This Week:

- History Repeats

- Gold & Silver in NZ Dollars: 2015 in Review & Our Guess For 2016

- Jim Rickards: Govt Spending Will Cause Inflation

- Gold is the Invisible Gorilla in Global Markets

|

LIMITED QUANTITY GOLD SPECIAL ***** 1oz Perth Mint 99.99% Gold Bars Black Packaging (Approx $1789) (20 black in stock) Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1680.81 | + $84.66 | + 5.30% |

| USD Gold | $1093.70 | + $19.70 | + 1.82% |

| NZD Silver | $21.78 | + $0.61 | + 2.88% |

| USD Silver | $14.17 | – $0.14 | – 0.97% |

| NZD/USD | 0.6507 | – 0.0253 | – 3.74% |

Happy New Year!

It has been a somewhat tumultuous start to the year too. New “circuit breakers” put in place by China’s central planners had the opposite effect and actually increased volatility. (Here’s a great explanation of how the “law of unintended consequences” came into play with their move).

[Actually on a side note but speaking of “unintended consequences”, here is a very surprising outcome of negative interest rates in Switzerland:A Swiss Canton (Region) has told its taxpayers to delay settling their tax bill so that the Canton doesn’t incur costs as a result of negative interest rates charged by Swiss banks! The canton calculates that the move will save SFr2.5m ($2.5m) a year.

Who would have though? A government asking you not to pay your taxes early!

Check out the full article here.]

History Repeats

In our last email of 2015 we stated:

“Historically the Christmas and New Year Holidays often see gold and silver spike down in price during this low volume time of year.

You can see this clearly in the chart below. Over the past 7 years NZD gold has spiked down at this time of year 6 times. On 4 occasions this was to the low for the year ahead.

It may be worth keeping an eye out for lower prices over the next 2 weeks if you are thinking of buying.”

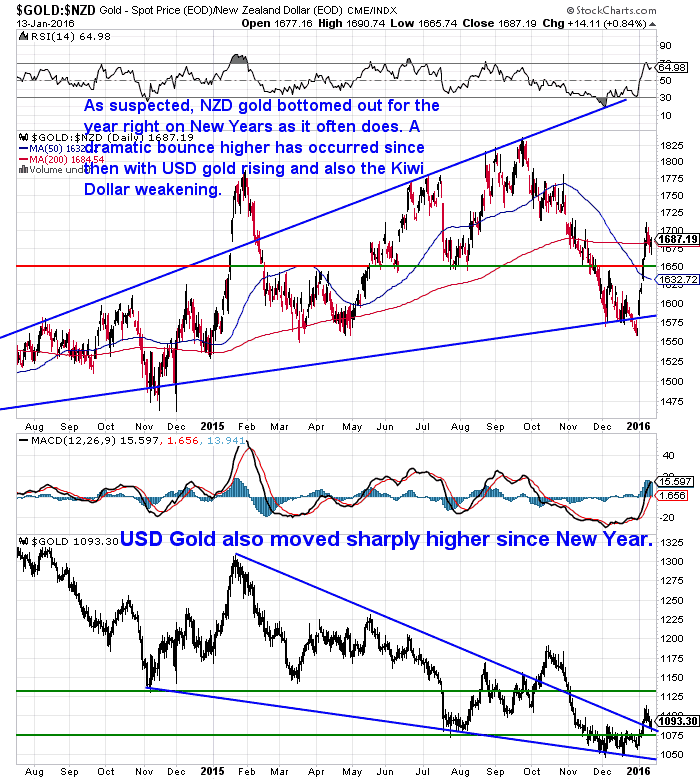

As you can see in the chart below NZD gold didn’t follow the Split Enz song and history did repeat. With NZD gold dropping sharply in the last few days of the year as we suspected it might, to be at its lowest since point since the start of 2015.

However since the New Year’s day low, precious metals have moved up sharply. This has been magnified here by the NZ dollar also falling. Down close to 4% since before Christmas.

Gold has dropped back from the overbought condition in the past few days and is hanging around the 200 day moving average. But we wouldn’t be surprised to see it drop further down towards the $1630 level still.

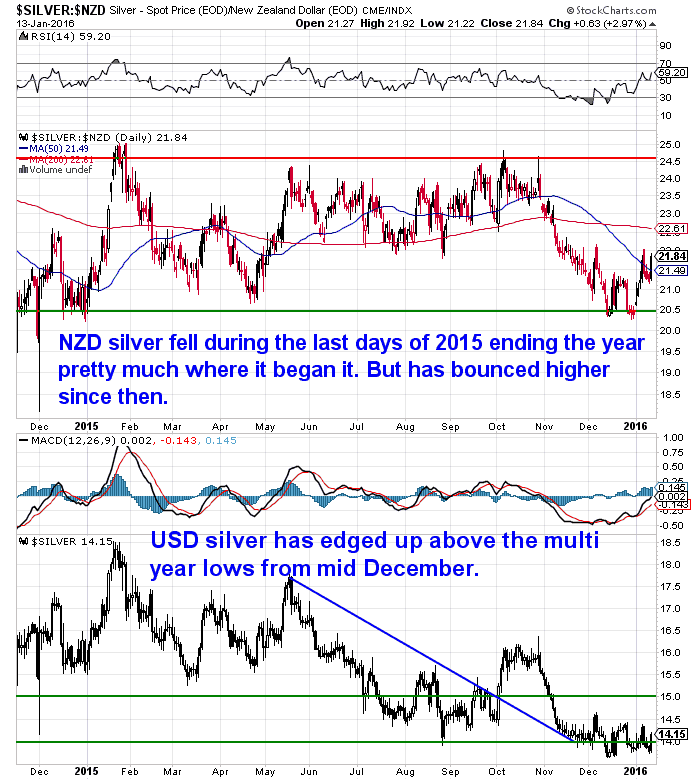

NZD Silver followed gold lower at the end of the year too. Dipping to its lowest level for the year just below NZ$20.50. It bounced back but not as much as gold did.

Gold & Silver in NZ Dollars: 2015 in Review & Our Guess For 2016

As we do every year at this time, this week we reviewed how NZD gold and silver performed in 2015. Also checking our predictions from last year and making a few more for 2016.

As we do every year at this time, this week we reviewed how NZD gold and silver performed in 2015. Also checking our predictions from last year and making a few more for 2016.

Gold & Silver in NZ Dollars: 2015 in Review & Our Guess For 2016

We’ve also got another couple of recommended posts on the website this week.

The always witty Grant Williams has an excellent presentation from his presentation at the Mines and Money Conference in December available “free to air” which we taken the trouble to summarise.

Williams lays out why he believes the gold price is languishing despite a wealth of what would ordinarily be positive catalysts.

He says that currently, outside those who focus on precious metals, there is an enormous amount of apathy but, he suspects, that apathy will shortly turn to enthusiasm – an enthusiasm which will expose the rift between paper prices set in NY and the structural changes undergone in the physical markets over the last several years.

He says that currently, outside those who focus on precious metals, there is an enormous amount of apathy but, he suspects, that apathy will shortly turn to enthusiasm – an enthusiasm which will expose the rift between paper prices set in NY and the structural changes undergone in the physical markets over the last several years.

So this makes it still a very attractive entry price for anyone not yet in possession of any physical gold.

We also have an excellent article from Hugo Salinas Price. He outlines how over the past 15 months international reserves have fallen three quarters of a trillion dollars. Something that has never happened since the creation of the current monetary system in 1944!

We also have an excellent article from Hugo Salinas Price. He outlines how over the past 15 months international reserves have fallen three quarters of a trillion dollars. Something that has never happened since the creation of the current monetary system in 1944!

See what he thinks this means…

The Crumbling World Order and Who Will Pick Up the Crumbs?

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

Jim Rickards: Govt Spending Will Cause Inflation

Jim Rickards made a comment this week which ties in nicely to what we said back on December 17 about how: NZ Government $1 Billion Capital Spending is a Sign of Things to Come? Back then we stated:

“Speaking of spending programs. Looks like we are following along with most everyone else as well – with an extra $1 Billion in “capital spending” to “boost” the NZ economy just announced…

…The announcement of the infrastructure spending by the NZ government also contained a statement from Bill English that:

Rickards believes that inflation is coming. Not from money printing but from massive new government spending programs:

“Inflation is the elites’ preferred solution to non-payable debt. By inflating the value of the dollar, debtors can pay nominal debt at greatly reduced costs in real terms. Inflation steals from savers and investors and gives to debtors (including corporations and governments). Banks and elites don’t suffer because they see it coming and prepare accordingly (often with gold purchases — the current course of China, and Russia). It’s everyday people who suffer from inflation. They are not in on the elite game.

The difficulty of course is that central banks have tried for seven years to create inflation and have failed. This is not due to lack of effort in printing money. It is due to the unwillingness of banks and borrowers to lend and spend. This is a psychological phenomenon, a throwback to the 1930s that is not easily changed.

There is one guaranteed path to inflation, as Keynes correctly described in his seminal works from the late 1920s and 1930s. It goes by various names today including “debt monetization,” “helicopter money,” “people’s QE,” and “fiscal dominance.” It’s all the same. Governments spend the money (no psychological resistance there), finance ministries and treasuries borrow to cover the deficits, and central banks print money to buy the new debt. Easy breezy.

Inflation is coming. Not yet, and not all at once, but it’s coming. It won’t come from “money printing” by central banks. It will come from massive new spending programs. Paul Ryan’s budget-busting spending resolution of December 2015 was a straw in the wind. Debt monetization is the very next thing. Rely upon it.”

Gold is the “Invisible Gorilla” in Global Markets

Then in an email this morning Rickards outlined how the saying “the 500 pound gorilla” arose from a psychology experiment where the participants didn’t notice a person in a gorilla suit because of what they were looking for in the film clip instead – people in white shirts…

What do they not want you to see? What is the invisible gorilla in global markets?The answer is gold.The facts on gold are as obvious as the gorilla in the video. World output is about 2,000 tons per year. China, India, Iran and Russia alone have been buying about 3,000 tons per year for the past seven years. The jewelry industry absorbs over 1,000 tons per year. (I consider jewelry to be gold bullion in decorative form, what I call “wearable wealth.”)Additional thousands of tons are being purchased by countries other than the “big four” mentioned above and by savvy individuals in Europe, Asia and Latin America. (U.S. citizens don’t understand gold and are not large buyers.)

This excess of buying over output means existing gold stocks from vaults in London, New York and elsewhere are being depleted at a rapid rate. Actual physical gold shortages and high-profile failures to deliver physical gold by banks and dealers are imminent…

…Our thesis is that physical gold is increasingly scarce despite the “paper gold” manipulations. Confirmatory data (from Russia, China, Iran and India) are piling up in the numerator of the fraction, giving us a Kissinger Cross probability in excess of 60% that our thesis is correct.

What about our timing? Is it too late to invest in gold? That’s where the invisible gorilla comes in.

Investors have been conditioned for 40 years not to think about gold. Investors have been told it’s a “barbarous relic.” Investors have been told “gold has no yield.” Investors have been told “there’s not enough gold to support a monetary standard.”

Sound familiar?

These canards from Washington and Wall Street are like the scientists telling the experimental subjects “just look at the white shirts and ignore the black ones.” Or, in this case, ignore the gold shirts and miss the golden gorilla.

I’ve never seen a better setup for gold. Physical supplies are scarce. Leveraged accounts are short. Gold stocks have been trashed.

And no one is paying attention.

Our analytical tool kit (Bayes’ theorem, Kissinger Cross and the invisible gorilla) is telling us that this is a great entry point for gold investors.”

With the NZ Dollar strengthening in the later part of 2015, this has given us another chance to add to our gold and silver stockpiles at cheaper levels too. If you’re looking to buy, keep an eye out over the coming weeks for a bit of a pullback again after the rise since New Year, as that may be a decent entry point.

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,870 and delivery is now about 3 weeks away.

— Going Camping this Summer? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|