Following on from the first free Aussie gold mining stock pick we featured a couple of weeks ago we have another free report this week from Fat Prophets. Founded by New Zealand born Angus Geddes in 2000, Fat Prophets is an Australian based stock market research house providing insightful reports, recommendations, and investment / wealth management services. They have also recently opened a New Zealand office and you can hear their N.Z. Chief Greg Smith regularly featured on 1ZB.

Fat Prophets have been bullish on Gold since 2002 and their Australasian share portfolio is heavily weighted to precious metals mining shares. In this exclusive excerpt from their latest stock report they profile the largest Australian gold producer Newcrest -who is in fact the 4th largest gold producer in the world by market capitalisation. Keep your eyes peeled for more free reports from Fat Prophets in the coming weeks. If you’re considering gold mining shares close to home then Fat Prophets is a good place to start.…

Newcrest Mining

Newcrest’s 3rd Quarter Activities report to 31 March 2012 was greeted with a less than favourably price fall, as the market digested lower production and another guidance downgrade for 2012. Production at Lihir in the near-term is the ugly duckling, while the weather crimped production elsewhere. Despite the operating issues at Lihir and weather events causing lower gold production numbers, costs were relatively well contained for the quarter.

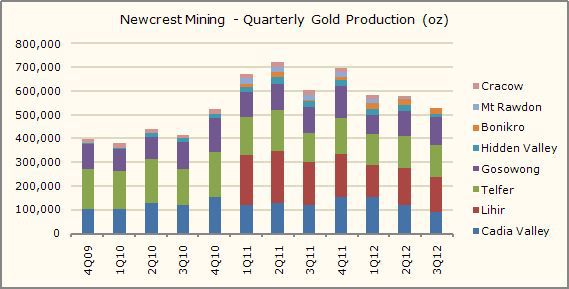

Gold production for the quarter fell 12.0% on the March 2011 Quarter, to 532,237 ounces. The following chart shows the contribution to production by each of Newcrest’s operations.

The softer production number for the reported quarter was attributed to operational issues at Lihir and weather events at both Cadia Valley and Hidden Valley.

Lihir continues to be the main source of frustration with the mine suffering from an historic underinvestment in fixed plant maintenance. As a result, gold production at Lihir dropped away for the quarter falling 16.4% on the March 2011 number, to 149,433 ounces. Management attributed the operational issues at Lihir to poor plant condition. We reported in FAT-MIN-312 the remedial action the company has been forced to take to bring Lihir to stable levels of production.

The ongoing plant issues have forced management to further downgrade the current quarter forecast for gold production. Lihir is now expected to produce between 50,000-60,000 ounces per month, down from the expected 65,000-75,000 ounce run rate.

Newcrest is guiding the market to expect gold production of 700,000 to 900,000 ounces in FY13 from Lihir, but this will be a somewhat rubbery figure given the spate of incidents and hassles the company has endured on site during the current year.

Lihir is a major operational test for the company and new chief executive Greg Robinson will not be enjoying the moment.

Cadia Valley is also experiencing difficulty following the ground slip in November resulting in gold production falling by 27% on the March Quarter 2011, to 86,865 ounces for the period. That’s well below the average production of 135,000 ounces of gold for the past four quarters. Recover was not aided by a period of extremely wet weather on site. Gold production will remain constrained at around 40,000 ounces per month to 30 June 2012.

Production guidance for Cadia Valley for 2013 is expected to be in the range 400,000 to 500,000 ounces of gold. The medium-term production target remains set at 800,000 ounces of gold.

Hidden Valley (Newcrest interest 50%) also experienced extreme wet weather, resulting in lower production for the quarter. Gold production fell 38.3% on the prior March 2011 Quarter, to 15,757 ounces

On the brighter side, Gosowong reported a record quarter, with gold production up 9% on the March 2011 number, to 118,853 ounces. The company’s other producing assets all performed inline with quarterly expectations.

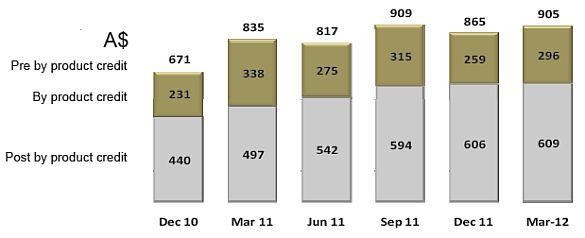

Despite the operational and weather related set backs during the quarter, the company managed to contain cash costs. The following chart shows Newcrest’s quarterly cash costs.

Cash costs rose by 22% post credits on the March 2011 number, to A$605 an ounce. The company cited lower ounces of gold produced, remedial activities surrounding operational and weather related issues and staffing as the primary drivers behind the deterioration in costs over the reported period.

For the remainder of the year to 30 June 2012, the company is expecting costs to remain under pressure, with cash costs expected to be in the range A$590 to A$620 an ounce.

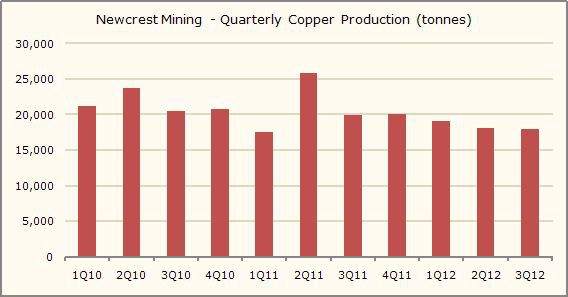

Copper is considered a by-product by Newcrest, however over the reported period production was 10.1% lower on the March 2011 number, falling to 18,072 tonnes. The following chart shows quarterly copper production.

The events at Cadia Valley that impacted on gold production also crimped copper production in the period. Production from Telfer remained relatively flat at 7,949 tonnes.

Copper guidance for the full 2012 financial year has also been downgraded to 70,000 to 75,000 tonnes, from the previous range of 75,000 to 80,000 tonnes.

It’s not all bad news. The average gold price achieved during the quarter was A$1,587 per ounce with copper achieving A$3.48 per pound and silver strongly up at A$39.36 per ounce.

The company indicated that gearing remains under 15% and that cash flow remains very robust, with the company generating sufficient cash resources to fund all future growth opportunities.

With less than three months of Newcrest’s financial year to run, the new guidance for the 2012 financial year is for gold production to be in the range 2.25 to 2.35 million ounces – down from previously downgrade range of 2.43 to 2.55 million ounces. Newcrest expects to provide full guidance across all its operations for 2013, with the releases its 2012 results in August 2012. The company will also release a five year outlook at the same time.

We view the quarterly announcement and further downgrade as a set-back in the very short-term. It does however not change the long-term value we see in the company’s progress toward production, within the next five tears, of four million ounces of gold per annum. With this view in mind, we reiterate our buy on Newcrest.

Interested in further research from Fat Prophets?

Email richard.kellow@fatprophets.com.au or call their Auckland office on (09) 306 8934 and say Gold Survival Guide sent you.

Are these free reports useful? Please leave a comment below if you’d like to see more of these…

Pingback: High NZ dollar? We need more intervention! | Gold Prices | Gold Investing Guide