Jim Rickards covers a variety of topics that may impact the gold price in the coming months. These include:

- Deteriorating relations between the U.S. and Russia

- Geopolitical risks from North Korea, to Saudi Arabia, to the South China Sea

- Whether the Fed will raise interest rates next month?

- Why the key data is the disinflation numbers

Golden Catalysts

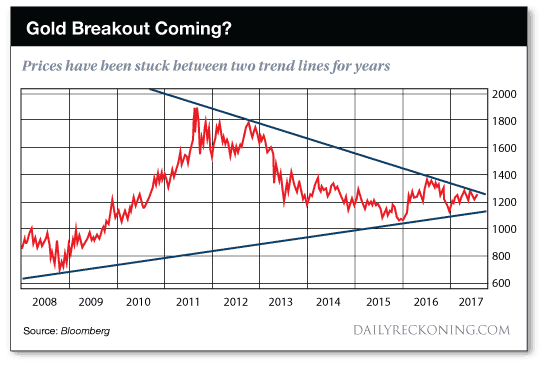

By Jim Rickards – First published at DailyReckoning.com The physical fundamentals are stronger than ever for gold. Russia and China continue to be huge buyers. China bans export of its 450 tons per year of physical production. Gold refiners are working around the clock and cannot meet demand. Gold refiners are also having difficulty finding gold to refine as mining output, official bullion sales and scrap inflows all remain weak. Private bullion continues to migrate from bank vaults at UBS and Credit Suisse into nonbank vaults at Brinks and Loomis, thus reducing the floating supply available for bank unallocated gold sales. In other words, the physical supply situation has been tight as a drum. The problem, of course, is unlimited selling in “paper” gold markets such as the Comex gold futures and similar instruments. One of the flash crashes this year was precipitated by the instantaneous sale of gold futures contracts equal in underlying amount to 60 tons of physical gold. The largest bullion banks in the world could not source 60 tons of physical gold if they had months to do it. There’s just not that much gold available. But in the paper gold market, there’s no limit on size, so anything goes. There’s no sense complaining about this situation. It is what it is, and it won’t be broken up anytime soon. The main source of comfort is knowing that fundamentals always win in the long run even if there are temporary reversals. What you need to do is be patient, stay the course and buy strategically when the drawdowns emerge. Where do we go from here? There are many compelling reasons why gold should outperform over the coming months. Deteriorating relations between the U.S. and Russia will only accelerate Russia’s efforts to diversify its reserves away from dollar assets (which can be frozen by the U.S. on a moment’s notice) to gold assets, which are immune to asset freezes and seizures. The countdown to war with North Korea is underway, as I’ve explained repeatedly in these pages. A U.S. attack on the North Korean nuclear and missile weapons programs is likely by mid-2018. Finally, we have to deal with our friends at the Fed. Good jobs numbers have given life to the view that the Fed will raise interest rates next month. The standard answer is that rate hikes make the dollar stronger and are a head wind for the dollar price of gold. But I remain skeptical about a December hike. As I explained above, the market is looking in the wrong places for clues to Fed policy. Jobs reports are irrelevant; that was “mission accomplished” for the Fed years ago. The key data are disinflation numbers. That’s what has the Fed concerned, and that’s why the Fed might pause again in December as it did last September. We’ll have a better idea when PCE core inflation comes out Nov. 30. Of course, the Fed’s main inflation metric has been moving in the wrong direction since January. The readings on the core PCE deflator year over year (the Fed’s preferred metric) were: January 1.9% February 1.9% March 1.6% April 1.6% May 1.5% June 1.5% July 2017: 1.4% August 2017: 1.3% September 2017: 1.3% Again, the October data will not be available until Nov. 30. The Fed’s target rate for this metric is 2%. It will take a sustained increase over several months for the Fed to conclude that inflation is back on track to meet the Fed’s goal. There’s obviously no chance of this happening before the Fed’s December meeting. A weak dollar is the Fed’s only chance for more inflation. The way to get a weak dollar is to delay rate hikes indefinitely, and that’s what I believe the Fed will do. And a weak dollar means a higher dollar price for gold. Current levels look like the last stop before $1,300 per ounce. After that, a price surge is likely as buyers jump on the bandwagon, and then it’s up, up and away. Why do I say that? There’s an old saying that “a picture is worth a thousand words.” This chart is a good example of why that’s true:

Gold analyst Eddie Van Der Walt produced this 10-year chart for the dollar price of gold showing that gold prices have been converging into a narrow tunnel between two price trends — one trending higher and one lower — for the past six years. This pattern has been especially pronounced since 2015. You can see gold has traded up and down in a range between $1,050 and $1,380 per ounce. The upper trend line and the lower trend line converge into a funnel. Since gold will not remain in that funnel much longer (because it converges to a fixed price) gold will likely “break out” to the upside or downside, typically with a huge move that disrupts the pattern. At the extreme, this could imply a gold price on its way to $1,800 or $800 per ounce. Which will it be? The evidence overwhelmingly supports the thesis that gold will break out to the upside. Central banks are determined to get more inflation and will flip to easing policies if that’s what it takes. Geopolitical risks are piling up from North Korea, to Saudi Arabia, to the South China Sea and beyond. The failure of the Trump agenda has put the stock market on edge and a substantial market correction may be in the cards. Acute shortages of physical gold have also set the stage for a delivery failure or a short squeeze. Any one of these developments is enough to send gold soaring in response to a panic or as part of a flight to quality. The only force that could take gold lower is deflation, and that is the one thing central banks will never allow. The above chart is one of the most powerful bullish indicators I’ve ever seen. Get ready for an explosion to the upside in the dollar price of gold. Make sure you have your physical gold and gold mining shares before the breakout begins. You might also want to check out: Does a Gold Revaluation to US$10,000 With All Major Countries Make Sense?

About Author

James G. Rickards is the editor of Strategic Intelligence, the latest newsletter from Agora Financial. He is an American lawyer, economist, and investment banker with 35 years of experience working in capital markets on Wall Street. He was the principal negotiator of the rescue of Long-Term Capital Management L.P. (LTCM) by the U.S Federal Reserve in 1998. His clients include institutional investors and government directorates. His work is regularly featured in the Financial Times, Evening Standard, New York Times, The Telegraph, and Washington Post, and he is frequently a guest on BBC, RTE Irish National Radio, CNN, NPR, CSPAN, CNBC, Bloomberg, Fox, and The Wall Street Journal. He has contributed as an advisor on capital markets to the U.S. intelligence community, and at the Office of the Secretary of Defense in the Pentagon. Rickards is the author of The New Case for Gold (April 2016), and three New York Times best sellers, The Death of Money (2014), Currency Wars (2011), The Road to Ruin (2016) from Penguin Random House.