This Week:

- How to Make Sure the Government Can’t Freeze Your Bank Account

- Should Financial Literacy Lessons be Compulsory in NZ Schools?

- Is NZ a “ticking time bomb” according to Antifragile author Nassim Nicholas Taleb?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

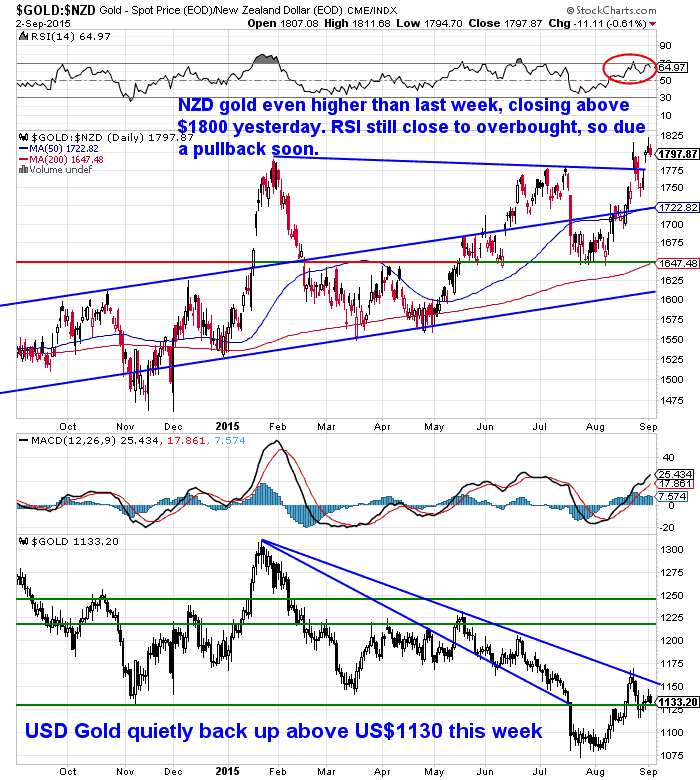

| NZD Gold | $1790.37 | + $9.00 | + 0.79% |

| USD Gold | $1134.20 | + $39.63 | + 2.26% |

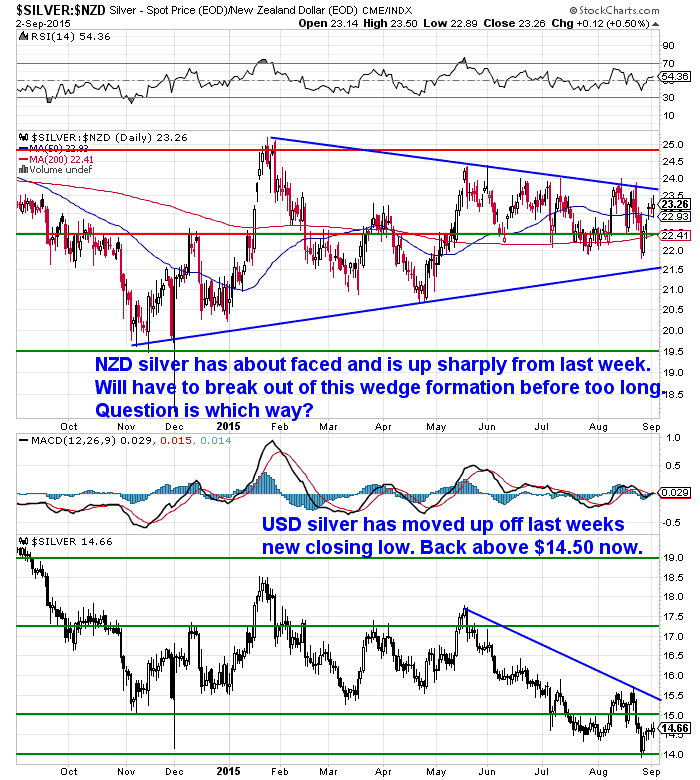

| NZD Silver | $23.26 | + $1.20 | + 5.43% |

| USD Silver | $14.73 | + $0.55 | + 3.87% |

| NZD/USD | 0.6335 | – 0.0092 | – 1.43% |

Silver was the big mover this week, up 5.43% after falling the previous week. Also of significance was the NZ Dollar falling yet again. More on that soon.

You can see that sharp rise in the NZD Silver chart below. Also clear is that silver remains in the confines of the wedge like trading range that is getting narrower and narrower. This range can only narrow for so long before it will have to break above or below either of the blue trend lines.

The only question then is which way?

The trend for the past 10 months has been up. So if the trend is our friend, then maybe we will see a break up, particularly while the Kiwi dollar remains so weak.

Looking at the NZD gold chart, there is no doubt about what the trend is here. Clearly up for the past year. Up over 15% for the calendar year to date. Of significance is a close above NZ$1800 yesterday and a new high for the year, beating that of February.

However the NZ Gold rally might be getting a little long in the tooth now, so a pull back from close to overbought levels would not be a surprise.

If you’re looking at buying, then zones to watch for could be $1725 and $1650. But of course no guarantees, especially with the weakness of the NZ dollar we could push on higher yet.

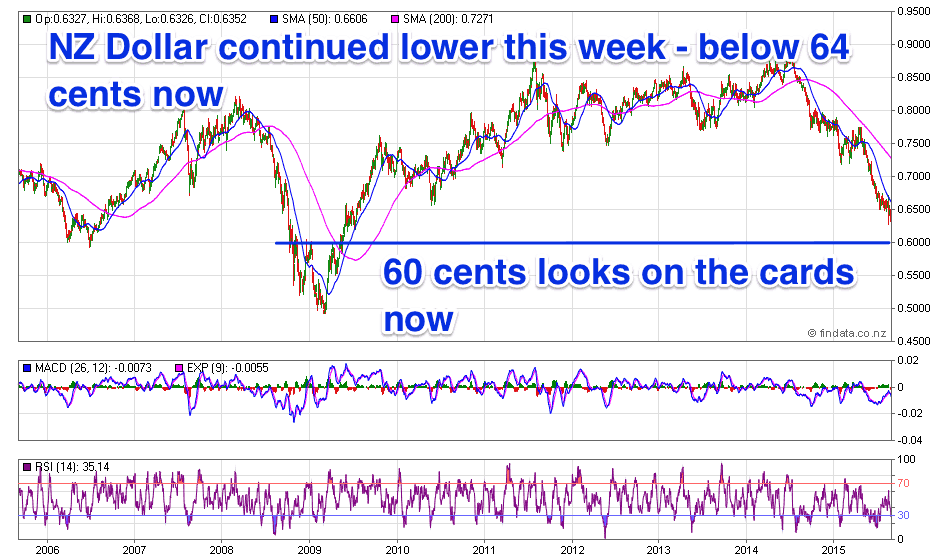

As noted already, the NZ Dollar has continued its fall this week. The brief intraday plunge below 64 cents last week has been revisited and we find the dollar at 0.6335 today – down 1.43% from a week ago.

So the weakness continues. At some point the US dollar strength will end but it doesn’t seem to be just yet. Even the fact that a rate rise in the US in September or even this year appears unlikely hasn’t been enough to reverse the trend.

Given the support zone at 65 cents has been so clearly broken 60 cents now looks decidedly on the cards.

Why Stocks Could Fall 50% if the Fed Makes the Wrong Move

In last weeks newsletter we shared part of the latest client letter from hedge fund manager Ray Dalio. It gave his opinion on what the US federal reserve should do when it comes to interest rates in the short term.

In last weeks newsletter we shared part of the latest client letter from hedge fund manager Ray Dalio. It gave his opinion on what the US federal reserve should do when it comes to interest rates in the short term.

Casey Research have just made a comment on the subject too so we thought it worth sharing their viewpoint on what is a very bold call from a very successful investor…

Why Stocks Could Fall 50% if the Fed Makes the Wrong Move

How to Make Sure the Government Can’t Freeze Your Bank Account

The following article refers to the US banking system, but the same issues exist here in New Zealand. In fact unlike the USA, New Zealand has no bank deposit guarantee whatsoever.

The following article refers to the US banking system, but the same issues exist here in New Zealand. In fact unlike the USA, New Zealand has no bank deposit guarantee whatsoever.

Once you’ve read this you might want to check out the previous articles of ours listed below (We’ve been writing about this since 2011). They outline the system the Reserve Bank of New Zealand has put in place should a bank failure occur here. Note: Odds are it would mean a “haircut” on your deposits.

How to Make Sure the Government Can’t Freeze Your Bank Account

More reading on bank failures and what would happen in NZ:

Bank Failures | Could they happen in NZ? | The Reserve Bank thinks so

What’s Wrong With the RBNZ’s Bank Failure Plans?

Bank Failures: Will New Zealand be Cyprussed?

Has New Zealand Been a “Test Case” for Depositor Haircut Scheme?

If you prefer to watch than read, then check out our video outlining the scheme here.

RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply. [Note Out of stock currently but you can preorder to ensure your order is filled in the next shipment]

Learn More.

—–

Should Financial Literacy Lessons be Compulsory in NZ Schools?

Have you noticed a few news items on the radio and in the papers discussing whether financial literacy lessons should be compulsory in NZ schools?

Here’s a couple we’ve read…

Kiwis overwhelmingly call for compulsory financial literacy in schools

Money-savvy children want financial literacy lessons in school

At first glance you might think “sure great idea” but if you mull it over a little more closely it’s not just a black and white answer for this one.

Some schools do include financial literacy in their curriculum – it is voluntary. Back in our day we recall it was limited to a visit from someone at the local bank with a Cashin the elephant money box encouraging you to start a bank account!

We think as parents ourselves, the most important question to ask is not “should they learn financial literacy?” but “what specifically do you want your kids to learn?”

Left to the state the curriculum would no doubt be about savings, bank accounts, Kiwisaver and maybe something about debt, more likely encouraging it given the partnership between banks and governments!

Some topics we think important to educate our kids on would include:

- The difference between good debt and bad debt.

- Profits, losses and balance sheets.

- The monetary system, how it works and who it favours

- Different investment asset classes and when they work best

But we doubt these will see the light of day in a school curriculum. The school system has been bought and paid for for over a century.

More likely is that we will have to make the effort to educate our kids ourselves when it comes to finances. Robert Kiyosaki has put together some good resources for this from what we have seen, so check that out if you have school age kids or grandkids yourself.

Although that said the methods of learning in the school system here in NZ has certainly changed dramatically in the past years at primary school level anyway, so perhaps there is hope yet that more free thinking individuals are being raised than ever before?

Is NZ a “ticking time bomb” according to Antifragile author Nassim Nicholas Taleb?

Have you read “Antifragile: Things That Gain From Disorder” by Nassim Nicholas Taleb? Or perhaps his more famous book “The Black Swan”?

Earlier this year Taleb co-wrote an essay called ‘The Calm Before the Storm, Why Volatility Signals Stability and Vice-Versa’.

Greg Canavan in the Daily Reckoning Australia did a good job of using Taleb’s methodology from this essay to look at how “fragile” Australia is to a potential economic shock this week.

We’ll reprint part of what Canavan wrote below and then try and also apply the same process to New Zealand at the end. It’s an interesting exercise in somewhat counter intuitive thinking. Over to Greg…

As Taleb writes in the Foreign Affairs essay:

‘Although one cannot predict what events will befall a country, one can predict how events will affect a country. Some political systems can sustain an extraordinary amount of stress, while others fall apart at the onset of the slightest trouble. The good news is that it’s possible to tell which are which by relying on the theory of fragility.

‘Simply put, fragility is aversion to disorder. Things that are fragile do not like variability, volatility, stress, chaos, and random events, which cause them to either gain little or suffer. A teacup, for example, will not benefit from any form of shock. It wants peace and predictability, something that is not possible in the long run, which is why time is an enemy to the fragile.’

Back to Taleb:

Australian households have excessive debt and leverage, which adds to the fragility of a narrow economy. The resources boom sustained the debt boom, but it cannot continue to do so now.

Australia also has little political variability. If we boot one bunch of clowns out a new circus just rolls into town. We get the same economic policies, adjusted slightly for political ideologies.

The economic policy of both parties is this: pander to the rent seekers and special interest groups, avoid meaningful reform because it’s too hard and too risky, and hope low interest rates do the job. In short, fragile.

On the last point, we get a pass. Australia has now enjoyed 24 years of uninterrupted economic group. We have survived past shocks. That’s largely because we’ve had the capacity to deal with them.

But now, as time rolls on, we’re running out of ammo. Interest rates are at historic lows, household debt at historic highs, and we don’t have much room to move on fiscal policy.

The conclusion I come to is that Australia is fragile to the next shock. What I don’t know is whether that shock is now underway. This could be the end of Australia as we know it. “

So Australia doesn’t come out looking too rosy according to Canavan’s assessment.

So how does New Zealand fare when using Taleb’s 5 point fragility criteria?

Lets look at each one in turn:

- A centralized governing system. Unlike Australia we definitely have a centralised governing system. You could argue that New Zealand is small enough so that this doesn’t matter. But we nonetheless have a central government that we vote for and who makes the decisions that affect us.

- An undiversified economy. We’d say we fit into this category too. While we rely on primarily agriculture, so perhaps we may be less affected than Australia as people still have to eat. However the impact of the plunging dairy prices on the “rock star” economy has been plain to see in recent months. We too rely on rising house prices to grow the services sector of our economy just like Australia.

- Excessive debt and leverage. While our government debt may be lower than Australia (although it continues to grow and our bet is it will grow more in the future), our private household debt remains right up there on a global scale.

- A lack of political variability. Without getting all political on you we don’t think there is too much difference between the left and the right in NZ politics. Voting for one or the other is unlikely to have a dramatic impact. Neither side is likely to make large cuts to the government budget overall. We’d say that stacks up as fragile too.

- No history of surviving past shocks. Like our Aussie cuzzies we get a pass mark here too. As NZ did weather the 2008 shock comparatively well.

However overall like Australia we have record low interest rates, and household debt also at historic highs. We do have room to lower interest rates further though as Mr English has reminded us recently.

“A harder landing for China is possible and it would affect our growth prospects if it occurred, but we’re yet to see whether it happens,” he said.

“If the outlook changes significantly then we’ve got room to make changes and more room than most other economies,” he said, pointing to the OCR being at 3% while other economies such as Canada had official rates closer to 0%.

“And because the Government books are in reasonable order we have the opportunity there to take a more relaxed view of Government spending if the economy really turned down, but fluctuations in financial markets isn’t enough to warrant changing the current strategy, but a hard landing in China might be.”

Source.

So the odds are the government will launch some sort of spending initiative if things slow down considerably as that is the governmental standard operating procedure globally as we have seen in recent years.

Yes our government books are in better shape than Australia’s, so perhaps we can weather the next downturn better than them.

However overall on the 5 principal sources of fragility New Zealand still doesn’t come out looking exactly pristine.

The NZ bank economist reports we read vary somewhat but overall they still don’t predict too much of a slowdown globally and that NZ won’t slip into a recession. We reckon they are underestimating what is to come.

If you want some insurance against “fragility” then the “antifragile” monetary metals might be just what you need.

You know where you can find some. As always let us know if you have any questions.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,860 and delivery is now about 7-10 business days.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Unsubscribe | Report Abuse PO Box 74437 Greenlane Auckland 1546 New Zealand

|

Pingback: Biggest Risk to Auckland and Wellington is a Market Crash - Gold Survival Guide