Like trying to be “the prettiest horse in the glue factory” was how Eric Sprott described the various paper currencies of the world today. Eric Sprott, head of Sprott Asset Management was the first of the “big names” to speak at the Gold Symposium in Sydney last week.

He certainly has a quick wit and is a sharp marketer indeed. Seeing a trend early and concentrating on it. This was borne out most notably in his response to a comment from the floor during the panel discussion at the end of the final day. An audience member brought up the topic of gold again being banned from ownership in Australia. And how for many years Australians couldn’t own gold except for in the form of jewellery. Mr Sprott quickly commented, “If that happened I’d love to own a jewellery store!”

He began his presentation with a quick summary of how since 2008 there has been a massive transfer of risk from the private sector to the public sector. We lost count of the different bail out programmes worldwide after about 14 when the print on his slide got too small to read.

Sovereign Credit Default Swap rates spiking

A great chart showed how sovereign Credit Default Swap (CDS) rates have spiked recently while in 2008 they hardly moved. (CDS’s are basically an insurance policy against loan default. So if the swap rates rise the seller or “insurer” perceives a higher risk of default). The debts of the banks have been moved onto the balance sheets of governments the world over.

In the face of this over indebtedness, not surprisingly European bank stocks have performed very poorly with the 4 big European banks having fallen 60-90% since 2007.

US banks haven’t fared a whole lot better with 140 bank failures in 2009, 157 in 2010 and even this year there have been 73 to date! But the key thing is these banks weren’t liquidated but rather taken over as there was nothing to liquidate, as on average they have lost 6 times their capital!

Not surprisingly for a guy who derives a large part of his wealth from funds in the precious metals sector, the rest of his presentation was on this topic.

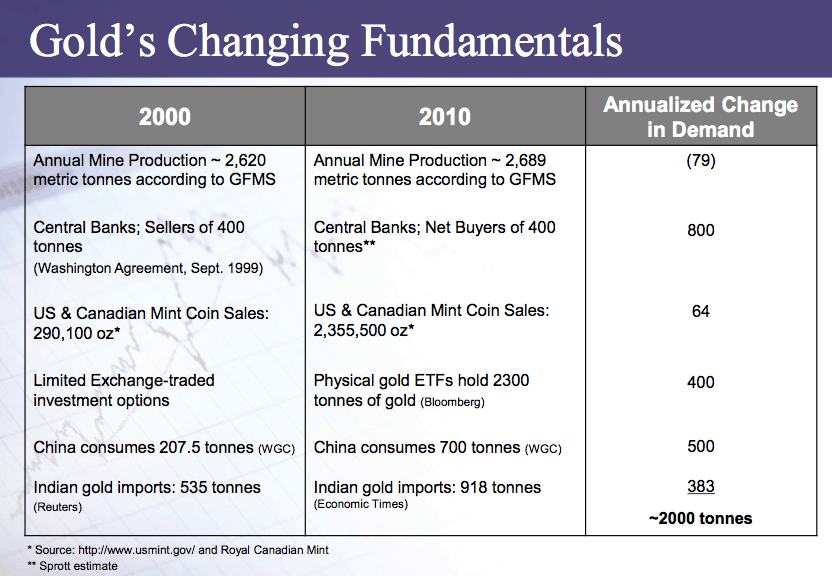

Gold supply and demand

Sprott outlined how the physical mine supply of gold has been pretty steady for the past decade. In fact annual mine production has only increased from 2,620 to 2,689 in a decade where the gold price has risen 100’s of percent…

“Mining production has hardly gone up for 10 years. We’re only adding 1.4% to the pool of gold each year.”

He had a great chart showing just five measures of gold demand including central banks, US and Canadian Mint, ETF’s, China and India. The numbers from just these 5 sources showed an increase in demand from 2000 to 2010 of about 2000 tonnes.

So what?

This is in a market of that is only 4000 tonnes in size. So where has all the gold come from?

He believes the only answer is central banks have been surreptitiously leasing it…

“I would argue very strongly that the central banks are surreptitiously leasing their gold. Gold lease implies they lease it to the bullion dealer, the dealer sells it in the physical market. Then it gets consumed in the sense savers like you buy it.”

So there is a great deal of “paper gold” out there where a central bank has leased gold to another party who in turn has sold it on to someone else. But, at some point the books must be balanced and they will have to go into the market to repurchase that which they have leased out. Will it be available we wonder?

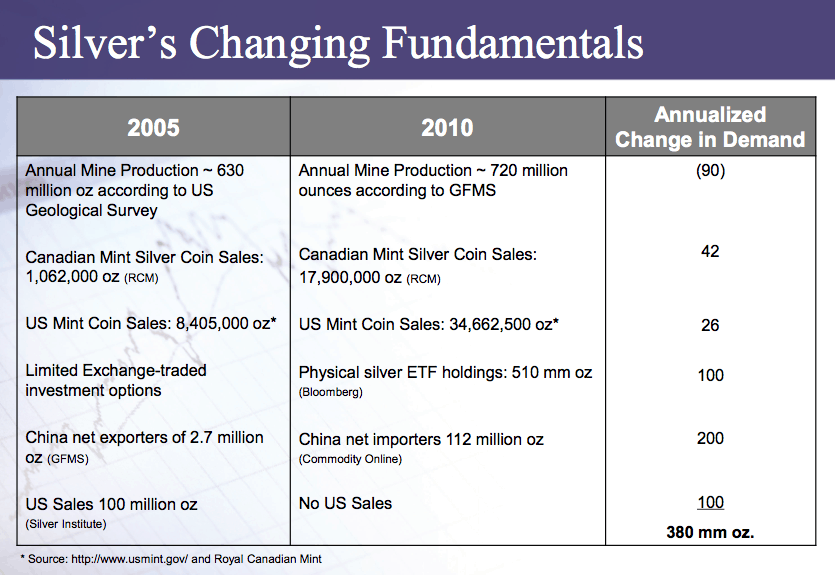

Silver – the investment of the next decade.

So while gold has been the investment of the decade Sprott believes silver will be the investment of the next decade (of course you can make the argument he is talking his book given the Sprott Physical Silver Trust was only launched earlier this year).

He had a similar slide showing silvers changing fundamentals from only 2005 to 2010.

Again mine supply has increased – from 630 million oz to 720 million oz. The 5 sources of demand were the same apart from India being swapped for US Sales.

So for silver the end result was an annualised change in demand of 380 million ozs. This is in a market of 900 million ozs. So again where is it coming from?

Price Ratio Argument

You may have heard previously that the historical gold to silver ratio is 16:1 (although as we have reported here previously this is over the very long term and not necessarily likely to happen in anything resembling a straight line).

This is very close to the ratio of the 2 metals in ground. The ratio at the time of his presenatation was about 50:1 which implied a silver price of $100 per oz if the ratio reverted back to 16:1 at today’s gold price of around $1600.

According to various sources such as GoldMoney, US Mint coin sales and Canadian Mint sales, people are buying silver and gold in about equal amounts in dollar terms, so this equates to about 50 times more physical silver being bought (on a personal note this is quite similar to what we are seeing with sales via us too). So he believes if this continues so will the upwards trajectory of the price.

The Great Wealth Redistribution

Sprott argues that we are in the midst of a great wealth redistribution. With those holding precious metals and their related shares seeing their buying power going up, while just about everything else stagnates or goes down.

This is demonstrated by the HUI Gold Index returning 1389% since 2000 while the S&P 500 index returned just 1.99% and the Dow Jones 1.33%. The KBW bank index has fared much worse at -56.78%!

But interestingly even in the face of this dramatic out performance, bank stocks currently make up about 25% of the world’s financial assets versus gold only 1.5%.

So in the understatement of the decade he quipped “if you’re in gold and silver you’re doing okay”.

Conclusion?

Sprott believes keeping you money in the bank at 0% interest is a huge financial risk. That said he obviously still sees there is money to be made in banking as he’s applying for a Canadian Banking licence! “Sprott Bank” will keep your money in gold and silver or just cash. Unlike virtually every other bank on the planet your money won’t be lent out.

He sees gold as the ultimate currency or rather that’s what the markets have decided…

“I believe the market has already determined gold is the reserve currency. The markets decided that. Not the central banks. Not the Treasuries. The markets made up their mind that gold is the reserve currency. It’s up 600% versus almost every currency…”

Then the classic line…

“The stuff we have to listen to every day: the dollar versus the euro, the yen versus the dollar… they’re all crap. It’s like, who’s the prettiest horse in the glue factory!”

He believes gold will continue to rise and that James Sinclair’s prediction from the GATA conference 10 weeks ago will be proven correct.

What was that? That once $1764 was breached – which it was recently – that $12,000 would be the next target.

He felt that the 16:1 gold:silver ratio would be reached and likely overshoot to 10:1.

His parting comment was, ultimately gold will become the reserve currency but until then be very concerned about where you have your money.

Pingback: Bank Failures - could they happen in NZ? The Reserve Bank thinks so | Gold Prices | Gold Investing Guide

Pingback: Schizophrenic markets and why the US may be the last to fall | Gold Prices | Gold Investing Guide