Prices and Charts

NZD Gold Making a Lower Low

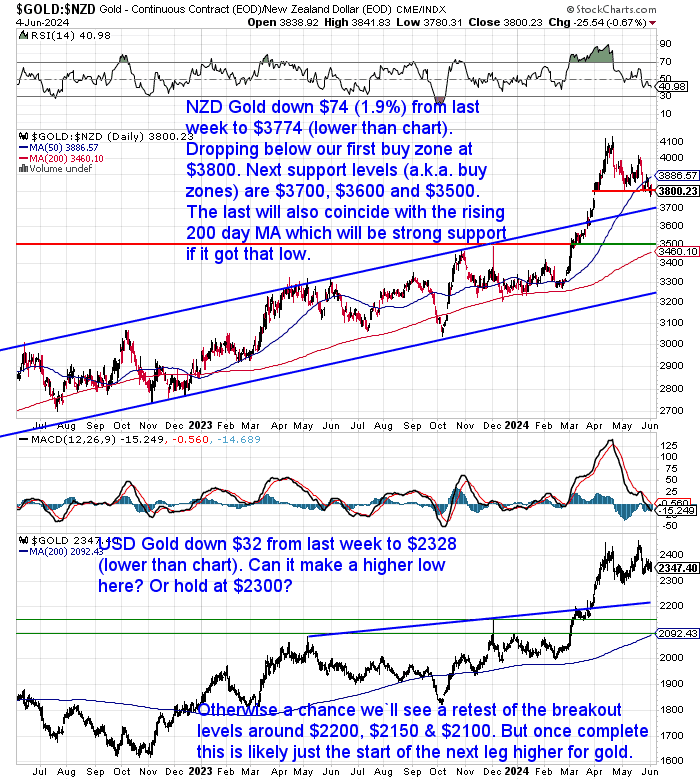

Gold in NZ dollars was down $74 or 1.9% from a week ago. At $3774 today it has fallen below our first buy zone of $3800. It’s now not far from the top line in the rising trend channel at $3700. The next support area below that would be $3600. While the strongest support zone is likely to be at $3500. As this is where the previous high is and also where the rising 200-day moving average could soon be.

Gold in US dollars is still above the recent low at $2300. If it can’t hold there then we could see a drop back to any of the breakout levels of $2200, $2150, or $2100.

Once this healthy pullback is over it will set the stage for the next leg up in gold.

Silver Plunges 8%

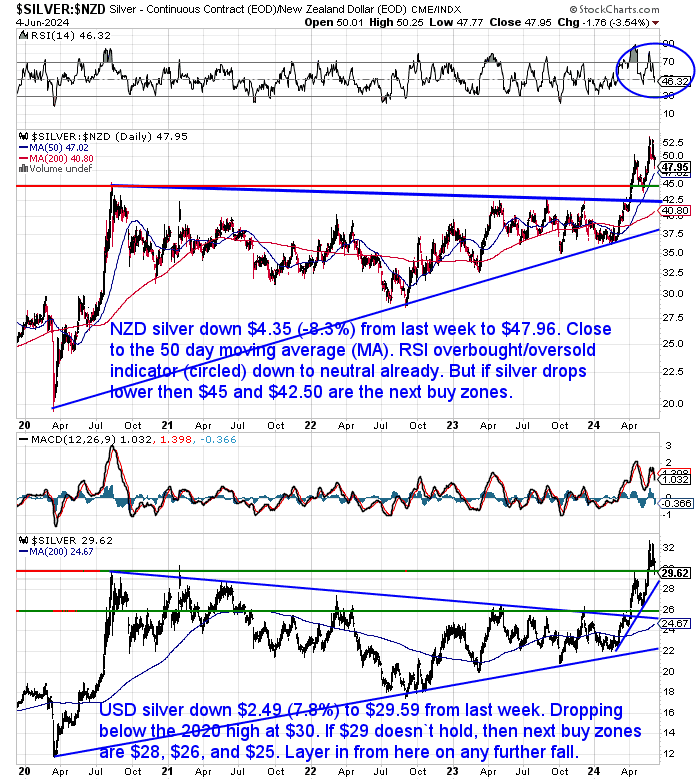

Silver in NZ dollars fell $4.35 (-8.3%) from last week to $47.96. The RSI overbought/oversold indicator has dropped down to neutral (50) already. So silver could well turn up off the 50 day moving average (MA), currently $47.02. If it doesn’t hold there then $45 and $42.50 are the next areas to watch for. $42.50 in particular should be very strong support as that will likely also coincide with the rising 200-day MA.

USD silver is looking similar. Falling almost 8% to $29.59, it is back below the $30 level. If $29 doesn’t hold – which is where both horizontal support and rising trendline coincide, then the next buying zones will be at $28, $26, and $25.

As we’ve been saying in our daily price alert email, layer in on these dips. As this is just a healthy pullback in what is potentially a much larger move to come for silver.

If you want to know more about how we see this silver breakout playing out then sign up for our Q&A call tomorrow. Where we’ll be analyzing this silver breakout and answering your questions.

NZ Dollar Strength Continues

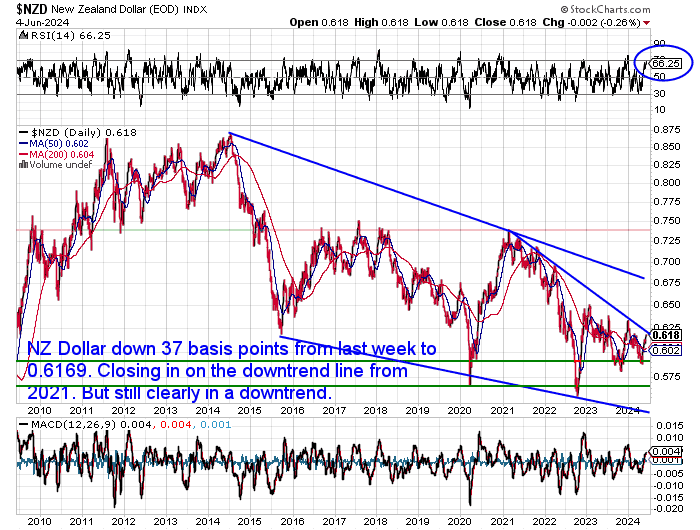

The New Zealand dollar was up 37 basis points from last week to 0.6169. It is getting very close to the downtrend line dating back to 2021. With the RSI (circled) also approaching overbought, it wouldn’t be a surprise to see it turn down from the downtrend line.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

KiwiSaver and Bank Bail-Ins: Are Your Retirement Savings at Risk?

KiwiSaver funds have become a cornerstone of retirement planning for many New Zealanders. Nearly two-thirds of the country’s population have a KiwiSaver account.

“Total KiwiSaver funds under management rose $4 billion, or 4.3%, to $93.7 billion in the March 2023 year.”

Source.

But what happens if the unthinkable occurs – a bank failure? This week’s feature article explores the concept of “bail-ins” and their potential impact on KiwiSaver funds.

In this article, you’ll discover:

- What a “bail-in” is and how it could affect depositors in a failing bank

- The current protections in place for KiwiSaver funds in the event of a bank failure

- Whether these safeguards are sufficient to ensure the complete security of your retirement savings

Feeling unsure about the potential risks to your KiwiSaver in a financial crisis? This article provides valuable insights to help you navigate these uncertainties and make informed decisions about your retirement security.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

The Commodity Bull Market Has Started – But Nobody Has Noticed

Last week we shared a chart from Tavi Costa that showed how few people own hard assets compared to shares.

Here’s a chart from Ronni Stoeferle that shows how commodities have outperformed stocks so far in 2024. You certainly wouldn’t know that from the financial media where all the talk remains Nvdia and AI…

#Commodities, the silent bull market that almost nobody cares about…

Source.

India Not Just Importing Silver – Also Repatriating Their Gold

In April we reported how India had record silver imports in February. Likely because the average consumer prefers the much cheaper silver over gold.

But now its central bank has chosen to repatriate 100 tonnes which is 32,000 ozs or around $6B in gold.

India’s central bank has moved around a 100 tonnes, or 1 lakh kilograms of gold from the United Kingdom back to its vaults in India, and intends to move more in coming months, a TOI report claimed on Friday.

Source.

This is a decent chunk of the RBI’s total gold reserves of 822.10 metric tonnes. They now hold about 50% within India. With more to come according to the above report. Why are they doing this now?

As an article from the Indian website Business Today points out:

“The freezing of Russian assets by Western nations has heightened concerns about the safety of assets held abroad. The RBI’s recent move to repatriate gold from the UK likely reflects these concerns.”

Source.

But India is not just repatriating gold, they are also purchasing more:

“The RBI has ramped up its gold purchases significantly. In just the first four months of 2024, the RBI bought one and a half times the gold it acquired in the entire previous year. This aggressive buying is partly due to a decline in confidence in dollar assets among central banks globally. Data from the US Treasury Department shows that non-US central banks’ holdings of US Treasury bonds have dropped from 49.8% in March 2023 to 47.1% in March 2024.

In FY24, the RBI added 27.47 tonnes of gold to its reserves, increasing the total from 794.63 tonnes the previous year. This move is part of a broader strategy to diversify foreign exchange reserves and hedge against inflation and currency volatility.”

So we continue to see central banks adding to their gold reserves. How are your non-debt money financial reserves looking?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|