This Week:

- The $5 TRILLION Paper Silver Scam

- PAPER vs. PHYSICAL: The Amazing Amount Of Leverage In The Silver Market

- The Darker Side of Bitcoin Technology and Gold’s Next Spike

—–

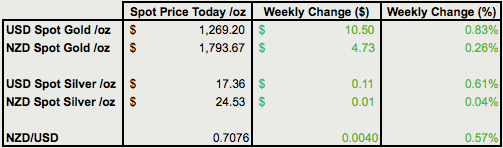

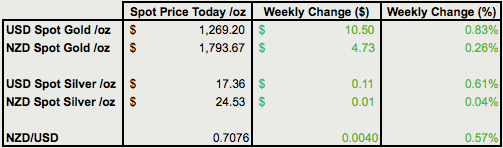

Prices and Charts

Consolidation Before Next Move?

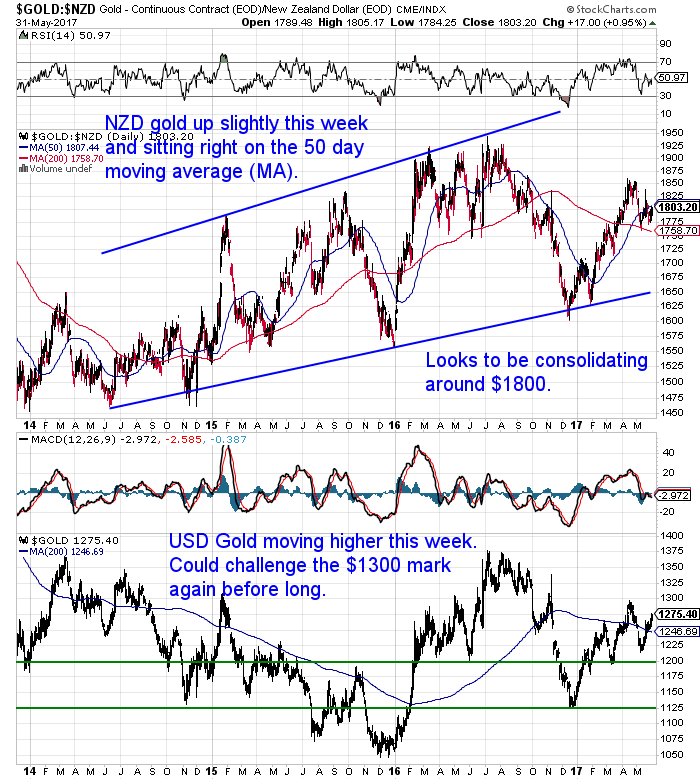

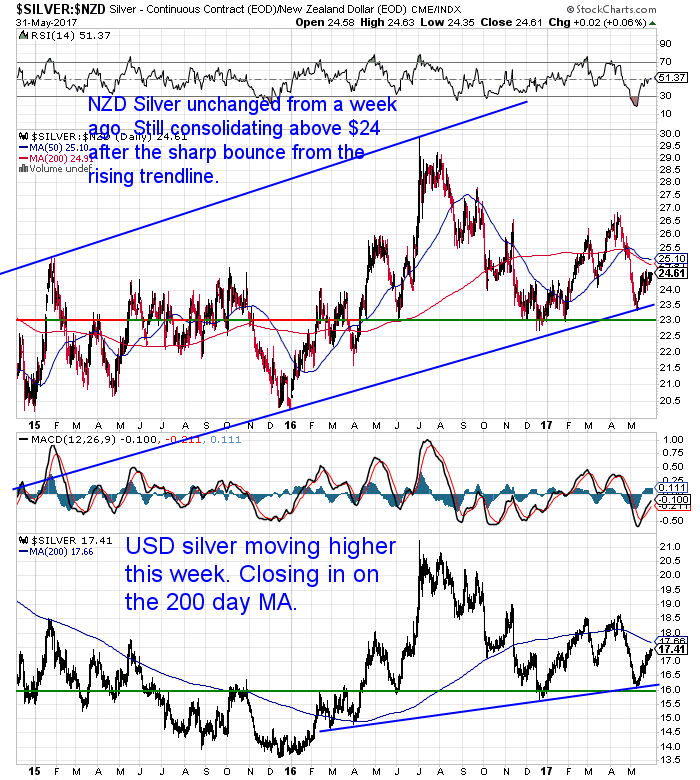

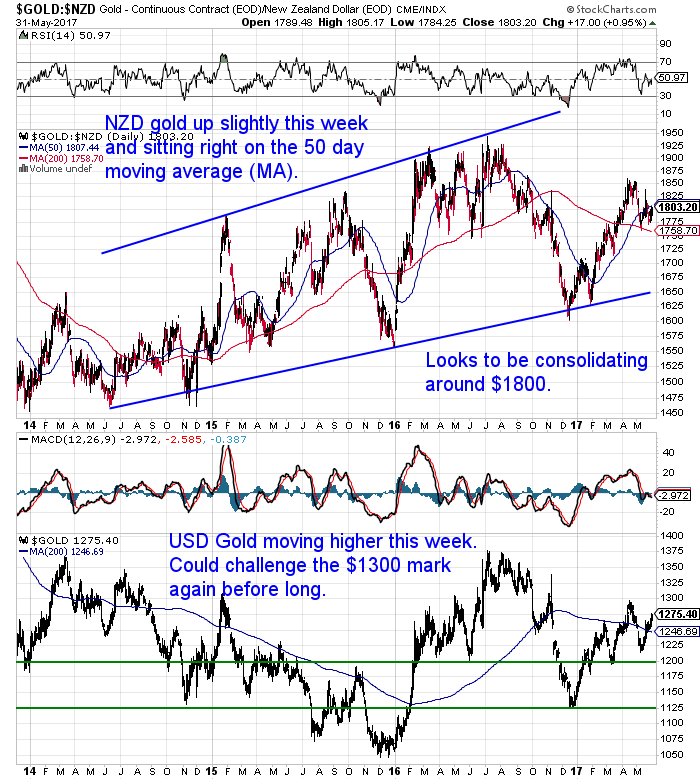

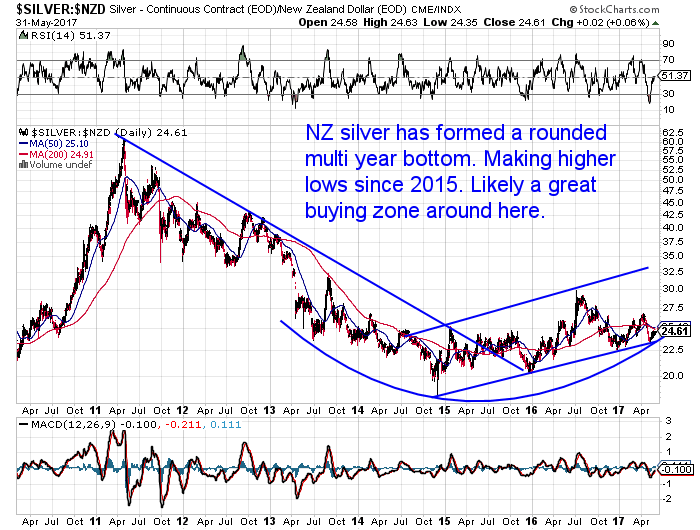

Precious metals in NZ dollar terms have not moved too far this week.

NZD Gold looks to be consolidating around $1800 which is also the 50 day moving average. We may not see a return down to the 200 day moving average after all. So NZD gold could be just building a base around these levels before it’s next move higher.

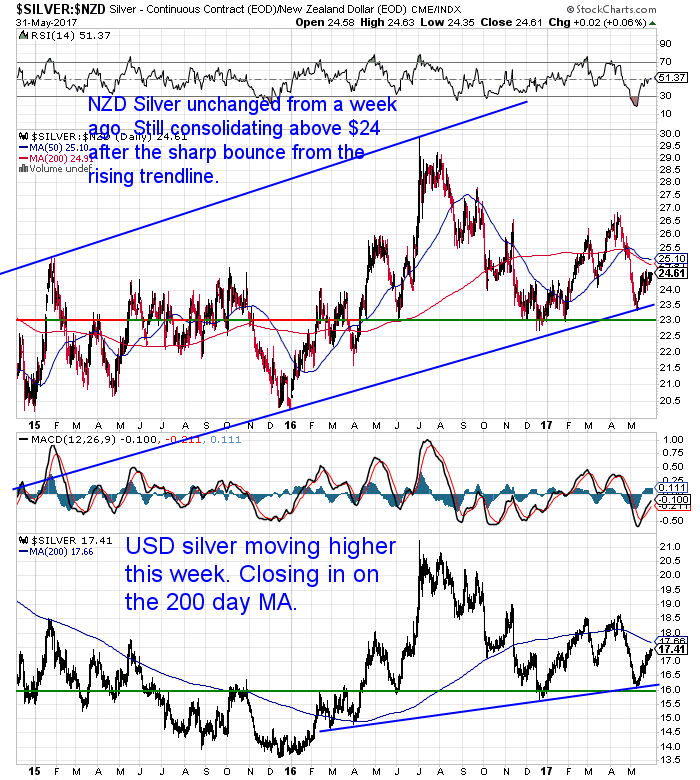

Likewise, silver in NZ dollars also looks to be consolidating around the $24.50 level, after the recent sharp bounce higher. Like gold the overbought/oversold RSI indicator is now neutral. So there is room for silver to run plenty higher from here now too.

The NZ Dollar may help to boost local precious metals prices in the short term too. The Kiwi is sitting right on the 200 day moving average and the top Bollinger Band. It is now also the most overbought it has been in a year on the RSI indicator.

So a pullback from here would be of no surprise. Of course a weaker NZ dollar means higher local gold and silver prices.

Good Time to Buy Silver

Silver in NZ dollars has bottomed out and is still not too far from the recent low. So it’s looking like a good time to buy silver. See the long term chart below:

Phenomenal Numbers in the Paper Silver Market

This week we have a focus on the paper versus physical silver market.

First up we have an excellent article from Steve St Angelo.

We’ve written many times how it is currently the paper markets that set the price for gold and silver. So the demand for physical metal is not the main driver.

This interesting article outlines just how significant this paper market is especially for silver. It also covers why the action in the cryptocurrency space might be a good indicator for what will be to come in precious metals markets down the track.

Next you can check out a video (along with a written summary) of the key takeaways from the above article. You’ll also see how even the crazy number Steve St Angelo came up with is less than half of what Bloomberg reports as the size of the global paper silver market.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

<

Never worry about safe drinking water for yourself or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions and has time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

The Darker Side of Bitcoin Technology and Gold’s Next Spike

Gold is not completely forgotten this week either.

Jim Rickards provides some analysis as to how gold has now overcome a major hurdle and provides strong evidence why gold is now set to head to new highs. He also weighs in on Bitcoin and why blockchain technology will be the latest weapon in the war on cash.

But silver in particular still looks in a good buying zone currently. So a good chance to take advantage of one of the silver coin deal and remove some of your wealth from the reaches of a bank bail-in.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles:

|

|

Thu, 1 Jun 2017 12:32 PM NZST

You’ve no doubt seen how the price of Bitcoin has been flying these past few months. Jim Rickards believes that the blockchain technology underpinning Bitcoin is what we should be keeping an eye on. He thinks Bitcoin is just a “sideshow” — and that the blockchain technology is the latest weapon that will be used […] You’ve no doubt seen how the price of Bitcoin has been flying these past few months. Jim Rickards believes that the blockchain technology underpinning Bitcoin is what we should be keeping an eye on. He thinks Bitcoin is just a “sideshow” — and that the blockchain technology is the latest weapon that will be used […]

|

|

|

Wed, 31 May 2017 11:32 AM NZST

We just checked out this Chris Duane video which coincidentally covers the same topic as an article (and even summarises some key points of that article) we posted yesterday. PAPER vs. PHYSICAL: The Amazing Amount Of Leverage In The Silver Market So we thought if worthwhile to summarise and share the content of the video […] We just checked out this Chris Duane video which coincidentally covers the same topic as an article (and even summarises some key points of that article) we posted yesterday. PAPER vs. PHYSICAL: The Amazing Amount Of Leverage In The Silver Market So we thought if worthwhile to summarise and share the content of the video […]

|

|

|

Tue, 30 May 2017 12:13 PM NZST

Introduction We’ve written many times how it is currently the paper markets that set the price for gold and silver. So the demand for physical metal is not the main driver. This interesting article outlines just how significant this paper market is especially for silver. It also covers why the action in the cryptocurrency space […] Introduction We’ve written many times how it is currently the paper markets that set the price for gold and silver. So the demand for physical metal is not the main driver. This interesting article outlines just how significant this paper market is especially for silver. It also covers why the action in the cryptocurrency space […]

|

|

|

Fri, 26 May 2017 3:10 PM NZST

We always enjoy the dry but humorous writing of Bill Bonner. See why he believes even though the US central bank – the Fed – may be tightening it’s monetary policy currently, it won’t hesitate to revert to an easy money stance in the future… Fed Will Blink By Bill Bonner Justin’s note: Bill Bonner, […] We always enjoy the dry but humorous writing of Bill Bonner. See why he believes even though the US central bank – the Fed – may be tightening it’s monetary policy currently, it won’t hesitate to revert to an easy money stance in the future… Fed Will Blink By Bill Bonner Justin’s note: Bill Bonner, […]

|

|

|

Thu, 25 May 2017 11:31 PM NZST

This Week: What Does Short Covering Mean for the Price of Silver? Canary In The Silver Mine Doug Casey’s Top Two Ways to Store Wealth Abroad RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal TWO SILVER COIN SPECIALS TODAY OPTION 1: Sold 1500 this week, but still 6500 x 1oz Perth […] This Week: What Does Short Covering Mean for the Price of Silver? Canary In The Silver Mine Doug Casey’s Top Two Ways to Store Wealth Abroad RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal TWO SILVER COIN SPECIALS TODAY OPTION 1: Sold 1500 this week, but still 6500 x 1oz Perth […]

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Note: For local gold and silver orders your funds are deposited into our suppliers bank account. We receive a finders fee direct from them. Pricing is as good or sometimes even better than if you went direct.

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

- To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

- To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.

You’ve no doubt seen how the price of Bitcoin has been flying these past few months. Jim Rickards believes that the blockchain technology underpinning Bitcoin is what we should be keeping an eye on. He thinks Bitcoin is just a “sideshow” — and that the blockchain technology is the latest weapon that will be used […]

You’ve no doubt seen how the price of Bitcoin has been flying these past few months. Jim Rickards believes that the blockchain technology underpinning Bitcoin is what we should be keeping an eye on. He thinks Bitcoin is just a “sideshow” — and that the blockchain technology is the latest weapon that will be used […]

We just checked out this Chris Duane video which coincidentally covers the same topic as an article (and even summarises some key points of that article) we posted yesterday. PAPER vs. PHYSICAL: The Amazing Amount Of Leverage In The Silver Market So we thought if worthwhile to summarise and share the content of the video […]

We just checked out this Chris Duane video which coincidentally covers the same topic as an article (and even summarises some key points of that article) we posted yesterday. PAPER vs. PHYSICAL: The Amazing Amount Of Leverage In The Silver Market So we thought if worthwhile to summarise and share the content of the video […]

Introduction We’ve written many times how it is currently the paper markets that set the price for gold and silver. So the demand for physical metal is not the main driver. This interesting article outlines just how significant this paper market is especially for silver. It also covers why the action in the cryptocurrency space […]

Introduction We’ve written many times how it is currently the paper markets that set the price for gold and silver. So the demand for physical metal is not the main driver. This interesting article outlines just how significant this paper market is especially for silver. It also covers why the action in the cryptocurrency space […]

We always enjoy the dry but humorous writing of Bill Bonner. See why he believes even though the US central bank – the Fed – may be tightening it’s monetary policy currently, it won’t hesitate to revert to an easy money stance in the future… Fed Will Blink By Bill Bonner Justin’s note: Bill Bonner, […]

We always enjoy the dry but humorous writing of Bill Bonner. See why he believes even though the US central bank – the Fed – may be tightening it’s monetary policy currently, it won’t hesitate to revert to an easy money stance in the future… Fed Will Blink By Bill Bonner Justin’s note: Bill Bonner, […]

This Week: What Does Short Covering Mean for the Price of Silver? Canary In The Silver Mine Doug Casey’s Top Two Ways to Store Wealth Abroad RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal TWO SILVER COIN SPECIALS TODAY OPTION 1: Sold 1500 this week, but still 6500 x 1oz Perth […]

This Week: What Does Short Covering Mean for the Price of Silver? Canary In The Silver Mine Doug Casey’s Top Two Ways to Store Wealth Abroad RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal TWO SILVER COIN SPECIALS TODAY OPTION 1: Sold 1500 this week, but still 6500 x 1oz Perth […]