Special Today

1oz NZ Mint Gold Kiwi coins at spot plus 2.75%

Minimum purchase 10 coins

Delivered and fully insured for $17,625.25

Reply to this email or phone David on 0800 888 465

This Week:

- World’s Largest Hedge Fund Manager Predicts Bleak Future for Markets

- Deflation and Gold: A Contrarian View

- Will the Banker War on Cash Spread to Bitcoin?

- New Zealand’s ‘Trump”

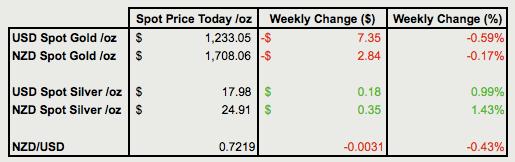

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1643 |

| Buying Back 1kg NZ Silver 999 Purity | $762 |

Silver Sharply Outperforming Gold This Week

Gold in NZ Dollars is down ever so slightly from last week. But it does look like the start of a further correction after a strong second leg higher for 2017. So keep an eye out for a pullback to around the 50 day moving average mark of $1670. Silver sharply outperformed gold since last Thursday. Shooting up just under 1.5%. But now it too looks to be pulling back after touching the 200 day moving average (MA).

Silver sharply outperformed gold since last Thursday. Shooting up just under 1.5%. But now it too looks to be pulling back after touching the 200 day moving average (MA). The Kiwi dollar bounced sharply higher this morning from just above the 50 and 200 day MA’s. It remains down on last week, but looks to have room to run higher again now.

The Kiwi dollar bounced sharply higher this morning from just above the 50 and 200 day MA’s. It remains down on last week, but looks to have room to run higher again now. This will likely help to nudge local gold and silver prices down over the short term.We got a mention from John Kim in an article he posted this week as we’d let him know about the article we saw here in New Zealand last year proposing removing the $100 note:“In concluding, just a quick word on gold and silver and the global banking war on cash. As promised, I will continue to update you with information provided to us by our readers. One of our readers in New Zealand sent us this article about bankers’ plans to ban the $100 note here, which we wanted to pass on to you, with much thanks to him. As well, he has mentioned that he has sagely warned his readers to stockpile smaller notes like $20 notes in anticipation of this banker executed war on cash, so for more information on the state of banking affairs in New Zealand, please visit his website here.”His full article is worth a read so we posted that onto the site too:Will the Banker War on Cash Spread to Bitcoin?

This will likely help to nudge local gold and silver prices down over the short term.We got a mention from John Kim in an article he posted this week as we’d let him know about the article we saw here in New Zealand last year proposing removing the $100 note:“In concluding, just a quick word on gold and silver and the global banking war on cash. As promised, I will continue to update you with information provided to us by our readers. One of our readers in New Zealand sent us this article about bankers’ plans to ban the $100 note here, which we wanted to pass on to you, with much thanks to him. As well, he has mentioned that he has sagely warned his readers to stockpile smaller notes like $20 notes in anticipation of this banker executed war on cash, so for more information on the state of banking affairs in New Zealand, please visit his website here.”His full article is worth a read so we posted that onto the site too:Will the Banker War on Cash Spread to Bitcoin?

Confirmation Inflation Has Surprised to the Upside in NZLast week we reported how inflation expectations have moved higher in New Zealand.Confirmation came this week that inflation has actually surprised to the upside. ASB reports:“Looking back over 2016, low inflation and falling inflation expectations saw the RBNZ cut the OCR three times. At the same time the RBNZ maintained a distinct easing bias, reflecting the fact that the risks to inflation remained firmly to the downside. Oh how quickly things can change. Indeed, within a short period of time, the inflation outlook in New Zealand has shifted rather significantly. Q4 CPI, which was released on the 26th of January, showed that annual inflation had increased to 1.3% from 0.4% in Q3. This is the first time inflation had been back within the RBNZ’s 1-3% target band for the first time in over two years.”But like we said last week, could there be a real surprise a bit further down the track with much bigger rises in inflation and accompanying interest rate increases?A surprise is also what just happened with the US Consumer Price Index. It had its biggest jump in 4 years. This puts the US CPI well above the 2% “ideal” level the Fed aims for. So could this be the start of global inflation heading higher?Confirmation: Gold ETF’s Are What Moves the PriceThe latest update from the World Gold Council (WGC) backs up what we reported last week. Namely that it is the large buying of the ETF’s and wholesale purchasers that move the gold price. Not demand from private buyers.This is shown by the fact that the gold price has risen in January while the holdings of ETF’s and similar products went up 1% to 2,157.2t.This was the summary from the latest WGC report:“Gold-backed ETFs and similar products regained ground in January, holdings up 1% to 2,157.2t

- At the end of January, total holdings in gold-backed ETFs and similar products stood at 2,157.2t (69.4 moz), up 14.9t from December. In value terms, total holdings stood at US$84.1bn, 7% higher from a month earlier.

- Gains in European holdings more than offset the decline in North America. Their respective holdings were 881.2t (+4%) and 1,163.5t (-2%) by the end of December.

- In North America, performance of the world’s two largest gold ETFs diverged: SPDR Gold Shares was 3% lower to 799.1t while holdings of iShares Gold Trust inched up 2% to 200.1t.

- In Europe, Germany’s Xetra-Gold saw the largest gain for the month with holdings up 17% to 138.1t. ZKB Gold ETF(Switzerland) remained the region’s top fund: its holding came at 146.3t by the end of December, marginally above ETFS Physical Gold (UK).

- In Asia, China’s Huaan Yifu Gold ETF remains firmly seated at the top. After a temporary loss of momentum in December, it gained 2.6t (+11%) in the past month to 26.7t.”

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare? For just $290 you can have 4 weeks emergency food supply.

For just $290 you can have 4 weeks emergency food supply.

—–

New Zealand’s ‘Trump”You’ve no doubt seen many of the articles in the mainstream comparing Trump to Hitler or Mussolini. But here’s a Bloomberg article our favourite newsletter writer Chris Weber sent our way. It makes a good case why Trump has very much in common with NZ’s own Robert “Piggy” Muldoon.Feisty, Protectionist Populism? New Zealand Tried ThatRecall that Muldoon’s easy money leanings saw inflation hit 15% in New Zealand under his leadership. Perhaps the numbers from the USA mentioned earlier are the start of what could come under Trump?With Trump being a real estate man, it’s not hard to envisage him enacting many property friendly policies. Inflation may well also be a product of his policies.It’s also interesting to consider what happened after Muldoon left office. As Chris Weber noted:“After Muldoon was defeated, the opposition Labour party took over, but instituted free-market solutions that put an end to New Zealand’s long experience with welfare-state economics. Though Muldoon was a Conservative, he took the welfare state as far as it could go in NZ, and those policies were seen as a failure by the time he left office. It took the nominally left-wing Labour party to install the free market reforms. I’m not sure at all that the Democrat party in the US would do the same the next time it comes into office, but that’s a long way off. And in politics the most surprising things have a habit of coming true. We still must see how interventionist Trump will be, and what the effects of his policies will be. But it is interesting to compare him to New Zealand’s Muldoon.”Yes indeed it is very hard to imagine the US Democratic party going all “free market” on us. But then again no one suspected it would happen here in the 1980’s either.Rising Mortgage Interest Rates and Political Uncertainty to “Derail New Zealand’s Growth Train”Before we finish up, here’s an article that ties in nicely with regards to the risks of rising interest rates we wrote about last week:

“Mortgage holders in Auckland look particularly vulnerable to even modest interest rate rises that are likely to occur in the next 2-3 years,” Mr Kiernan said. “Debt-servicing costs in the city now take up a greater proportion of income than in 2007, when mortgage rates reached 8.7%. A future rise of 1.5-2.0 percentage points in mortgage rates would clearly stretch many borrowers in Auckland and squeeze potential buyers out of the market.”

Infometrics predicts that wholesale interest rates will gradually rise further over coming months and that the Reserve Bank will start increasing the official cash rate by mid-2018. “Net migration and population growth will be easing at the same time as interest rates start to rise, and this cocktail could be the catalyst for a housing market correction,” said Mr Kiernan. “Apart from the stresses on the market in Auckland, underlying demand conditions in some other regions do not justify current high prices, and we see scope for a 12% drop in property values by the end of 2020.”

The Infometrics prediction that NZ wholesale interest rates will rise is expanded upon in this piece from John Bolton of Squirrel Mortgages.John Bolton on how retail banks make money and why mortgage rates are increasingHe does a good job of outlining why NZ banks will raise rates to try and increase their profitability.You might think they’re not doing too bad as it is! But he is just explaining what might happen not the rights or wrongs of it. Nonetheless it is another reason to be careful about how much leverage you operate with and what calculations you have made for higher rates in any borrowings you have.Of course another way to prepare is to own a non-correlated asset like gold or silver. Precious metals generally perform somewhat opposite to shares, property and other investments. So if you’d like a counter balance to your existing assets get in touch for a quote.You can call, email or order online for a quote. See the details below along with all the articles posted on the website this week.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

This Weeks Articles:

| Looking to sell your gold and silver? Visit this page for more information | ||

|---|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1643 | |

| Buying Back 1kg NZ Silver 999 Purity | $762 | |

Trump Left Saudi Arabia Off His Immigration Ban… Here’s the Shocking Reason WhyThu, 16 Feb 2017 12:47 PM NZST  The world has been aghast at Trump’s recent travel ban of immigrants from a number of muslim countries. (Never mind that Obama instigated a similar ban at one time in his presidency.) However the biggest question about this ban is why was Saudi Arabia left off? A country that “provided 15 of the 19 hijackers […] The world has been aghast at Trump’s recent travel ban of immigrants from a number of muslim countries. (Never mind that Obama instigated a similar ban at one time in his presidency.) However the biggest question about this ban is why was Saudi Arabia left off? A country that “provided 15 of the 19 hijackers […]

|

||

Doug Casey on Why Gold Is MoneyThu, 16 Feb 2017 12:24 PM NZST  The money we use today is only money due to government decree which is the definition of fiat as in fiat currency. The legal tender laws of today require us to pay our taxes with the money of the state. However money should have certain attributes. Read on to see what they are and why […] The money we use today is only money due to government decree which is the definition of fiat as in fiat currency. The legal tender laws of today require us to pay our taxes with the money of the state. However money should have certain attributes. Read on to see what they are and why […]

|

||

Will the Banker War on Cash Spread to Bitcoin?Wed, 15 Feb 2017 5:28 PM NZST  We’ve published many articles over the past couple of years on the “War on Cash”. And this war has certainly been heating up lately. What else might get targeted by the central planners and monetary elite? John Kim outlines why bankers may be targeting Bitcoin as an area where they wish to assert more control. Be […] We’ve published many articles over the past couple of years on the “War on Cash”. And this war has certainly been heating up lately. What else might get targeted by the central planners and monetary elite? John Kim outlines why bankers may be targeting Bitcoin as an area where they wish to assert more control. Be […]

|

||

Deflation and Gold: A Contrarian ViewTue, 14 Feb 2017 1:33 PM NZST  Currently there is a battle between inflation and deflation for control of the global economy. The conventional wisdom say gold doesn’t perform well in a deflationary environment. So what is likely to happen to gold if deflation wins out? This short article chronicles three historic periods of deflation and demonstrates gold’s performance during each period. […] Currently there is a battle between inflation and deflation for control of the global economy. The conventional wisdom say gold doesn’t perform well in a deflationary environment. So what is likely to happen to gold if deflation wins out? This short article chronicles three historic periods of deflation and demonstrates gold’s performance during each period. […]

|

||

World’s Largest Hedge Fund Manager Predicts Bleak Future for MarketsFri, 10 Feb 2017 4:10 PM NZST  Earlier this week Bloomberg reported that hedge fund manager Stanley Druckenmiller had bought gold reversing his stance from November when Trump was elected: “Stan Druckenmiller, the billionaire investor with one of the best long-term track records in money management, said he bought gold in late December and January, reversing the sale he made after the U.S. […] Earlier this week Bloomberg reported that hedge fund manager Stanley Druckenmiller had bought gold reversing his stance from November when Trump was elected: “Stan Druckenmiller, the billionaire investor with one of the best long-term track records in money management, said he bought gold in late December and January, reversing the sale he made after the U.S. […]

|

||

What Causes Gold Prices to Rise?Thu, 9 Feb 2017 3:06 PM NZST  This Week: Precious Metals Continue Upwards What if Inflation Surprises? Impact on Interest Rates, Aussie and NZ Why Gold is Not “Just Another Commodity” What Causes Gold Prices to Rise? Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1710.90 + $46.87 + 2.81% USD Gold $1240.40 + […] This Week: Precious Metals Continue Upwards What if Inflation Surprises? Impact on Interest Rates, Aussie and NZ Why Gold is Not “Just Another Commodity” What Causes Gold Prices to Rise? Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1710.90 + $46.87 + 2.81% USD Gold $1240.40 + […]

|

||

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

||

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

||

Note:

|

||

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

||

Our Mission

|

||

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

||

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

||

| Copyright © 2017 Gold Survival Guide. All Rights Reserved. |

||