A common argument is what will bring about the end of the current monetary system?

Will it be hyperinflation as a result of excess currency creation and a loss of trust? Or will it be a deflationary collapse due to the massive levels of global debt?

Darryl Schoon gives his version of events in this article…

HYPERINFLATION VERSUS DEFLATIONARY COLLAPSE

If the thunder don’t get you, then the lightning will…

The Grateful Dead, The Wheel (lyrics)

In the world of phenomena, everything has a beginning and an end; and today, the bankers’ endgame is moving closer to its inevitable resolution and demise. The question is no longer if, it is when and how.

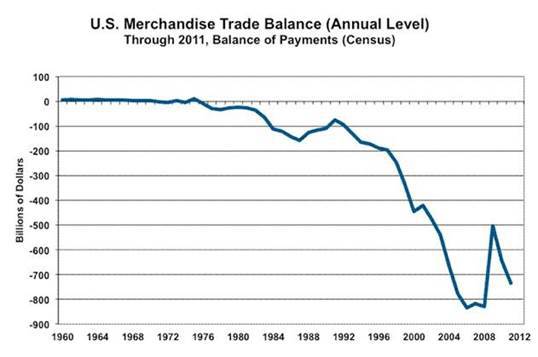

The relationship between paper money and gold is causal in central banking’s collapse. When paper money was backed by gold, it (1) gave the bankers’ paper money its value and (2) constrained the ability of governments to print limitless amounts of money, as governments needed money backed by gold to balance trade deficits, i.e. value for value.

The importance of this constraint, i.e. “golden-fetters”, became clear when escalating military spending caused the rapid loss of US gold reserves; and in 1971, the US withdrew the gold-backing of the US dollar and the US balance of trade permanently went negative.

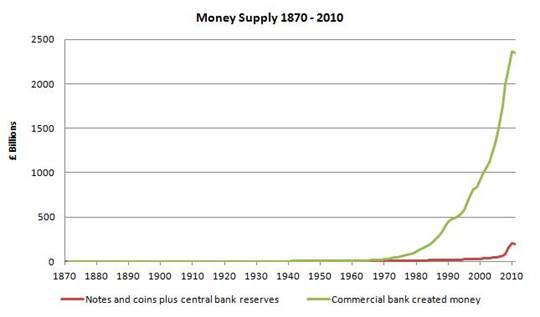

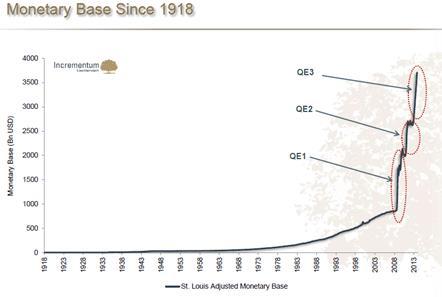

With gold no longer limiting how much money governments could print, after 1971 the global money supply exploded.

http://positivemoney.org/how-money-works/how-did-we-end-up-here/

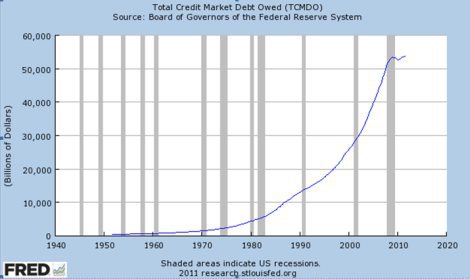

In capitalist economies, because money enters the money supply as loans, the explosive rise in the money supply led to an equally explosive rise in debt.

Today, this is the central bankers’ final—and fatal—conundrum: Aggregate levels of debt are now so high, credit can no longer induce sufficient economy expansion to pay off or even service capitalism’s constantly compounding debts.

Central bankers’ efforts to revive economic growth, e.g. quantitative easing, low, zero and negative interest rates, are like pouring more and more gasoline into an already flooded engine hoping the additional gas will cause the stalled engine to go faster.

Today, central bankers are trapped by conditions they created. It was their excessive expansion of the money supply after 1971 that lead to the speculative bubbles whose serial collapse resulted in the reawakening of deflationary forces not seen since the Great Depression.

To prevent another Great Depression, central bankers desperately tried to revive economic demand and growth by increasing the monetary base to increase the amounts of loans banks could make.

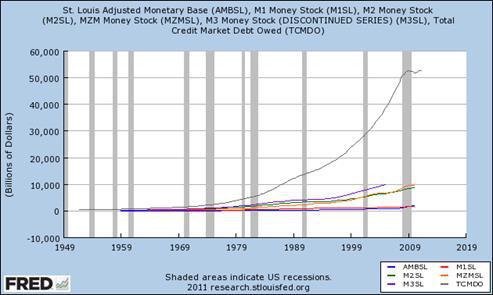

But instead of loaning the money, banks redeposited the excess reserves (AMBSL) with central banks; and the hoped-for increase in circulating money (M1, M2, M3, etc.) and credit and debt (TCMDO)—and growth in economic activity—never occurred.

..the increase in the monetary bases was not translated into growth in the money supply because banks have been reluctant to extend loans, choosing instead of accumulate reserves.

P 265, Quantitative Easing As A Highway to Hyperinflation, Imad A. Moosa, 2014

In the end, self-interest is a two-edged sword with no handle

TOMORROW: A HYPERINFLATIONARY TSUNAMI OR A RIPTIDE OF DEFLATION..OR BOTH

During the Great Depression, money appeared to ‘disappear’ because in capitalist economies, banknotes are derivatives of credit and debt masquerading as money; and in a severe deflationary collapse, debts default, credit is withdrawn and what appears to be money vanishes.

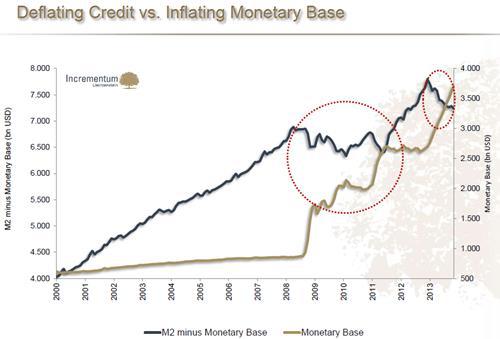

Today, central bankers are attempting to offset the growing global deflationary riptide by ‘inflation targeting’, i.e. using cheap credit and inflating the monetary base to artificially induce inflationary demand. So far, deflation is winning; but should inflation gain the upper hand, hyperinflation, not inflation, will result as the monetary base is now too large to limit any inflationary surge.

A deflationary collapse or hyperinflation may be an even-money bet

Capitalism’s survival is not

Fiat Paper Money: The History and Evolution of Our Currency by Ralph T. Foster (2010) tells the story of fiat paper money. In its one-thousand year history, no regime of paper money has every lasted. The fate of today’s fiat paper currencies, e.g. the US dollar, the euro, the yen, the yuan, the pound, etc. will be no different.

In my latest youtube video, It’s Not About Gold; But It’s All About Gold, Ralph T. Foster and I discuss Eric Maria Remarque’s book, The Black Obelisk, and the Weimer hyperinflation. Foster’s observation that the Weimer hyperinflation was intentional has particular relevance today, see below.

Germany intentionally hyperinflated its currency to pay its onerous war debts, i.e. reparations, after World War I with hyperinflated, i.e. worthless, paper money. Today’s desperately over-indebted nations might well do the same.

While the cost of hyperinflation is extremely high

In extreme cases, it appears reasonable

Buy gold, buy silver, have faith.

Darryl Robert Schoon