You’ve no doubt seen how the price of Bitcoin has been flying these past few months. Jim Rickards believes that the blockchain technology underpinning Bitcoin is what we should be keeping an eye on. He thinks Bitcoin is just a “sideshow” — and that the blockchain technology is the latest weapon that will be used in the war on cash…

Then he also shows you how gold has now overcome a major hurdle and provides strong evidence why gold is now poised to make a run at the record books. An interesting couple of reads..

The Darker Side of Bitcoin Technology

By James Rickards – Originally published at The Daily Reckoning

I have long predicted that the war on cash is just the first phase of a coming war on gold.

The reason is obvious. Governments around the world want to force all citizens to keep their wealth and savings in digital form at one of a small number of major commercial and investment banking institutions. The banks themselves will be herded into a small number of clearinghouses.

That way all of your wealth — cash, stocks, bonds, etc. — can be frozen and locked down when the time comes. You can be denied access (except for small amounts for gas and groceries) and subject to confiscatory taxation and other demands.

This is also why J.P. Morgan and others are working on something called blockchain technology. Blockchain technology is a decentralized digital ledger that secures online transactions. Bitcoin is based on blockchain technology. But forget all the hype about Bitcoin you’ve been hearing lately — that’s a sideshow.

The real threat is from the blockchain technology on which Bitcoin is based. It can be used to turn supposedly “hard assets” like land into digital form, with “good title” being reserved for those who join blockchain registries at approved banks.

This is happening not just in emerging markets such as India. The groundwork is also being laid in developed economies such as the U.S., China and Europe.

Physical gold is a threat to these elite plans, because it is not digital and does not require any form of “registration.” If you hold it, it’s your wealth, and no digital plan can dispute that or take it away. When citizens turn to physical gold, they escape the state-sponsored money grab.

That’s why many nations are making it harder to get gold.

One of the main arguments governments and the cashless society’s supporters are making is based on convenience. It’s so much easier to use a card, they say. And consumers seem willing to agree, at least in many countries.

In Sweden, for example, you can now make your church contributions with a mobile app instead of putting cash on the collection plate. That’s just one small example, but it indicates how pervasive the trend has become.

Of course, the case for convenience is usually backed up by arguments that a cashless society makes life more difficult for terrorists, tax evaders and criminals of all kinds.

But as I’ve said before, the real reason for a cashless society is so central banks can confiscate savings with negative interest rates. Right now a simple solution to negative interest rates is to take your cash out of the bank, stash it in a safe place and just wait.

Your neighbors with money in the bank will see that money disappear slowly by the imposition of negative rates, while your wealth remains intact in the form of physical cash. Central banks know this, so they aim to eliminate cash in order to force everyone into digital accounts at a small number of mega-banks. Then the confiscation via negative rates can begin.

A cashless society will not stop criminals or terrorists. They can easily move to gold, silver or cryptocurrencies to carry out their activities.

People will realize too late that the convenience that going cashless provides comes at a price. When the time arrives for governments to freeze, seize or confiscate your assets they will be able to do so with a few keystrokes and cyber commands.

For that matter, honest citizens can also move to gold to preserve wealth in a cashless society. That’s why I expect a “war on gold” to arrive soon now that the “war on cash” is in full swing. That’s one more reason to buy your gold now while you still can.

The lesson is to get your gold now, before it’s too late.

Below, I show you how gold has now overcome a major hurdle, which will pave the way for all-time highs in the years ahead. Read on.

Regards,

Jim Rickards for The Daily Reckoning

Gold’s Next Spike

Is the latest gold rally for real?

Investors can be forgiven for asking that question. Gold reached an all-time high dollar price of $1,898 per ounce on September 5, 2011. Then it began a relentless four-year, 43% plunge that took it to $1,058 on November 27, 2015.

Of course, gold did not go down in a straight line. There were numerous strong rallies along the way.

Gold rallied 13%, from $1,571 in June 2012 to $1,780 in October 2012. Then gold rallied 15%, from $1,202 in December 2013 to $1,381 on March 2014. Gold rallied 22.5% again, from $1,058 in November 2015 to $1,366 in July 2016, just after the Brexit vote in the UK.

If you were fortunate enough to buy each dip and sell at each high, lucky you. I don’t know anyone who actually did that. More common behavior is to buy near the interim tops on euphoria, and sell at the interim lows on depression. That’s a great way to lose money, but unfortunately it’s exactly how many investors behave.

With that said, no one can blame investors for being discouraged and skeptical about the price action in gold. Every rally since late-2011 was followed by a sickening plunge.

Perhaps the worst plunge was the dizzying 24% plunge, from $1,607 to $1,223 per ounce, in a brief 15-week span between March 22 and July 5, 2013. That period included the notorious “April Massacre” when gold fell over 5% in just two trading days.

Each time gold experienced one of these major reversals, investors were quick to claim price manipulation by dark forces, usually central banks, using highly-leveraged “paper gold” dumps on the commodity futures exchanges.

Actually there is strong statistical and forensic evidence to support the gold price manipulation claims, as I explain in my 2016 book, The New Case for Gold. China has a keen interest in keeping gold prices low because it is on a multi-year, multi-thousand ton buying spree. If you were buying 3,000 tons in a thin market, you’d want low prices too.

Of course, all of that will change when China reaches its gold reserve target of 10,000 tons — surpassing the United States. At that point, it will be in China’s interest to become more transparent and let the price of gold soar, which is another way of saying the value of the dollar is in free-fall.

China’s endgame may still be a few years away. Meanwhile, there are other more prosaic explanations for the long decline in gold prices from 2011 to 2015.

The best explanation I’ve heard came from legendary commodities investor Jim Rogers. He personally believes that gold will end up in the $10,000 per ounce range, which I have also predicted. But, Rogers makes the point that no commodity ever goes from a secular bottom to top without a 50% retracement along the way.

The calculation of a retracement necessarily relies on certain assumptions about which baseline to use for the analysis. For instance, gold fell, but traded in a narrow range between $490 per ounce in November 1987, and $255 per ounce in August 1999.

From there, gold turned decisively higher and rose 650% until the peak in 2011. So, the August 1999 low of $255 seems like a reasonable baseline for a retracement calculation.

Based on that, gold rose $1,643 per ounce from August 1999 to September 2011. A 50% retracement of that rally would take $821 per ounce off the price, putting gold at $1,077 when the retracement finished. That’s almost exactly where gold ended up on November 27, 2015 ($1,058 per ounce).

This means the 50% retracement is behind us and gold is set for new all-time highs in the years ahead.

Still, investors have been disappointed so many times since 2011 that they remain skeptical. Why is this rally different? Why should investors believe gold won’t just get slammed again?

The answer is that there’s an important distinction between the 2011-2015 price action and what’s going on now. The four-year decline exhibited a pattern called “lower highs, and lower lows.” While gold rallied, and fell back, each peak was lower than the one before and each valley was lower than the one before also.

The March 2014 high of $1,381 per ounce was lower than the prior October 2012 high of $1,780 per ounce. The November 2015 low of $1,058 per ounce was lower than the prior December 2013 low of $1,202 per ounce. Meanwhile, the overall trend was down.

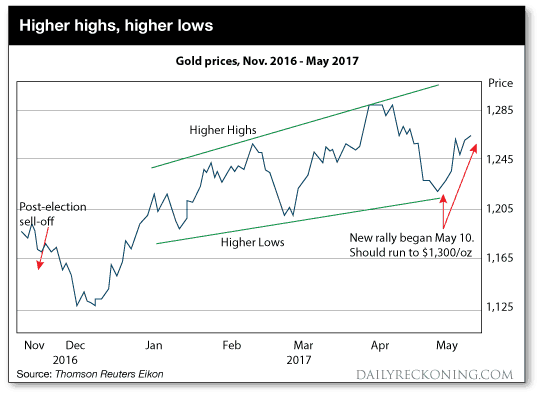

Since December 2016, as shown in the chart below, it appears that this bear market pattern has reversed. We now see “higher highs, and higher lows,” as part of an overall uptrend.

The February 24, 2017 high of $1,256 per ounce was higher than the prior January 23, 2017 high of $1,217 per ounce. The May 10, 2017 low of $1,218 per ounce was higher than the prior March 14, 2017 low of $1,198 per ounce.

Of course, this new trend is only five months old and is not deterministic. Still, it is an encouraging sign when considered alongside other bullish factors for gold.

The current rally in gold began on December 15, 2016 at $1,128/oz. For over 5 months, gold has Adhered to a pattern in which each new high price is above the one before (“higher highs”), and each drawdown settles at a price above the one before (“higher lows”), If this pattern persists, the next high will be above $1,300/oz. Gold could rally further from there based on Fed policy.

The question for investors today is: Where does the gold market go from here?

We’re seeing a persistent excess of demand over new supply. China and Russia alone are buying more than 100% of annual output each year. That’s on top of normal demand by individuals and the jewelry industry. This means that demand has to be satisfied from existing stocks in vaults.

But western central banks have all but stopped selling in recent years. The last large sales were by Switzerland in the early 2000s and the IMF in 2010.

Private holders are keeping their gold also. On a recent visit to Switzerland, I was informed that secure logistics operators could not build new vaults fast enough and were taking over nuclear-bomb proof mountain bunkers from the Swiss Army to handle the demand for private storage.

With gold sellers disappearing and large demand continuing, the price will have to go up to clear markets — regardless of how much “paper gold” is dumped.

Geopolitics is another powerful factor. The crises in North Korea, Syria, Iran, the South China Sea, and Venezuela are not getting better; they’re getting worse. The headlines may fade in any given week, but geopolitical shocks will return when least expected and send gold soaring in a flight to safety.

Fed policy tightening is normally a headwind for gold. But, the last two times the Fed raised rates — December 14, 2016 and March 15, 2017 — gold rallied as if on cue. Gold is the most forward-looking of any major market. It may be the case that the gold market sees the Fed is tightening into weakness and will eventually over-tighten and cause a recession.

At that point, the Fed will pivot back to easing through forward guidance. That will result in more inflation and a weaker dollar, which is the perfect environment for gold. Look for another Fed rate hike on June 14, and another gold spike to go along with it.

In short, all signs point to higher gold prices in the months ahead. I look for a short-term rally to $1,300 in the next month, and then a more powerful surge toward $1,400 later this year based on Fed ease, geopolitical tensions, and a weaker dollar.

The gold rally that began on December 15, 2016 looks like one that will finally break the bear pattern of lower highs and lower lows, and turn it into the bullish pattern of higher highs and higher lows.

Regards,

Jim Rickards for The Daily Reckoning

About the Author

James G. Rickards is the editor of Strategic Intelligence. He is an American lawyer, economist, and investment banker with 35 years of experience working in capital markets on Wall Street. He is the author of The New York Times bestsellers Currency Wars and The Death of Money.

You can now buy gold and silver with bitcoin. Check out this post to learn more about the pros and cons: How to Buy Gold and Silver with Bitcoin

Related: Gold vs Bitcoin/Cryptocurrencies – Which One Should You Choose?