As we mentioned last week Dan Denning of the Bill Bonner Letter is on a scouting trip to New Zealand. Reporting back to their (mainly American) readership on the benefits of a “bolthole” down under.

We thought it worth sharing Dan’s report on his trip to the beaches north of Auckland – an area we are very familiar with ourselves.

He reports on where a number of Bill Bonner Letter readers are living and what they are doing to make themselves more self sufficient than the average person. Not because they all think the end of the world is coming. But simply because we are overdue for another “financial volcanic eruption” as he puts it.

We know a number of our readers are also doing what they can to get closer to the land, live more self sufficiently and be better prepared for come what may. A lot of the rationale for many people is is simply about having a simpler less stressful life. Not necessarily preparing for doomsday!

So we’d love to hear what you might be doing. Drop us an email (or fill in the contact form here) and let us know what you have in the way of self sufficient preparation.

Then read on for Dans thoughts not just on New Zealand, but also on the potential for inflation and the gold versus bonds argument…

Prepare for the Financial Volcanic Eruption

By Dan Denning – Coauthor, The Bill Bonner Letter

Editor’s Note: Today, a bolthole treat for Diary readers. Dan Denning, Bill’s right-hand man on The Bill Bonner Letter, catches up with a few readers along his New Zealand bolthole road trip.

While these dear readers have been lucky enough to find their escape, an inflation surge and worldwide financial panic may be coming soon… and Dan says it’s time to start preparing now, before this volcano blows…

- $22 trillion and QE4EVA…

- The inflation temptation and gold or government bonds?…

- Flow towers, victory gardens, and boltholes…

NEW PLYMOUTH, TARANAKI – The Fed is going to make this sucker blow. That’s what I found myself thinking this morning, looking out of my room at the sunrise on Mount Taranaki.

I sipped a cup of coffee, waiting for an early morning conference call with the Bonner & Partners analysts back in Florida.

I’m in New Plymouth, on the west coast of the North Island of New Zealand (NZ). The bolthole search continues. You’ll find more on that below.

Last week, I met up with readers in small towns north of Auckland. I’ll tell you what they told me and show you some pictures of the stunning coastline.

Mount Taranaki, which tops out at 8,261 feet, last erupted in 1854. It reminds me of Mount Vesuvius, which erupted in A.D. 79 and buried Pompeii and Herculaneum.

We know about that eruption because Pliny the Younger wrote about it. And he wrote about it because his uncle, Pliny the Elder, was in the Bay of Naples when the volcano erupted and later died (though history is not clear how). Moral of the story: Let sleeping volcanoes lie.

$22 Trillion and Quantitative Easing Forever (QE4EVA)

Bad news for America: The national debt has gone over $22 trillion. The U.S. Department of the Treasury released the news on Tuesday, a day that will live in infamy. Actually, no one will probably remember or care, at least not until much later.

But the debt builds under the economy like a magma chamber under a volcano. Another $2 trillion has been added to the debt since Donald Trump became president. Far from draining the swamp, he’s clogging it with even more IOUs. Who will pay them?

More disturbing news from Washington… The Federal Reserve is NOT going to normalize interest rates nor is the Fed going to shrink its balance sheet in 2019, as it planned.

But on top of that, it’s also going to consider making quantitative easing (QE) a permanent feature of its policy toolkit (and not just an emergency measure). What does that mean?

We are in a perpetual monetary emergency now. The public debt could double from here to reach Japan-like levels. It will never be paid off. And after a 20% correction in the stock market late last year, the Fed had to completely reverse course, abandon “normalization,” begin laying the groundwork for negative interest rates, and talk about QE4EVA.

Seismic activity – after prolonged quiet periods – is what tends to come right before a volcano erupts. Financial markets are not volcanoes.

While the debt builds and the deficits grow, the financial system becomes more complex and more fragile. The real economy weakens. And the instability in a financialized system can mean sudden and violent crashes. That’s why we continue to buy gold.

Gold or Bonds For the Long Term?

Speaking of gold, China bought more last month. Chinese gold reserves grew for the second straight month, according to data published earlier this week by the People’s Bank of China. China’s back to buying gold after taking some time off in 2016-2018 to try and rein in rampant debt and credit growth.

Why are central banks ramping up gold purchases? And could it be a signal or a catalyst for a bigger move in gold ahead? Hmm…

Central banks buy gold as a reserve asset. And they buy it because it’s always been money. That’s why they put it in vaults. The second question is tougher.

But I’ll repeat that both Bill and I believe before this bull market in gold is over, the Dow-to-gold ratio will be at 3-to-1… likely, with the Dow down at least 10,000 points from here and gold at $5,000 per ounce.

Meanwhile, it’s no coincidence that the buildup in central bank gold reserves comes at the same time government debt-to-GDP ratios in the Western world are at their highest levels since the end of World War II.

Wall Street research firm Bernstein says the buildup in gold may be a sign that central banks are preparing for a huge spike in inflation. The firm also says that gold – and not government bonds – will do much better in that kind of market. It reports that:

A material shift in geopolitical risk and a near-record build up in government debt make other potential risk-free assets more questionable and also bring a temptation to create inflation, thereby further enhancing the case for gold… The problem with holding gold is that the long run real return is zero. However, it is also apparent […] that there are periods when the other traditional source of ‘risk free’ returns, in the form of Treasury bills, fail to deliver risk-free returns. […]

These tend to be in periods of geopolitical uncertainty or after large build-up of debt.

Inflation is the dog that hasn’t barked since 2009. That is, if you’re looking for consumer price inflation, you won’t find it. You will find rising health insurance, education, and housing costs. And you’ll find soaring financial asset prices, which is where QE has created a huge wealth- effect and also inequality.

But a bigger inflation surge where gold prices soar? That hasn’t happened in the QE era… Yet. Our take: With debt levels building, and common sense suggesting that inflation is the easiest way to manage unpayable debts, inflation is coming.

The geopolitical risk is default, contagion, and conflict between nation-states (armed conflict, not just financial warfare or cyber warfare).

Cheerful? Definitely not. But look on the bright side… If Modern Monetary Theory takes hold, the destabilization of the whole Ponzi scheme will accelerate. It’s like some people actually want the volcano to blow.

Flow Towers, Victory Gardens, and Boltholes

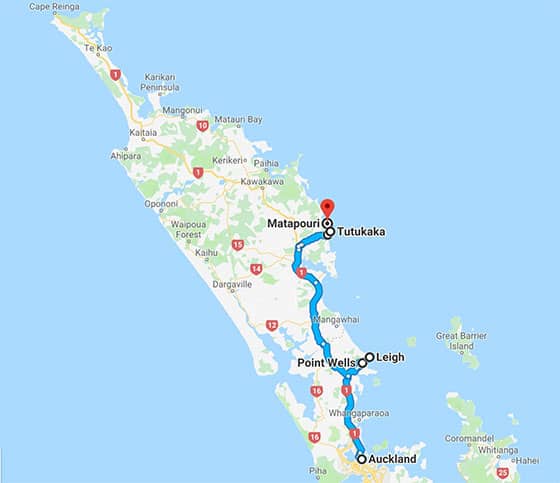

Hopefully, we can all find our paradise bolthole before it’s too late. To that end, I spent last weekend road-tripping north of Auckland to the small towns of Leigh, Point Wells, and Tutukaka (with a visit to Matapouri Beach mixed in).

Everyone says the South Island of New Zealand is prettier. But as you’ll see in my notes below, the North Island has its secret escapes, too.

My friend Mike helped me organize this leg of the trip. Mike and I first worked together in London back in 2002. He moved back to New Zealand with his wife in 2004, and then helped me start Bill’s Australian business in 2005.

As the commodity boom – and the influx of Chinese private money – hit New Zealand, Mike and his wife looked at property and real estate to the north, about an hour outside of Auckland, in the town of Leigh. The road to get there is narrow and clogged on Friday afternoons (a huge new road is being constructed). But the quiet, coastal towns are worth it.

Kiwis on the North Island call their cottages and boltholes “batches.” Don’t ask me why. On the South Island, they call them “cribs.”

We stayed at Mike’s batch, overlooking an old harbor where native Kauri trees used to be floated out from a sawmill to waiting ships in the Hauraki Gulf. The timber industry is largely gone (that sawmill is now a pub with good food).

Looking back up at the batch with the bay behind me, you can see working on the deck (or having a cold drink) isn’t a bad way to spend the day. If you want, you can stay in touch with the outside world via satellite TV. Cell reception is spotty, which suited me just fine.

One fact to note: Most of the structures I saw (including those on Waiheke Island) capture rainwater in big tanks for drinking. Rain isn’t taxed here yet. But you would have to install a filtration system. And it wouldn’t hurt to know how to fix or maintain your water pump.

If you’re expecting these modest little boltholes outside Auckland to be cheap, your expectations are unreasonable. You’d pay around NZ$500,000 (about $343,000) for a fixer-upper, and obviously more for something more comfortable. The upside: It’s only an hour away from Auckland. The downside: It’s only an hour away from Auckland.

My next stop was lunch at the invitation of Steve and his family, including several interested guests who came along. They live in Point Wells, in a beautiful home Steve designed and constructed. He’s installed 20,000-90,000 liters of water storage (it rains a lot up here, which you can see from the picture below).

Steve bought the property in Point Wells years ago, after being shown a smaller and more expensive property in nearby Omaha Beach. He got a property with twice as much space and set about building exactly the home he’d dreamed of.

It’s not the first time I’ve heard that kind of story from fellow travelers. Part of this decision is a lifestyle one. You may have a dream home you’ve always wanted to build. Or maybe you just want to do something useful with your hands, after years of tapping away at keyboards (Steve and his mates were in real estate, shipping, and finance, respectively).

The well-heeled suburbs next door in Omaha Beach were a combination of charming and hideous. It looked like a suburb from 100 years in the future, with sharp angles on every building and big glass panels or white walls.

Sometimes it works. Sometimes it’s awful. But Omaha Beach, despite being right next to the beach of the same name, was pretty soulless. Point Wells – a bit older – was more liveable.

Steve and his family treated me to a lunch of grilled kingfish, caught by his son, James, the day before. All the vegetables we ate were from his garden. And the wine (a Rosé) was from a local vineyard.

It wasn’t a meager “victory garden” built for rugged self-sufficiency. It was a lush and productive plot of land that Steve and his wife, Barbara, find enjoyable to cultivate and eat from. Like I said, it’s a lifestyle as much as anything.

On to my next stop… I took the three photos below from a small hotel I found on a spit of land overlooking the tiny village of Tutukaka. You can thank Tim and his wife, Sonya for them. Tim found The Bill Bonner Letter after following Doug Casey for years, and hearing about Bill through Legacy Research. It’s a small world.

Tim and Sonya are Canadians from Edmonton. He’s a firefighter. Wanting to get out of the Canadian cold and, perhaps, to live a freer life elsewhere, they decided on New Zealand. It wasn’t easy, partly because the New Zealand points system for skilled immigration values some skills over others.

But they made it, brought their first daughter with them, and are now raising a family in the house they built in nearby Ngunguru.

Like Steve and Barbara, they’re concerned about the world’s financial markets and big unsustainable debts. They’re trying to live a simpler and safer life, and bring their kids up in a beautiful place.

Mike and I ate fresh cinnamon rolls Sonya had baked from scratch and even some small (and sweet) bananas grown in their garden. They also showed us the contraption in the picture below.

I dubbed the flow tower a “honey keg,” which kind of captures the point. You can tap the honey inside without putting life and limb at risk. And I had no idea you could go out and buy a queen bee for this kind of contraption on the open market. Sonya said her queen cost around $70, which seems like a good bargain.

Like all the folks I’ve visited with, the people here are trying to balance prudence with preparation. It might be a matter of proportion. In a normal world, volcanoes don’t blow up in your backyard. You can prepare for such an event without selling everything and panicking. You get some peace of mind and the lifestyle you’re looking for.

History doesn’t play favorites, though. Sometimes the volcano blows during the middle of your lunch hour. And yes, by volcano, I mean a great financial crisis that comes upon you suddenly (not in slow motion). Preparing for that crisis – both financially and practically – is what we’re trying to help you do.

I’ll have more next week from points farther south.

Until then,

Dan Denning

Coauthor, The Bill Bonner Letter

P.S. The three photos below are of Matapouri Beach from three different angles. It was the northernmost point on my last trip. It’s said to be one of New Zealand’s finest beaches. There was hardly anyone there on a Sunday morning!

NZ is horrible, it’s full of Orcs and stuff. Stop tell people about it and faking photos, those pics look like Aussie, you want to go there 😉

Nice one Simon. Yes he failed to mention the Orcs and dragons lurking about.

Bach! Bach! not Batch!

Haha. But you have to cut Dan a bit of slack. He is an American! Doesn’t know a Batch from a bach. 🙂