This Week:

- Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine?

- Why Silver May Not Be Completely “Off the Radar” For Much Longer

- Silver: Black Swan, 2018 and Beyond

Prices and Charts

Weaker NZ Dollar Bumps Local Gold and Silver Prices

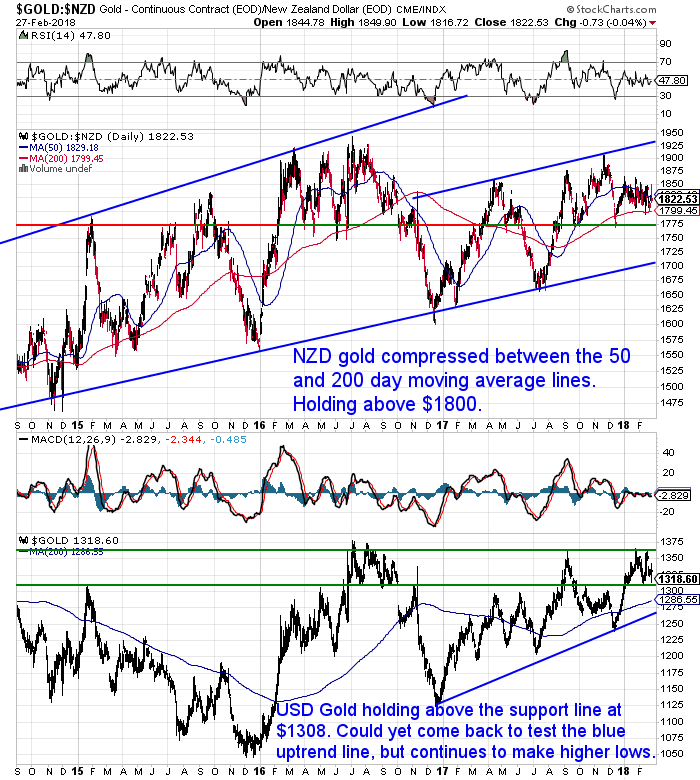

Gold in NZ Dollars was up three quarters of a percent this week. Solely driven by a weaker NZ dollar. The chart below shows NZD gold getting very compressed between the 50 and 200 day moving average (MA) lines. So far it has held above the 200 day MA at $1800. So could be building for a move higher.

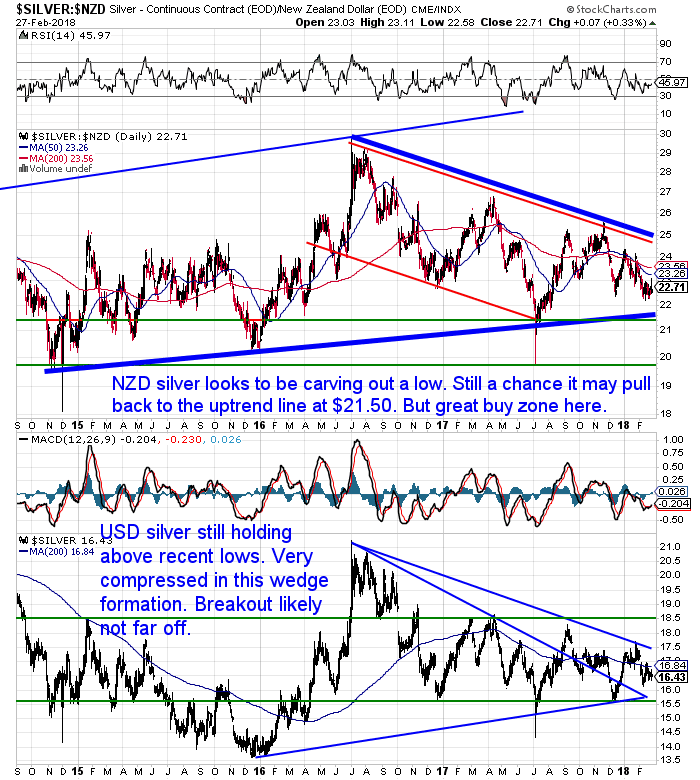

Meanwhile silver has been bumping along just above the $22 mark. Up 1.34%, it has for a change outperformed gold this week.

There remains a chance silver could yet test the thick blue uptrend line at $21.50. However that is not far off so anywhere around these levels is likely to be an excellent buying zone long term.

More on silver in this weeks articles below.

As noted above, the weaker Kiwi Dollar this week has been the sole driver of the higher local gold and silver prices. The Kiwi is sitting on the 50 day MA. It may yet head down to the 200 day MA just below 0.72. Possibly we will see it trade between 0.74 and 0.72ish for a spell now after such a strong rise.

Unsure About Any Terms We Use When Discussing the Charts?

Remember to check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine?

Our feature article is in response to a follow on question from a recent post: What is the Best Type of Gold to Buy For Trading in a Currency Collapse?

“Considering the variety of things that might become tradable in the event of a breakdown of society, I wonder what might be the advantage of gold or silver coins over other tradable items such as tools, water or bottles of wine (for example), since the average person could not be expected to have all the technology required to authenticate the purity of materials claimed to be silver or gold but might easily recognise basic tools, clean water or wine?”

It covers:

- What you should buy before you buy gold or silver?

- What is the advantage of gold and silver over tradable everyday necessities?

- How would purity of gold and silver coins be authenticated in a societal breakdown?

- When exactly are gold and silver most important and useful?

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Gold Silver Ratio Peak: Contrarian Indicator – Hedge Funds Betting Against Silver

The gold/silver ratio remains stretched above 80. Meaning gold is about as expensive (compared to silver) as it has been at almost any time over the last 25 years.

Adrian Ash pointed out this week that the hedge funds in the silver futures market are effectively betting that the gold/silver ratio will rise even further yet.

“But what if silver suddenly does catch a bid as part of 2018’s growing call for a commodity boom? Might that make the current price look like a bargain as the Gold/Silver Ratio falls?

Calling a top in gold’s price relative to silver doesn’t necessarily mean that silver will go up.

But fact is, that is how things have panned out…on a monthly basis at least…some 79% of the time since 1968.

When the Gold/Silver Ratio falls, silver prices have tended to rise.

No guarantees and no promises, of course. And the hot-money hedge funds are taking very much the opposite bet.”

Talk of silver futures dovetails nicely into another article we posted this week. It also looks at the silver futures commitment of traders report and a couple of other indicators showing silver is perhaps poised to catch a bid soon:

Also then check out…

As we’ve been saying silver remains largely ignored.

But Gary Christenson shows how the previous runs higher by silver could easily push it up to new all time highs within 2-3 years. Even more if one of a number of black swans were to occur.

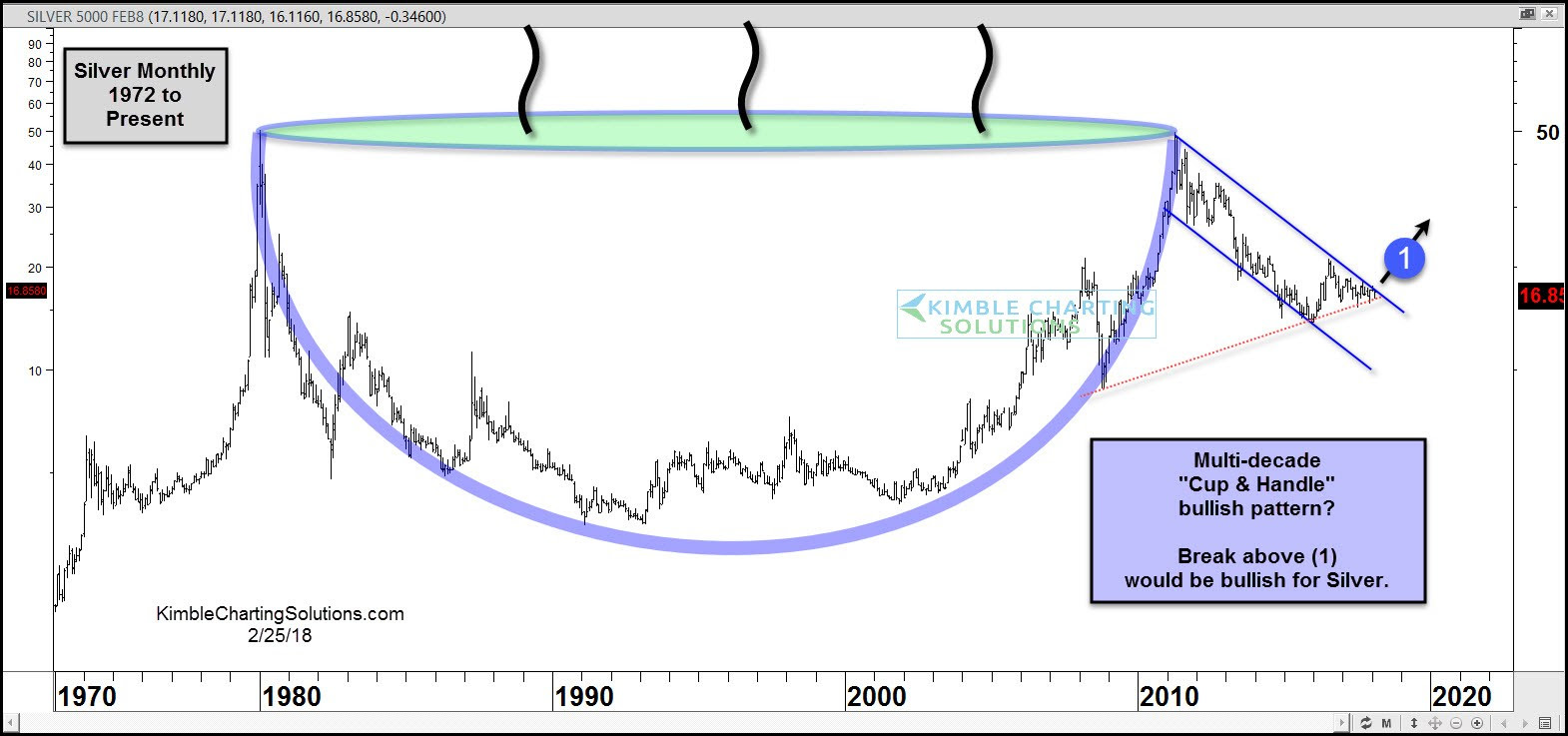

Finally for all your technical analysts out there, check out this impressive almost 4 decade “cup and handle” pattern.

Once silver breaks above 1 this would be very bullish. As this would indicate silver is heading back towards the all time highs of $50.

Source.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Why You Might Not Want to Own “Blockchained” Gold and Silver

We saw this week that “Andy Schectman of Miles Franklin Institute is partnering with Sprott Asset Management on a physical gold backed, distributed ledger with bullion held at the Royal Canadian Mint.

Many pre-mined cryptos have early deep-pocket investors tend to own 80% or more of the tokens outstanding, diminishing the much touted decentralization aspects.

The Sprott / Franklin gold blockchain is equally distributed, albeit somewhat centralized. Due to government backing, investors gain greater flexibility to use funds as collateral for loans.

The current release date is expected within the next five weeks.”

Source.

There are others currently working on similar blockchained gold offerings like the Royal Mint in the UK and also the Perth Mint.

But at the moment we’d have to agree with this quote from Sean Walsh, founder of crypto-asset investment firm Redwood City Ventures.

In response to questions about the newly announced, but very vague, “Petro Gold” from Venezuela he said:

“…it was difficult to reach conclusions about the petro gold without seeing specific details. But he said he had little interest in tokens backed by physical assets.”

“Rather than buying a cryptocurrency backed by gold, I’d just go buy the gold,” said Walsh in a telephone interview. “Gold is a physical thing that you want to be able to hold in your hands, because that’s the point.”

Source. Venezuela aims for crypto alchemy with new ‘petro gold’ token

For now we’d agree. While the world is going through such massive monetary changes we’d prefer to know exactly where our gold and silver was and be able to access it when we want.

After we come out the other side this might well change.

Silver remains on our “best buy” list. If you don’t have any in your possession yet, get in touch to discuss your options:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|