This Week:

- Negative Interest Rates and Outlawing Cash

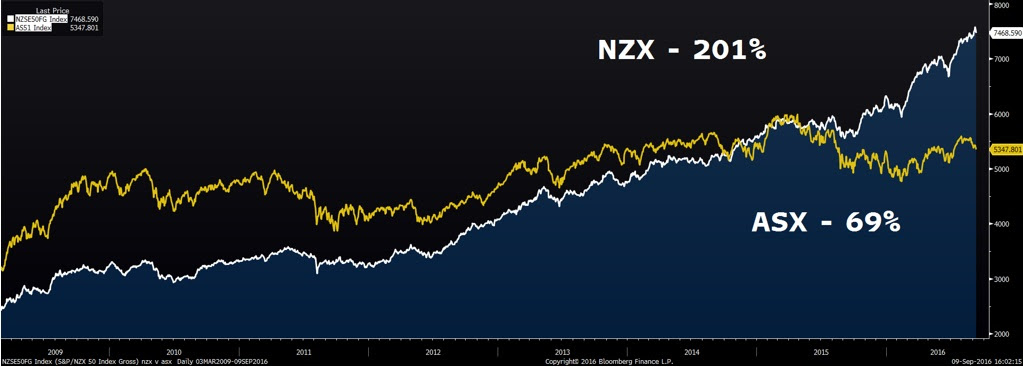

- Low Interest Rates Have Boosted the NZ Sharemarket

- Has the Bond Bubble Popped? Interest Rates to Rise? Impact on Gold and Silver?

- Deflation vs Hyperinflation

First up a reminder if you have registered or if you are still to…

5 Days to Go Until Free Webinar:

How to Increase Profits in Gold, Silver, and Foreign Currencies

With record low interest rates generating a yield today is really tough.

We’ve convinced a past client of ours who is a full time forex trader and also a forex trading coach to come along to a webinar and share some of his 12 years worth of knowledge.

Sign up to the webinar on Tuesday, 20 September 2016 at 12:00 PM NZST here.

In this webinar you will get information on technical analysis for beginners that can be used in the gold and silver futures markets. So you can increase your potential profit when timing purchases of physical gold and silver.

Come along and you can also learn about how to generate an ongoing income via foreign currency trading strategies as well as via gold and silver futures. So you can spend more time doing what you enjoy with your family and friends, and less time working.

He’s not one of the guys you hear advertising on the radio from Australia or the US. He’s an ex-dairy farmer based right here in Hamilton, New Zealand.

You’ll hear him present in a laid back, low pressure and no hype style, from a Kiwi point of view.

You won’t hear promises of get rich quick or make millions in just 10 minutes a day. You will learn how to make a steady profit over many years regardless of market conditions.

Sign up today for the webinar on Tuesday, 20 September 2016 at 12:00 PM – 1:00 PM NZST

We’re hoping to have a recording of the event to share later. So even if you can’t make it live we encourage you to sign up to be sure you don’t miss it.

We look forward to seeing you there.

Now we return to our usual broadcast…

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1817.68 | + $8.70 | + 0.48% |

| USD Gold | $1323.45 | – $22.25 | – 1.65% |

| NZD Silver | $26.09 | – $0.55 | – 2.06% |

| USD Silver | $19.00 | – $0.82 | – 4.13% |

| NZD/USD | 0.7281 | – 0.0158 | – 2.12% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1748 |

| Buying Back 1kg NZ Silver 999 Purity | $799 |

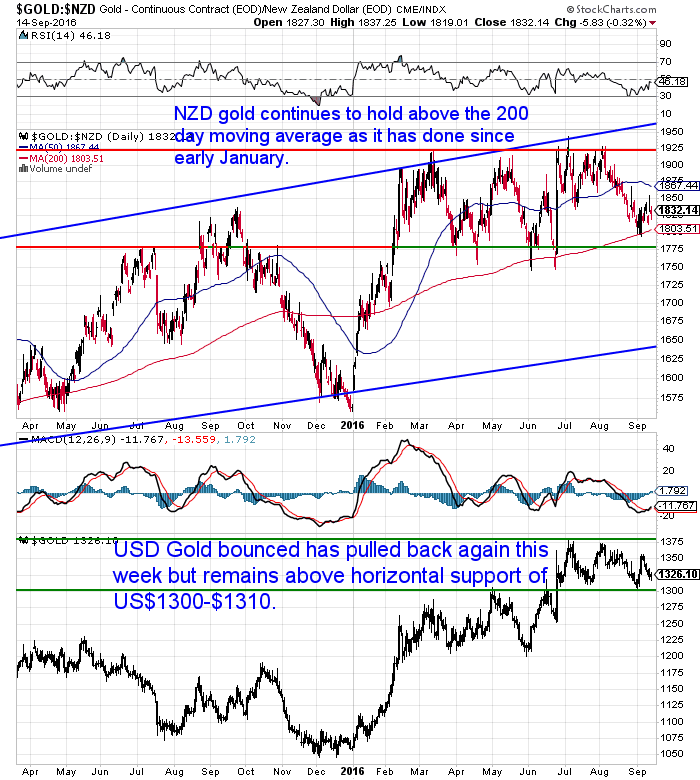

Gold continues to hold above the important 200 day moving average (currently $1803). So we remain in the range above the horizontal support line of around $1775 and below the resistance line at $1925.

Also check out an article on the site this week which takes a more indepth look at many technical and sentiment indicators for gold. While this refers to US Dollar prices, it still has plenty of relevance as the local NZ charts are not too different.

Gold Market Update: “Going Off the Rails”

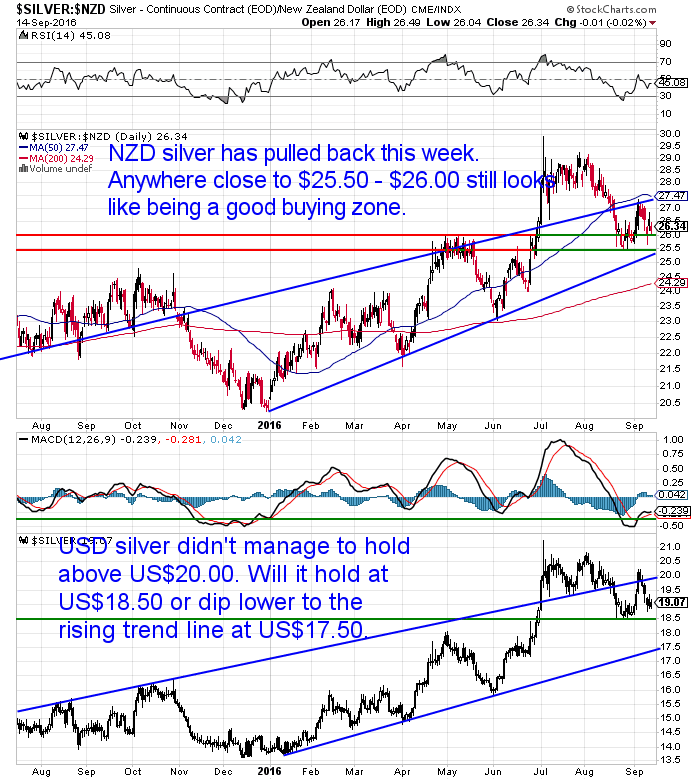

Silver too has pulled back this week. It is now not too far above the rising blue trendline. This line also coincides with horizontal support at around $25.50. So odds favour any purchase close to that mark being a decent long term bet.

There is also an accompanying silver article worth reading on the website.

Silver Market Update: Despite Downturn, Silver Market Looks Positive

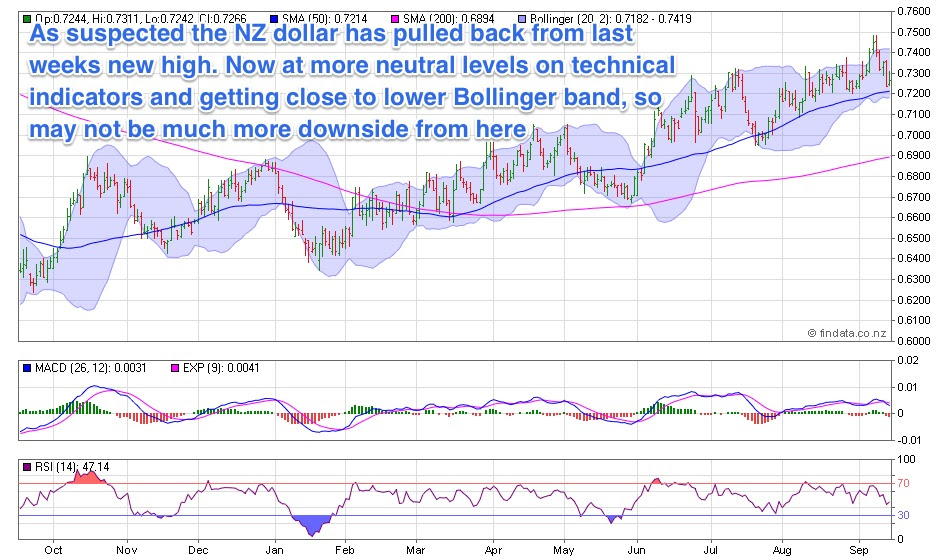

The NZ Dollar has pulled back from the overbought condition of last week. It is getting close to the lower Bollinger band so may not have too much more downside from here. Like the metals the kiwi continues its steady rise of this year.

Negative Interest Rates and Outlawing Cash

Bill Bonner has a sharp wit and equally sharp pen. He made a very good point about Harvard Economist Kenneth Rogoff’s theory on outlawing cash to deter crims and terrorists. Bonner quipped:

- “Writing last month in the Wall Street Journal under the headline, “The Sinister Side of Cash,” [Kenneth Rogoff] noted that “paper currency, especially large notes such as the U.S. $100 bill, facilitate crime: racketeering, extortion, money laundering, drug and human trafficking, the corruption of public officials, not to mention terrorism.”

- Of course, large notes do make it easier for criminals to operate. Like cellphones. And sunglasses. And automobiles with air-conditioning.”

Classic line we just had to share! This shows these arguments are just a disguise for the main reason for outlawing cash. More control over us.

If you’d like to see a more comprehensive but still elegantly written counter, then check out James Grant’s rebuttal also in the Wall Street Journal. He does an excellent job of pulling apart Rogoff’s arguments for getting rid of cash: Hostage to a Bull Market

But it’s hard not to get the feeling that this is where we are heading. With negative interest rates steadily spreading, this removal of cash is an obvious next step. It enables the central planners to force us to spend, or to tax us for “hoarding”.

Low Interest Rates Have Boosted the NZ Sharemarket

Last week we shared some comments from Kris Sayce at Port Phillip Publishing in Australia on Auckland house prices versus Sydney.

He also thinks record low interest rates here have helped to boost the NZ Sharemarket:

- “A victory for New Zealand

- Speaking of bubbles brewing… Yesterday, we drew your attention to the New Zealand housing market, and how the median price in Auckland is higher than the media house price in Sydney.

- Today, we draw our own attention, and yours, to the unbeatable performance of the S&P/NZX 50 stock index. The chart below shows the relative performance against the Aussie blue chip index, the S&P/ASX 200:

- Source: Bloomberg

- Click to enlarge

- Since 2009, the Kiwi index is up 201%. The Aussie market is up a lowly 69%. The New Zealand market has been less impacted by the resources slowdown.

- Despite being a much smaller market, the NZ index has a much broader exposure to varied sectors.

- The S&P/ASX 200 index is weighted 27% towards bank stocks. The financial sector as a whole accounts for 36% of the Aussie market. 15% of the Aussie market is in mining stocks.

- That’s over half the market in two relatively narrow industries — both of which, incidentally, have performed poorly in recent years.

- By contrast, in the NZ market, utilities make up 16% of the market, healthcare accounts for another 16%, and industrials make up 15%.

- This perhaps reflects the relative outperformance of the NZ market against the Aussie market.

- But, like Australia, you still have to wonder if it’s sustainable. As noted yesterday, NZ interest rates are at a record low. The NZ market has done well. But let’s not be under any illusions that low interest rates have been a big help.”

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

For just $190 you can have 4 weeks emergency food supply.

Has the Bond Bubble Popped? Interest Rates to Rise?

But the really big question is how long can these low interest rates remain?

It seems that short term interest rates seem to be getting lower in most places. Or even negative in many.

It would seem to make sense that rates could stay low for a long time yet. As argued in this article: Gold Investors – Get ready for the magnet effect

But while central banks can control short term rates, it is much more difficult to have such an impact on the longer term interest rates (as in 10 to 30 year bond rates).

Last week we noted that US 30 year treasury bond yields may well have bottomed out.

Mega bond investor Jeffrey Gundlach made similar comments this week:

- “This is a big, big moment,” Gundlach said during a webcast Thursday. “Interest rates have bottomed. They may not rise in the near term as I’ve talked about for years. But I think it’s the beginning of something and you’re supposed to be defensive.”

- …He said both Trump and Democrat Hillary Clinton have advocated more spending on infrastructure, which would add fiscal stimulus to the economy as central bank low- and negative-interest rate policies across developed markets show diminishing returns.

- “This idea that fiscal stimulus may be coming seems to be getting sniffed out by the bond market,” Gundlach said. More debt spending may increase the cost of government borrowing by adding supply and making investors demand higher yields, he said.

- “People say, ‘How can rates rise?”‘ he said. “That’s how they can rise and they’re sort of rising already.”

- Source.

This marketwatch article does a good job of outlining what may well be the early stages of a change in trend for interest rates.

Did the Bond Bubble Just Pop?

Last week, U.S. Treasury prices plunged… pushing yields to their highest level since the end of June. Was it just the beginning of the end of the 35-year bubble in bonds?

The simple thought is that if interest rates were to rise then that would be negative for gold. Higher yields hurt gold right?

But as we’ve written before, in the 1970’s this is exactly what happened. Interest rates rose alongside gold and silver.

And just very recently we have been witnessing this, with long term interest rates moving higher along with gold and silver prices.

Of course in investment circles this idea of the end of the bond bubble and rising rates has been known as the “widow maker” for good reason. Many have got it wrong so far.

Also it doesn’t mean that interest rates are going to skyrocket higher this month or even this year. But maybe, just maybe this is a start of a trend change.

We have low inflation, record low interest rates and precious metals having been in free fall up until early this year.

So a switch to higher inflation, higher long term interest rates and rising precious metals prices would take most completely by surprise. Perhaps this is what we could see happen though?

HYPERINFLATION VERSUS DEFLATIONARY COLLAPSE

On the website we also have a couple of articles looking at the deflation versus hyperinflation scenarios.

HYPERINFLATION VERSUS DEFLATIONARY COLLAPSE

And in the Gold Market Update: “Going Off the Rails” already mentioned earlier this topic is also examined.

Canadian Silver Maple Special Today – Year 2012 Coins

We have a special today. Just 2 monster boxes (500 x 1oz silver maples in each box or 20 tubes of 25 x 1oz coins). One box unopened; one box has just had its outside strapping cut.

Each monster box today is $15150 pick up or fully insured until you sign for it and couriered within NZ for $15223.

If buying both monster boxes (1000 silver maples) the price is $30,150 pick up or ins/del for $30,295

Just reply to this email or phone David on 0800 888 465.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

“Good Guys” or “Bad Guys”: Who Wins in Coming Monetary ResetThu, 15 Sep 2016 9:51 AM NZST  If you’re not familiar with Bix Weir, he has some really interesting theories. In this interview with Jeff Berwick of Dollar Vigilante he pretty much covers all of them. At some point the current monetary system is certain to change. As you no doubt know, every fiat currency in history has failed. This one will […] If you’re not familiar with Bix Weir, he has some really interesting theories. In this interview with Jeff Berwick of Dollar Vigilante he pretty much covers all of them. At some point the current monetary system is certain to change. As you no doubt know, every fiat currency in history has failed. This one will […]

|

Janet And Gold: Does History Rhyme?Wed, 14 Sep 2016 4:54 PM NZST  We’ve got another helping of Stewart Thomson this week. Apart from his usual comments on the gold, silver and mining index charts, he also has a look at the action in the US Treasury Bond market. He’s not the only one to notice some action there. Is it significant though? See what he reckons… Janet […] We’ve got another helping of Stewart Thomson this week. Apart from his usual comments on the gold, silver and mining index charts, he also has a look at the action in the US Treasury Bond market. He’s not the only one to notice some action there. Is it significant though? See what he reckons… Janet […]

|

Silver Market Update: Despite Downturn, Silver Market Looks PositiveWed, 14 Sep 2016 2:21 PM NZST  Following on from the gold article posted earlier today: Gold Market Update: “Going Off the Rails”, this is a corresponding article on silver’s current technical indicators. The recent pullback may have already been enough to set silver up for further gains… Silver Market Update: Despite Downturn, Silver Market Looks Positive Originally published September 5th, 2016 in […] Following on from the gold article posted earlier today: Gold Market Update: “Going Off the Rails”, this is a corresponding article on silver’s current technical indicators. The recent pullback may have already been enough to set silver up for further gains… Silver Market Update: Despite Downturn, Silver Market Looks Positive Originally published September 5th, 2016 in […]

|

Gold Market Update: “Going Off the Rails”Wed, 14 Sep 2016 12:47 PM NZST  There is an argument to be made that technical analysis is pointless in these times, where even the most important financial indicator, the “cost” of money (a.k.a. the interest rate) is manipulated. We are sympathetic to this view. However there are still large volumes of money that are invested by following trends. So there is […] There is an argument to be made that technical analysis is pointless in these times, where even the most important financial indicator, the “cost” of money (a.k.a. the interest rate) is manipulated. We are sympathetic to this view. However there are still large volumes of money that are invested by following trends. So there is […]

|

HYPERINFLATION VERSUS DEFLATIONARY COLLAPSEMon, 12 Sep 2016 11:06 AM NZST  A common argument is what will bring about the end of the current monetary system? Will it be hyperinflation as a result of excess currency creation and a loss of trust? Or will it be a deflationary collapse due to the massive levels of global debt? Darryl Schoon gives his version of events in this […] A common argument is what will bring about the end of the current monetary system? Will it be hyperinflation as a result of excess currency creation and a loss of trust? Or will it be a deflationary collapse due to the massive levels of global debt? Darryl Schoon gives his version of events in this […]

|

Reminder: Gold Will Rise With Interest RatesThu, 8 Sep 2016 6:10 PM NZST  This Week: SDR Bonds Sold in China – Will the Dollar Live to Die Another Day? When they say ‘hoarding’ instead of ‘saving’ you know you’re in trouble Why Gold Demand Doesn’t Necessarily Correlate with Price Support from Across the Ditch for our Theory on House Prices World’s largest money manager sees inflation ahead Reminder: […] This Week: SDR Bonds Sold in China – Will the Dollar Live to Die Another Day? When they say ‘hoarding’ instead of ‘saving’ you know you’re in trouble Why Gold Demand Doesn’t Necessarily Correlate with Price Support from Across the Ditch for our Theory on House Prices World’s largest money manager sees inflation ahead Reminder: […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: Forget The Fed…Here’s the Key Interest Rate You Need to Be Watching - Gold Survival Guide