2 SILVER SPECIALS TODAY

Wanting Some Great Value Minted Silver Bars?

LIMITED STOCK – Just 14 RemainingSunshine Minting (USA) 100oz .999 Silver Minted Bars

$2503 each pick up (Insured delivery price add $9.20 per 100oz bar) Note: Compare to locally refined cast 100oz bars at $2483 each – pick up

Ph 0800 888 465 or simply reply to this email to secure them

Ph 0800 888 465 or simply reply to this email to secure them

SILVER COIN SPECIAL TODAY

1oz Perth Mint Silver Kangaroos 2016 BU (Brilliant Uncirculated) Minimum order 500 coins

500 x 1oz Perth Mint 2016 Silver Kangaroos are $13,250 ($26.40 per coin)

– $200 cheaper than 500 Silver Maples1000 x 1oz Perth Mint 2016 Silver Kangaroos are $25,900 ($25.90 per coin)- $500 cheaper than 1000 Silver Maples

5000 x 1oz Perth Mint 2016 Silver Kangaroos are $128,000 ($25.60 per coin)Bonus for 1000 coins or more – more details further down.

(Price includes fully insured delivery via Fed Ex directly to you anywhere in New Zealand or Australia.)

Get a Huge Vehicle Survival Pack Valued at $304 for Free

Free with any order of 1000 or more 1oz Silver Kangaroo coins.

This subscriber only deal (it’s not mentioned anywhere on the website) contains enough gear to spread across 2 vehicles. The pack includes:

- 2 x Inflatable Solar Lanterns

- 2 x 3-in-1 Car Escape Tools

- 2 x Credit Card Knives

- 2 x Credit Card Multi-tools

- 1 x Car Glove Box Survival Kit

- 1 x Vehicle First Aid Kit with Fire Extinguisher

Call David on 0800 888 465 to learn more about this deal or just reply to this email. Note: Minimum order is 500 coins.

This Week:

- How to Create More Freedom Now With These Three Steps

- 4 Reasons You Should Store Some Precious Metals Outside of New Zealand

- Has Peak Silver Arrived?

- Visa Ups the War on Cash + How Governments Can Kill Cash

- What Are Gold and Silver Futures Positions Telling Us Currently?

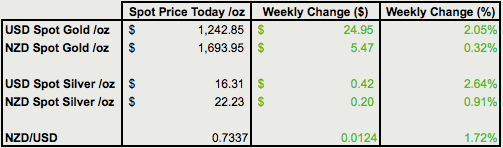

Prices and Charts

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1625 |

| Buying Back 1kg NZ Silver 999 Purity | $675 |

Both Metals Up But So is the NZ Dollar

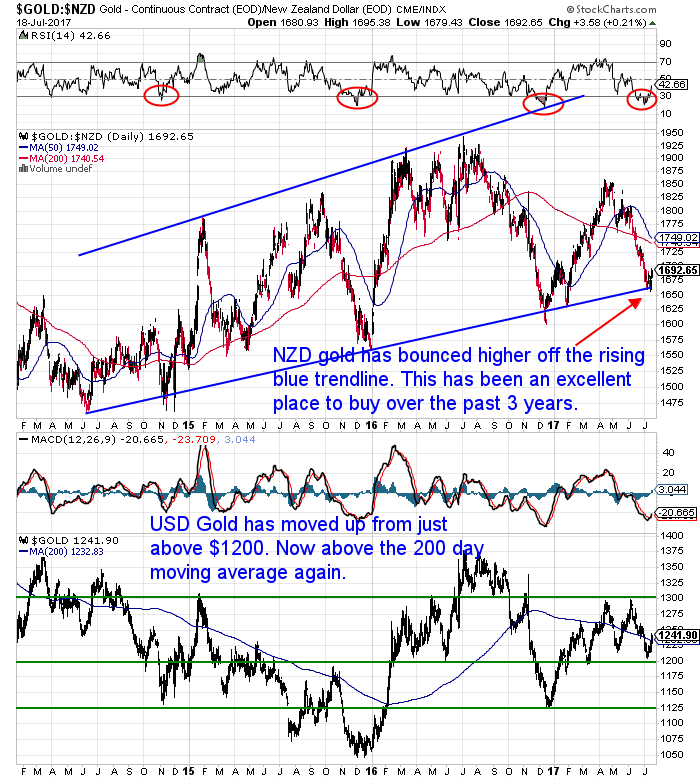

Gold in NZ Dollars has moved a little higher this week. Looks to have once again bounced off the long term rising blue trendline.

As we mentioned last week when the RSI gets very oversold as it just did, this has coincided with a bottom being formed multiple times over the past few years. See the red circles in the chart below. There’s every chance this is happening again.

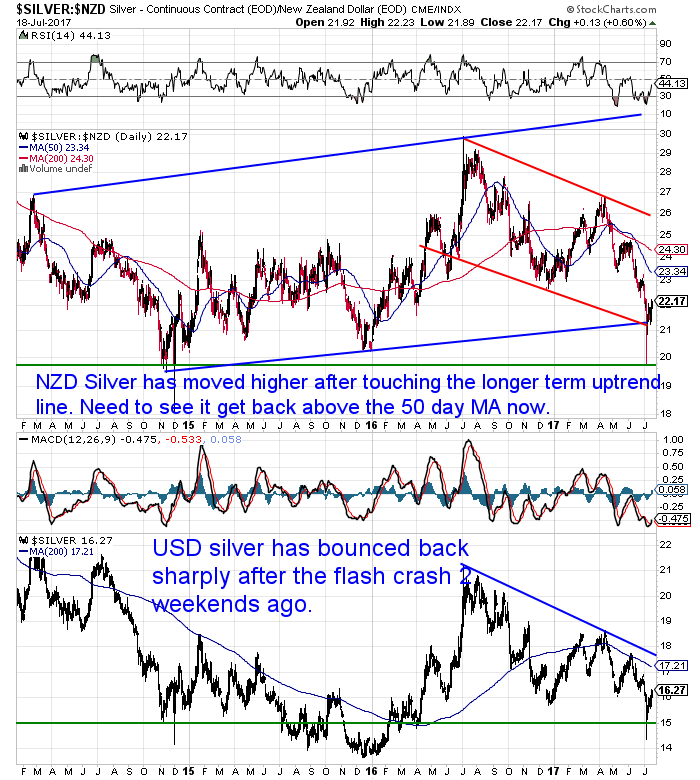

NZD silver also looks to have bounced up off the rising blue long term trendline. Plus also off the red short term downtrend line. We now need to see it rally back above the 50 day moving average (MA) line.

The Kiwi dollar has definitely stunted the rise of local gold and silver prices this week. The NZ dollar is up a hefty 1.72% this week.

(Looking to buy currently? Sign up here for our daily price alert to stay up to date on the day to day movements in both metals and get the best entry point.)

This rise in the Kiwi Dollar came after US Central Bank head Janet Yellen alluded to the pace of further US interest rate rises not being as steady as most traders would have thought. So sell the US dollar, buy other currencies like the Kiwi.

What is the Fed up to? Jim Rickards explained in an email earlier today:

“In past business cycles, the Fed would tighten until the economy cooled or went into a recession because the Fed tightened too much. Then the Fed would ease until the economy came out of its funk and started to grow and create jobs.

The point is that the easing and tightening cycles were continual and were based on the business cycle. There were no flip-flops.

What’s different this time is that the Fed is dancing on a knife edge between preventing the next recession and being the cause of one. The Fed is not raising rates as part of a normal business cycle associated with an overly strong economy.

The Fed is raising rates in a desperate attempt to get them high enough (to around 3.25%) so they can cut them in the next recession without hitting the “zero lower bound.”

The trick is to raise rates in a weak economy without causing the recession you are preparing to cure. That’s what accounts for the easing by pauses and forward guidance.”

So as a result the NZ dollar could quite conceivably move higher from here and challenge the 0.74 level. However bear in mind that this change of “forward guidance” from the US Fed head is also likely to be gold and silver positive.

Back to Rickards:

“In short, growth is weak, inflation is weak, retail sales and real incomes are weak, labor force participation is low and stocks are at all-time highs. Brainard and Yellen made it clear that the Fed will continue to tighten through balance sheet reductions even if rate hikes are on hold.

Tight money, a weak economy, and a stock market bubble is a classic recipe for a stock market crash. It’s time for investors to go into a defensive crouch by selling stocks and reallocating assets to cash, Treasury notes, gold and gold mining shares.

In particular, gold will be the big winner when the Fed suddenly realizes its blunder and has to pivot quickly to ease, probably by late summer. The time to position in gold is right now.”

Therefore we may see the NZ Dollar rising but precious metals prices also rising. The upshot may be that local gold and silver prices rise but in percentage terms just not as much as the commonly reported US Dollar gold and silver prices.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

What Are Gold and Silver Futures Positions Telling Us Currently?

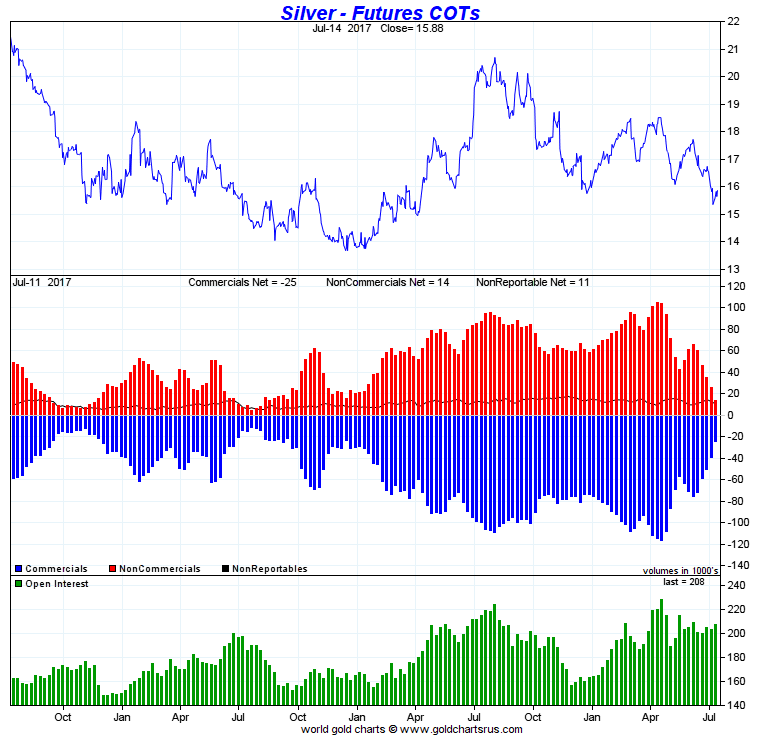

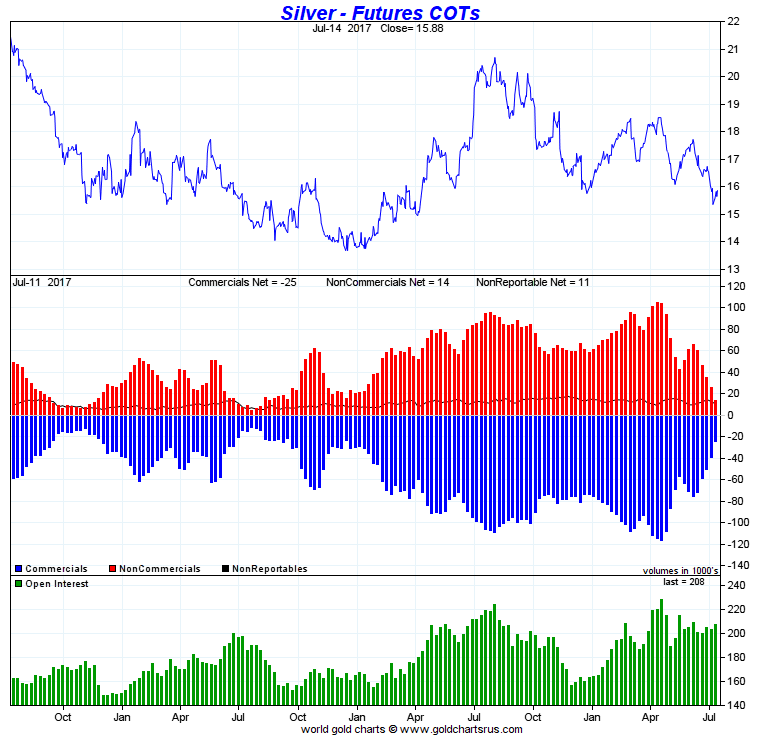

Adrian Ash commented earlier this week, that the futures traders who are usually wrong at the extremes, look to be positioned that way again following Yellen’s remarks:

“…on the latest data, the so-called ‘Managed Money’ category of Comex traders was net short overall last week on record-high bearish bets.

This is the first time the hot-money was overall bearish on silver since August 2015.

More telling still, there were more speculative bears on Comex silver contracts than bulls last week…in this instance for the first time since December 2015.

Might these guys be right? Well, they held a record-high bullish position on Comex silver contracts…net of the same group’s bearish bets…only this April.

Prices have fallen 10% since then.

As for the last time these guys were net short…back in the second-half of December 2015…that coincided with 6-year lows in US Dollar silver prices.

Prices have risen by one-fifth since then.

None of this means the ‘Managed Money’ going net short is a guaranteed buy signal. It stayed net short for 7 weeks in late 2015…and these hedge funds might make a few bucks yet by being right in summer 2017.

But in the end the fact is harder than concrete…

The hot-money speculators both create and must also lose out to silver’s high and low price extremes. Because once the herd has all run one way, it can only turn round and run the other. “

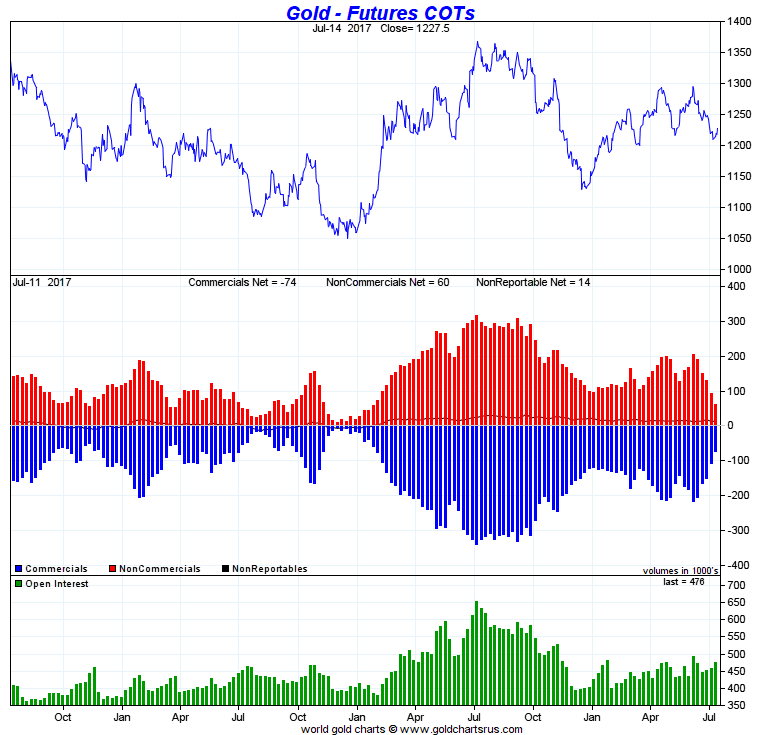

On the opposite side of the trade are what are referred to as the “Commercials”.

These are the companies like miners, refiners and bullion banks that are using futures to actively hedge their positions.

They are the traders that are more likely to be correct at the extremes. And Ted Butler this week showed how they are positioned.

“The Commercial net short position in silver is now down to 24,567 contracts, or 122.8 million troy ounces of paper silver. And once you factor out the extra 30,000+ non-technical funds Managed Money longs that have been added over the last three years, this report is, with out a word of a lie, the most wildly bullish in COMEX history…especially for JPMorgan.

Here’s the 3-year COT chart. Click to enlarge.

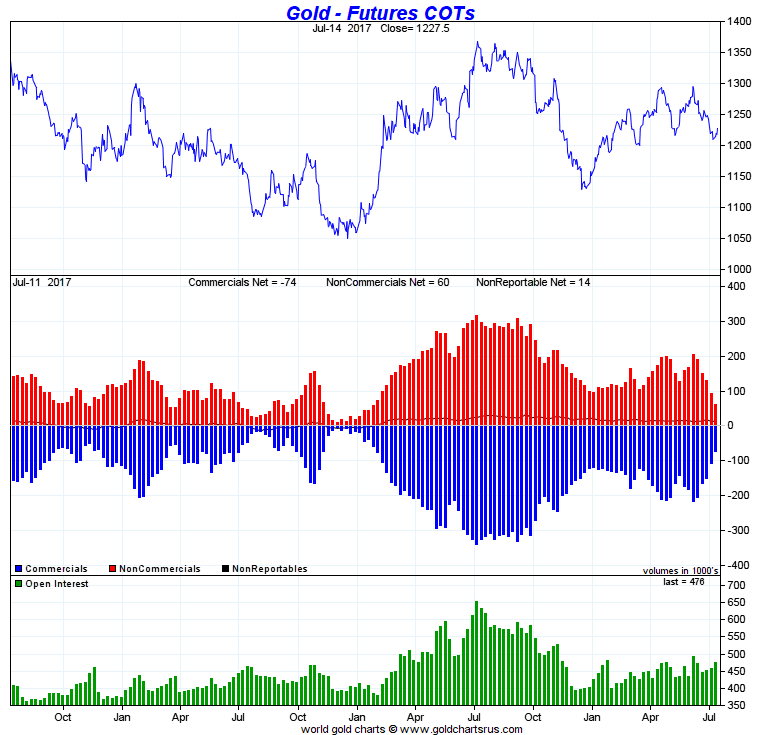

…The commercial net short position in gold is down to only 7.39 million troy ounces. I haven’t seen that small a number in many, many years — and I know that Ted will have the exact date in his column later today.

Here’s the 3-year COT chart for gold — and like its silver counterpart, it’s set up for a rocket ride higher as soon as JPMorgan et al allow it. Click to enlarge.

…The commercial net short position in gold is down to only 7.39 million troy ounces. I haven’t seen that small a number in many, many years — and I know that Ted will have the exact date in his column later today.

Here’s the 3-year COT chart for gold — and like its silver counterpart, it’s set up for a rocket ride higher as soon as JPMorgan et al allow it. Click to enlarge.

…the numbers you see above couldn’t possibly get more extreme than they are now. Of course, if ‘da boyz’ really wanted to hammer prices lower, I suppose they could. But at these levels, the law of diminishing returns is in full force — and if I had to bet the proverbial ten dollar bill, I’d happily bet it on the fact that lows for this move down are already in place.”

Source.

…the numbers you see above couldn’t possibly get more extreme than they are now. Of course, if ‘da boyz’ really wanted to hammer prices lower, I suppose they could. But at these levels, the law of diminishing returns is in full force — and if I had to bet the proverbial ten dollar bill, I’d happily bet it on the fact that lows for this move down are already in place.”

Source.

…The commercial net short position in gold is down to only 7.39 million troy ounces. I haven’t seen that small a number in many, many years — and I know that Ted will have the exact date in his column later today.

Here’s the 3-year COT chart for gold — and like its silver counterpart, it’s set up for a rocket ride higher as soon as JPMorgan et al allow it. Click to enlarge.

…The commercial net short position in gold is down to only 7.39 million troy ounces. I haven’t seen that small a number in many, many years — and I know that Ted will have the exact date in his column later today.

Here’s the 3-year COT chart for gold — and like its silver counterpart, it’s set up for a rocket ride higher as soon as JPMorgan et al allow it. Click to enlarge.

…the numbers you see above couldn’t possibly get more extreme than they are now. Of course, if ‘da boyz’ really wanted to hammer prices lower, I suppose they could. But at these levels, the law of diminishing returns is in full force — and if I had to bet the proverbial ten dollar bill, I’d happily bet it on the fact that lows for this move down are already in place.”

Source.

…the numbers you see above couldn’t possibly get more extreme than they are now. Of course, if ‘da boyz’ really wanted to hammer prices lower, I suppose they could. But at these levels, the law of diminishing returns is in full force — and if I had to bet the proverbial ten dollar bill, I’d happily bet it on the fact that lows for this move down are already in place.”

Source.

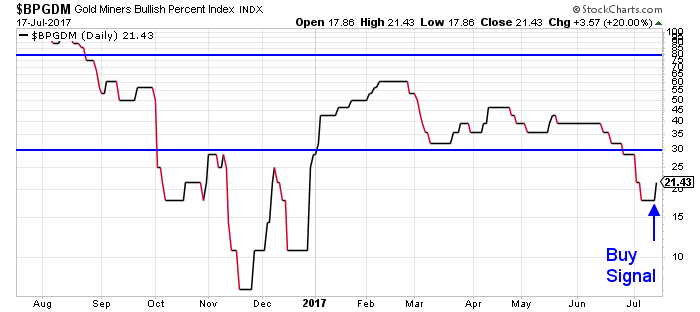

Gold Stocks Also Have a Bullish Indicator For the First Time in 2017

It appears that gold mining shares might also be giving a buy signal now too. And miners often seem to lead gold prices higher. Here’s Jeff Clark:

“After chopping back and forth for the past several months, gold stocks are finally ready to rally. The Bullish Percent Index (BPI) for the gold sector just generated its first buy signal since December.

A BPI illustrates the percentage of stocks in a sector trading with bullish chart patterns. It’s a measure of overbought and oversold conditions. In most cases, a sector is overbought – and subject to a correction – when the BPI rallies above 80 (meaning 80% of the stocks in the sector are trading in bullish technical patterns). A sector is oversold when the BPI dips below 30. And the BPI generates a buy signal when it turns higher from oversold conditions.

Here’s how the Gold Miners Bullish Percent Index (BPGDM) looks now…

Earlier this month, the BPGDM dipped below 30. That’s an oversold condition – indicating that less than 30% of the stocks in the gold sector were trading with bullish technical formations.

But yesterday, BPGDM turned higher from oversold conditions and generated its first gold stock buy signal of 2017. The last buy signal we got from this indicator was back in December. Gold stocks – as measured by the VanEck Vectors Gold Miners Fund (GDX) – rallied 30% in just two months back then.A similar move this time would have GDX rallying above $27 per share by September.

There’s no guarantee, of course, that this BPGDM buy signal will play out the same way. But, after chopping around for several months, the gold sector has plenty of energy to fuel a strong rally.”

Source.

Earlier this month, the BPGDM dipped below 30. That’s an oversold condition – indicating that less than 30% of the stocks in the gold sector were trading with bullish technical formations.

But yesterday, BPGDM turned higher from oversold conditions and generated its first gold stock buy signal of 2017. The last buy signal we got from this indicator was back in December. Gold stocks – as measured by the VanEck Vectors Gold Miners Fund (GDX) – rallied 30% in just two months back then.A similar move this time would have GDX rallying above $27 per share by September.

There’s no guarantee, of course, that this BPGDM buy signal will play out the same way. But, after chopping around for several months, the gold sector has plenty of energy to fuel a strong rally.”

Source.

Earlier this month, the BPGDM dipped below 30. That’s an oversold condition – indicating that less than 30% of the stocks in the gold sector were trading with bullish technical formations.

But yesterday, BPGDM turned higher from oversold conditions and generated its first gold stock buy signal of 2017. The last buy signal we got from this indicator was back in December. Gold stocks – as measured by the VanEck Vectors Gold Miners Fund (GDX) – rallied 30% in just two months back then.A similar move this time would have GDX rallying above $27 per share by September.

There’s no guarantee, of course, that this BPGDM buy signal will play out the same way. But, after chopping around for several months, the gold sector has plenty of energy to fuel a strong rally.”

Source.

Earlier this month, the BPGDM dipped below 30. That’s an oversold condition – indicating that less than 30% of the stocks in the gold sector were trading with bullish technical formations.

But yesterday, BPGDM turned higher from oversold conditions and generated its first gold stock buy signal of 2017. The last buy signal we got from this indicator was back in December. Gold stocks – as measured by the VanEck Vectors Gold Miners Fund (GDX) – rallied 30% in just two months back then.A similar move this time would have GDX rallying above $27 per share by September.

There’s no guarantee, of course, that this BPGDM buy signal will play out the same way. But, after chopping around for several months, the gold sector has plenty of energy to fuel a strong rally.”

Source.

Overall we have local prices for gold and silver bouncing off long term support levels.

This combined with the set up in the gold and silver futures outlined above, mean the odds favour any purchases around current levels.

This coincides nicely with the 2 silver deals mentioned earlier. So hit reply for the latest pricing.

Plus be sure to check out the articles posted this week below.

In particular the 4 Reasons You Should Store Some Precious Metals Outside of New Zealand.

Call David on 0800 888 465 for a quote or with any questions.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles: |

|||

|

|||

|

|||

|

|||

|

|||

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

Copyright © 2017 Gold Survival Guide. All Rights Reserved.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Visa Ups the War on Cash Following on from last weeks report on the expanding war on cash down under, the latest news is that credit card processor Visa and other payment networks want to abolish cash and cheques that compete with their credit and debit cards. In the USA, the card companies are offering thousands […]

Visa Ups the War on Cash Following on from last weeks report on the expanding war on cash down under, the latest news is that credit card processor Visa and other payment networks want to abolish cash and cheques that compete with their credit and debit cards. In the USA, the card companies are offering thousands […]

Over the past few years we have seen scrap silver recovery plummet. So that there is now very little silver coming from this source anymore. The following article has some excellent tables that clearly show the supply dynamics in silver. You’ll see how it appears that new silver mine production has stagnated, or perhaps even […]

Over the past few years we have seen scrap silver recovery plummet. So that there is now very little silver coming from this source anymore. The following article has some excellent tables that clearly show the supply dynamics in silver. You’ll see how it appears that new silver mine production has stagnated, or perhaps even […]

New Zealand is seen as a safe, low risk, low corruption location, with a stable government. It is therefore seen as an excellent place to buy and store gold and silver. For these reasons we get expats, and also foreign citizens from the USA and Europe, looking to buy and store precious metals in New […]

New Zealand is seen as a safe, low risk, low corruption location, with a stable government. It is therefore seen as an excellent place to buy and store gold and silver. For these reasons we get expats, and also foreign citizens from the USA and Europe, looking to buy and store precious metals in New […]

Last week we commented on the next possible direction of the expanding war on cash down under. We highlighted a couple of possible steps to follow with a view to protecting yourself from an expected continuation of the war on cash. Over the weekend, Simon Black of Sovereign Man wrote from a similar perspective but […]

Last week we commented on the next possible direction of the expanding war on cash down under. We highlighted a couple of possible steps to follow with a view to protecting yourself from an expected continuation of the war on cash. Over the weekend, Simon Black of Sovereign Man wrote from a similar perspective but […]

SILVER COIN SPECIAL TODAY 1oz Perth Mint Silver Kangaroos 2016 BU (Brilliant Uncirculated) Minimum order 500 coins 500 x 1oz Perth Mint 2016 Silver Kangaroos are $13,230 ($26.46 per coin) – $200 cheaper than 500 Silver Maples 1000 x 1oz Perth Mint 2016 Silver Kangaroos are $26,130 ($26.13 per coin) – $500 cheaper than 1000 […]

SILVER COIN SPECIAL TODAY 1oz Perth Mint Silver Kangaroos 2016 BU (Brilliant Uncirculated) Minimum order 500 coins 500 x 1oz Perth Mint 2016 Silver Kangaroos are $13,230 ($26.46 per coin) – $200 cheaper than 500 Silver Maples 1000 x 1oz Perth Mint 2016 Silver Kangaroos are $26,130 ($26.13 per coin) – $500 cheaper than 1000 […]