In our subscriber only email newsletter last week we said:

“So to us the odds of another Brexit-like surprise outcome seem to be much closer than most would expect.

If Trump wins we will likely see a jump in volatility in the sharemarket. That is already happening after the FBI investigation announcement.

If gold’s correction has ended (as we suspect it has) then we could likely see a decent jump in gold and silver prices with a Trump win. As everyone seems to be bracing for “uncertainty”.”

Over the weekend the World Gold Council also weighed in on the US election and it’s impact on gold:

As investors fly to quality, gold surges

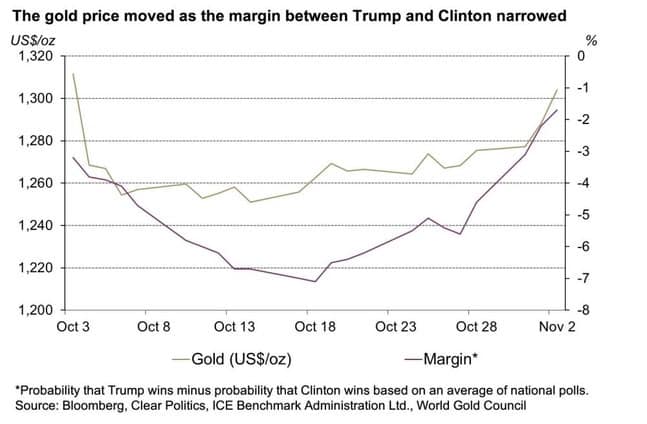

• The US presidential election has tightened up again, pushing investors to hedge risk through high quality, liquid assets such as gold.

• The gold price broke its 200-day moving average (US$1,275/oz) and breached the key US$1,300/oz level yesterday where many call options were likely executed.

• The gold price posted its strongest two-week gain since the surprise result of the British referendum in late June, when gold also fulfilled its classic safe-haven role.

• The fact that the gold price has fallen only slightly below US$1,300/oz, despite a more hawkish-than-expected statement from the Federal Reserve yesterday signaling that they will likely increase interest rates before the end of the year, is also very significant and shows the degree of momentum in investor demand for gold.

• We expect that both the presidential and congressional elections results will be supportive of gold regardless of the outcome, given the high uncertainty in the direction of policy and the possibility that the results may be contested.

• In our view, rising nationalist movements and political uncertainty around the world, as well as the prevalence ineffective monetary policies, make gold a valuable hedge and key component to investment portfolios long term.

Here’s someone else making the argument for a jump in gold prices after the US elections…

Why Gold Will Jump at Least 7% After Election Day

By Justin Spittler

Investors are on edge…and we can’t blame them.

Stocks are in free fall. The S&P 500 has fallen nine straight days.

Bonds are crashing. Yields on 10-year U.S., British, German, and French government bonds all hit multi-month highs recently. (A bond’s yield rises when its price falls.)

Even oil is tanking. Its price has dropped 14% since October 19.

• Right now, gold is about the only major asset that’s doing well…

It’s up 4% over the last three weeks. Yesterday, it closed above $1,300 an ounce for the first time since October 3.

Frankly, we’re not surprised gold’s doing so well. It’s the ultimate safe-haven asset, after all. Investors buy it when they’re worried about the economy or the financial system.

Lately, investors have also been buying gold for political reasons.

• No one knows who the next president will be…

If you’ve been following the election, you know it wasn’t like this a few weeks ago.

According to statistics website FiveThirtyEight, Hillary had an 87% chance of winning the election after the last presidential debate.

Then, last Friday, the FBI said it was reopening the investigation on Hillary’s email scandal.

Trump shot up in the polls on the news. Just like that, Hillary was no longer a shoe-in to win the presidency. According to CNBC, Hillary is now beating Trump in the polls 45% to 42%.

• In just a few days, the U.S. presidential race became much more uncertain…

And the market hates uncertainty.

That’s why stocks and bonds are falling. It’s why gold is doing well.

• You also have to remember that Trump is a total wild card…

With Hillary, you know what you’re getting: a career politician who’s in bed with the Deep State.

With Trump, you have no clue what you’re getting. His policy plans are vague at best. Plus, he’s never served as a politician. (Now, many people will say that’s a good thing…but we’re not here to talk about that.)

On the surface, Hillary and Trump seem like polar opposites. But they actually have much more in common than most people think…

• Both candidates want to fix America’s problems with more laws, regulations, and red tape…

According to Doug, more government won’t solve anything:

Almost everything government does, certainly relative to the economy, creates distortions and misallocations of capital. Their inflation of the currency discourages saving and creates the business cycle. Their taxes and regulations destroy capital. Their actions are almost purely destructive of society. This reminds me of one definition of stupidity—it’s an unwitting tendency to self-destruction.

In short, the next president will almost certainly do serious damage to the economy and financial system. Clearly, that’s bad for stocks and bonds. But those disastrous policies could cause gold to soar.

That’s why we think gold is headed much higher, no matter who wins the election.

• HSBC, Europe’s biggest bank, also thinks gold is a safe bet heading into the election…

Bloomberg Markets reported on Tuesday:

There’s one certain winner of next week’s presidential election, according to HSBC Holdings Plc: investors in gold.

Although they deem a Donald Trump victory more supportive for the price of the metal than a win by Hillary Clinton, the bank’s Chief Precious Metals Analyst James Steel says it’ll enjoy at least a[n] 8 percent jump whoever wins the race.

According to Bloomberg Markets, HSBC thinks the price of gold will reach $1,400 by the end of the year if Hillary wins. That’s 7% higher than where gold closed yesterday.

If Donald wins, the price of gold could hit $1,500 an ounce by the end of the year, which would mean a 15% spike in gold. That would also set a new three-year high for gold.

• Like us, HSBC thinks the policies of both candidates are bullish for gold…

Bloomberg Markets continued:

Both candidates have espoused trade policies that could stimulate demand, with gold offering a potential “protection against protectionism,” [Steel] says. Even the relatively more internationalist Democratic candidate has argued for the renegotiation of longstanding free-trade agreements. That’s positive for gold — even if “not on the scale of Mr Trump’s agenda.”

Also, both candidates want to spend hundreds of billions to repair America’s aging infrastructure. HSBC says this, too, would be good for gold. Bloomberg Markets went on:

…[A] Democratic sweep of Congress would further stoke demand for the metal owing to a possible boost in fiscal spending. Clinton’s not alone in having suggested stimulus through channels outside of monetary policy, with Trump at one point saying he would put at least half a trillion dollars to work.

• Now, we realize that America’s infrastructure is in desperate need of repair…

That’s because the government has spent trillions of dollars on entitlements and other wasteful programs over the last few decades…instead of fixing the country’s bridges, highways, and dams.

There’s just one problem: The federal government is dead broke.

By its own count, the government is $19.4 trillion in debt. To fix America’s crumbling infrastructure, the government would have to borrow more money. But the country can’t afford to do that.

The U.S. federal debt already stands at 105% of U.S. GDP, which measures the country’s annual economic output. That’s the highest level since World War II.

• If you’re nervous about this presidential election, own gold…

If you’re nervous about the fragile financial system, own gold.

If you’re nervous about the weak economy, own gold.

Right now, there are countless reasons to own gold. That’s why it’s up 23% this year, and coming off its best start to a year since 1980.

• We recommend most people put 10% to 15% of their portfolio in gold…

Once you own enough gold for safety, you could consider gold stocks for profit.

Gold stocks are leveraged to the price of gold. This means the price of gold doesn’t have to rise much for them to surge.

This year, a 23% jump in the price of gold caused the VanEck Vectors Gold Miners ETF (GDX), which tracks large gold miners, to spike 83%. But we could see much bigger gains going forward…

• Earlier this year, Doug placed a GIANT bet on gold…

He put about $1 million of his own money into gold stocks.

Doug “backed up the truck” on gold because he thinks gold stocks have entered a true mania.

But Doug didn’t buy GDX or any other gold ETF. He invested in tiny gold stocks with huge potential.

Most Wall Street analysts have never heard of these companies. But Doug found them because he’s developed a way to find the best gold stocks on the planet.

This secret approach, which we call “The Casey Method,” has helped Doug book incredible gains on gold stocks. We’re talking returns of 487%, 711%, and even 4,329%.

You can learn more about The Casey Method by watching this new presentation. You’ll also learn how to access nine gold stocks that Doug and his team recently found using this same method. Each of these stocks could double in the coming months. Some could go even higher from here.

To learn about The Casey Method—and how to access the names of these nine stocks—click here.

Chart of the Day

When gold stocks get going, the gains can be explosive.

Today’s chart shows the performance of the NYSE Arca Gold BUGS Index (HUI), which tracks major gold stocks, since 2000. You can see that the HUI soared 1,167% between 2000 and 2007.

That’s important to keep in mind. You see, a lot of investors see this year’s huge rally in gold stocks and think they missed their chance. But, as you can see, gold stocks can head many times higher during major bull markets.

You also have to keep in mind that HUI basically represents your average gold stock. The best gold stocks soared 2,000% or more during the last bull market. But we could see much bigger gains than that in the coming years.

According to Doug, gold stocks aren’t in a run-of-the-mill gold bull market right now. He thinks we could be in the early innings of the greatest gold bull market ever.

To help you take advantage of this opportunity, we put together a special presentation. As we said earlier, this video reveals the method Doug used to book incredible gains during previous bull markets. Plus, it shows you how to access a brand-new special report that lists nine gold stocks with massive upside potential.

Watch this FREE video to learn more.