This Week:

- Silver Still Outperforming Gold

- What Might Happen Now After Fed Rate Hike?

- ‘Bond God’ Gundlach: Trump rally is ‘losing steam’… Gold headed higher

- The Full Details on Silver Manipulation Exposed

- Not Long Until the “War on Cash” Comes to New Zealand

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1608.21 | – $31.63 | – 1.92% |

| USD Gold | $1142.95 | – $29.54 | – 2.51% |

| NZD Silver | $23.74 | – $0.24 | – 1.00% |

| USD Silver | $16.87 | – $0.24 | – 1.40% |

| NZD/USD | 0.7107 | – 0.0044 | – 0.61% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1548 |

| Buying Back 1kg NZ Silver 999 Purity | $723 |

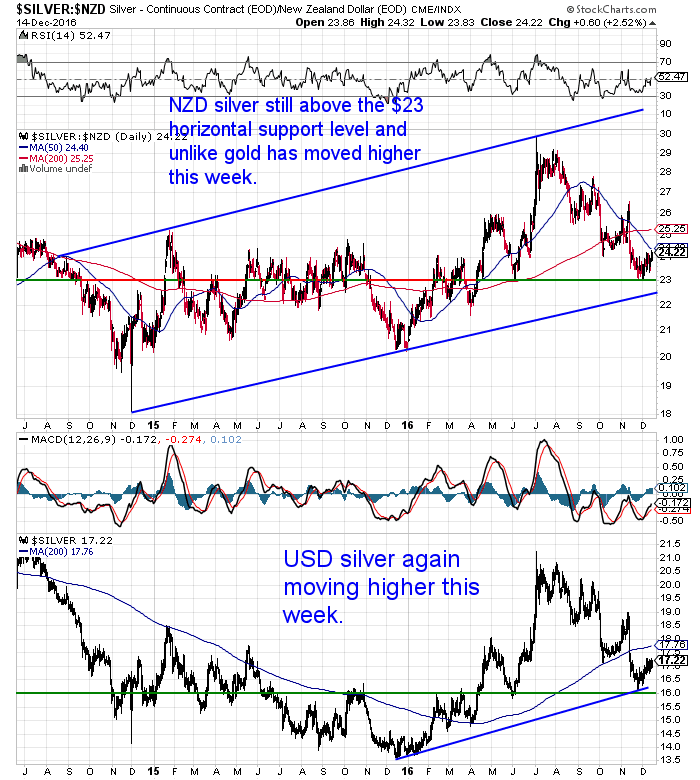

The same recent trend continues with silver outperforming gold again this week.

Gold fell just under 2% while silver only dipped 1%.

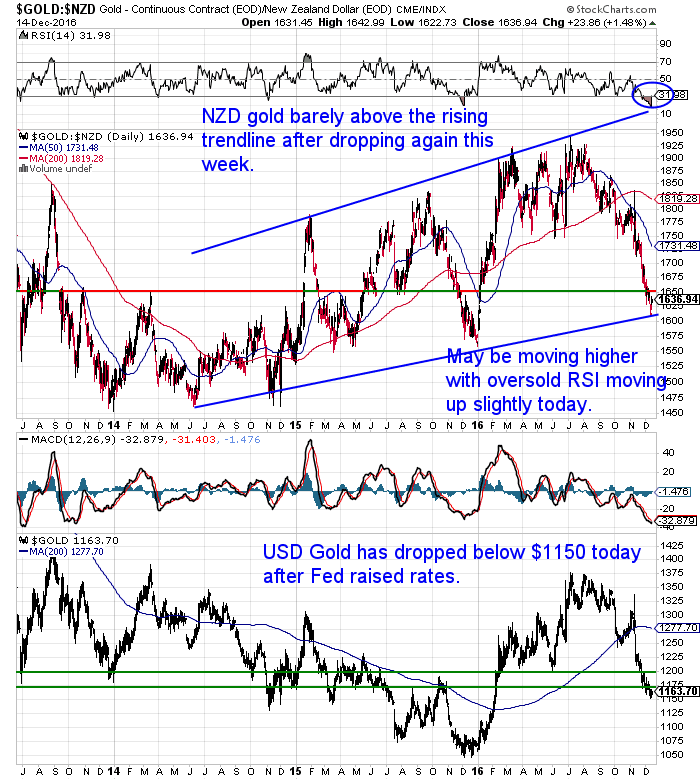

Gold is barely above a redrawn rising trendline today. It is actually lower than on the chart as the price of gold fell following the US Fed interest rate hike which occurred after the closing price on the chart. NZD Gold is just turning up from the extremely oversold region it has been in. So perhaps we may see it finally bounce higher now?

NZD silver has moved higher all this month but again like gold dropped today even though it too isn’t shown on the chart. The redrawn longer term trendline shows silver is still in a rising trend in NZ dollar terms, as it has been since late 2014.

The NZ Dollar reacted sharply to the US rate hike dropping over a cent this morning, giving a bit of buoyancy to NZ precious metals prices.

What Might Happen Now After Fed Rate Hike?

With gold so oversold it wouldn’t be a surprise to see it bounce higher in the coming days. But the previous US Federal Reserve rate increase this time last year, saw gold and silver fall in the short term. It wasn’t until January that they turned and began their powerful run higher.

So perhaps as is outlined in this article we may not see gold move much higher until after the Trump inauguration as President in the New Year?

Dollar Vs Yen: Good News For Gold

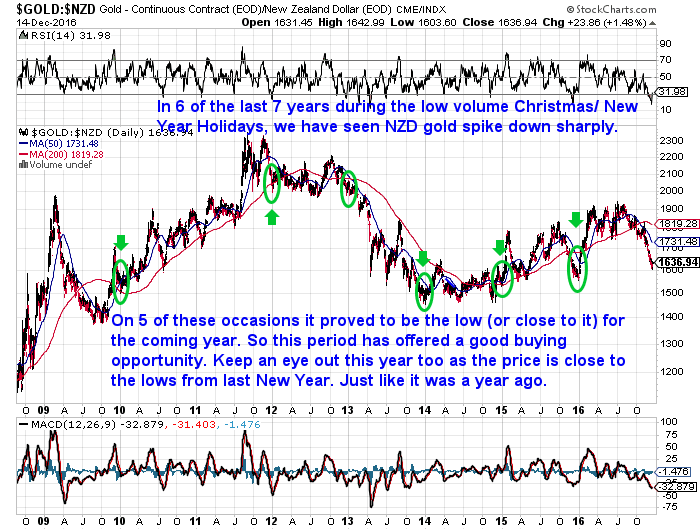

Recent history also points to the end of the year being a good time to purchase. We posted this chart last year and again we are seeing a similar pattern play out. With NZD gold again falling in December. Will we again see a spike lower over the Christmas/New Year period? This has proven a good time to purchase for each of the past 3 years. Will this make it 4 in a row?

Bond Guru Jeffrey Gundlach thought the post Trump stock rally might be losing steam and that gold could rise in the short term.

‘Bond God’ Gundlach: Trump rally is ‘losing steam’… Gold headed higher

“There is going to be a buyer’s remorse period,” said Gundlach, who voted for Trump and accurately predicted in January the winner of the presidential election.

“The dollar is going to go down, yields have peaked and will move sideways, stocks have peaked as well and gold is going to go up in the short term.“

Gundlach, known on Wall Street as the “Bond King,” went “maximum negative” on Treasuries on July 6 when the yield on the benchmark 10-year Treasury note hit 1.32%.

“I am less defensive now on Treasuries and I am less negative on the 10-year Treasury note at a 2.35% yield than we were at 1.35% yield,” he said. “Bank of America’s dividend yield is 1.39% while the 3-year Treasury yield is 1.45%. I mean, really?”

Gundlach began purchasing Treasuries last week and agency mortgage-backed securities on Tuesday, as yields have risen, he said.

He said that at the start of the month. Yesterday it was reported:

Source.

So perhaps this is playing out now with the stock market also falling today?

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

Last 4 Days: Get up to 25% off 120 serve mains buckets.

Last 4 Days: Get up to 25% off 120 serve mains buckets.

15 days emergency food for a family of 6.

The Full Details on Silver Manipulation Exposed

We have a larger than usual number of articles on the website this week so we’ll just point you in the direction of a few of them in particular. As there is plenty of reading there.

You may have heard about the documents Deutsche Bank had to reveal as part of its settlement in a lawsuit against them accusing them of silver manipulation. There really can be no doubt no about manipulation in the silver market.

The Full Details on Silver Manipulation Exposed

Not Long Until the “War on Cash” Comes to New Zealand

Overnight there was news out of Australia of that points to the likely removal of the $100 note over there and a limit on the size of cash transactions. See what this likely means for us here in New Zealand.

Not Long Until the “War on Cash” Comes to New Zealand

Check out the rest of the articles at the end of this email.

GoldSurvivalGuide: In The News

If you’re a deep south reader you may have seen some of our content on the RBNZ’s bank bail in policy was quoted in an article in the Advocate South ealier this week. If you’re not a Southerner you can still view it online here (you’ll need to flick forward 2 pages to page 5):

Good to see some information on NZ’s bank bail in and lack of bank deposit insurance making it into the local press.

In Closing

It will be interesting to see how the last couple of weeks of the year play out and if we get somewhat of a repeat of what happened following last years Fed rate rise.

Get in touch if you have any questions about the buying process. We’ll be open over the holidays but will confirm trading hours next week.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

This Weeks Articles:

Not Long Until the “War on Cash” Comes to New ZealandThu, 15 Dec 2016 1:40 PM NZST  Another week, another step close to the end of cash down under? Overnight it was announced that the Australian government was to launch a special taskforce to police the cash economy which is supposedly worth an estimated AU$21 billion a year. “[Minister for Revenue and Financial Services Kelly] O’Dwyer told the ABC not only is […] Another week, another step close to the end of cash down under? Overnight it was announced that the Australian government was to launch a special taskforce to police the cash economy which is supposedly worth an estimated AU$21 billion a year. “[Minister for Revenue and Financial Services Kelly] O’Dwyer told the ABC not only is […]

|

The Full Details on Silver Manipulation ExposedThu, 15 Dec 2016 11:57 AM NZST  If you’ve been involved in the world of precious metals for any length of time it’s highly likely you’ve come across some charts from Nick Laird’s website www.goldchartsrus.com. With the release of screeds of documents (350,000 pages!) as part of a settlement by Deutsche Bank in a lawsuit for manipulation in the silver market (i.e. […] If you’ve been involved in the world of precious metals for any length of time it’s highly likely you’ve come across some charts from Nick Laird’s website www.goldchartsrus.com. With the release of screeds of documents (350,000 pages!) as part of a settlement by Deutsche Bank in a lawsuit for manipulation in the silver market (i.e. […]

|

Why Your Hard-Earned Nest Egg Could Be in Serious DangerWed, 14 Dec 2016 5:25 PM NZST  See why digital money is dangerous and why if you have a significant amount of money in digital form (like at a bank or a brokerage), you face greater risks than merely just a potential bank failure… Why Your Hard-Earned Nest Egg Could Be in Serious Danger By Justin Spittler Editor’s note: Today’s Dispatch is […] See why digital money is dangerous and why if you have a significant amount of money in digital form (like at a bank or a brokerage), you face greater risks than merely just a potential bank failure… Why Your Hard-Earned Nest Egg Could Be in Serious Danger By Justin Spittler Editor’s note: Today’s Dispatch is […]

|

How Much Gold is There in India?Wed, 14 Dec 2016 5:05 PM NZST  With the war on cash in full force in India, Hugo Salinas Price contemplates just how much gold might actually be in India, and why gold in the hands of everyday people is so much more beneficial than gold in central bank vaults… How Much Gold is There in India? By Hugo Salinas Price – […] With the war on cash in full force in India, Hugo Salinas Price contemplates just how much gold might actually be in India, and why gold in the hands of everyday people is so much more beneficial than gold in central bank vaults… How Much Gold is There in India? By Hugo Salinas Price – […]

|

Dollar Vs Yen: Good News For GoldWed, 14 Dec 2016 3:33 PM NZST  While gold has been falling since the US election, Stewart Thomson outlines a number of bullish factors in play currently. He theorises that gold could pop higher after the expected US Federal Reserve rate hike this week or perhaps more likely after Trump is inaugurated in the New Year… Dollar Vs Yen: Good News For […] While gold has been falling since the US election, Stewart Thomson outlines a number of bullish factors in play currently. He theorises that gold could pop higher after the expected US Federal Reserve rate hike this week or perhaps more likely after Trump is inaugurated in the New Year… Dollar Vs Yen: Good News For […]

|

Mrs. O’Leary’s CowWed, 14 Dec 2016 1:24 PM NZST  There are a good many possibilities for what may kick off the next financial crisis (it’s likely to come from something that most people aren’t expecting at all and likely to come when no one is looking for it – maybe a bit in the future yet). But it doesn’t mean we shouldn’t consider what […] There are a good many possibilities for what may kick off the next financial crisis (it’s likely to come from something that most people aren’t expecting at all and likely to come when no one is looking for it – maybe a bit in the future yet). But it doesn’t mean we shouldn’t consider what […]

|

Will the RBNZ Bank Dashboard Help Us Pick a “Safe” Bank?Thu, 8 Dec 2016 5:40 PM NZST  This Week: Silver Outperforming Gold Still No Deposit Insurance for NZer’s in Case of Bank Failure – Well Not Much Anyway Will the RBNZ Bank Dashboard Help Us Pick a “Safe” Bank? John Key’s Exit All About Italy Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1639.84 […] This Week: Silver Outperforming Gold Still No Deposit Insurance for NZer’s in Case of Bank Failure – Well Not Much Anyway Will the RBNZ Bank Dashboard Help Us Pick a “Safe” Bank? John Key’s Exit All About Italy Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1639.84 […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9amClick here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |