Prices and Charts

Gold Drops 2% – Entering Decent Buying Zone Again

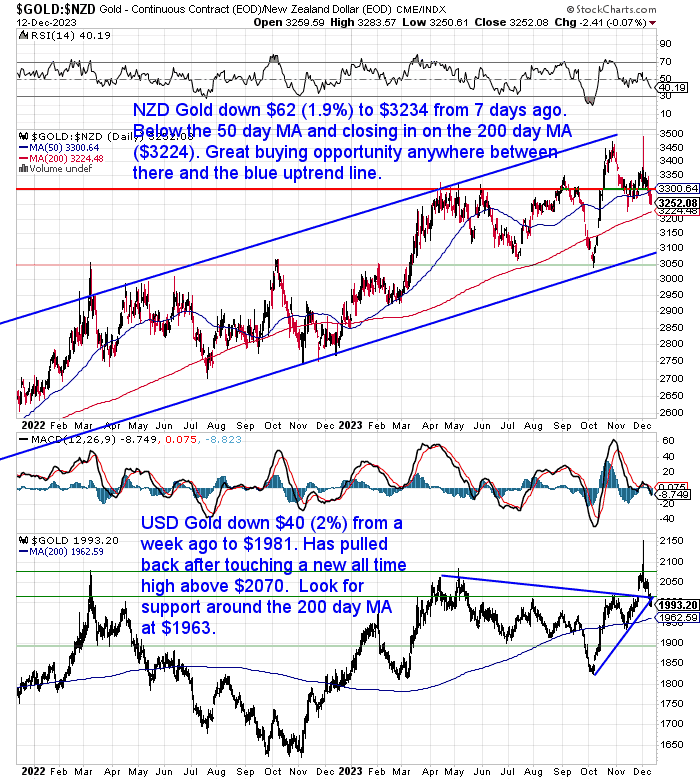

Gold in New Zealand dollars is down $62 from a week ago. Sitting at $3234 it has dropped below the 50 day moving average (MA) and is now closing in on the 200 day MA currently at $3224. Anywhere between there and the blue uptrend line is looking like being a very good buying zone. Just as it was back in October. Don’t count on catching the exact bottom. Perhaps start layering in from here?

USD gold is down $40 from 7 days ago to $1981. The 2% fall has taken USD gold back below $2000 and under the downtrend line. Perhaps we’ll see a further dip to the 200 day MA around $1963?

Silver Falls Further – Down Almost 6%

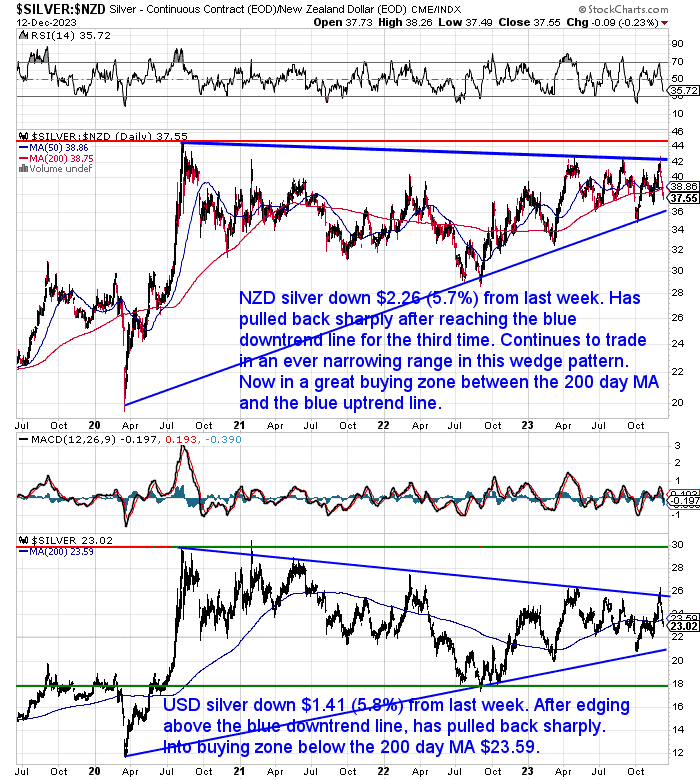

Silver had an even larger pullback. In NZ dollars it was down $2.26 or a hefty 5.7% from last week. After reaching the downtrend line for the third time this year it has been a sharp drop. But that has already taken the price back well below the 200 day MA. Silver continues to trade in an ever narrowing range within the blue lines of the wedge or pennant pattern. It is only a matter of time before it breaks out of this. This is likely a very good buying zone anywhere between here and the blue uptrend line.

It is much the same situation for Silver in US Dollars. Also down just under 6% from 7 days prior and in what is likely to be a great buying zone between the 200 day MA and the uptrend line.

NZ Dollar Hardly Changed

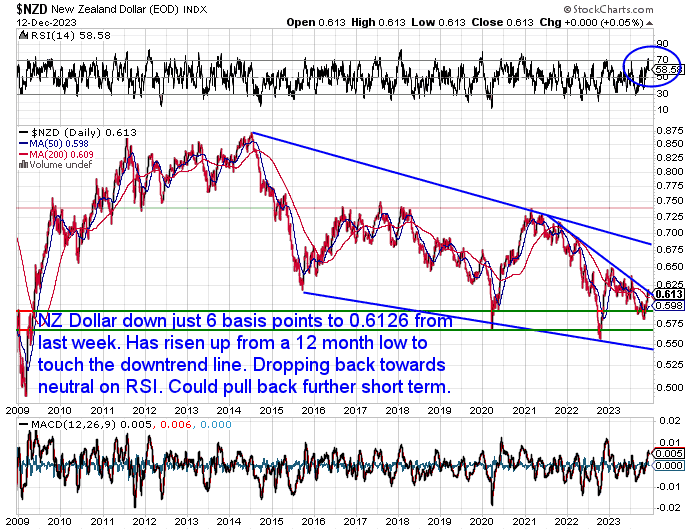

Very little change in the Kiwi dollar. Down just 6 basis points to 0.6126 from last week. Sitting just below the downtrend line but could pull back a little further in the short term. Watching for a break higher in the longer term though.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Does a Gold Revaluation to US$10,000 (or more) Make Sense? Good or Bad?

The US dollar is slowly but surely losing its status as the world’s reserve currency, and a global monetary reset may be coming soon. In this article, you will learn how this revaluation would work, and why it could be beneficial for the US and the world economy. But perhaps not so beneficial for the average working person. You will also discover the history of previous revaluations in 1934 and 1980.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Argentina Devalues Peso by 54% – But Better Times Ahead?

Speaking of revaluations, or rather in this case devaluation, the newly elected government of self described anarcho-capitalist president Milei today promptly devalued the Argentinian currency by 54%. Along with slashing the number of government ministries in half, they announced numerous cost cutting measures.

The new president has explained to the populace that they will likely have to suffer many months of things seeming even worse before they get better. He seems to have succeeded in getting the country behind his ideas and switched the majority away from decades of socialist excess.

This is setting up to be a very interesting experiment in turning around a country that has suffered terribly at the hands of hapless goverment’s for decades.

We’ll now watch from afar and see if Milei can actually implement even half the changes he campaigned upon.

Argentina could yet serve as a shining light that other countries may follow in moving away from the trend of more and more government to the absolute minimum instead.

Doug Casey has a good run down in this interview of what could evolve:

Doug Casey on How Milei Could Make Argentina a Beacon of Freedom and Prosperity

Gold and Silver Edging Closer to a Break Out

As we showed in this week’s charts, both gold and silver have pulled back noticeably this week. They are likely edging closer and closer to breakout of the patterns they have been trading in this year.

But before that takes place we are likely entering perhaps one of the last chances to buy at lower prices.

Silver in particular is now back into the range we pointed out to watch for in our recent Q &A Call: “How to Improve Your Timing When Purchasing Gold and Silver”.

One of our favourite indicators, the Relative Strength Index, is once again hitting very oversold (a reading below 30). This is likely to coincide with the silver price hitting the uptrend line that it has bounced off multiple times over the past 2 years.

As we highlighted in the Q&A Call, when we see multiple indicators signaling buy at the same time is often one of the best times to buy.

So another excellent buying opportunity is approaching. Or is even already here.

Technical analyst Clive Maud points out how precious metals sector investors have…

“…just been royally played – first they are encouraged to pile in on gold’s breakout to new highs, which occurred when it was already very overbought, and now they are being pressured into barfing their holdings before the sector turns around and then goes on to break out for real.

…So don’t let the MSM (mainstream financial media) con you into turning over your holdings to Big Money here right before the sector turns around and goes marching higher again because next time gold tries to break above the key $2100 level it’s likely to succeed and usher in the major bullmarket that we continue to expect. They fooled a lot of people with that false breakout,

…this nasty Big Money contrived hiccup which is viewed as providing a last golden opportunity to buy the sector and add to positions, especially in the big gold stocks which are at a “dream” entry point on post breakout reactions.”

Source.

Some of our suppliers shut down completely over the Christmas/New Year period. However others don’t, albeit with a more limited range of products over the holidays. So you are still able to purchase if we see any further dips during the low volume Christmas and New year break.

Just get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|