This Week:

- Are You Ready For The Next Rally?

- China is about to shock the gold market

- Bitcoin – Plan Your Exit Strategy Now – Maybe With Gold

- How Bitcoin Might Affect the NZ Dollar

- Reader Question: Would Gold and Silver Get Cheaper in NZ if the US Dollar Collapsed?

Prices and Charts

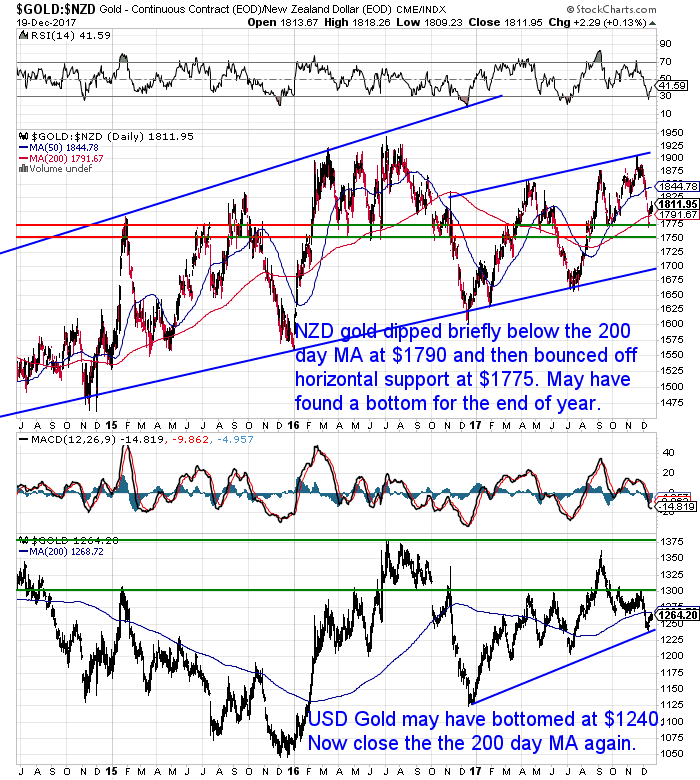

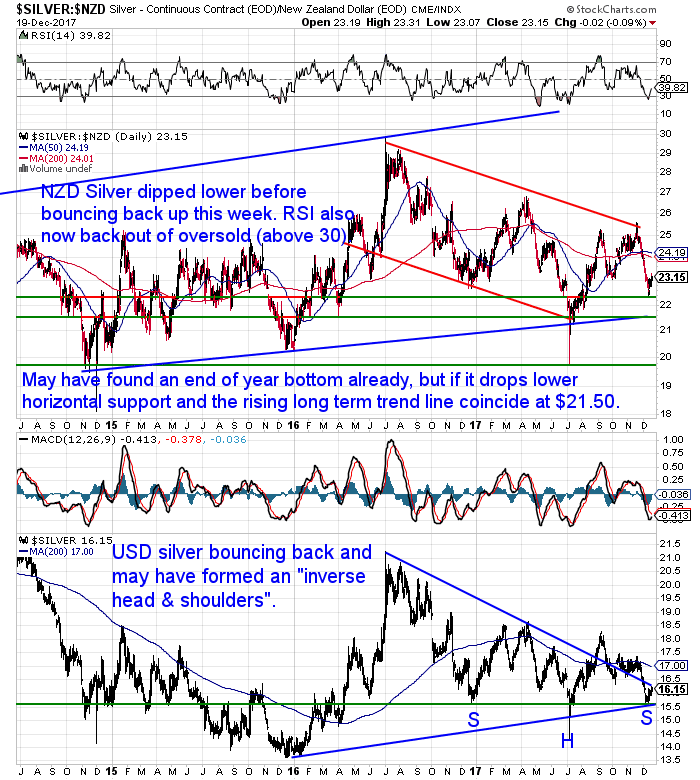

Gold and Silver May Have Bottomed Already

NZD Gold dipped briefly below the 200 day moving average (MA) line at the start of the week. It touched horizontal support at $1775, but has since bounced higher.

Gold may well have found a bottom for the end of the year already. So odds favour a bounce higher in January – as has been the case for the past few years.

Silver fell much more sharply than gold. But silver too looks to have bottomed out just above $22. Like gold, it is also now out of the oversold territory it was in on the RSI overbought/oversold indicator. Therefore there is a good chance that silver too has bottomed for the year.

But even if it hasn’t there is not much downside from here with the rising long term trendline and horizontal support coinciding at $21.50. We remain in an excellent buying zone, with significantly more upside than downside likely.

The New Zealand dollar rose this week but so far has struggled to close above 0.70. With strong resistance ahead at 0.71 for the 200 day MA, the Kiwi still looks to be in a slight downtrend to us.

Unsure About Any Terms We Use When Discussing the Charts?

Remember to check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Are You Ready For The Next Rally?

As we’ve been pointing out lately, both metals have bottomed in December over the past few years. Here’s someone else showing why the charts are saying this is likely to happen again and we should see a strong rally into January.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Bitcoin – Plan Your Exit Strategy Now – Maybe With Gold

Here’s some good advice for anyone who has managed to make a decent profit in Bitcoin or other cryptocurrencies.

Make sure you plan your exit strategy to lock in any gains before the herd does.

How Bitcoin Might Affect the NZ Dollar

Speaking of bitcoin, here’s an insightful comment we received from a reader this week (Thanks A.E.) on the potential impact of Bitcoin on the NZ Dollar. It was in response to a zerohedge article:

One Bank Believes It Found The Identity Of Who Is “Propping Up The Bitcoin Market”

The gist of the article is that a Deutsche Bank report by Masao Muraki states that:

“Japanese traders have reportedly come to account for nearly half of cryptocurrency trading since China started to shut down cryptocurrency exchanges, and this is said to be widely known among industry insiders (various estimates exist). This report shows that Japanese men in their 30s and 40s who are engaged in leveraged FX trading (or who used to trade but have stopped) are driving the cryptocurrency market.”

They believe these former amateur FX traders (often referred to as “Mrs Watanabe” although perhaps more rightly should be Mr “Watanabe”) are now involved in leveraged Crypto trading instead.

Our reader points out:

“If this is correct, Mrs. Watanabe’s interest in BTC could have negative impact on NZD. But if/when BTC crashes, the (long BTC) Watanabes won’t have anything to invest in “other” currencies, so NZD will stay down.”

What he means is that the New Zealand Dollar has long been the home of the Japanese Yen “carry trade”. Where these Japanese FX traders invest in New Zealand Dollars to enjoy the higher yield and generally rising exchange rate here (remember Japan has had incredibly low interest rates for years).

So were these amateur Japanese investors to get wiped out in a potential Bitcoin crash, there would be very little money to return to the NZ Dollar trade. Thereby the dollar will stay down in the long run.

It’s a good argument. We’ll watch with interest to see how this plays out.

Reader Question: Would Gold and Silver Get Cheaper in NZ if the US Dollar Collapsed?

A question in this week:

I was wondering one thing : if the US dollar collapses or if there is a big devaluation of this fiat currency, gold and silver would become inaccessible for americans but don’t you think People from New Zealand, having a more stable money, could have the opportunity to buy gold and silver even cheaper ?

Here’s our thoughts:

There may be a hole in your reasoning when you say:

“if the US dollar collapses or if there is a big devaluation of this fiat currency, gold and silver would become inaccessible for americans”

The US dollar could well collapse or lose significant value but that doesn’t necessarily mean Americans wouldn’t be able to buy gold or silver. Just that they would have to pay much higher USD prices for it.

The likely only way that gold and silver wouldn’t be available would be if gold went into what is termed “Permanent backwardation” in the futures market. Which really just means that holders of gold were unwilling to swap any gold for dollars at any price.

Were this to happen then the likelihood is that there would also be a similar loss of faith in all fiat currencies as currently the USD is at the centre of them all.

Here’s a couple of articles that explain backwardation in more detail:

Antal Fekete: Gold Backwardation and the Collapse of the Tacoma Bridge

Gold Backwardation Now Permanent

Now on to the next part of your question when you ask:

“but don’t you think People from New Zealand, having a more stable money, could have the opportunity to buy gold and silver even cheaper ?”

I think you are getting at the idea that the USD may collapse and so the NZD will be much higher and therefore gold will be cheaper to buy in the future.

But the last 16 years or so don’t back this up. Why?

Because the New Zealand dollar has still been losing value too. Albeit sometimes at a slower rate than the USD. Other times like this past year at a faster rate than the USD. Or put another way gold has gone up in price against all currencies since the early 2000’s.

See this article, in particular under the heading: In the Long Run All Currencies are Going Down Against Gold

So just because the USD dollar may lose value it doesn’t mean that the NZ Dollar won’t also be losing value against gold too. As recent history shows that is has been too.

Here’s some other articles related to this topic:

If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

How Will the Global Monetary System Change Take Place?

China is About to Shock the Gold Market

The last article on the site this week is an interesting discussion on what is going on between China, Russia and very surprisingly Saudi Arabia and how this will impact the US Dollar and global monetary system.

Your Questions Wanted

Finally Remember, if you’ve got specific question, be sure to send it in to be in the running for a 1oz silver coin.

Merry Christmas – Enjoy Your Holidays – But We are Open for Business

This will most likely be our last weekly Newsletter for 2017 (unless we get especially inspired over the holidays).

So we’ll take this chance to wish you a very merry Christmas and a safe and sunny New Year. Thanks for being a reader in 2017 and we’ll see you back in a couple of weeks for 2018!

Remember today’s deals will end tomorrow and Friday. So call David to discuss any of them on 0800 888 465. Or just reply to this email.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|

Pingback: The Stealth Rally in Gold Continues - Gold Survival Guide