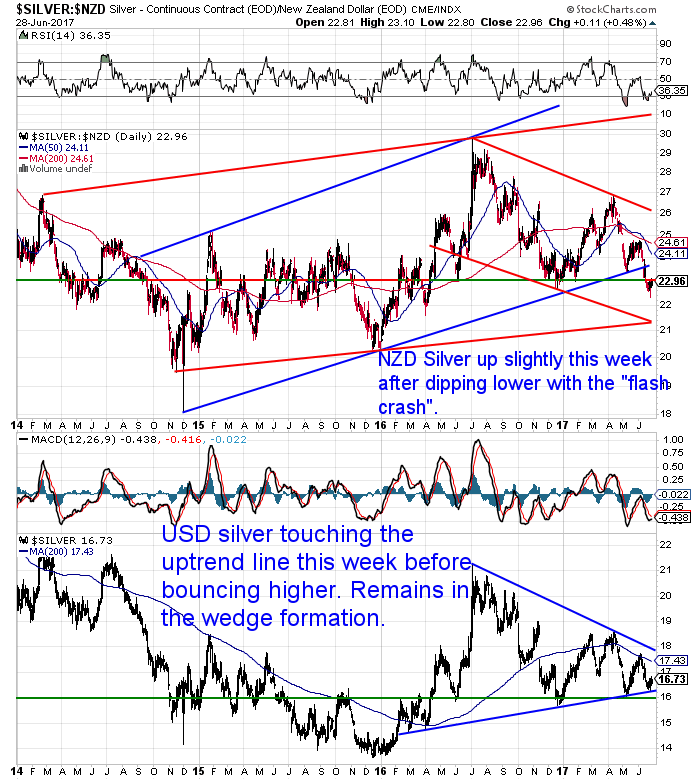

Silver Flash Crash Signals Market Bottom?

How Does Gold Compare to Shares For the Past 100 Years?

- That shares outperformed gold over the last 100 years.

- But why perhaps you shouldn’t simply compare shares/stocks to gold over a long period of time and then use this as an argument not to buy gold

How Does Gold Compare to Shares For the Past 100 Years?

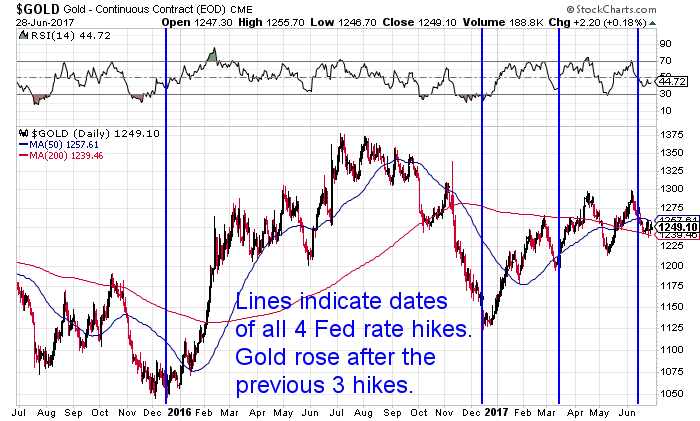

Dissent within the Fed?

“Now, what happened last week that’s so pivotal?

What happened was that the opposition to more tightening broke out in open revolt.

Charles Evans of the Chicago Fed and other prominent commentators like Larry Summers said that a rate hike in September would be a huge mistake. (There’s a Fed meeting in late July, but no one expects a rate hike then.)

These voices were added to earlier opposition from Fed Gov. Lael Brainard, who gave a speech on May 30 saying she was a yes vote for the recent June rate hike but is a likely no vote in September.

Why the opposition to tightening all of a sudden, and what does this have to do with gold?

Again, the reason for the opposition is that disinflation, one of our model pause factors, has returned with a vengeance. Both actual inflation and inflationary expectations are plunging. The global economy is slowing perceptibly.

The disinflation is coming from the prior Fed rate hikes going back to last December. One more rate hike this September would be suicidal for economic growth. We’re likely headed to a recession by late summer anyway. The Fed is poised to make things worse. That’s why they’ll eventually change course and not raise rates in September.

Once that message gets out, gold prices will soar.

Forward guidance about no rate hikes is a form of ease, which will weaken the dollar and send commodity prices and the dollar price of gold much higher.

Gold has been performing well against the head winds of higher rates. Once the head winds turn to tail winds, gold will be like a thoroughbred in the paddock when the bell sounds and the paddock gate springs open. “They’re off!!”

I expect gold to win the race against all other forms of money.”

Silver + June = More Ounces for Your Currency!

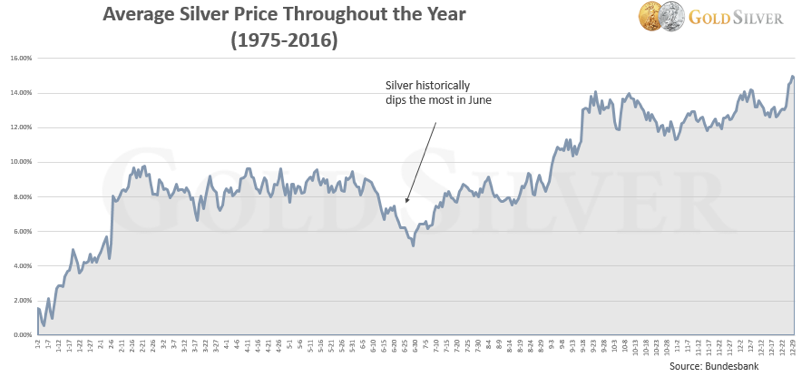

“The official beginning of summer occurs in mid to late June every year (this year it was June 21), and you can see that is when silver historically has its biggest dip of the year. There are always exceptions, but 41 years of data says we shouldn’t be surprised to see silver sell off this month.

What this means is that other than January, the best time of the year to buy silver is in June.

In other words, now. Yes, today. As in, log on now or pick up phone and buy some silver.

If you don’t, history says you will likely pay a higher price later.

Of course, any correction is a buying opportunity if you don’t have enough bullion to offset an economic or monetary crisis. In that type of environment—and one we think is inevitable—physical gold and silver are one of the few assets that will prevail.

2016 Perth Mint Silver Kangaroos 9999 purity

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

This Weeks Articles: |

|||

|

|||

|

|||

|

|||

|

|||

|

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.