|

Gold Survival Gold Article Updates

May. 8, 2014

This Week:

- Central Bankers Still Rule the World

- Time to Admit That Gold Peaked in 2011?

Just one article for you this week, but an interesting one if you’ve come across the meme that gold reached its “inflation adjusted” high in 2011 and has already peaked. See the link below for that.

How Have Both Monetary Metals Fared in the Past Week?

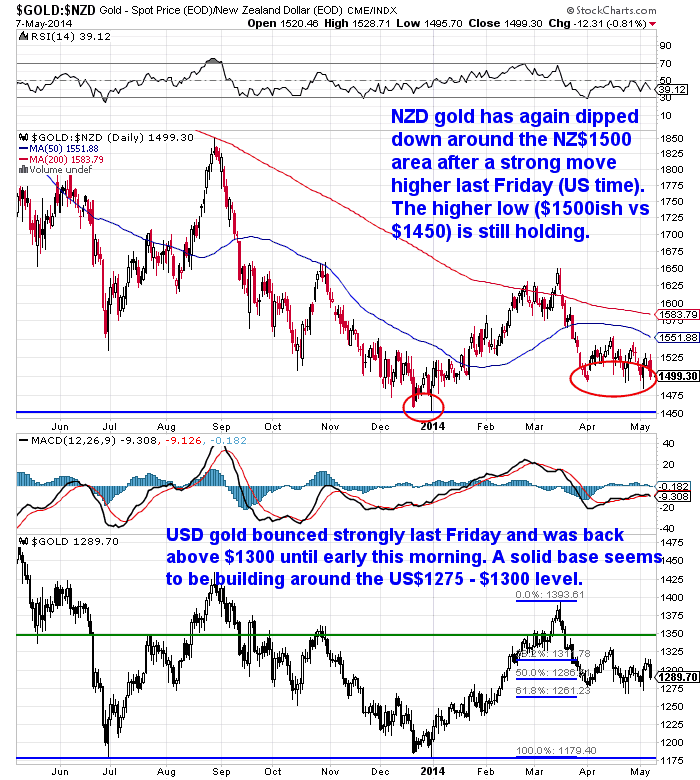

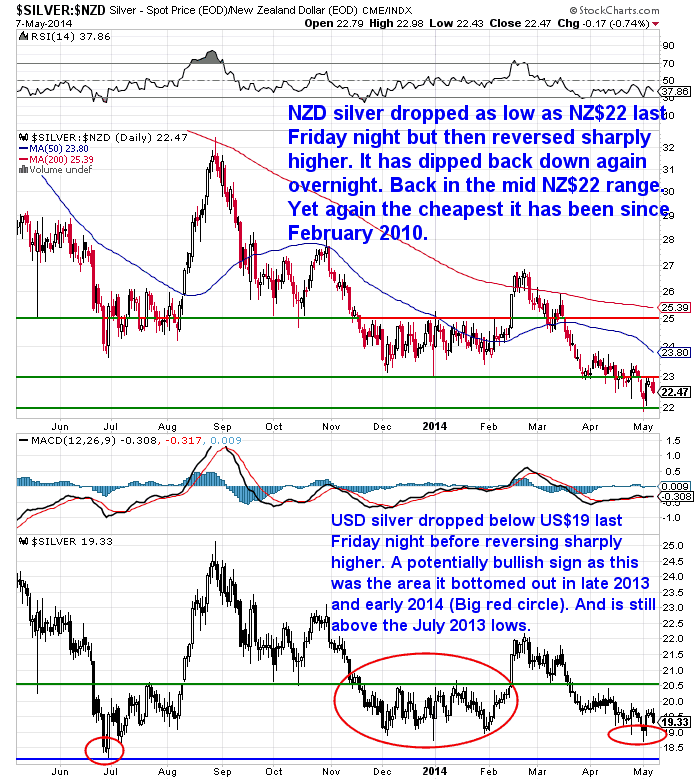

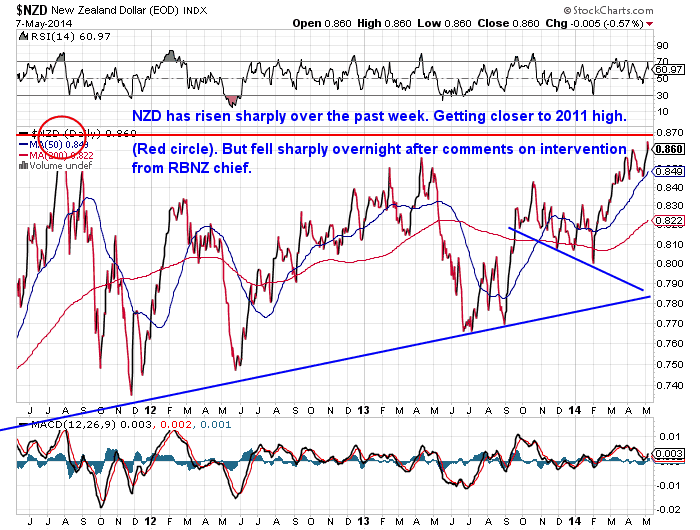

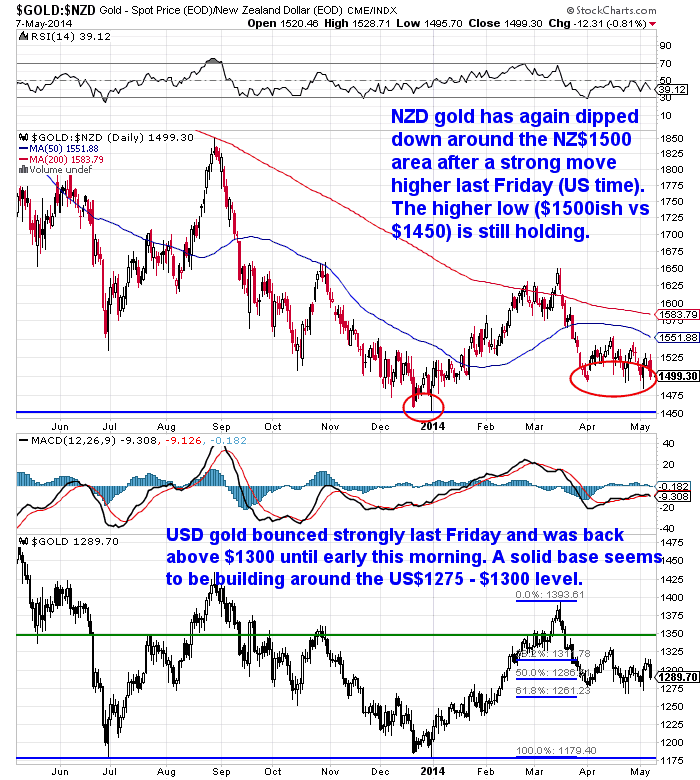

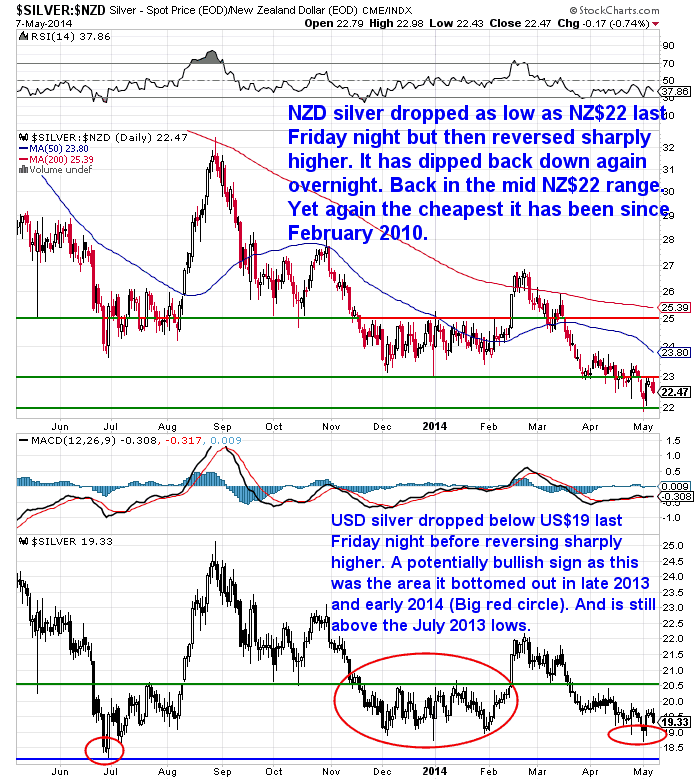

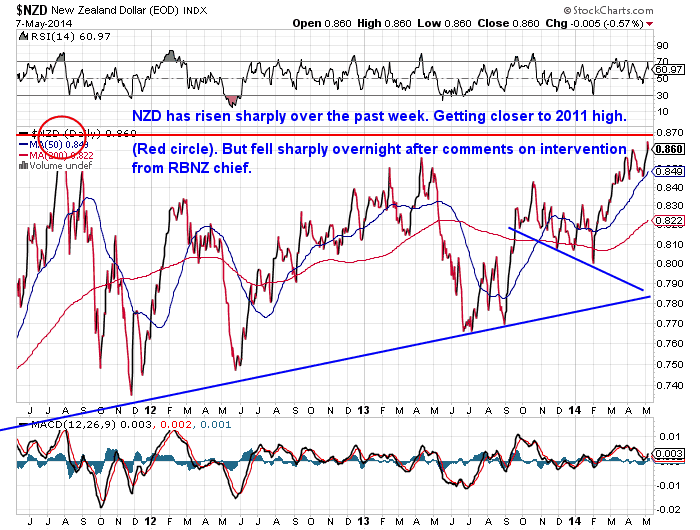

Interestingly overnight local prices fell less than the US gold and silver prices due to a sharply weaker NZ Dollar (more on that soon). In US dollar terms they were down about 1.35% wheres in NZ dollars just under 0.50%.

We saw it reported that this move lower was due to Putin’s comments being less confrontational. However as we’ve said before geopolitical conflict is not the main driver of the gold price, as much as the mainstream would have you believe otherwise. The current bull market has been driven by central planner monetary policy not a decade of international conflict.

Since last week gold in NZ dollars is down $9.34 per ounce or 0.62% to NZ$1492.00.

Whereas silver reversed the trend of recent months, outperforming gold and was actually up 3 cents per ounce or 0.13% to NZ$22.37.

They both pretty much did a repeat of the previous week as you can see in each chart. Gold jumped up from NZ$1500 before moving back just below it again overnight.

Silver dipped down to new lows around $22, before bouncing sharply higher also.

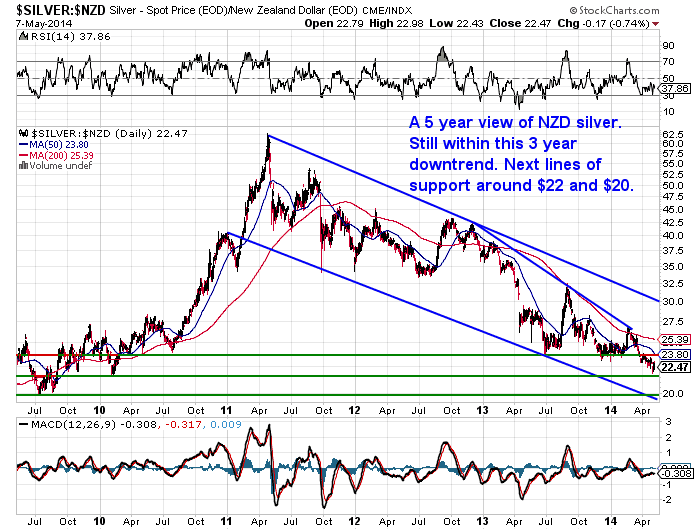

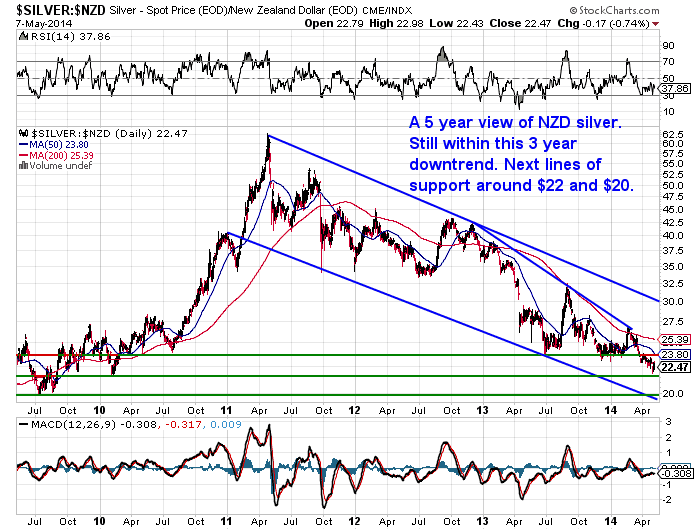

You can see in this longer term 5 year chart below that NZD silver still remains within the confines of the downtrend it has been in for 3 years. Although it is getting quite compressed. In April it dropped below the support line dating back from August 2010. Then overnight last Friday it dipped even lower to touch the support line from February 2010 at NZ$22.00. So the cheapest it has been in over 4 years. There is even stronger support below this at NZ$20.00 but who knows whether we will reach this.

We’ve seen a few people grab positions in recent days – but few is the operative word. Seems most people are still on the sidelines by all accounts. Although it seems there aren’t too many sellers at these prices either. Gold in particular seems to be building a solid base around here despite what appears to be concerted efforts to send it lower.

Central Bankers Still Rule the World

The past day or so has been a reminder that for most that Central Bankers definitely still rule the world. RBNZ Guv Wheelers comments that it would make sense for them to intervene in currency markets if the kiwi dollar stays high while dairy prices continue to fall seem to have caused the dollar to drop lower after being on a rise for the previous few days.

This article gives a good run down of not only his comments but also what various bank economists think they might mean.

Interestingly they are coming round to our way of thinking that the RBNZ rate rises might not be so steady and regular as first thought (NZ Herald: Signs of a Reserve Bank rate-rise pullback?).

And that the Reserve Bank wants to get the kiwi dollar lower before raising rates further.

The issue here is that a lower NZ dollar would translate into higher prices for everyday goods we import (as we discussed here in answer to a question from a reader: “Why would a fall in the NZ dollar be a negative?”).

So while they may not raise rates if the dollar falls and export prices remain lower, a lower dollar would in turn lead to higher prices and “inflation” (as per standard economist definition of higher prices not an inflation in the monetary supply as per Austrian Economics), which is usually why a central bank then raises interest rates – to curb inflation.

So the RBNZ could be on a hiding to nothing here, whether they realise it or not. What they do is usually the cause of another problem. For example how their record cheap interest rates have caused rises in house prices in recent years.

So: Export prices keep falling, but dollar remains high, inflation/prices will drop so they don’t raise interest rates. Or NZ dollar falls, prices rise due to more expensive imports, inflation ticks up, rates increase.

Unfortunately they can’t have their cake and eat it too.

Although the Labour party thinks their new fangled “Variable Savings Rate (VSR)” means they can. If you missed what this was, in a nutshell the Labour policy is that they will force everyone into Kiwisaver then raise or lower the amount everyone is forced to save depending on how the economy is performing. This would allow interest rates to stay low. i.e. If the economy heats up they take some money away by forcing everyone to save a higher percentage.

We saw the question: “What about the poor? How will taking more money off them in forced savings help if they don’t have enough to live on?”

Labours answer was along the lines of: Lower interest rates will mean lower higher purchase and car repayments.

You can’t make this stuff up! So the solution is to let the poor stay in debt but make the debt a bit cheaper to repay. Oh man oh man oh man.

Here’s the MD of Infometrics view on why he doesn’t like Labours VSR idea.

Interestingly he doesn’t talk about the issue above at all though. What would it actually achieve and who would it help?

Now we’re no fans of the current central bank run monetary policy system but putting more band aids on the wound won’t actually help.

An imbalanced monetary system means an imbalanced world and an imbalanced local economy (as clearly elucidated by our favourite billionaire in: The Gold Standard – Generator and Protector of Jobs). An imbalanced monetary system means an imbalanced world and an imbalanced local economy (as clearly elucidated by our favourite billionaire in: The Gold Standard – Generator and Protector of Jobs).

And one reason for these imbalances is trying to control the price of money – interest rates.

Try asking someone how interest rates work sometime. Why they go up and why they go down. You’ll get something like: “The Reserve Bank raises interest rates when things get too hot to cool it down and lowers them when things slow down to crank them back up.”

Then explain how in a free market interest rates would function in the exact opposite of the way they do now.

That is, the interest rate would be naturally higher when the economy slowed down as this would encourage savings and capital formation. And poor business and poor decisions made would be punished.

Also this cycle of rising and lowering rates could likely occur over much shorter time spans than it does currently. So corrections would be short and sharp and booms would not run on endlessly one after another.

But Central Bankers remain in the drivers seat – for now at least.

Overnight were comments from Janet Yellen that the US economy looks great after the winter weather has passed which were also used as a reason as to why gold and silver prices backed off.

Seems people have a short memory. But if you prefer to follow the “Central Bank of You” and set up your own “Sovereign Wealth Fund” then you know here to find us.

|

An imbalanced monetary system means an imbalanced world and an imbalanced local economy (as clearly elucidated by our favourite billionaire in:

An imbalanced monetary system means an imbalanced world and an imbalanced local economy (as clearly elucidated by our favourite billionaire in: