Weekly Wanderings 27 October 2009

This week…

- 2 great interviews from King World news summarised.

- Central banks shift their reserves away from dollars, and

- Mish Shedlock is outraged!

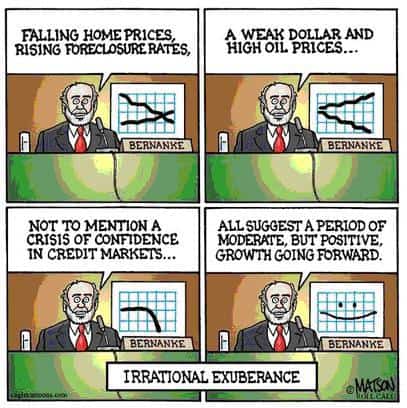

But first a quick word from B52 Ben…

This week among the wealth of interviews at King World News, Eric has two star guests – John Hathaway, extremely highly regarded manager of the Toqueville Gold Funds, and Louise Yamada, possibly the best technical analyst on Wall Street. If you are at all interested in precious metals investing, I strongly recommend that you check out Eric’s site – he has a number of very knowledgable and interesting regulars and guests that he interviews each week. In this week’s column, I am summarizing the contents of the two interviews mentioned above.

(a) Louise Yamada

(1) Continued gold uptrend.

Firstly, with respect to the gold market, the continued uptrend from 2002 to the present, characterized by a sequence of higher highs and higher lows, in all major currencies, indicates increasing demand for the metal. Also, as Eric mentioned, increasing institutional demand is occurring, suggesting that we could be in the second (of 3) major legs up in this gold bull market.

(2) Inflationary pressures on the bond market.

With respect to bonds, Louise spoke of the very long cycles in that market. The current uptrend is very long-lived. Currently, and for the foreseeable future, massive quantities of new debt are being issued. At the same time, foreign countries are becoming less inclined to purchase said debt, thus forcing the Fed to buy back some of this debt. This would be highly inflationary in the longer term. The only way to persuade foreigners to buy back more debt would be to raise long term rates – creating considerable pressure on the housing market, amongst others.

(3) Gold vs Fiat. The result of the pressures emerging from (2) above is to create yet more upward pressure on the gold price, as gold becomes not just a hedge against inflation, but also a hedge against all fiat currencies losing their value.

(4) Depression? If (2) above were to continue against a backdrop of serious economic weakness, rising long term rates could easily usher in a depression.

(5) Fate of the US dollar. The US dollar has been in a long-term downtrend against its major trading partner currencies since 2002. If the current actions of stimuli and quantitative easing are not reversed, serious problems lie ahead for the dollar. Growth coming from strong consumption (and not production) and big Govt spending leads to currency weakness. Louise also noted that the Chinese yuan is gradually becoming backed by gold, as China is now a leading producer, and not much leaves the country.

(6) Long-term target. The potential target for the USDX is now 60 (implying a further 20% fall in the dollar’s value – or a gold target of at least $1200/oz).

(7) Retirement Shortfall? With the movement away from retirement pension funds and towards 401k’s, we are heading to a future where retirees will have less and less purchasing power, thus leading

to a further headwind for the economy. Louise made the very good point that Social Security should not be viewed as an entitlement, but as an insurance against hard times in retirement.

(b) John Hathaway

(1) Gold buying. The gold price in US dollars has quadrupled since 2002. The fact that gold is trading now at over $1000/oz is waving a warning flag to those invested in paper assets. On balance there is now central bank buying of gold taking place…

(2) Central banks losing gold? Because the central banks leased out gold to financial institutions that may no longer have it, they are now possibly being forced to buy it back at much higher prices…

(3) Downside for gold? Probably limited to around $950/oz.

(4) Gold price manipulation? Although it has yet to be proven, it appears that the US and other governments have been actively holding down the price of gold… However, the focus now of governments is now more on protecting the economy than pretending the currency is strong, so there may be less downward pressure on the gold price going forward.

(5) Small gold float. The total worth of available above-ground gold is of the order of $1 trillion. However the total worth of financial assets that could move into gold is of the order of $90 trillion. What we see is that financial institutions are becoming increasingly disenchanted with paper financial assets and are increasingly searching for more reliable places to park their money, hence the burgeoning institutional interest in gold.

(6) Don’t forget silver! We could see $150 silver coming down the pike at some stage..

(7) Gold stocks provide leverage. As the gold bull market continues, assets which are currently marginal will become the blue chips of the future…. With this in mind, don’t forget the impending launch of the van Eck ETF for junior mining companies..

Central Banks Shift Reserves Away from U.S. Dollar

From Jeff Neilson on Seeking Alpha.

Jeff Nielson is from Canada and is a writer/editor for Bullion Bulls Canada. He has a personal background in law and economics. Bullion Bulls Canada provides general macro-economic and political commentary, since the precious metals markets are among the most complex (and misunderstood) in the world………..

The problem with trying to specify why the U.S. dollar is currently having its worst collapse in two decades is that one would wear out their fingers on their keyboard before they ran out of reasons.

Let’s start with economic fundamentals. The U.S. is hopelessly insolvent. It has over $57 trillion in current public/private debt (see “A Tale of Two Economies: U.S. versus China”). However, since none of the three levels of governments properly accounts for their future obligations, their largest liabilities are not even recorded on their balance sheets – with “unfunded liabilities” for the federal government (alone) somewhere around $70 trillion. With real GDP of roughly $11 trillion per year, this economy is simply much too small to even service those debts and liabilities. Given that there are no assets “backing” the U.S. dollar, then obviously the value of a currency of a totally insolvent economy is near-zero.With mountains of debt far in excess of the rest of the world combined, allowing (or rather encouraging) the collapse of the U.S. dollar is the only way for the U.S. government to delay formal bankruptcy.

Most of the remaining arguments which guarantee a weak dollar in the future fall under the category of either “supply” or “demand”. On the supply-side, a recent article in The Telegraph puts one measurement of U.S. money-creation at over 100% for the previous year, with the even more insolvent financial system of the U.K. showing growth in the money supply of more than 160%, using the same measurement.

This is more than ten times higher than during the loose monetary policy which caused all these bubbles in financial markets. Like an alcoholic, who reaches for a ‘bottle’ first thing in the morning to relieve his hang-over, the U.S. and U.K. are doing much more of what caused their problems in the first place – and calling it a “fix” (again, much like an addict).

Meanwhile, a world already over-saturated with U.S. debt has been bombarded with trillions of dollars in new U.S. Treasuries. The “TIC reports” for this year show that instead of the usual $100+ billion per month in accumulation of U.S. debt by foreign entities that these same investors have dumped (on a net basis) hundreds of billions of dollars of U.S. “assets” this year (see “Foreign Investors FLEE From U.S. Debt”). In order to pretend that there is still demand for U.S. Treasuries, the U.S. has begun to “monetize” this debt – printing money to “buy” its own debts.

The Federal Reserve has engaged in massive chicanery to hide most of these purchases, aided by the Treasury Department, with its own reports on Treasuries auctions now so convoluted that traders with decades of experience in this market are totally unable to even decipher the descriptions of what is taking place in those auctions.

Ultimately, the key demonstration of demand for the U.S. dollar (or lack thereof) are the currency reserve ratios of foreign governments. Over the last several decades, the holdings of U.S. dollars have constituted well over 2/3rds of the holdings of foreign governments. However, in the 2nd quarter, foreign governments were only putting 1/3rd of their surpluses into U.S. dollars – literally only half of historical demand.

Exacerbating this trend, thanks to the Wall Street-engineered global recession, those surpluses are all much smaller than they were just two years ago. Thus, at a time when the U.S. has doubled its supply of U.S. dollars, demand has simultaneously been cut by more than half. Even those without a firm grasp of basic economics can understand what these parameters mean. And the recent collapse in the U.S. dollar would have even been worse, but several Asian central banks intervened in currency markets last week by buying up some dollars – perhaps the only thing preventing the dollar from a complete nose-dive.

As if these economic and supply/demand fundamentals weren’t already bad enough, as many (including myself) have pointed out, the dollar has been selected by traders as the new “carry-trade” currency, inheriting the yen’s dubious honour as the world’s official “weakest currency”.

This new “role” for the dollar comes as the result of the combination of near-zero interest rates, along with an economy (and particularly, a financial sector) which is so weak that traders are convinced the U.S. government will be unable to raise interest rates at any time – again much like Japan, and its “lost generation” with the yen. The only way in which U.S. interest rates will rise is if higher rates are imposed on the U.S. by the global bond market. Since such a move would occur only based upon soaring U.S. inflation and/or a fear of imminent debt-default, even if rates were forced higher this would not cause increased demand (for the exact reasons why rates were forced up).

This carry-trade status ensures that the dollar will be even weaker in the future than it would have been on fundamentals alone, because the mechanics of the carry-trade dictate that vast quantities of the carry-trade currency are continually being dumped onto global currency markets.

If it seems that dollar-bears are taking excessive “pot-shots” at the dollar, it’s because there remains a huge contingent of inane dollar perma-bulls. These “experts” don’t let a little thing like the U.S.’s insolvency stop them from boldly predicting that the dollar’s current collapse is only a temporary, short-term trend. However, when it comes to “reasoning”, the dollar bulls are capable of nothing more than pointing to past periods of dollar weakness – and mindlessly concluding that those outdated patterns will repeat.

The problem is that in previous currency cycles, the U.S. wasn’t sitting with $57 trillion in existing debts, and an additional $70 trillion in unfunded liabilities. In past cycles the U.S. didn’t have interest rates frozen at their lowest level in history. In past cycles there was not a clear move away from the dollar by the entire global community. And (of course), in past cycles the U.S. dollar was not a carry-trade currency.

Yes, truly, it is “different this time.” However, don’t bother trying to convince dollar-bulls of this. They would much prefer living in the past.

Mike “Mish” Shedlock is one of the most respected financial bloggers out there and he’s not a happy camper…

Where’s The Outrage? from Mike “Mish” Shedlock at http://globaleconomicanalysis.blogspot.com

I don’t know about you, but I am outraged.

I am outraged and not just about Goldman Sachs, but about a process that allows, even encourages political pandering, by time and time again rewarding leveraged riverboat gamblers and failed institutions and at taxpayer expense.

I am outraged that real people are suffering massively while the influence peddlers have stolen the country for their own personal benefit.

I am outraged at a political system that is totally unresponsive to the American people.

I am outraged by campaign contribution and lobbying processes that allows corporations to buy votes with donations.

I am outraged how legislators ignored the wishes of the people who clearly did not want these bailouts in the first place.

I am outraged that very little of this is in mainstream media. Why is this stuff not on the frontpage of every newspaper in the country or at least in the editorial pages?

I am outraged that the average US citizen is not aware of any of this, instead depending on CNBC, or ”The View” for their interpretation of the world.

I am outraged how special interest groups have exercised their power to monopolize the economy for the benefit of themselves, US citizens be damned.

I am outraged that all these bailout programs are doing nothing to alleviate the massive consumer debt problems. Every program, virtually every program was designed to bailout lending institutions, not consumers.

I am outraged at fees charged by banks receiving bailouts.

I am outraged over government pension plans and government pay scales massively out of line with the private sector.

I am outraged that Congress and this administration thinks the solution to massive budget deficits are still higher budget deficits in excess of a trillion dollars.

I am outraged about indictments. Paulson Admitted Coercion to force a shotgun wedding between Bank of America and Merrill Lynch yet no indictments were handed out. Let the Criminal Indictments Begin: Paulson, Bernanke, Lewis.

I am outraged that US citizens are not concerned enough and not educated enough to demand change.

I am outraged that the two party system has failed. Neither party has delivered meaningful change on budgets, on taxes, on social security, on deficit spending, on the size of government, on military spending, or fighting needless wars.

I am outraged at a Fed that purports to be “inflation fighters” when the only source of inflation in the word are central bankers, and their fractional reserve lending policies.

I am outraged that Greenspan and Bernanke could not see a housing bubble that 1000 bloggers could see.

I am outraged at the selective memory of Bernanke when speaking to Congress about these problems.

I am outraged that Bernanke’s one sided response to asset bubbles, letting them grow without end, then bailing out the financial institutions that cause them.

I am outraged the Fed exists at all. It is a useless organization that cannot see bubbles, that panders to banks, that supports inflationary policies that are tantamount to theft by fraud.

I am outraged that the Obama Administration promised changed and did not deliver. “Yes We Can” was a lie. The reality is “It’s Business As Usual, Only Worse, With Higher Deficits”.

I am outraged there is not enough outrage over this.

Where the hell is the outrage?

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Thanks for the great reading, we buy Buy gold bullion in a recession. I will pass this on to our ira clients to read

Pingback: Is Gold in a bubble? | Gold Investing Guide