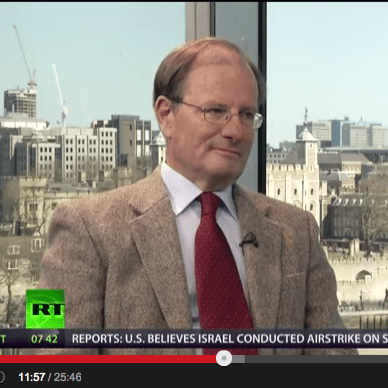

We have a lot of respect for Alistair Macleods point of view. This a great interview where his matter of fact approach contrasts nicely to Max Keisers outrageousness. In the interview they cover a lot of ground including:

- Why most analysts looking at the supply of gold get it wrong

- Why the move out of gold ETFs may not in fact be investors moving out of gold but rather into physical

- When he thinks we may see the next trouble brewing

- Why it is the Indians and Chinese are buying gold

- Why the Bullion Banks/Central Banks/hedge funds got it wrong and didn’t realize that “If you lower the price of something you increase the demand for it”

- The problems with using open interest as an indicator with respect to gold

- Why he’s not convinced it was a central bank that had the 400 tones sale that set off the price plunge

The interview begins at 11:50min but the first half has some interesting banter between Max and his partner in crime Stacey too.