This Week:

- Silver Again Outperforming Gold

- NZ Dollar Should Have Tough Resistance Here

- Strange pattern develops in dollar trading

- Coming: NZ’s own form of “helicopter money”?

|

Opening Hours Easter Holidays Local Auckland suppliers closed for Good Friday on 25th March and Easter Monday on 28th March. However have an offshore supplier that is open all this week up to half day Saturday 26th March and open on Easter Monday 28th March for orders around $10,000 or more. Ph 0800 888 465 anytime and speak to David for a quote, placing an order or just a general chat; no advice sorry, just my personal opinion for what its worth! |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1825.59 | – $48.85 | – 2.60% |

| USD Gold | $1221.50 | – $38.50 | – 3.05% |

| NZD Silver | $22.81 | – $0.40 | – 1.72% |

| USD Silver | $15.26 | – $0.34 | – 2.17% |

| NZD/USD | 0.6691 | – 0.0031 | – 0.46% |

NOTE: If you ever miss getting your weekly email, you can read it on the website. Just go to the “Articles and Videos” and choose the “Weekly Newsletter Archive” from the drop down. Or bookmark this link.

Silver Again Outperforming Gold

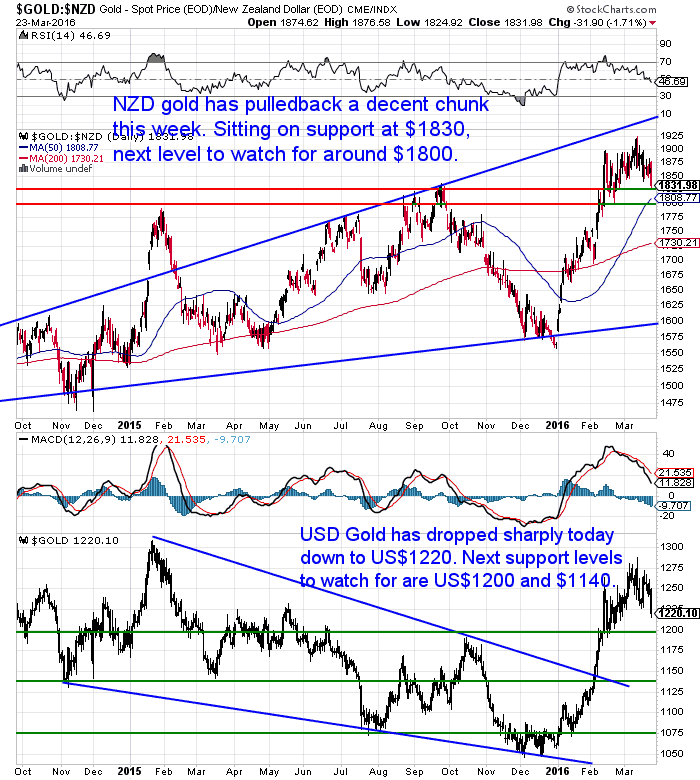

After tracking steadily higher for most of the week gold corrected sharply this morning. Now down 2.60% on last week. It is now sitting near support at $1830, but the next level to watch is $1800. This also is around where the 50 day moving average is.

After such a large move higher most have probably been expecting a pretty decent correction. However with the serious consolidation going on above $1800, we wonder if we may just be surprised with a much smaller correction at this stage?

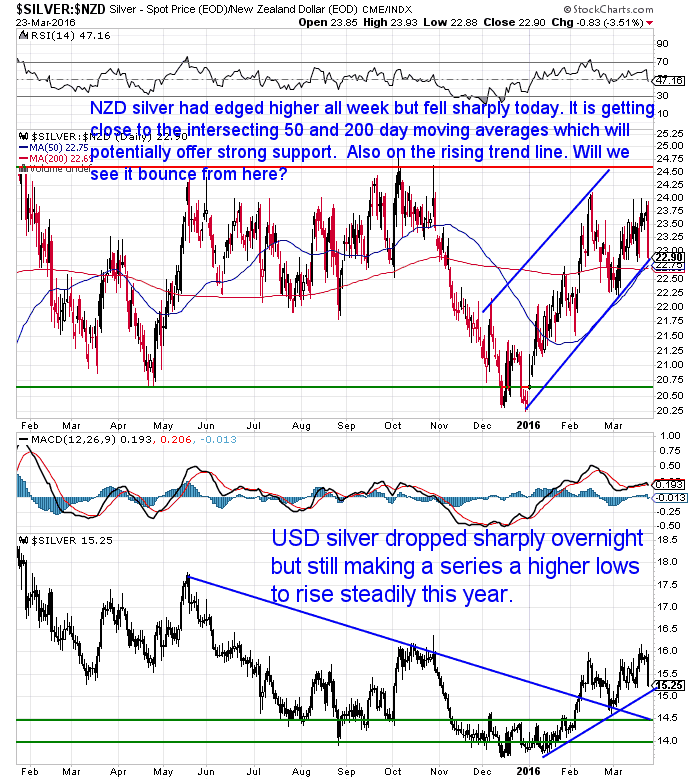

Silver has continued the trend of last week, by falling less than gold. With today’s fall it is back down almost to the intersecting 50 and 200 day moving averages. This also coincides with the rising trend line. So with silver making a series of “higher lows” since the start of the year, perhaps we will see it once again continue higher from here?

NZ Dollar Should Have Tough Resistance Here

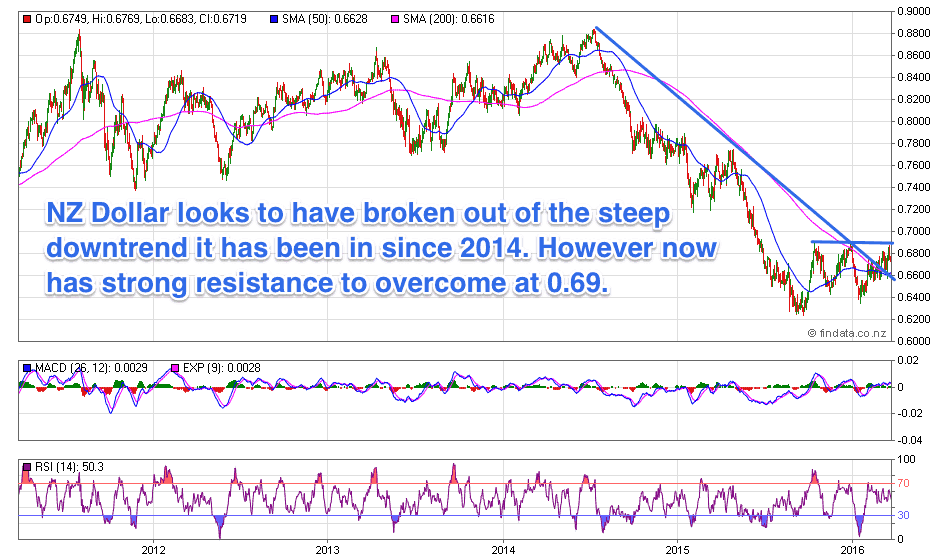

After a couple of sharp spikes higher following last week’s US Fed announcement, the NZ Dollar is actually down around 0.50%.

It does appear to have bottomed out here and has broken out of the steep downtrend it’s been in since 2014.

But there is very strong resistance for it at 0.69, which it failed to breach this week. So we may well see it trade sideways in the band between 0.64 and 0.69 it has been in for the last 6 months.

Zero Hedge: Strange pattern develops in dollar trading

On the topic of exchange rates, Zero Hedge reports on what seems like a “strange pattern” in how U.S. dollar has traded lately. This pattern – that of the dollar falling during US trading hours – has gotten stronger ever since the G-20 meeting in Shanghai. Zero Hedge says Bank of America’s chief foreign exchange strategist, Athanasios Vamvakidis, believes that this pattern “would be consistent with emerging-market central bank interventions,” presumably China selling dollars.

This would fit in nicely with another article this week where the idea has been floated that perhaps a secret deal was made at the G-20 meeting in January to stop the strengthening US Dollar?

“The dollar has taken a surprisingly big stumble in recent weeks, prompting traders to ask: What’s really driving the selloff? The answer some are coming up with smacks of conspiracy theory.

Rumors are flourishing that global policy makers made a secret deal at the G-20 meeting in Shanghai late last month. This “Shanghai Accord” to weaken the greenback was aimed at calming the financial markets, which had gotten off to an awful start to the new year, according to the chatter.

No foreign-exchange pact was announced at the February meeting of central bankers and policy makers from the 20 largest economies. That hasn’t stopped speculation that a plan of action was whipped up behind closed doors, as its supposed effects are beginning to emerge now: The greenback has shaved off more than 3 percent since the gathering, sparking a rally in stocks, emerging market assets, and commodities.”

The Gold Anti Trust Action Comnittee’s (GATA) secretary Chris Powell then wonders out loud…

“It’s plausible, but note how the MarketWatch report takes for granted that central banks are willing and able to rig markets in secret, how the report assumes that this is the natural order of things and not even worth questioning.

So why do MarketWatch and all other mainstream financial news organizations refuse to report that central banks long have been surreptitiously rigging the gold market as the prerequisite for all their market rigging, even though documentation and admissions of gold market rigging abound?:

http://www.gata.org/node/14839

That is, if rumor and speculation are reportable, why not fact as well?”

The link Chris gives is to a transcript of a speech entitled:

“Chris Powell: Gold market manipulation: Why, how, and how long?”

This speech is largely the same as one he gave here in Auckland a couple of years ago.

After reading that and the links it contains, we’d ask you if you could have little doubt that central banks have regularly intervened in gold markets?

Chris Powell in Auckland: Gold price suppression – why, how, and how long?

Central banks are already doing the unthinkable – you just don’t know it

Sticking to the topic of Central Banks, as we all love the central planners who make our lives so much better, don’t we?

The topic of helicopter money which we have been discussing for months is cropping up more and more in mainstream press. This week the UK Telegraph was in the mix:

Thinking the unthinkable

“Faced with political intransigence, central bankers are openly talking about the previously unthinkable: “helicopter money”.

A catch-all term, helicopter drops describe the process by which central banks can create money to transfer to the public or private sector to stimulate economic activity and spending.

Long considered one of the last policymaking taboos, debate around the merits of helicopter money has gained traction in recent weeks.

ECB chief Mario Draghi has refused to rule out the prospect, saying only that the bank had not yet “discussed” such matters due to their legal and accounting complexity. This week, his chief economist Peter Praet went further in hinting that helicopter drops were part of the ECB’s toolbox.

“All central banks can do it”, said Praet. “You can issue currency and you distribute it to people. The question is, if and when is it opportune to make recourse to that sort of instrument”.

With 16 out of Europe’s 28 economies still in deflation and annual eurozone growth set to hit just 1.4pc in the middle of a cyclical upturn, the opportune moment may soon be upon us.

“We have had forward guidance, QE and negative interest rates, says Gabriel Stein at Oxford Economics.

“But none of these has proven a panacea and their shelf-life is getting shorter.”

Helicopter drops by stealth

For some observers, the next phase in extraordinary central bank action is already upon us, and it is Japan which is leading the way.

The Bank of Japan’s move to impose a three tiered deposit rate on banks is a covert attempt to inject funds directly to the private sector, argues Eric Lonergan, economist and hedge fund manager.

He notes that the BoJ’s decision to exempt some reserves from the negative rate represents a transfer of cash to commercial lenders at rate of 0.1pc.

The system “separates out the interest rate on reserves from that which affects market rates”, says Lonergan.

“It is taking the first step along the journey towards helicopter money and opens up a whole new avenue of stimulus”.

In the same vein, the ECB has also signaled its intention to move towards targeted attempts to boost private sector credit demand.”

It’s worth reading as it gives some insight as to the steps along the way to true “helicopter money”.

Bloomberg was also in on the act. Discussing how desperate Central Banks are talking “Helicopter Money” after six hundred interest-rate cuts and $12 trillion of QE failed to stimulate the economy. It seems central banks are running out of ammo. So the next “stimulus” may hand money directly to the people.

“Economists at Citigroup Inc., HSBC Holdings Plc and Commerzbank AG all published reports to investors on the topic in the past two weeks, while hedge fund titan Ray Dalio sees potential in the idea. European Central Bank officials are already squabbling about what President Mario Draghi calls a “very interesting concept.”

“We don’t know for certain that ‘helicopter money’ will be the next attempted silver bullet, however the topic is receiving considerably more attention,” said Gabriel Stein, an economist at Oxford Economics Ltd. in London. “The likelihood is reasonably high of some form being implemented somewhere.”

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $179 you can have 4 weeks emergency food supply.

Learn More.

—–

The past “stimulus measures” have not stemmed the slow down the world seems to be entering.

We have another article on the site this week from Hugo Salinas Price (see the end of the email for that and other articles as usual). But you may recall earlier this year where he discussed the falling global central bank currency reserves.

Today some numbers from Jim Rickards back up this assertion that global trade is slowing and with it falling currency reserves.

“One of the signals we are picking up is the shrinkage in world trade. Investors tend to focus on trade deficits and surpluses, but those figures mask the fact that overall trade is shrinking.

You can have a reduced trade deficit but still find that exports and imports are both shrinking. The lower deficit sounds like good news, but the reduction of imports and exports is troubling.

It means the global trading economy is shrinking: a sure sign of recession.”

Lower Rates Ahead For NZ

It seems the bank economists here at home are coming round to our way of thinking. With ASB now thinking rates will go even lower.

“The odds have now tipped towards a 1.75% low in the OCR. Events since the March Monetary Policy Statement show the RBNZ is not likely to get the stimulatory response to the OCR cut that it would have hoped for. Several benchmark lending rates have not fallen as much as the RBNZ clearly expected them to. Moreover, the RBNZ again runs the risk that the NZD holds up at a higher level than it has assumed, continuing to undermine the extent to which inflation will pick up in the future.

We now expect two final OCR cuts, at the June and August Monetary Policy Statements, with the April meeting a very lineball call for the next move. But the housing market’s response to lower interest rates will remain a consideration for the “how much” and “when”.”

New Zealand Won’t Escape Deflation

These lower interest rates are the central planners answer to deflation. BERL Chief Economist Dr Ganesh Nana notes that for New Zealand it is:

“…becoming increasingly difficult to ignore the shadows cast by lurking deflationary influences. Deflation stalks the global economy and we will not be able to escape these influences.”

“Critically, the anti-inflation bias in our policy framework of the past 25 years must be replaced by a clear understanding that the costs of deflation are just as vigorously to be avoided.” commented Dr Nana. “Our adjustment to lower commodity prices and sluggish world demand is continuing. Both the OCR and the exchange rate will have to come down further, and it is important that officials don’t get distracted from this path”.

“But the model of the past 25 years centred on monetary policy (i.e. interest rates) is now close to impotent in the face of the deflationary world. We can no longer rely on contracting-out economic policy to the central bank. However, the appetite for active fiscal policy to make a return to the policy toolkit remains unclear.”

He finished up with:

“the longer-term structural imbalances in the New Zealand economy, including a persistent external deficit and a struggling tradable sector remain. While GDP growth will continue, and this will present a better picture than other economies, the nature and composition of that growth will do little to rectify these imbalances. It remains to be seen if we are willing to recognise that a deflationary world will require a new toolkit.”

So what will the “new toolkit” to fight deflation in NZ be?

How about NZ’s own form of “helicopter money”?

Labour looks to ‘limited trial’ of universal basic income.

Labour’s finance spokesman Grant Roberston warned at a party conference that the global economy was undergoing “warp speed” change. And that this would require “active labour market policies” and “a social partnership model between government, business and unions to manage change and disruption.”

One of these ideas is the ‘limited trial’ of “universal basic income”.

“The Labour Party is signalling major reform of the social welfare system it developed, saying it will investigate “new models of income security for New Zealand, including considering a limited trial of a universal basic income.

…The concept is to replace the current range of social welfare and other benefits with an equal payment to every citizen, irrespective of income, to deliver sufficient income for adequate living standards, especially in a period of fast-changing transition in the workforce. The UBI would be paid for by higher taxes on higher incomes and structured to prevent a beneficiary who finds work being penalised as the UBI would not reduce as they start earning.”

What’s wrong with this idea?

Check out this article we posted last week that delves into the issues with any form of “free” money.

How Negative Interest Rates Will Turbocharge the Migrant Crisis

Again, this is yet another straw in the wind indicating where things are heading. If not this year then not too far in the future.

So as noted earlier, New Zealand interest rates are likely going lower. While the banks may not be passing on the full cut yet, they are certainly quick to cut savings rates:

“Tough times for savers.

The banks have been reluctant to pass on the recent Official Cash Rate (OCR) cut to borrowers. But they have proved much keener to cut savings rates. That is bad news for New Zealand savers, who collectively have $141 billion invested in savings accounts and term deposits.”

A likely further dwindling interest rate return is another reason to move some of your “cash” out of the bank and into real assets. Like what?

Well you should be working it out by now! Gold and silver! And you know where to find them…

Enjoy your Easter long weekend. Unplug and relax. That’s our plan. We are off with a tent to the beach so thankfully the weather looks on the mend!

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,990 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Unsubscribe | Report Abuse

|