This Week:

- Holiday Opening Hours – Last Day to Buy Local Gold & Silver

- A Chance to Buy Gold and Silver Cheap?

- Sneak Peak: Interesting Views from Ronni Stoeferle to Close Out the Year

|

LIMITED QUANTITY GOLD SPECIAL

***** PERTH MINT 1 oz GOLD BARS 1oz Perth Mint 99.99% Gold Bars Green Packaging (Approx $1690) (6 green in Stock) Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1596.15 | + $22.63 | + 1.43% |

| USD Gold | $1079 | + $27.10 | + 2.57% |

| NZD Silver | $21.17 | + $0.62 | + 3.01% |

| USD Silver | $14.31 | + $0.57 | + 4.14% |

| NZD/USD | 0.6760 | + 0.0075 | + 1.12% |

Tomorrow: Last Day to Order Local Gold & Silver Bars

+ Holiday Opening Hours

We’re sending this out early this week so you’ll know when we’re closed.

Well we’re not actually “closed for the holidays”, but we are limited in product availability due to our local NZ refiners and suppliers being closed.

No local NZ refined gold or silver bars

24 December 2015 to 4 January 2016 inclusive

So the last day to order local NZ gold or silver bars is tomorrow up until 5pm.

These will not be available to purchase then until 5 January 2016.

However we can still supply some imported products such as gold and silver maple leaf coins in larger order sizes during the holiday period.

The only days “shut” where we can’t lock any pricing in are:

Christmas Day (25th December)

Boxing Day (26th December)

New Year’s Day Holiday (2nd January)

A Chance to Buy Gold and Silver Cheap?

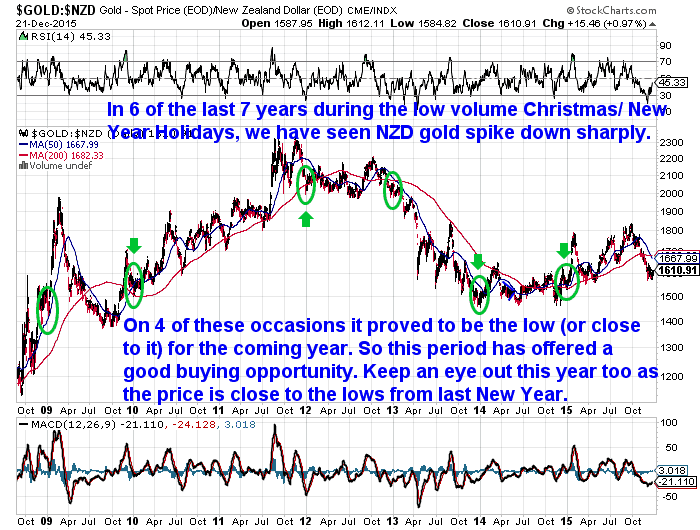

Historically the Christmas and New Year Holidays often see gold and silver spike down in price during this low volume time of year.

You can see this clearly in the chart below. Over the past 7 years NZD gold has spiked down at this time of year 6 times. On 4 occasions this was to the low for the year ahead.

It may be worth keeping an eye out for lower prices over the next 2 weeks if you are thinking of buying.

As noted above we are only “closed” for 3 days during the holiday break. So keep your eyes open for a chance to buy cheaper.

So if we see a spike down get in touch with David for a quote on 0800 888 464 or 0274 401 113. Or email: orders@goldsurvivalguide.co.nz

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Gluten Free Emergency Food

Are you or is anyone in your family gluten intolerant?

Have you had trouble finding suitable long life emergency food options?

Now in stock: Gluten Free Emergency Food Bucket…

For just $325 you can have 1 months long life gluten free emergency food supply.

Learn More.

—–

Sneak Peak: Interesting Views from Ronni Stoeferle to Close Out the Year

Just in our inbox last night was a “Letter to Investors & Outlook 2016” from Ronni Stoeferle at Incrementum. Co-Author of the yearly In Gold We Trust report, Ronni had some interesting views in this email. We can’t see it posted on the Incrementum website yet so we’ll share a few excerpts here which tie in nicely with some of the things we’ve reported in past weeks.

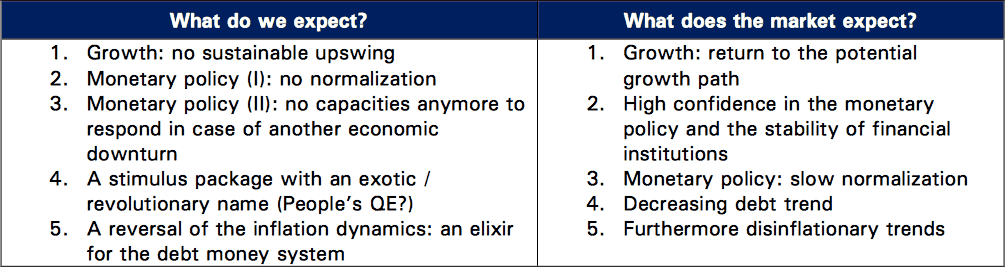

“What inferences can be drawn for the investment strategy?

While many market participants have been trying to evaluate for years the sustainability of the current recovery, our view in this context is clear: Our belief is that we won’t see any self-sustaining economic recovery in the years to come and that reflationary policy measures of governments and central banks will finally cause a (systematically required) U-turn in the inflation dynamics. We are quite sure that the low in inflation dynamics – and thus the low of the inflation-sensitive investments – will be overcome in the next months.

This view is absolutely contrary to the current consensus and provides excellent opportunities to construct a “macro-contrarian” portfolio.

Rising inflation rates will be the “pain trade” for most traditional portfolios because it catches the majority of investors on the wrong foot. In the light of the currently widespread carefree manner inflation-sensitive assets [Gold and Silver Miners] appear to be extremely undervalued, which makes the hearts of anticyclically oriented investors flutter, who expect an excellent entry point.

…Regarding commodities, the fear of the first rate hike could turn out to be a huge “buy the rumor, sell the fact”. Contrary to the common assessment, commodities are the best performers after historical rate hikes of the Fed when comparing different asset classes.

…Although the Austrian school of economics is modest with respect to predicting the future – since market developments are the result of many subjective evaluations and decisions of countless individuals – we would like to formulate some theses for 2016:

– The US dollar will play a prominent role: We expect a weaker tendency, since many market participants might be surprised by the non-normalization of the monetary policy (DXY, also against EUR)

– In the US, recession concerns are becoming increasingly serious. The Fed will counter with dovish statements and actions. Election candidates will create some pressure for fiscal stimuli (infrastructure projects, a Marshall Plan for the US, People’s QE etc.).

– The oil price will stabilize and tend towards 60 USD, driven primarily by geopolitical events.

– Shares will have a significantly higher volatility.

– Inflation rates will increase significantly due to the base effect in Q1 and Q2. “

So their view is not too dissimilar to those of the likes of Chris Martenson that we shared last week. Deflation first followed by inflation.

Like Chris Martenson, Ronni also believes most people will be surprised by the onset of inflation. However Ronni and Co indicate this rise in inflation may show up next year which is perhaps sooner than many would think.

This could also see gold and silver rise – not because of the inflation itself but because higher inflation would cause lower real (i.e. after inflation) interest rates. 2016 could well hold some surprises for most people.

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,490 and delivery is now about 3 weeks away.

Final Weekly Email for 2015

We’ll be back with our weekly Newsletter in the New Year in just over 3 weeks for a wrap up of 2015. Although we may fire something out if we do again see a spike down in prices during the holiday break.

So with that we’d like to wish you a merry Christmas, safe travels and we hope you have a happy and prosperous 2016!

*****

DICTIONARY HOME DIVERSION “BOOK SAFE”

JUST $34.95

This home diversion book safe looks just like a real dictionary.

Place it on a book shelf and it will blend right in with the rest of your books.

Hide valuables and important documents like wills and passports

where thieves won’t think to look.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|