With the New Year now celebrated it’s once again time to review the annual performance of gold and silver in New Zealand dollars. We’ll also cast our eyes over the punts we made back at the beginning of 2024 and see what our success rate was like. Plenty of people make predictions but do they check back to see how accurate they were? Then finally we’ll continue the trend and make a few predictions as to what 2025 might have in store for us…

Table of contents

Estimated reading time: 8 minutes

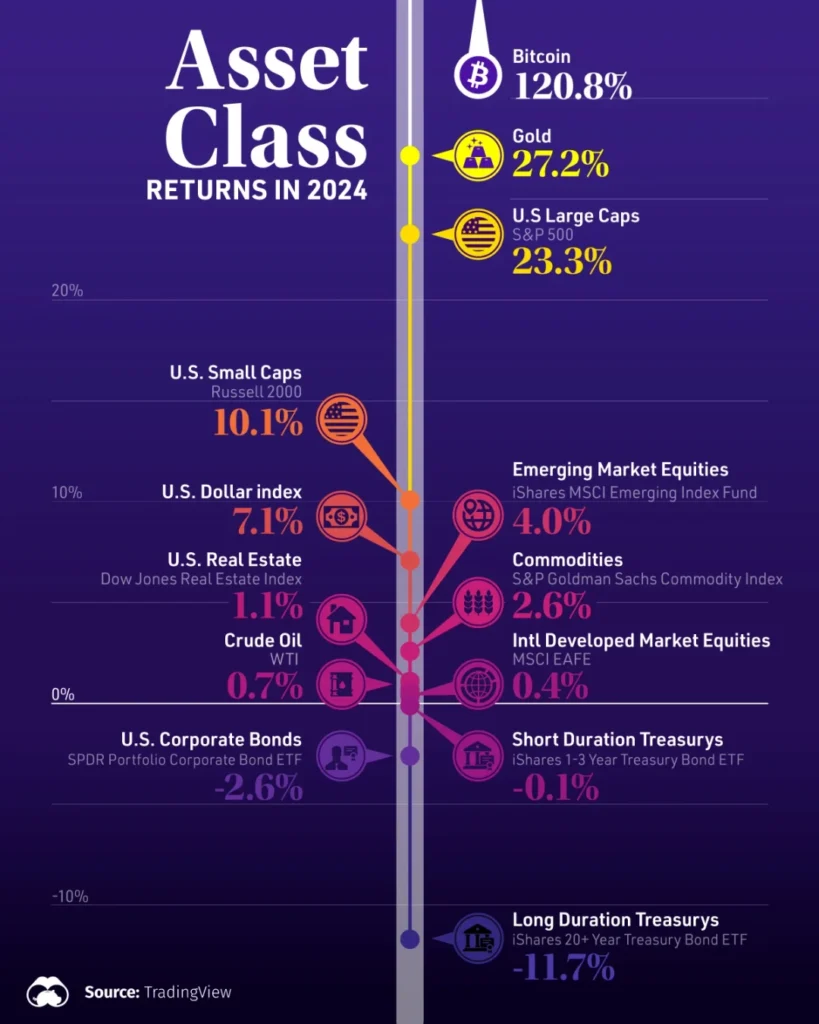

2024 saw most major asset classes in the positive apart from many bonds. However there was a large variation in performance between them. You’ll see in the chart below that only the volatile Bitcoin outperformed gold last year. While the US stock market was the top performer of developed nation stock markets. The US dollar itself was also a top performing currency for 2024, with the US dollar index up 7.1%. The worst performing on this list were 20 year US treasurys or long duration government bonds – down 11.7%. This shows that bond investors are not prepared to lend to governments long term without a high interest rate. Probably because they fear inflation being higher than most people expect.

What stands out to us from this list of asset class performances?

That you are better off “not investing”. That is gold just sits there as many of its opponents like to say. But it outperformed the risk of owning stocks, bonds or realestate, which are still the most common investments to own.

The other point that is key for New Zealand residents is that these are mostly US based investments including the performance of gold. Of course we in New Zealand should track the gold and silver price in NZ dollars, not the commonly quoted US dollar price. So that’s what we always do this time of the year.

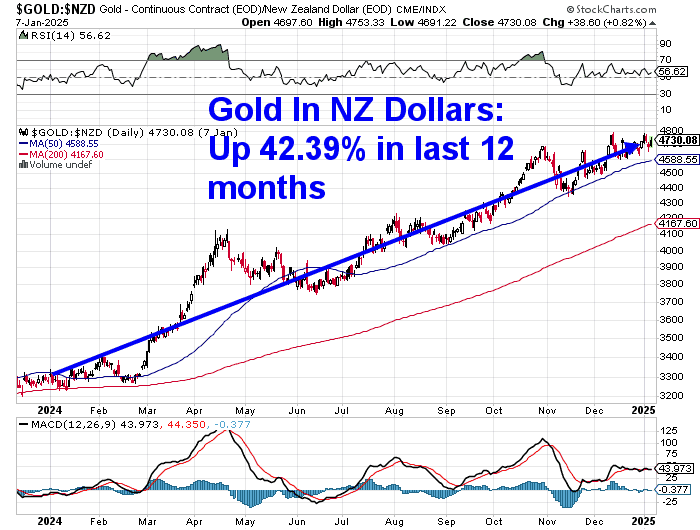

Gold in $NZ – Performance During 2024

The chart below of gold in New Zealand dollar shows the very significant value of holding gold when your home currency weakens. With NZD Gold up a very hefty 42% from during 2024.

Much like in 2023, gold rose pretty steadily all year but with a sharper rise in March and April. 42% is a pretty significant move for a major asset class. However if you ask the average person in the street, while they might have heard gold had risen, they would likely have no idea that it was up anywhere near that amount. We’d say that is a good sign that this is just the start of a multiyear rise.

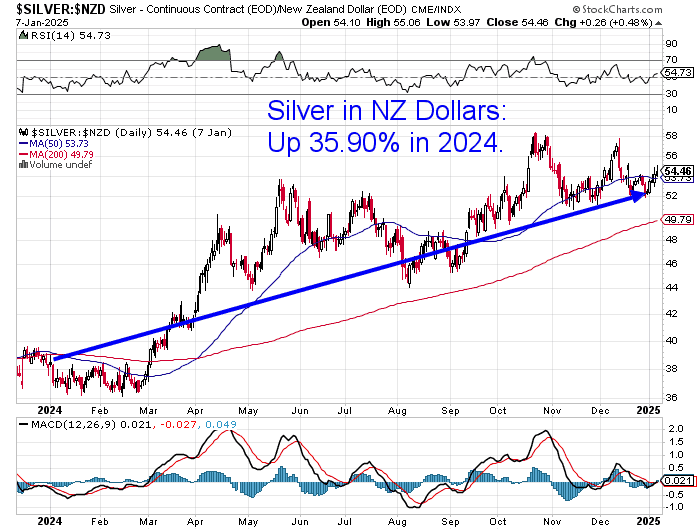

Now let’s look at golds performance back even further. Right back to the start of the millennium and the birth of the current bull market in precious metals. Over that time NZD gold is up over 750%. The significant rise this year has made a big difference to that total tally. As at this time last year the rise since the year 2000 was just under 500%.

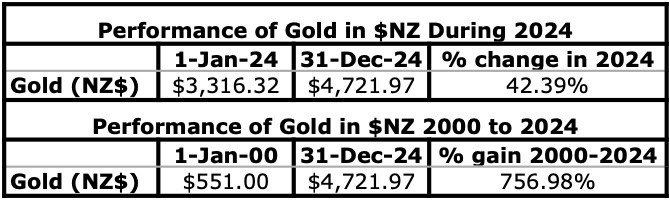

Silver in $NZ – Performance During 2024

Silver in NZD also had a great year in 2024, although it slightly underperformed gold. It had a flying start in the first half of the year. But then went mostly sideways, finishing up nearly 36%. What we said last year proved correct. That once NZD silver got above $42 then the 2020 high of $45 was tested (and surpassed) fairly quickly.

Over the long term, since the year 2000, silver has also underperformed gold. With NZD silver up 407% versus gold’s 757%.

However, we’ll repeat what we said last year that this shouldn’t come as a big surprise. Because history shows the big gains in silver come towards the tail end of precious metals bull market. This chart of silver shows that silver could be very close to a major breakout. It plots the yearly “candles” showing the opening and closing prices of silver each year since 1975. At some point in the next few years we’re likely to see a big green candle again.

How Accurate Were Our 2024 Predictions?

Now we get to review our 2024 prognostications and see whether we had a bit of Nostradamus in us! As we said at the opening, there’s no point making predictions or perhaps what we should call somewhat educated guesses, if you don’t look back at them.

Here’s what we said at the start of 2024:

1.We think it is only a matter of time before USD gold will set a new all time closing high above $2100 during 2024. We’ll go out on a limb and say we’ll see double digit percentage gains for USD gold. And close to that for NZ gold. 2023 was the first time USD gold closed the year above $2000. We’ll also say that 2024 may be the first year that USD gold doesn’t again go below US$2000.

This proved to be a pretty conservative call with USD gold closing above $2100 early in March. As already noted USD gold was up 27% for the year and NZD gold up way more. We were also correct that USD gold didn’t really close below $2000 during 2024. There was an intraday dip in February, but then it was off to the races.

2. US silver will finish the year higher than it starts. Silver is due to play catch up with gold but should we say 2024 will be that year? We don’t feel it strongly enough to put it down on paper.

Again this was pretty conservative in hindsight. Although silver had actually been flat in 2023. But we were also correct that while silver did have a very good year it still trailed gold.

3. We think the US dollar will weaken this year and so the NZ dollar is likely to rise compared to the US. Maybe we’ll finally get this call right this year!

Totally wrong there. The US dollar was the strongest major currency (although not against gold of course). The NZ dollar started the year at 0.63 and ended it at 0.56 for an 11% loss. Of course anyone holding gold or silver in New Zealand was shielded from the weaker NZ dollar. So we can feel a bit better about getting that one wrong.

4. We’ll also double down on the stock market call from last year. With US stocks back around all time highs we’d expect them to fall back towards the previous lows in 2024.

Wrong again there. With the AI boom pulling the broader US stock market higher for the year.

5. Long term interest rates and inflation rates will fall during the year. But we’d say this is a short term counter-cyclical move in a longer term uptrend for them both. So maybe by the end of the year they will both have turned back up again?

We think we did pretty well on this one. As long term interest rates did fall until September. However, despite most major central banks cutting short term rates, long term rates actually ended the year higher than they began.

As for inflation, the last quarter data isn’t out yet. But according to TradingEconomics, “Inflation Expectations in New Zealand increased to 2.10 percent in the fourth quarter of 2024 from 2 percent in the third quarter of 2024”. Source. So that was heading back up.

Given that the US often leads where the world is heading, we can also look at their data as it is released on a more timely basis.

“The inflation rate in the United States in November 2024 was 2.7%:

Monthly

The consumer price index (CPI) increased by 0.3% in November 2024, which was the highest monthly increase since April.

Annual

The annual inflation rate increased to 2.7% in November 2024, up from 2.6% in October.

So while it’s not conclusive we think we may be on the money there too.

Overall we got 3 out of 5 so while not Nostradamus like, we’d still give ourselves a pass.

Here’s Our 2025 Predictions

Now that we’ve reviewed our guesses for 2024, what might the year ahead have in store for us?

- Silver will outperform gold for the year.

- Silver will take out its all time nominal high by year end, at least in NZ dollars Maybe even USD as well.

- Both long term interest rates and inflation rates will be higher than they began the year.

- Major stock market indexes will be down for the year.

With the Kiwi dollar hitting new lows it is tempting to also again say that the US dollar will be weaker by years end. But we might have to cut out losses on that prediction for now.

We’ll leave it at that for our 2025 predictions. It’s hard enough getting the general directions right, without having to predict what will happen in a specified time period. That’s why we say for most people using dollar cost averaging and buying gold and silver at set intervals is a better way to go.

Or if you feel more inclined to try and use some timing then check out our favourite technical indicators help make your purchases after a pull back in the precious metal prices.

So sign up to our daily price alerts if you want to be kept informed about these optimal times to buy throughout the year.