Prices and Charts

Gold in NZ Dollars Down $300 From All-Time High

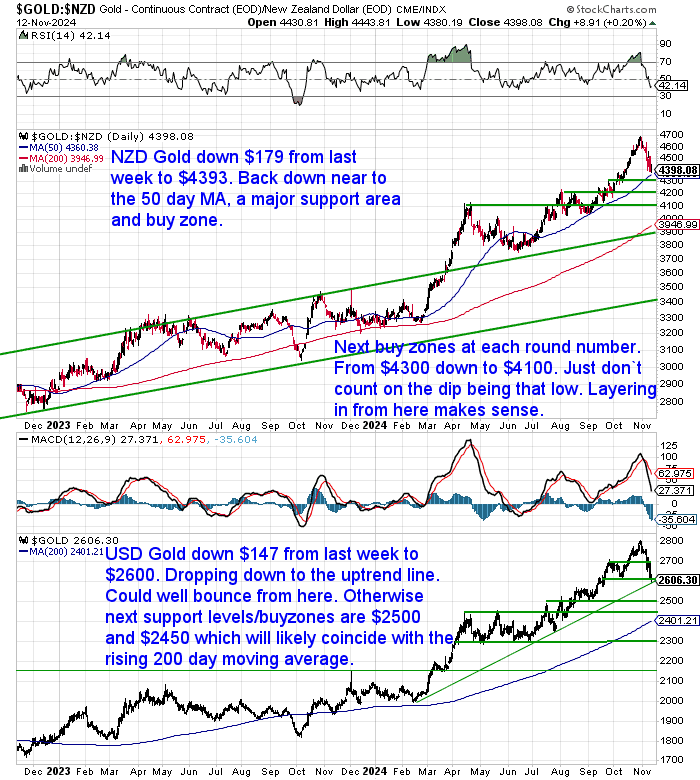

The correction we have been watching for finally arrived post the election result. We’ll focus on that below. Gold in NZ Dollars is down $179 from last week. Today it is down close to the key 50-day moving average (MA). This is a major support area and buy zone. However, we are not oversold on the RSI indicator yet. So layer in from here and watch for the next support levels from $4300 down to $4100. Then finally below that is $4000 which would also coincide with the rising 200-day MA.

USD gold was down $147 (-5%) from last week to $2600. It has fallen below the 50-day MA and is now on the uptrend line from February. So we could see a bounce from here. If not the next support zones are $2500 and $2450. The last will likely coincide with the rising 200-day MA.

NZD Silver Down to 50-Day Moving Average

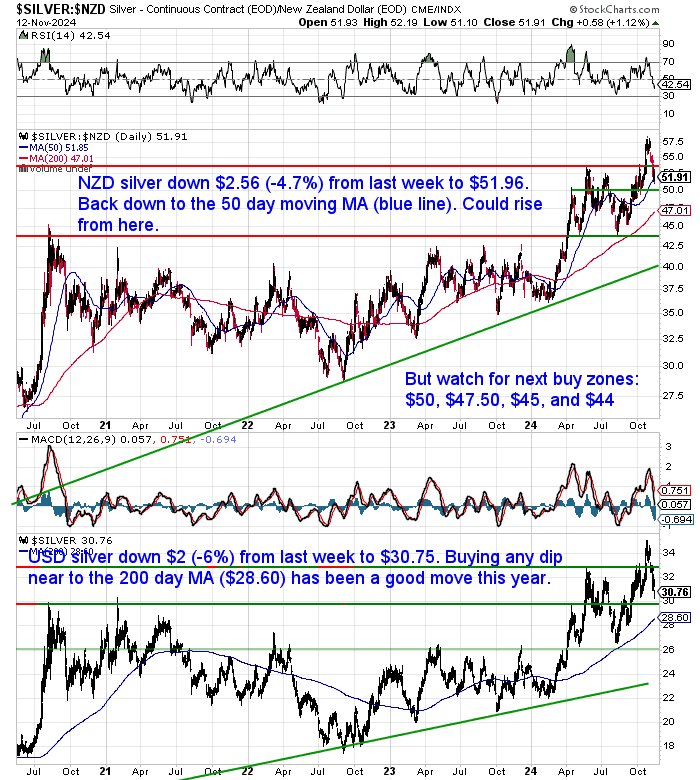

Silver in NZ dollars was down $2.56 or 4.7%. At $51.96 it is just above the key 50-day MA. So we could easily see a rise from there. But the next buy zones to watch for are $50, $47.50 and $44.

While in USD silver was down $2 or 6% to $30.75. We could yet see a dip down to the 200-day MA, currently at $28.60 and rising. Buying anywhere near that has been a good move so far this year.

NZ Dollar Down 1.5% Post Election

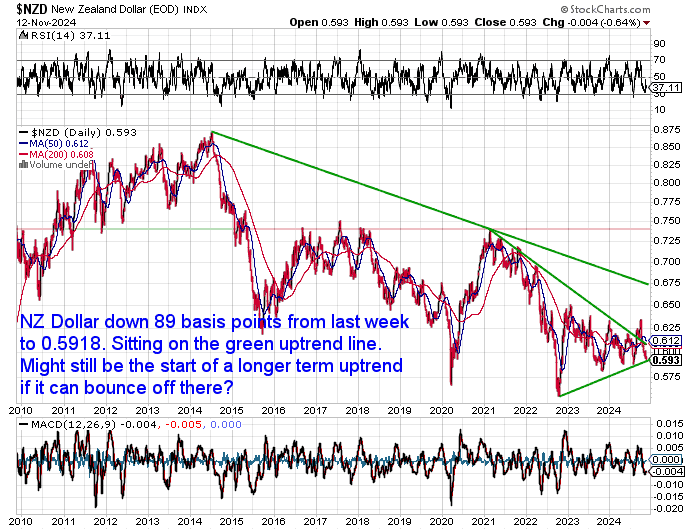

The Kiwi dollar dropped 89 basis points from a week ago and following the election. It is back right on the green uptrend line and close to oversold. So it could bounce from around here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Could a Gold-to-Debt Reset Push Gold to $35,800?

There has been a good deal of focus on the increasing US government debt levels in recent years. That along with higher interest rates has seen a massive rise in the US interest bill since 2020.

So in this week’s article, we explore how the value of gold has been adjusted in the past to align with national debt levels, specifically in 1934 and 1980. By examining these historical events, we calculate what the gold price would need to be today to achieve a similar debt-to-gold ratio. This analysis offers insights into gold’s potential role in addressing the world’s current economic challenges.

If you’re curious about how historical precedents might influence gold’s future value, then check out the full analysis below.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Prices Adjusted by US Money Supply

Another historical comparison we can use with gold is the money supply. That date of 1980 comes up again…

“If or when this line is crossed, it should have a profound macro significance, in my opinion.

Gold is increasingly becoming the optimal alternative for central banks to improve the quality of their international reserves.

Despite being at record prices, here is a reminder that back in 1980, gold made up 70% of central bank assets.

Today, it’s still below 20%. In my opinion, this creates potential long-term demand for the metal as these large monetary authorities are compelled to strengthen their balance sheets amid the ongoing surge in global debt imbalances.”

Source.

How Will Trump Impact Gold?

As noted already gold has taken a dive post-election. So why is this? Will Trump be “bad for gold”. Is he wanting a stronger US dollar? Can he achieve lower inflation and pay off debt?

Today we’ll dive into a number of opinions on this…

Ronni Stoeferle: Gold’s Performance Under Previous Presidents

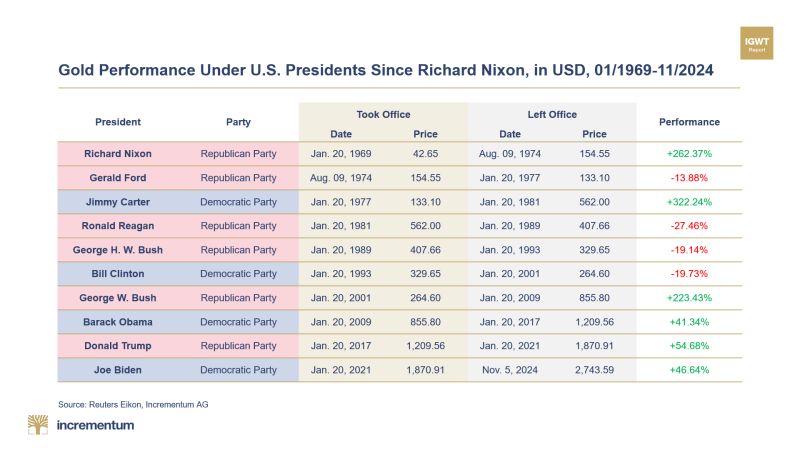

First up, what happened under previous presidents?

“What could the election of #DonaldTrump mean for #gold?

Have a look at gold’s performance under previous presidents:”

To our eye what this table shows is that it doesn’t matter who is president and whether they are from the left or the right. If gold is in a bull market (like it is now) then the gold price will go up.

World Gold Council on Gold’s Reaction Post-Election

A just-released World Gold Council report points out that western investors have not actually bought much gold this year. So they believe there won’t be many sellers and this is just a short-term reaction:

“…gold’s negative reaction to both the US election results and a continued move higher in bonds yields and the US dollar is in our view a near-term phenomenon. Other drivers including lower sanctions risks, a renewed bullishness in equity markets and [digital] currencies mask the underlying – and in our view – more fundamental concerns of:

• A world where protectionism is likely going to be more acute and current conflicts see no signs of abatement

• Equity markets are heavily concentrated and richly valued during the end of a business cycle

• [Digital] currencies continue to be a marginal consideration and not a replacement for gold

• Western investors have, outside of futures, not added much gold this year and so there is unlikely a slew of sellers in the wings.”

Source.

Will Trump Reduce Inflation?

“Gold crashes on expectations Trump will reduce inflation.

I’m old enough to remember when 23 Nobel Prizewinning economists told us Trump would be catastrophic for inflation so we had to vote Kamala.”

However Tavi Costa thinks this is a:

“Sell the news event.

Inflation expectations did surge yesterday with breakeven rates breaking out in almost every duration.

The macro case for gold remains intact regardless of the political leadership in my view.”

Source.

Another comment also pointed:

“Trump told us he will devalue the dollar, take control of the Fed to push interest rates to zero, deport millions of workers, and heavily tariff imports.”

The point being that all this will of course lead to further inflation.

Lobo Tiggre – previously at Casey Research noted:

“Given the promises, I can see why stocks & [digital currencies] would soar.

But I can’t think of what Trump promised that’s bad for #gold… though the news does seem to have sent the USD higher.

If traders are idiotically thinking higher inflation will send gold lower because the Fed will have to raise rates, then:

Mistake = Opportunity.”

Source.

As a contact of ours noted in the election aftermath. Trump will be:

“Good for pm’s and [digital currencies] as he lowers interest rates probably to negative in an attempt to inflate their way out of debt. People will flock to… PM’s to preserve their wealth”.

What About Impacts for NZ?

Mixed thoughts on this. On the one hand, we have:

“Incoming US President Donald Trump’s trade policies will reduce New Zealand’s economic growth next year, and could even force an increase in interest rates in a worst case scenario, a new report has claimed.”

Read more

While on the other hand:

“Opinion – Dan Brunskill: Donald Trump’s return to power could force a rethink of New Zealand’s China trade policy and create unexpected opportunities to access the US market”

Read more

But we are reminded of something we wrote during Trump’s previous presidency:

Trump and the Gold Standard: What’s His Aim With Trade Wars? – Could We Return to a Gold Standard?

Trump (like every politician!) promised a lot and didn’t do a lot of it last time around. As we allude to in the above article a lot of what he says is likely bluster and part of his “art of the deal” Make crazy demands so that your real demand is not seen so badly.

So who knows just how much he will push ahead with. The US is a big old ship and we’re not sure anyone can fully turn it around.

To us the key point is that gold has not been rising due to who is in power in the US. It is a hedge against the ballooning debt and heightened economic risks globally.

Or as El-Erian Says Soaring Gold Is Driven by Dollar Diversification

Mohamed El-Erian, the chief economic adviser at global insurance giant Allianz, says:

“…that gold surging to a fresh record reflects how global financial institutions are deliberately diversifying away from the US dollar.

…”When we try to relate the moves in gold this year to traditional, financial and economic variables — interest rates, the dollar — the relationships have broken down,” said El-Erian,… The “secular” move can be attributed to two fundamental drivers, he added. One is the slow diversification away from the dollar in the reserves of central banks around the world,” he said. “The other is a slow diversification away from the dollar payment system.”

Source.

To us this pullback was overdue. The gold markets were looking for an excuse to correct, and a conclusive election result was as good enough reason as any.

There is no way for the US to pay down its massive debt. There could be a revaluation of gold to solve this. But that would be abrupt and incredibly painful for the average person.

So far more likely is to inflate the debt away by devaluing the dollar, along with all other fiat currencies connected to it.

That in our view is what you should be preparing for.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|