Prices and Charts

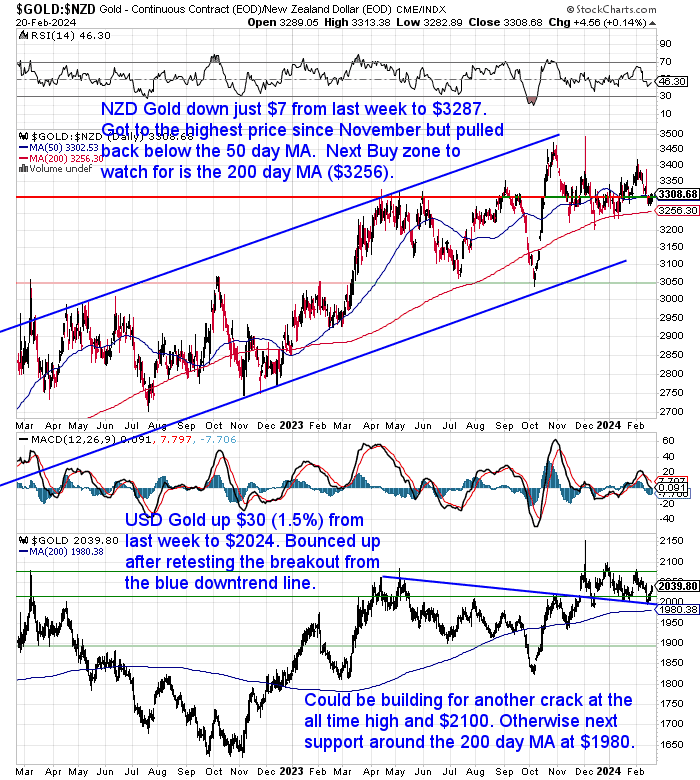

NZD Gold Rising Up From Near the Key 200 Day MA

Gold in New Zealand dollars was down just $7 from last week. It got down close to the 200 day moving average (MA), but is back close to the 50 day MA now. Keep an eye out for the next buy zone at the 200 day MA at $3256. However it looks like NZD gold might be building for a move towards the all time high above $3400.

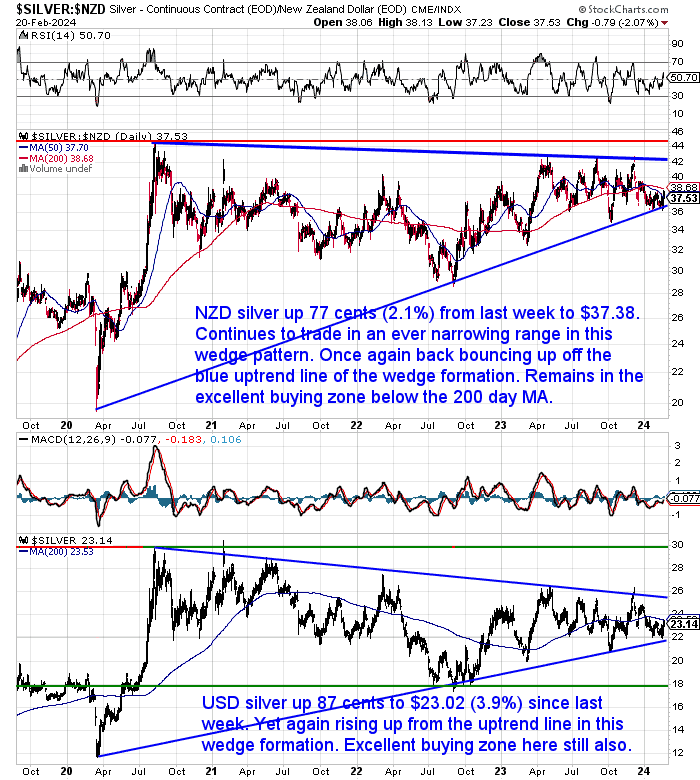

NZD Silver Bounces Back Up Over 2%

Meanwhile silver had a sharp bounce back, up 77 cents or over 2%, to $37.38. Yet again it bounced up off the blue uptrend line. That continues to be an excellent buying zone as silver trades within the confines of this ever narrowing wedge pattern. Despite the sharp jump silver still remains in the very solid buying zone below the 200 day MA.

An even bigger jump for silver in USD terms. Up 3.9% from last week and back above $23. It’s back close to the 200 day MA. But this wedge formation is getting so narrow that any purchase within it is likely to be good buying in the long run.

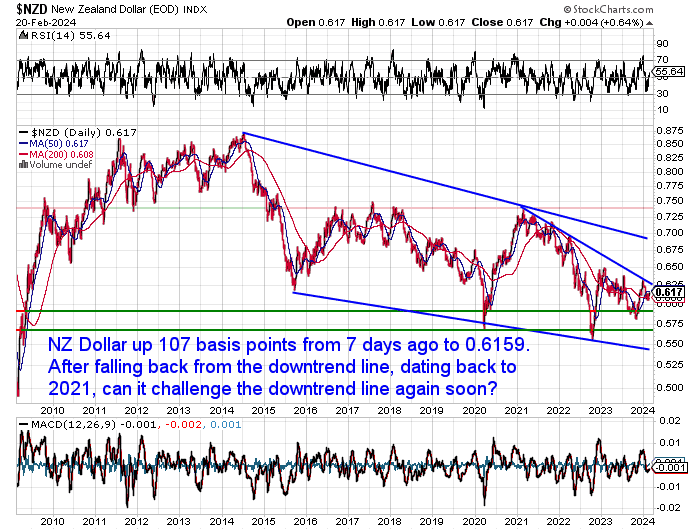

NZ Dollar Rising Up From the 200 Day MA

The Kiwi dollar has jumped 107 basis points from last week to 0.6159. It could quite likely head up to challenge the downtrend line again from here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Investing in Gold Bars? Not All Bars Are Created Equal!

Gold bars are a popular way to invest in gold, but with so many different sizes and types available, it can be tough to know where to start. This week, we take a deep dive into the world of gold bars, exploring the key factors to consider before making your purchase. You’ll discover:

The different sizes of gold bars and their pros and cons

- How to spot a high-quality gold bar

- How gold bar prices have changed in the last 2 years

- Insider tips for storing and selling your gold bars safely

So, whether you’re a seasoned investor or just starting out, this article is packed with valuable insights to help you make informed decisions about your gold bar purchases.

P.S. Want to know the secret to finding the best-size gold bar for your needs? Read the full article to find out!

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Inflation: Consensus is for “Sticky” – So Watch Out For Wave 2

Paulo Macro (who like us is a proponent of the theory of multiple waves of inflation) points out below that the consensus view is that there won’t be a second wave, but just that inflation will be “stickier”. This seems to be the view of the NZ Central Bank and also bank economists too:

“The official cash rate will likely remain on hold in 2024, although the risk of higher interest rates cannot be ruled out if the economy and inflation fail to adjust fast enough,” Westpac chief economist Kelly Eckhold said.

“Domestic inflation remains very sticky and is only slowly declining. The labour market is similarly adjusting but more slowly than the RBNZ expected. Both factors seem likely to keep the RBNZ on edge for a while yet.”

Source.

Paulo says:

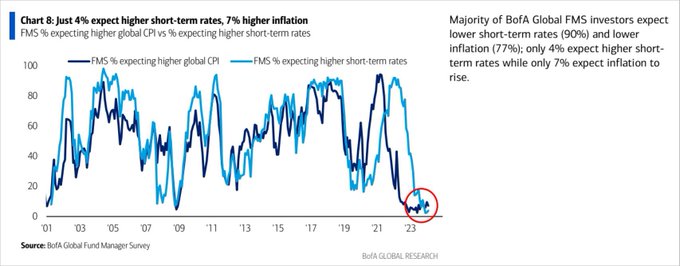

There it is…the ‘second inflation wave’ resistance again. Kind of amazed we are still doing this. But then I see surveys like this chart, and sleep easy knowing ‘premature’ is a firmly consensus view

Despite all the excitable punditry, I think CBs are in an OK position. Disinflation has been happening, albeit with periodic setbacks, & their economies look resilient. It’s premature to worry about a “second wave”, but the worry is that inflation will prove a little stickier

Source.

Warning Signs for Biggest US Banks

Latest news about commercial real estate loans shows that it’s not just the small regional banks being affected (see our report from 2 weeks ago here for that):

“Bad commercial real estate loans have overtaken loss reserves at the biggest US banks after a sharp increase in late payments linked to offices, shopping centres and other properties.”

…Richard Barkham, global chief economist at commercial real estate firm CBRE, said that… Banks could lose as much as $60bn on soured commercial real estate loans in the next five years, he estimated — about double the $31bn they have reserved for those loan losses, according to BankRegData.”

Source.

We’ll continue to keep a close eye on this sector as it could be a bit of a “grey swan”. That is, not a completely out of the blue black swan, but still something that most people aren’t expecting.

Gold Open Interest at Lowest Level In More Than 5 Years – So What?

Last week we outlined how consumer demand for gold has not been pretty low recently, while central banks have been continuing to purchase at record levels.

Given that gold has actually performed pretty well over the past year, it’s been somewhat surprising that more people haven’t been turning to gold as a hedge.

Jan Nieuwenhuijs shared the following which also shows the low level of interest in gold currently:

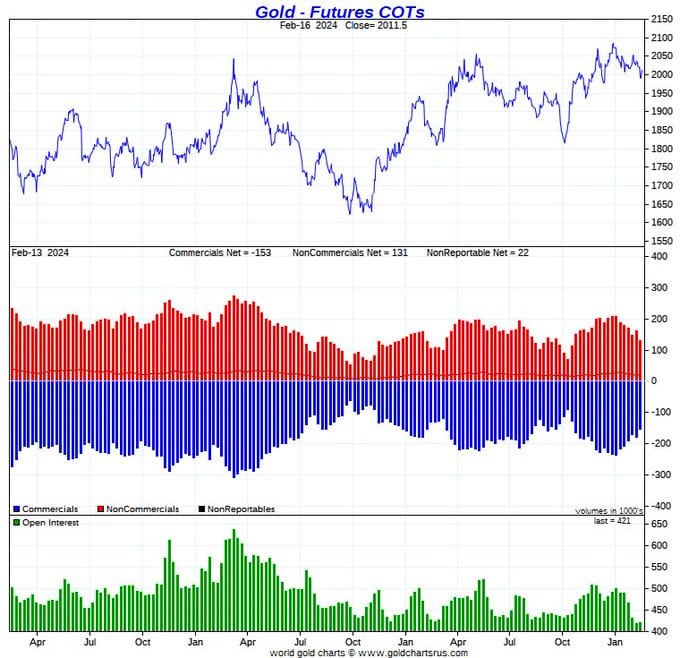

Gold open interest is low.

Next leg up?

Source.

Low open interest (the green bars at the bottom of the chart) means there are fewer bets being placed on the future price of gold, either up or down. This could be because:

- People are uncertain about the direction of the market: If they’re unsure if gold will go up or down, they might be hesitant to take a position.

- They’ve lost confidence in gold: If gold has been performing poorly recently, people might be less interested in buying futures contracts.

- They’re focusing on other investments: Gold might be out of favour compared to other assets like stocks or real estate.

So what does Jan mean by asking “Next leg up?”

Here’s a couple of reasons why gold prices could rise:

- Reduced selling pressure: With fewer people betting on gold going down, there’s less selling pressure pushing the price lower.

- Potential buying opportunity: If people see low open interest as a sign of undervaluation, they might jump back in, pushing the price up.

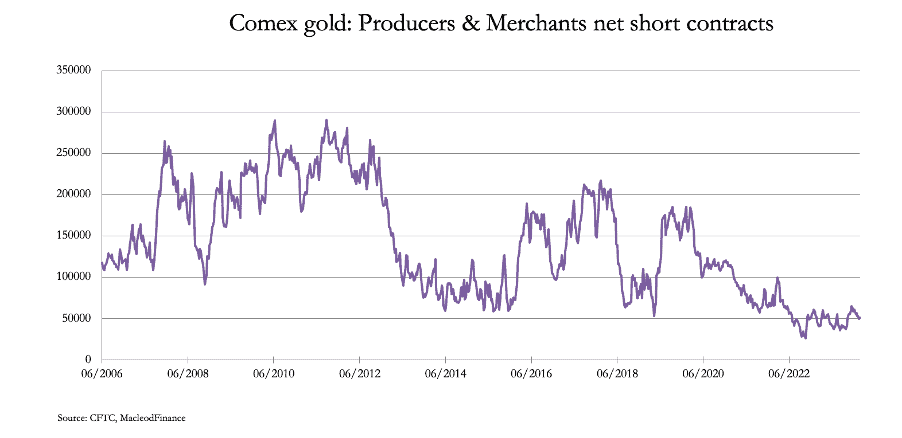

Alisdair Macleod goes into the open interest in more detail. But he also looks at the position of the Producer/Merchant category in gold futures. As these guys are usually the smart money and positioned correctly during the significant moves:

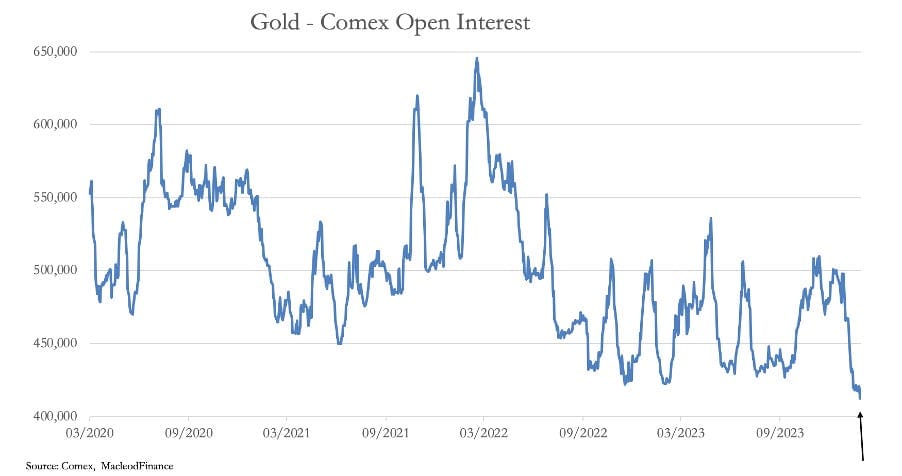

“Preliminary figures for yesterday are 412,506 contracts, the lowest [open interest] in four years. In fact, it is the lowest since December 2018 when gold was sold down to under $1200. The level of disinterest today is similar to then, which preceded a 20-month bull phase taking the price to $2074.

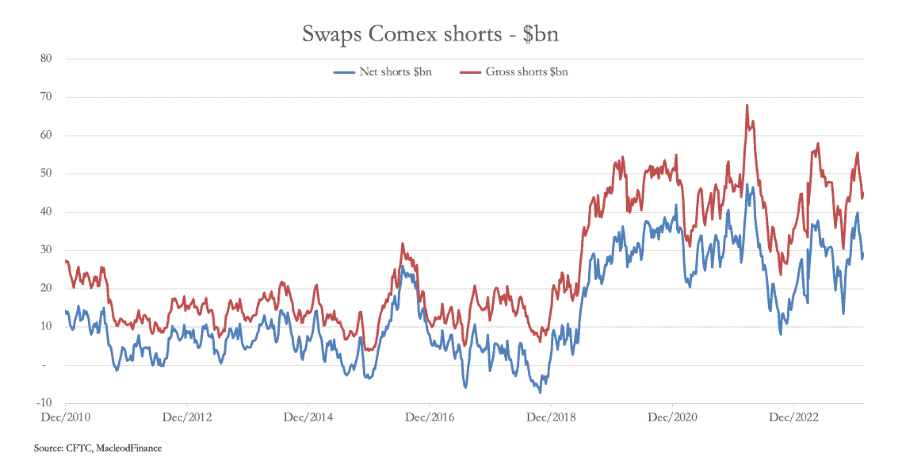

Two months before, in August 2018 Managed Money had gone record net short (109,454 contracts. It is not so extreme today, with MM net long 68,069 contracts on 6 February. This gives the Swaps category bullion banks a problem: in August 2018 they were net long 60,000 contracts, so were the right side of the massive bear squeeze that followed. Ten days ago, they were net short 143,623 contracts (14.36 million ounces, 446.7 tonnes) worth $29.23 billion. See the next chart of the gross and net short values:

The Swaps’ problem is that the other category normally taking the short side, Producers and Merchants, have reduced their hedging to a minimal level. This is next.

Admittedly, in late-2018 producer hedging was at similar levels to today, but this you would expect in a sell-off such as occurred at that time. Today is different. With the gold price close to all-time highs, you would expect a far higher level of producer hedging.

Taking these technicalities into account, we can only conclude that the situation in the Comex gold contract could become systemically threatening for the bullion banks. It is becoming apparent to the major players (central banks etc.) that the fundamentals behind the US dollar are becoming dangerous to it, threatening its very survival. Yet the bullion banks are unable to close their short gold positions.

Will the dip testing the water at under $2000 be the last chance to buy gold before it roars ahead on a bear squeeze, potentially taking out some bullion banks? It is a possibility which should not be lightly dismissed.”

Source.

To simplify, here is a short summary of MacLeods key points:

Low open interest: The number of bets on gold’s future price is very low, similar to a period in 2018 that preceded a major price increase. This suggests less downward pressure on the price.

Hedge funds (Managed Money): They are currently slightly bullish on gold (net long).

Bullion banks (Swaps): They are heavily bearish, holding a large net short position (betting the price will go down).

Producers: They are not actively hedging their gold production, unlike in previous sell-offs. This means less selling pressure from them.

Dollar concerns: Macleod mentions concerns about the long-term stability of the US dollar, potentially driving investors to gold as a safe haven.

The argument:

- The low open interest and lack of producer hedging create an environment with less selling pressure on gold.

- If the bullish sentiment grows (e.g., due to dollar concerns), there could be a sudden surge in buying, as the bullion banks are heavily exposed on the short side. This could lead to a “bear squeeze,” where they are forced to buy gold to cover their positions, pushing the price up sharply.

Joke (or Truth Bomb?) From RBNZ Head Widely Reported Overseas

The governor of the RBNZ has garnered a bit of overseas attention with a statement he recently made during a parliamentary committee meeting. We’ve seen it widely reported overseas and then even the NZ Herald reported on it.

You can see the 26 second video at the link below:

“It’s a great business to be in, Central Banking, where you print money and people believe it” – Adrian Orr, Governor Reserve Bank of NZ

He says this while the state imposes legal tender laws, and myriad banking and AML laws. “Belief”? or coercion?

Source.

Perhaps it was a joke but he does end by “knocking on wood”. Maybe he realises the masses are starting to lose trust in the fiat currency system?

Be sure to have some insurance in place in case the trust does one day run out.

Get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

New Australian Product: The Superoo 16 Litre Gravity Water Filter by Filteroo. Leak-free design with double the capacity of similar filters.

This filter will provide you and your family with safe drinking water for years to come. It’s simple, lightweight, easy to use, and very cost-effective. Comes complete with a Stainless Steel Tap, Stand and Water Jug.

—–

|

Pingback: Is John Key Right About NZ Property Doubling in the Next Decade? - Gold Survival Guide