This Week:

- Big Mac Index: NZ Dollar Overvalued

- Inflation Rates Edging Higher

- Trump and a New Gold-Backed Dollar

- Axis of Gold to Overthrow the US Dollar

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1651.98 | – $40.13 | – 2.37% |

| USD Gold | $1200.16 | – $4.79 | – 0.39% |

| NZD Silver | $23.41 | – $0.56 | – 2.33% |

| USD Silver | $17.01 | – $0.06 | – 0.35% |

| NZD/USD | 0.7265 | + 0.0144 | + 2.02% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1589 |

| Buying Back 1kg NZ Silver 999 Purity | $715 |

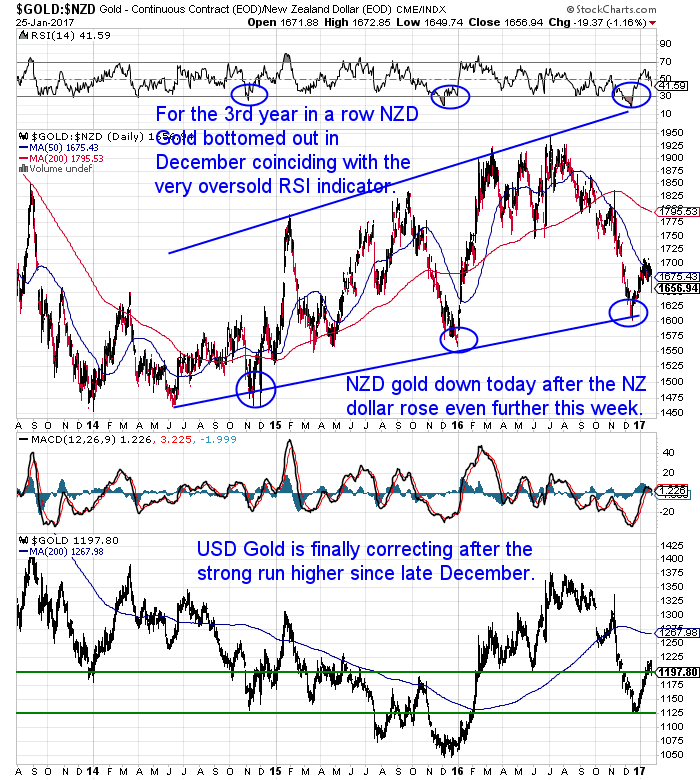

Gold in NZ Dollars has corrected sharply this week. Down over 2%. The majority of this fall was due to the strongly rising NZ dollar. But after such a sharp run higher for gold from before Christmas, a pull back was to be expected.

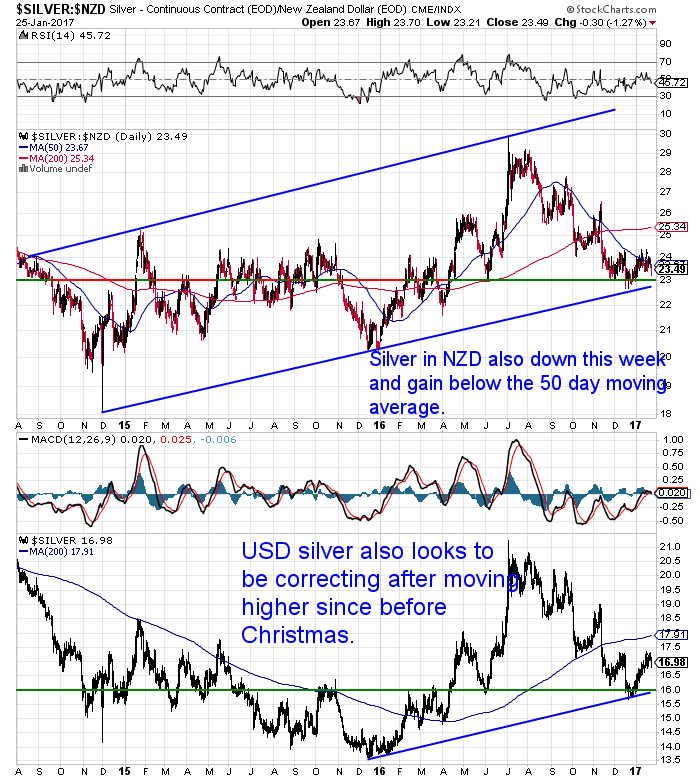

Silver in NZD is down almost the same percentage wise for the week. It is also back below the 50 day moving average.

As noted, the NZ dollar has had, to coin the phrase of the times, a “yuuge” week. Up over 2%. But it is now into overbought territory and still right up on the upper Bollinger band.

What happens from here?

Our guess we could see a reverse of the above trends. Namely, the kiwi dollar may now fall after a strong run higher and gold and silver in US dollars may also pull back a bit.

This is a “triple witching” week with gold options expiry, the Chinese on holiday, and a Federal Reserve FOMC meeting next week (see this video from our Facebook page. If you’re not following us on Facebook we post other gold and silver related news items on there daily. Check us out here). These are all factors that up the odds of lower gold and silver prices in the short term.

But the net effect for NZ dollar gold and silver holders and buyers may be that there is not too much of a further pull back, if we see the NZ Dollar also fall.

If you’re looking at buying there could be a good opportunity arising now. With both metals looking like having bottomed out but now pulling back a bit.

Big Mac Index: NZ Dollar Overvalued

The NZ central bank continues to try and talk down what they perceive as an overvalued NZ Dollar.

However the latest numbers out from the Economist magazine show just the opposite.

http://www.economist.com/

That is, the NZ Dollar that is undervalued by 17.3% in comparison to the US dollar.

This is measured by calculating the price of a Big Mac in the US versus here in NZ.

However the Economist also has an adjusted index which takes into account the differing costs of labour in certain countries. So the index is adjusted by the GDP per person for each country.

This measure results in an index where the NZ Dollar is only 1.8% undervalued against the US.

One of our predictions for 2017 was that the NZ dollar would rise against the US Dollar. So the Big Mac Index seems to back this up. Although perhaps this rise will be closer to the adjusted index than the raw index?

Inflation Rates Edging Higher

Inflation is starting to lift globally, but perhaps also here in New Zealand now too.

ASB Reports:

“The Q4 CPI rose more than expected in Q4, rising 0.4% qoq and 1.3% yoy, higher than we and the RBNZ had forecast. While non-tradable inflation was largely in line with expectations, tradable inflation was less of a drag on inflation than expected. Excluding fuel, tradable inflation fell only -0.1 qoq in Q4, the smallest drag since 2011. Underlying inflation pressures appear to have lifted, something which the RBNZ will be relieved to see.

…This result confirms that further OCR cuts are well off the table, barring some major development. But, with inflation only just within the target band for the first time in over two years and the high NZD a key downside risk, we expect the RBNZ to leave the OCR on hold for the foreseeable future. As a result, OCR hikes this year, as priced into wholesale interest rates, still seem premature.”

What if this rise continues and surprises people, who expect low inflation and low interest rates for the foreseeable future, as ASB seem to?

Rising interest rates are probably the biggest threat to the average New Zealander as this recent article outlines:

Kiwis could lose homes if rates rise

“Some Kiwis could face losing their homes if interest rates rise but we are not as far under water as our Australian neighbours.

Australian research has found one in five Aussies are walking such a fine line on their mortgage they could lose their home if mortgage rates were to rise by just 0.5 percentage points.

Christina Leung, a senior economist at NZIER said New Zealand households were not as leveraged as Australia’s but there was still “a large degree of risk there”.

Leung said Australia’s household debt to disposable income was around 200 per cent while New Zealand’s level was 160 per cent.

But New Zealand’s level was still higher than prior to the global financial crisis, which meant households were vulnerable to any change in circumstances.

That could come from a change in the labour market or pressure from mortgage rates which have already begun to rise.”

Sticking to the topic of inflation, we have an article on the website this week looking ahead at what inflation may do. Including how Trump’s policies may have an impact, and what other investments could be affected by a surprise rise in inflation rates.

Not Even Trump Can Clean Up This Mess

Gold & Silver in NZ Dollars: 2016 in Review & Our Guess For 2017

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?  For just $290 you can have 4 weeks emergency food supply.

For just $290 you can have 4 weeks emergency food supply.

—–

With the presidential inauguration this week we’ve got a bit of a Trump theme going on.

Firstly a look at why a Trump presidency has heightened the chances of the end current US petrodollar monetary system.

Plus see what the two most likely options are to replace the US dollar at the centre of the new system.

Trump and a New Gold-Backed Dollar

Then we have a slightly different take on Trump from Mexican Hugo Salinas Price. He explains why Trump is completely wrong in his conclusions about America and foreign trade. And the impacts his trade policies will have across the globe.

Salinas Price believes Trump will unwittingly bring about the end of the US Dollar’s role as global reserve currency. But interestingly his conclusions about the result of this share the same two possibilities as the above article.

Trump’s Ignorance

Then next check out another article from Salinas Price. Here’s an excerpt from that one:

“Everybody loves a big-spender. The man who spends lavishly is listened to with respect and his every word is marked. He is the center of attention of a great coterie; all try to please him. But when his money runs out, he finds himself out in the cold; his friends no longer show up, nobody cares any longer about what he likes or dislikes. He embarrasses his former friends.

By rejecting the world’s products – except for oil, of course – Mr. Trump is alienating the friends of the US. Trade promotes friendship and interest in the welfare of your trading partner. No trade produces mutual indifference.

By cutting down on foreign goods entering into the US, the US will lose influence around the world. Why listen to the US, when it turns its back on your products, on what you have to offer? The rest of the world will now go its own way, indifferent to US interest and to the negligible value of its superficial culture.

The operative word is: FORFEIT.

US protectionism means that the US forfeits its leadership in the world and forfeits its right to issue the world’s money.”

The Further Decline in International Reserves

Axis of Gold to Overthrow the US Dollar

Jim Rickards also recently commented on the “overthrow of the US dollar as the benchmark global reserve currency”. He said US Treasuries are being dumped, and gold is being acquired by the largest investors in the world:

When will this buying panic erupt? What signs can we look to for guidance?

The most important input is the gradual dumping of US Treasury debt by foreign creditors of the US. These market participants are highly sophisticated. They know they cannot dump all of their US debt at one time without causing a panic and hurting their own positions.

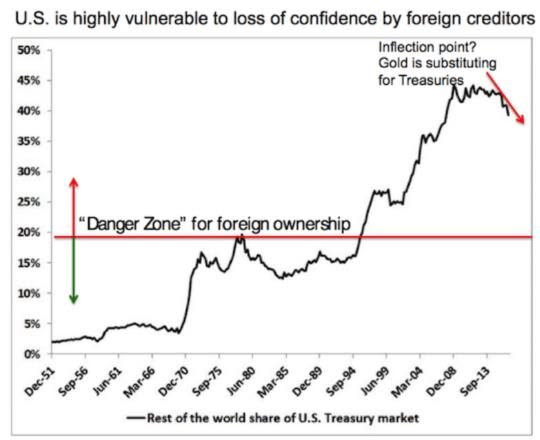

If any dumping was viewed as malicious or hostile, the president could freeze the accounts of market participants using his powers under the International Emergency Economic Powers Act of 1977. Based on this, one would expect sales of Treasuries to be gradual, and to play out over time. That’s exactly what we’ve been seeing since 2013, as shown in this graph:

This graph is revealing not only because of the gradual reduction of US Treasury holdings by foreigners, but also because of the extremely high level of such holdings. Some countries, such as Japan, are highly indebted, but the debt is held primarily by their own citizens who have no interest in attacking their own government.

That’s not true for the US. We are extremely vulnerable to foreign attack because of the high percentage of foreign ownership — almost 40% of the market.

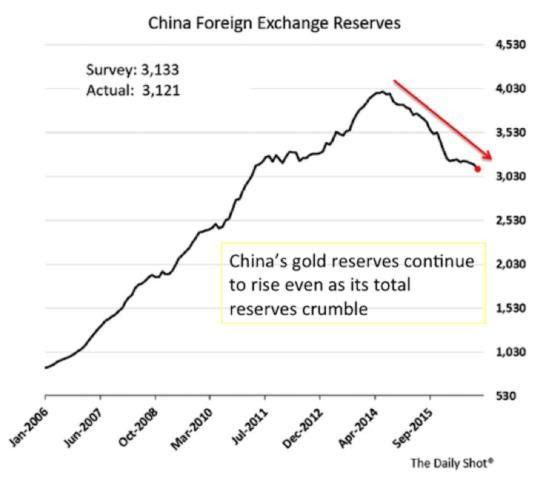

The second major indicator is the run-off in China’s reserve position. China’s reserves have collapsed from over $4 trillion to about $3 trillion in the past 30 months. This decline shows no signs of stopping; in fact it has accelerated lately to the point that China is now imposing capital controls.

What is revealing about this is that, while total reserves have been collapsing, gold reserves have been going up. China has been buying thousands of tons of gold even as they sell US Treasury bonds to pay offshore creditors and prop-up their currency.

Indicators all point in the same direction — Treasuries are being dumped, and gold is being acquired by the largest investors in the world. This is being done not as a ‘day trade’, but as a strategic geopolitical move. This means these trends will continue until the aims of the ‘Axis of Gold’ have been achieved. Those aims include the overthrow of the US dollar as the benchmark global reserve currency. When that happens, collapsing confidence in the dollar will send the dollar price of gold skyrocketing. But you do not have to wait until the final collapse of confidence in the dollar to benefit. Momentum will accelerate long before the endgame, giving early investors ample opportunity to profit from the trend.”

This current pull back after the recent rise in gold and silver looks like a good time to take a position in either metal. Silver in particular remains significantly undervalued not just in dollar terms but also against gold.

If you’d like a quote please get in touch.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

This Weeks Articles:

The Further Decline in International ReservesWed, 25 Jan 2017 12:59 PM NZST  We first featured this concept of Hugo Salinas Price’s declining international reserves back in 2013. Check that link for a more in depth explanation. This article follows on from Salinas Price’s previous article we posted earlier this week “Trump’s Ignorance” which outlines the problems that Trump’s trade policies are likely to cause not just in […] We first featured this concept of Hugo Salinas Price’s declining international reserves back in 2013. Check that link for a more in depth explanation. This article follows on from Salinas Price’s previous article we posted earlier this week “Trump’s Ignorance” which outlines the problems that Trump’s trade policies are likely to cause not just in […]

|

Not Even Trump Can Clean Up This MessWed, 25 Jan 2017 11:25 AM NZST  Here in New Zealand the government inflation rate has just ticked up ever so slightly lately. This has been happening in many places across the globe. Can we expect more of it and what might the impact be? Read on to see… Not Even Trump Can Clean Up This Mess By Justin Spittler Higher prices […] Here in New Zealand the government inflation rate has just ticked up ever so slightly lately. This has been happening in many places across the globe. Can we expect more of it and what might the impact be? Read on to see… Not Even Trump Can Clean Up This Mess By Justin Spittler Higher prices […]

|

Trump’s IgnoranceTue, 24 Jan 2017 5:14 PM NZST  This is a slightly different take on Trump and the end of the current monetary system. Unlike in the article we posted earlier, our favourite billionaire – Hugo Salinas Price – believes Trump will unwittingly bring about the end of the US Dollar’s role as global reserve currency. But nonetheless his conclusions about the result are […] This is a slightly different take on Trump and the end of the current monetary system. Unlike in the article we posted earlier, our favourite billionaire – Hugo Salinas Price – believes Trump will unwittingly bring about the end of the US Dollar’s role as global reserve currency. But nonetheless his conclusions about the result are […]

|

Trump and a New Gold-Backed DollarTue, 24 Jan 2017 2:33 PM NZST  See why a Trump presidency has heightened the chances of the end current US petrodollar monetary system. Plus discover what the two most likely options are to replace the US dollar at the centre of the new system are… Trump and a New Gold-Backed Dollar By Nick Giambruno On August 15, 1971, President Nixon killed the […] See why a Trump presidency has heightened the chances of the end current US petrodollar monetary system. Plus discover what the two most likely options are to replace the US dollar at the centre of the new system are… Trump and a New Gold-Backed Dollar By Nick Giambruno On August 15, 1971, President Nixon killed the […]

|

War on Cash Expands into Greece – May Hit NZ and Canada NextThu, 19 Jan 2017 3:47 PM NZST  This Week: Gold & Silver in NZ Dollars: 2016 in Review Our Guesses For 2017 War on Cash Expands into Greece – May Hit NZ and Canada Next 2017: What to expect in the first 3 months Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1692.11 – […] This Week: Gold & Silver in NZ Dollars: 2016 in Review Our Guesses For 2017 War on Cash Expands into Greece – May Hit NZ and Canada Next 2017: What to expect in the first 3 months Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1692.11 – […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2017 Gold Survival Guide. All Rights Reserved. |