This Week:

- Even More on the “War on Cash”

- Capital Controls Are Coming

- The Coming Revaluation of Gold

- A Costly Lesson Why You Should Buy Physical Gold Not “Trade”

- America’s Most Closely Guarded Secret: The Covert Fund That Controls It All – Rob Kirby

- Elites at World Ecnomic Forum Also Sounding the Alarm

|

LIMITED QUANTITY GOLD SPECIAL ***** 1oz Perth Mint 99.99% Gold Bars Black Packaging (Approx $1855) (20 black in stock) Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

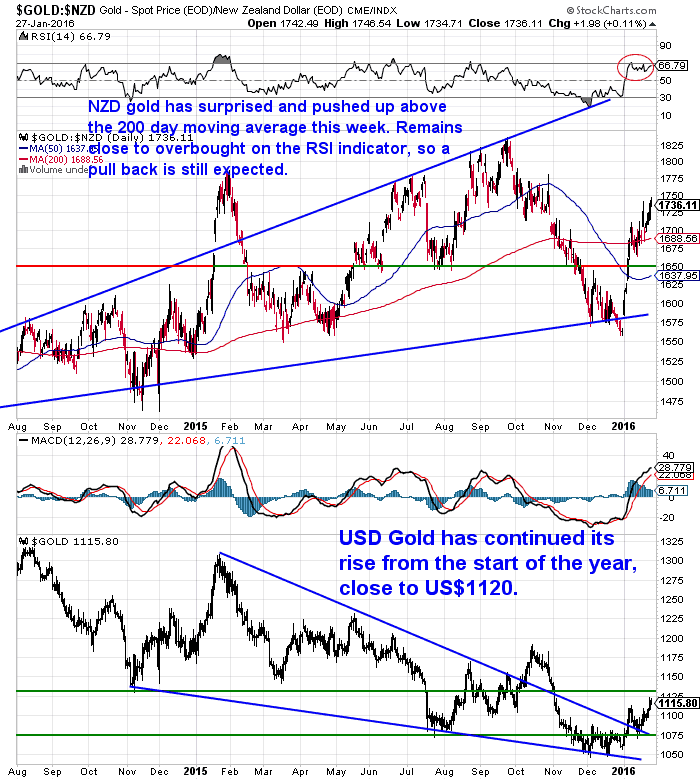

| NZD Gold | $1751.48 | + $34.88 | + 2.03% |

| USD Gold | $1125.50 | + $24.30 | + 2.20% |

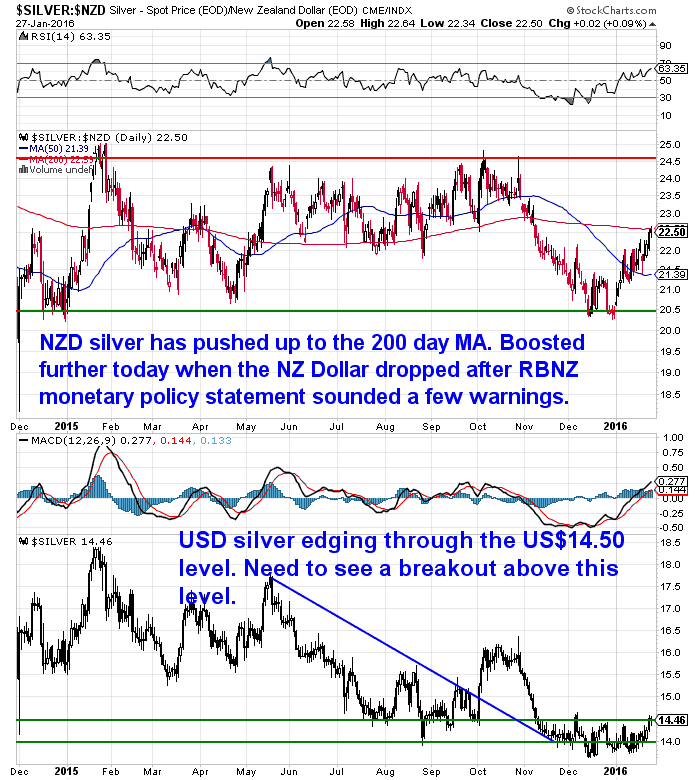

| NZD Silver | $22.52 | + $0.42 | + 1.90% |

| USD Silver | $14.47 | + $0.29 | + 2.04% |

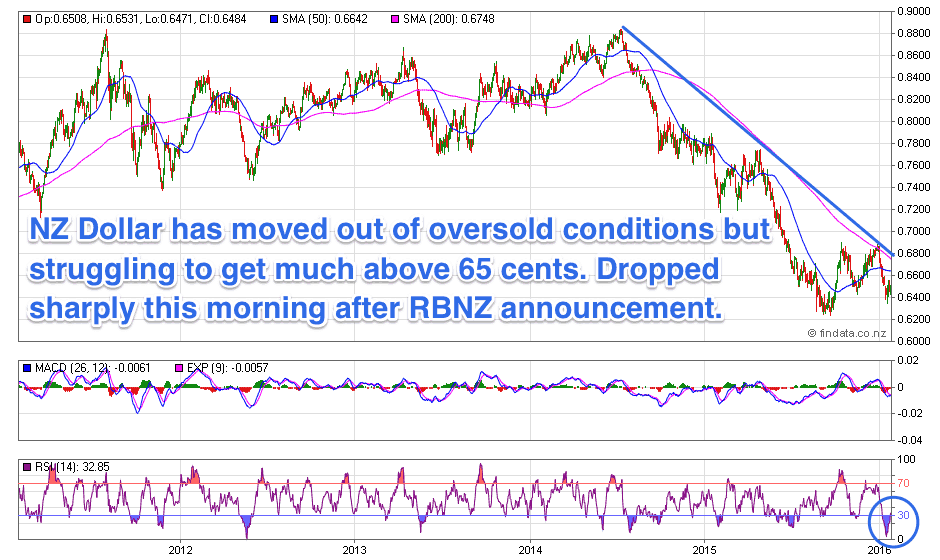

| NZD/USD | 0.6426 | + 0.0011 | + 0.17% |

Gold Up and Stocks Down

With the first month of 2016 almost gone, it looks like gold has done the opposite of what most expected when the Fed raised interest rates back in December. The call was this would be good for stocks as it indicated a strengthening economy.

In contrast it was meant to be bad for gold, since gold has no yield. So rising interest rates would mean people would sell gold.

However we published a number of articles last year that showed just the opposite was likely to happen. See: 3 Reasons Why Gold Doesn’t Have to Fall when Interest Rates Rise

So thus far it’s been gold up and stocks down. Although the NZ sharemarket is holding up better than most around the world. The NZSX50 peaked at the very end of 2015 just above 6300 and and is now just below 6150.

This move (gold up) was amplified here in NZ this morning with gold moving higher and the Kiwi dollar weakening after the RBNZ left the official cash rate on hold at 2.5% but sounded quite a few warnings. Official inflation data this week from Statistics New Zealand also came in below expectations. So it seems the expectation is that rates will stay lower for longer, hence the NZ Dollar was sold.

The gist of the RBNZ statement was there are risks on the horizon but they expect growth “to increase in 2016 as a result of continued strong net immigration, tourism, a solid pipeline of construction activity, and the lift in business and consumer confidence.”

We think this is optimistic given what is happening with major trade partners.

Silver too has pushed higher, although continues to lag gold.

Here’s a 5 year NZ Dollar chart showing the kiwi unable to get above the downward resistance line. It didn’t manage to get much above 0.65 before falling again today. So currently that is adding support to the local gold and silver prices..

Even More on the “War on Cash”

Last week we posted an article entitled: The International War on Cash

It summarised the slow but steady creep of the clamp downs on cash.

More news this week on the progression to the “cashless society”.

The DailyBell.com reports how the fact that the mainstream media is focussing on banking problems coincides with a likely plan to also move towards doing away with cash:

“Headlines are not shying away from Italy’s banking insolvency, which is forecast to overtake all of Europe sooner or later and then, like Superman, to “go beyond.”

Any time the mainstream media focuses on an issue with some directness we know it is something that globalists want mentioned. In this case, they want to keep us fearful, afraid we will go to bed starving and shivering in the dark.

But it is very likely we are looking at a dual meme here, as both events [cashless society and bank insolvency] seem to have arisen at once.

More from the Times: “DNB has said 60 per cent of Norwegian cash usage is out of government control and is being used in money laundering schemes and black market deals.”

That’s an astounding statement, and who knows how accurate it is? In any event, it surely includes such activities as gambling, prostitution and drug purchases; in other words, activities that the state declares to be criminal even though they are in a sense “victimless” and dictated by human nature.”

They refer to another article that outlines how as well as supposedly being implemented to crack down on criminals, a cashless society would also mean that…

… “there would be absolutely no escaping the bank bail-ins that are coming in Europe. If there was no way to pull your money out of the system, there would be no way to avoid the kind of theft that has now been institutionalized by European authorities.”

The article reminds us that on January 1st, 2016, a new bail-in system went into effect in Europe based on the Cyprus bank bail-ins … Now the exact same principles that were used in Cyprus are going to apply to all of Europe.” In Cyprus, troubled banks removed funds from anyone who carried accounts of over 100,000 euros.

This is where bank runs and the “cashless society” converge from a promotional standpoint. The bank runs give banking elites the justification to further bankrupt the middle classes. It is the middle class that elites are always at war with.

We also came across an article that highlights just how widespread the move to a cashless society has become across the planet. It covers moves in China, Canada, Great Britain, Sweden, Switzerland, Denmark, Norway, India, and parts of Africa.

It also gives a comprehensive overview of why and how a cashless society could emerge.

Interestingly it also refers to the timeline of 2018 for a move to a global currency as written about in The Economist magazine back in 1988.

Check that out here.

This same magazine cover is also referred to in one of the articles we posted on the website this week.

America’s Most Closely Guarded Secret: The Covert Fund That Controls It All — Rob Kirby

America’s Most Closely Guarded Secret: The Covert Fund That Controls It All — Rob Kirby

If you haven’t heard of the Exchange Stabilisation Fund (ESF) then this is a must read (or watch -take your pick). It outlines how this shadowy fund came into being and what it has been involved in. It also theorised that it is this fund that effectively “swallowed” the $1 trillion in central bank bonds that have been sold over the past year and a bit.

(If you didn’t catch last weeks email this was a question posed by Hugo Salinas Price).

Speaking of Salinas Price. We also have another article from him this week on:

Speaking of Salinas Price. We also have another article from him this week on:

The Coming Revaluation of Gold

He outlines how the current meltdown of the world’s debt bubble will continue, but eventually result in the revaluation of gold. He covers how this new system may function and what level gold may need to be revalued at.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

A Costly Lesson Why You Should Buy Physical Gold Not “Trade”

Here’s a reminder why if you’re looking to buy precious metals, to buy actual physical metal and take delivery of it yourself.

Our understanding is that’s just what investors with this NZ bullion trading company didn’t do. They instead handed money over to someone else who promised returns on gold and then it seems didn’t actually buy much of the stuff:

“Investors owed $2.7 million by a failed bullion company may now try to bankrupt its jailed boss, who prosecutors say ran a “bogus, fraudulent scheme”. The 36 investors left out-of-pocket by Robert Kairua’s firm have yet to make their mind up on whether to pursue civil action against him after he was jailed for 3 years and nine months last July.

…The Auckland businessman’s company, Grace Holdings NZ, ran the gold and silver trading website BullionBuyer and was probed by the Serious Fraud Office when he told some investors in 2012 they would not be getting their money back.

When the company was liquidated, it was revealed investors were owed $2.7 million.”

Ideally buy from one party and store with someone else.

Why Any New Financial Crisis Will be Worse Than 2008

In case you hadn’t noticed the global financial system hasn’t really gotten any better since 2008. Simon Black in Sovereign Man outlines just what has changed:

“Let’s take a moment to compare the world today to before the Global Financial Crisis struck roughly eight years ago.

In this short period of time, US federal government debt has DOUBLED.

The Federal Reserve now holds $2.4 trillion of that debt, up from $479 billion.

Interest rates, which were between 2-4%, are today just a hair above zero.

The Federal Deposit Insurance Corporation, which is expected to guarantee bank accounts, now has liabilities 530% greater than the cash and cash equivalents they are holding, compared to just 14% before the crisis.

Meanwhile, the banks that were deemed “too big to fail” 8 years ago are now even bigger, yet engaging in similarly foolish practices and accounting tricks.

In “saving” the system, all governments did was prevent anything from being actually fixed.”

The National Inflation Association also believes things will be worse if or perhaps rather when another financial crisis strikes. They outline what has happened not just to US debt but to global debt levels as well:

“Since the 2008 financial crisis, the manipulation of interest rates by the Federal Reserve and global central banks has allowed the world to become much more leveraged on debt than ever before in history – sowing the seeds for a new financial crisis that is beginning today.

Between January 2000 and October 2008, total global government, corporate, and household debt increased by 98.47%. This was in line with global GDP growth, which increased by the same percentage. However, since October 2008, total global government, corporate, and household debt has increased an additional 32.88% – more than double global GDP growth since October 2008 of only 15.24%!

At the beginning of the 2008 financial crisis, the world had total government, corporate, and household debt of $114.975 trillion. This was equal to 206.56% of global GDP – roughly the same percentage of global GDP as at the beginning of year 2000.

Today, the world has total government, corporate, and household debt of $152.784 trillion – a $37.809 trillion increase since the beginning of the 2008 financial crisis. This is equal to an insanely high 238.19% of global GDP, meaning the world has leveraged up to new extremes since the last crisis, which will make the new crisis much worse than 2008! See for yourself by clicking here!”

Elites at World Ecnomic Forum Also Sounding the Alarm

But now it’s not just alternative media types sounding the warning bells. This week there were a few somewhat surprising reports and danger signals being sounded from the global elite talkfest at the World Economic Forum in Davos this week.

First up we had Billionaire Investor George Soros saying:

Chinese Hard Landing Is “Practically Unavoidable”

Soros warns that a “hard landing” for the Chinese economy is now “practically unavoidable.” This will worsen global deflationary pressures, drag down stocks, and boost Treasury bonds.

Then Fund Manager Ray Dalio warned that the…

“Amid the global market turmoil, the Federal Reserve is more likely to ease than tighten interest rates again, Ray Dalio, founder of the world’s largest hedge fund, said Wednesday.”

“…The risks are asymmetric on the downside, because asset prices are comparatively high at the same time there’s not an ability to ease,” he added. “That asymmetric risk exists all around the world. So every country in the world needs an easier monetary policy.”

“It’s going to be much more difficult … next time,” he said, because the U.S. needs movement on fiscal policy from lawmakers in addition to monetary policy from the central bank.”

Then finally and perhaps most surprisingly we had the Former Chief Economist of the Bank for International Settlements (BIS) (aka the Central Bank to Central Banks) with a very stark warning.

Former Chief Economist Of BIS: World Faces Wave Of Epic Defaults, Central Banks Out Of Ammo

“Mr White said the Fed is now in a horrible quandary as it tries to extract itself from QE and right the ship again. “It is a debt trap. Things are so bad that there is no right answer. If they raise rates it’ll be nasty. If they don’t raise rates, it just makes matters worse,” he said.

There is no easy way out of this tangle. But Mr White said it would be a good start for governments to stop depending on central banks to do their dirty work. They should return to fiscal primacy – call it Keynesian, if you wish – and launch an investment blitz on infrastructure that pays for itself through higher growth.

“It was always dangerous to rely on central banks to sort out a solvency problem when all they can do is tackle liquidity problems. It is a recipe for disorder, and now we are hitting the limit,” he said.”

We then turn again to Simon Black of Sovereign Man also commenting on Mr White:

“White also suggested that banks, particularly in Europe, will have to be recapitalized on an unimaginable scale.

And due to all the new regulations, it will be depositors who have portions of their accounts confiscated by the state in order to fund the bank bailouts.

William White is not alone.

Michael Bury, the man who made $100 million betting against the last housing crisis, sees the same thing.

In an interview last month, Bury spoke about the “absurdity” of the massive level of debt in the system, and the Federal Reserve’s pitiful balance sheet.

When he gave the interview, the Fed’s balance sheet was leveraged 77:1. Today, barely a month later, it’s over 100:1. Incredible.

Financial markets have been in panic mode since the beginning of the year.

Just in the first few weeks of January, US stocks are down more than 10%. In China, the epicenter of the chaos, stocks are down 20%.

Commodity prices continue to fall. Pessimism abounds.

Look, maybe this is it. Maybe the global financial system has truly reached its limit.

Maybe the world has realized that the path to prosperity is not in conjuring money out of thin air, raising taxes, or going deeper into debt.

Maybe people have finally figured out that an insolvent government and insolvent central bank cannot possibly continue to underpin the entire financial system.

Or maybe not.

Maybe this will all be forgotten in a few weeks. And this coming Christmas no one will remember the great crisis of January that almost was.

But to me the incredible thing is how much panic there has been, particularly in banking and financial markets, just at the mere HINT of problems in the system.

It’s a clear indication of how quickly people can lose confidence and an entire system can become unglued.

Maybe things drag on like this for years, with government continuing to pile up debt and central banks continuing their slide into insolvency.

Maybe interest rates can become even more negative, and banks can become even less liquid.

But one day that confidence will turn. And as this month shows, it can all happen in an instant.

Look, I’m an optimistic guy.

Crisis always brings opportunity for those who can see the obvious realities. And I think what’s starting to unfold is tremendously exciting.

Economics isn’t complicated. The Universal Law of Prosperity is very simple: produce more than you consume.

Governments, corporations, and individuals all have to abide by it. Those who do will thrive. Those who don’t will fail, sooner or later.

When the entire financial system ignores this fundamental rule, it puts us all at risk.

And if you can understand that, you can take simple, sensible steps to prevent the consequences.”

“Simple, sensible steps” like perhaps removing some of your wealth from the banking system and into assets with no counterparty risk like gold and silver?

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via Fedex, fully insured.

Todays price is $14,275 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles: |

|

|

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices Spot Gold |

|

| NZ $ 1751.48 / oz | US $ 1125.50 / oz |

| Spot Silver | |

| NZ $ 22.52 / oz NZ $ 724.01 / kg |

US $ 14.47 / oz US $ 465.25 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |