This Week:

– NZ Interest rates – RBNZ cut on the horizon?

– Low Inflation in NZ – Boo! – High NZ dollar? We need more intervention!

– The start of an awakening?

– Another Free Aussie Gold Miner Share Report

Interest rates – RBNZ cut on the horizon?

Interest rates seem to be the talk of the week. Yesterday the Reserve Bank of Australia cut their OCR by a surprising 0.5%. Surprising as only a 0.25% cut was expected. The Aussie dollar promptly dropped against just about all currencies. It was down almost half a cent against the NZD. But the kiwi was tracking the Aussie lower against most other currencies such as the US dollar – down to .8135.

On the back of a slightly weaker kiwi, Gold in NZ dollar is hanging around the $2040 level, up a bit from the $2000 per ounce region it has repeatedly bounced off for the last month or 2.

Meanwhile last week our Reserve Bank held rates as they are. But there was some more jaw boning to get the dollar lower.

“Should the exchange rate remain strong without anything else changing, the bank would need to reassess the outlook for monetary policy settings.”

This seems to have been an inference that there could be further intervention in the way of a rate cut or even Forex market intervention – which we haven’t seen since 2007. Back in March Gov Bollard commented that if the “high NZ dollar prompted inflation expectations to fall further a cut in the OCR was possible”. So likely he was basically confirming this.

The bank economists think this is unlikely this year but their predictions haven’t been that spot on from what we recall over the past few years.

To be honest we don’t have too many ideas ourselves but if the US Fed is going to keep rates close to zero for another couple of years, and the global economy continues to limp along or worse, then it seems quite possible the RBNZ may try and do more to join the Currency Wars and get the kiwi dollar lower just like everyone else worldwide seems to be trying to do.

Low Inflation in NZ – Boo!

On the subject of the current “low inflation” mentioned above, this still makes us scratch our head. The CPI for March quarter rose 0.5%, amounting to 1.6% for the year to March.

So we are trained to accept that a less than 2% inflation rate is too low. That is, that a loss of purchasing power year after year is okay. But also this seems to be getting too low! Man we all hate low prices! Of course low inflation is a problem in a debt based monetary system. It must constantly expand or collapse upon itself.

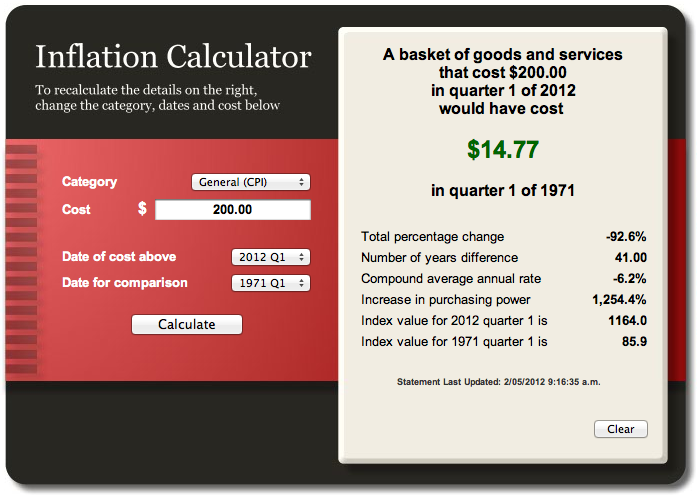

Anyway, the RBNZ is helpful enough to give us aninflation calculator to show just how successful they have been in destroying our purchasing power and giving us a lower standard of living. (Although they possibly haven’t been as successful as some other nations in recent years!)

Click image to enlarge

Just for fun we plugged in $200 – a standard enough amount to run up on a family trip to the supermarket. The calculator shows us that this is the equivalent to $14.77 back in 1971!

Did you also notice this is a loss of 92% since 1971? We hear Ron Paul constantly mention the Federal Reserve has been responsible for a 98% loss of purchasing power in the US dollar since 1913. Our leaders have managed to almost match this since 1971! Go Central Bankers!

Actually to be fair if you put 1913 into the calculator it will show a 98.7% loss from today so we’ve done just as well as the USA after all. But isn’t it funny – or maybe not so funny – that prices were much more stable here from 1913 to 1971 compared to 1971 to 2012?

Of course as we explain in our ecourse, 1971 was the year the last link was severed between the US dollar and gold. Isn’t that a coincidence? Of course our CPI is subject to the same adjustments and product substitutions that occur globally. That is, when a price of a specific item gets too high they swap it for something else assuming this is what people will do. Nevermind why are the prices rising? Anyway, it’s therefore likely that the CPI is much higher than 1.6% and a trip to the service station or supermarket would back this up.

– High NZ dollar? We need more intervention!

Anyway back to the high dollar – As usual the Poli’s seem to think the problem of the high dollar can be solved by more “intervention”.

The need for the Government to adopt a less ideological monetary policy has only increased with the Reserve Bank of Australia’s decision to reduce its official cash rate, Green Party Co-leader Russel Norman said today.

The Reserve Bank of Australia has cut its OCR from 4.25% to 3.75%. The New Zealand Reserve Bank chose to leave its OCR unchanged last week, citing concerns about rising house prices.

“The Reserve Bank’s one-tool toolkit is plainly inadequate for the economic reality we live in”, said Dr Norman

“Currently, the Reserve Bank faces a dilemma. If it cuts interest rates, it risks another housing bubble. Instead, it has done nothing, which causes a high exchange rate, hurting exporters and domestic producers.

“Despite record prices overseas for our exports, the high exchange rate caused by the high OCR is preventing New Zealand from cashing in and the country is running a growing current account deficit.

“The Reserve Bank needs a broader mandate and a wider range of tools, such as regulating loan to value ratios, to enable it to prevent housing bubbles while not punishing the trading sector.

“Kiwi exporters need a government that will act in their interests, not sit on its hands.

“The rest of the world is moving towards more sophisticated monetary policy, while National remains devoted to a failed ideology. Source

Unfortunately the Politicians, like most people on the street, have no understanding that it is the global interest rate fixing by Central Banks that is actually the cause of the global imbalances. And if “more sophisticated monetary policy” includes quantitative easing and the like, we think they can keep it. That said if things keep going the way they are it’s quite possible the RBNZ will feel forced to follow in the footsteps of the US, England, Japan, ECB etc.

The start of an awakening?

David and I were just discussing yesterday that there seems to be a bit more of an awakening going on in terms of the world’s monetary system.

For example in just the last week we’ve had a number of issues seeping through into the mainstream media. For example:

– Ron Paul on CNBC for more than 10 seconds

– Overnight Ron Paul debating establishment doofus Paul Krugman on Bloomberg

– New Law: Utah to accept gold and silver as currency – Reuters video: Gold Standard inevitable? And an explanation of how it could happen

– Bill Murphy of Gold Anti Trust Action Committee (GATA) on Russia Today (RT) (Hey we know RT isn’t mainstream and is backed by the Russian Govt but you can watch it on Sky TV nonetheless)

Speaking of Ron Paul, it’s hard to believe but we’ve been reading how Ron Paul is still a chance to win the Republican Presidential nomination. And for the conspiracy theorists out there, suspiciously Dr Pauls YouTube channel was removed overnight. Hmmm…

Anyway that is just a smattering of some of what’s been popping up lately. It does seem the gold revolution is steadily gaining more traction. Or perhaps we should say evolution as hopeful what comes next is not merely a return to the past but rather an evolution to something better.

If you’re ready to join the “golden evolution” then we’re happy to help.

As usual give David a call, email, or livechat and he can get you a specific quote for either metal.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 )

3. or Online order form and full product list

Have a golden week!

Glenn (and David).

Founders

Gold Survival Guide

P.S. We forgot to mention what articles we had this week! As usual the intros to them are all below. Amongst them we’ve got another free Australian Gold Mining share report from Fat Prophets and a great video on 600 years of silver history – The Big Silver Picture. Enjoy…

This Weeks Articles:

Gold in NZD – How Much Longer at This Level?

2012-04-25 06:28:00-04

This week: – The Best Reason in the World to Buy Gold – US Dollar’s Demise is 2 steps closer – Silver Manipulation – Gold in $NZ – How much longer at these levels? US Dollar’s Demise is 2 steps closer As we mentioned a few weeks back, according to Jim Sinclair the US was […] read more…

Australian Gold Miner Newcrest Still a Buy – Free Report

2012-04-29 17:08:29-04

Following on from the first free Aussie gold mining stock pick we featured a couple of weeks ago we have another free report this week from Fat Prophets. Founded by New Zealand born Angus Geddes in 2000, Fat Prophets is an Australian based stock market research house providing insightful reports, recommendations, and investment / wealth management services. They […] read more…

2012-04-30 01:56:23-04

We’ve discussed in recent weeks a number of reasons why the US dollar is on the way out as the global reserve currency. This article does well in summarising and linking together why all these recent factors that likely point to the end of the US dollar as the world’s reserve currency… By Marin Katusa, […] read more…

Why I’m Excited About This Gold Market

2012-04-30 03:32:06-04

We were lucky enough to meet Rick Rule at a gathering with Doug Casey from Casey Research here in Auckland a couple of years ago. We got to speak directly with someone who has been heavily involved in the commodity and mining sectors for many years and it was an enlightening experience. Today we hear […] read more…

2012-05-01 04:50:39-04

The title of this video is indeed accurate – it is a big picture view on silver. It’s a jam packed video that covers 600 years of silver history in just 16 minutes! Including: The pillaging of the South Americas China and silver The Hunt Brothers The crime of 1873 For more on the “crime of […] read more…

The legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Real interest rates in New Zealand: What can they tell us about when to buy gold? | Gold Prices | Gold Investing Guide

Pingback: Kiwi Dollar Takes a Dive and Helps Out Precious Metals | Gold Prices | Gold Investing Guide

Pingback: The gold standard: generator and protector of jobs | Gold Prices | Gold Investing Guide