This Week:

- NZD Gold Reaches New High

- NZD Silver has broken out of a 4 year downtrend

- Negative Interest Rates in the US?

- More Signs of US and Global Slow Down

- Changes to NZ Bank Disclosure Rules Could Increase the Likelihood of a Taxpayer Bailout

- More on the “Silver Shortage”

|

GOLD KIWI 1

1oz NZ Mint 99.99% Gold Kiwi Coins Normally priced at Spot + 5.7% at NZ Through us: Packaged Gold Kiwis: (Approx Ph 0800 888 465 and speak to |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1803.96 | + $33.03 | + 1.86% |

| USD Gold |

$1130.90 | + $9.90 |

+ 0.88% |

| NZD Silver |

$23.66 | + 0.04 | + 0.16% |

| USD Silver |

$14.83 | – $0.12 |

– 0.80% |

| NZD/USD | 0.6269 | – 0.0061 | – 0.96% |

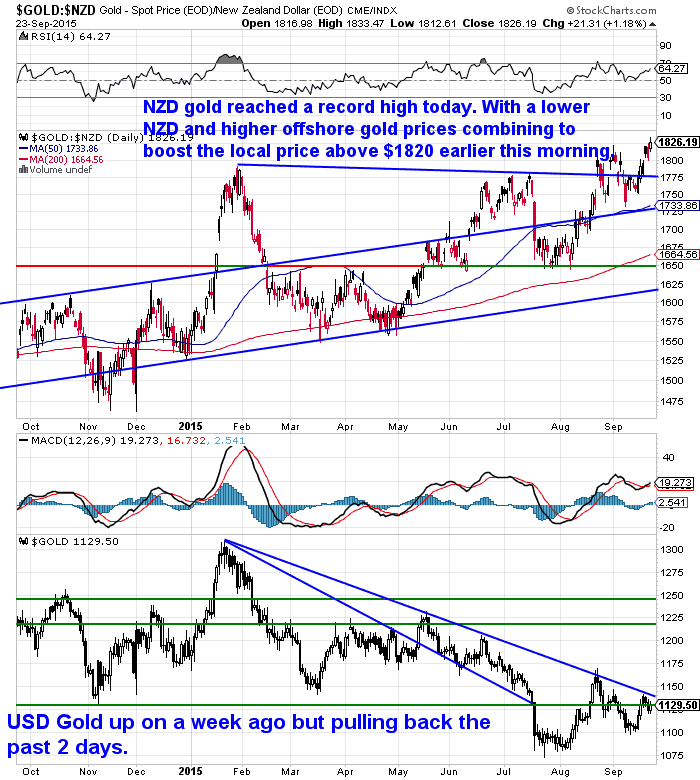

NZD Gold Reaches New High

Today gold in NZ Dollars reached another new high for the year. Nudging above NZ$1820 earlier this morning on the back of a weaker NZ dollar and higher offshore prices from a week ago. It has pulled back since then and a further fall in the short term won’t be a surprise. But the trend overall looks like up still.

Gold in NZ Dollars is up almost $300 since the 31 December 2014 and most people across the country won’t have noticed.

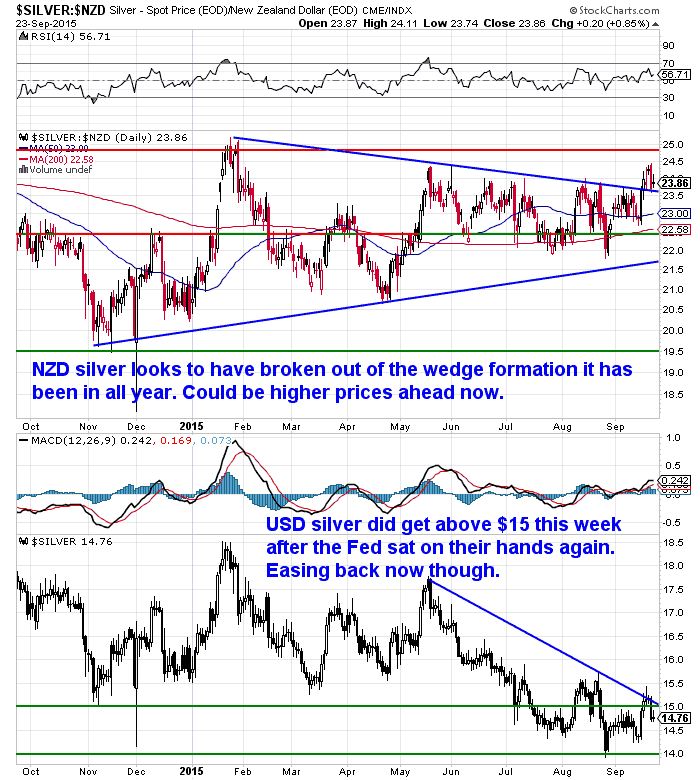

NZD Silver Breaks Out

Of particular interest today is that silver in NZ Dollars has broken out of the wedge formation it has been in all year. So odds favour higher prices ahead now. We’ll want to see it beat the January high of $25 now.

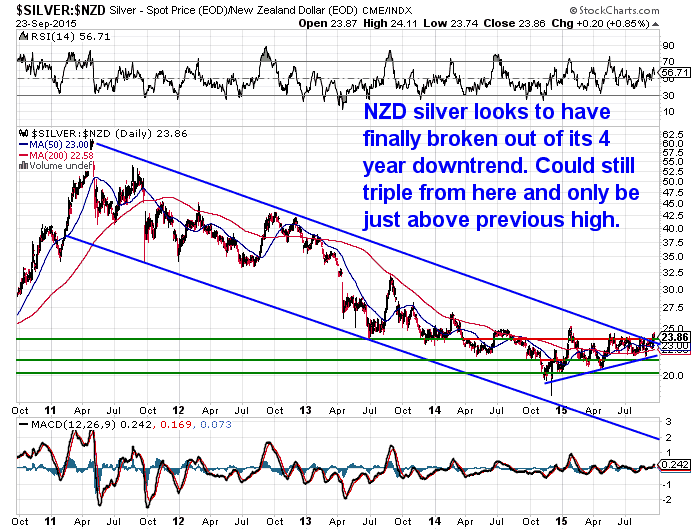

NZD Silver Looks to Have Broken Out of a 4 Year Downtrend

Perhaps even more significant for NZD Silver is that it looks to have also broken out of the 4 year down trend it has been in. You can see in the 5 year chart below that it looks to have poked its nose above the downtrend line.

So this too would also point to higher prices ahead. There is certainly still plenty of room for them. If NZD silver tripled from here it would only be a few bucks an ounce above the previous high from 2011.

Of course no guarantees, but we think the odds are in favour currently of higher prices ahead for both metals.

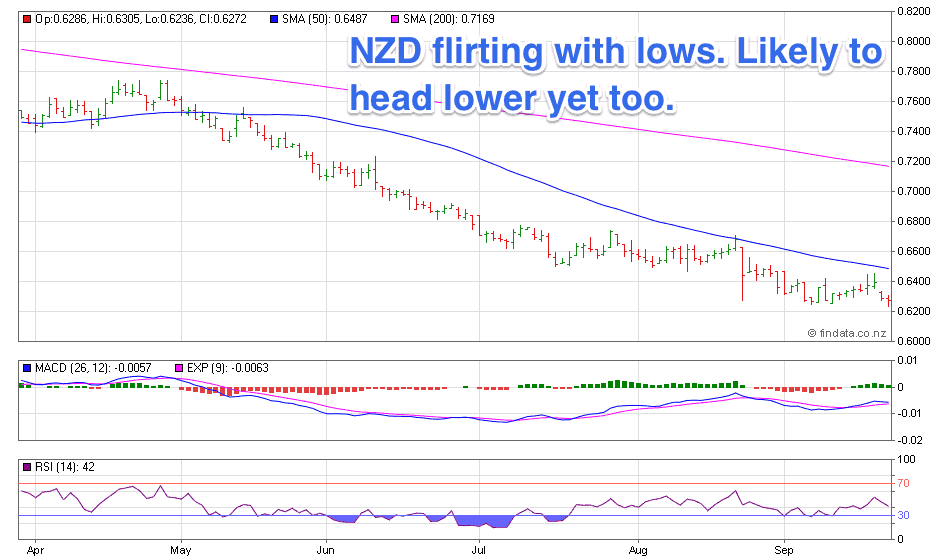

If the Kiwi dollar weakens further this will continue to support NZ precious metals prices. It is currently flirting with the lows from earlier this month.

So for now at least the downtrend in the Kiwi dollar seems in tact.

What Could Break the Downtrend in the NZ Dollar?

Perhaps when the mainstream finally registers that the US Federal reserve isn’t going to raise interest rates. That could finally weaken the USD against many currencies, the NZ dollar included.

However this is tempered by the fact that we’d guess most currency traders aren’t factoring in a recession in NZ at all yet. As we’ve noted the past few weeks, we think this is higher odds of happening than any bank economists or the RBNZ itself are giving credit to.

So while the US Dollar strength seems very long in the tooth, perhaps the Kiwi can get weaker still yet.

Negative Interest Rates in the US?

Not many people noticed but the Fed announcement last week holding interest rates yet again, also reported that one of the Federal Reserve Open Market Committee (FOMC) members noted the possibility of the Feds interest rate to be negative next year!

If this were to occur this would likely be very gold and silver positive. As negative interest rates mean the opportunity cost of holding gold and silver disappears.

This is something that the likes of Ronni Stoeferle in his In Gold We Trust report has been expecting to eventuate. Learn more about Ronni’s report here.

If this were to occur, here in NZ we could perhaps see even lower interest rates too.

John Mauldin discussed this week what he thinks the Fed will do now. He expects the US economy to actually do worse from here and also thinks negative interest rates are now on the cards:

We doubt we are going to see normal markets in a hurry. Not until we first experience some kind of global monetary reset anyway.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

Old Stock Clearance 18% Discount on 60 Serve Bucket

For just

Learn More.

—–

More Signs of US and Global Slow Down

A couple of weeks back we discussed the Dow Transportation Index being a forewarning of a falling US stock market. Here’s some more data that is showing the US and global economy is not going as well as most think.

From Tony Sagami in his “Connecting the Dots” column:

By comparison, the S&P 500 is down 3.8% during the same time, so the DJT has dropped almost 3 times as much.That weak relative performance is your first clue, but there are plenty of other clues (dots) that explain why transportation stocks are doing so poorly.Dot #1: China Freight Rates Plunge. The China Containerized Freight Index (CCFI) tracks the rates for shipping containers from Chinese ports to major ports around the world. The CCFI dropped to 820.9 last week, is 22% below where it was in February, and 18% below where it was in 1998 when the index was created.Rates to the US have dropped the most. Rates from Shanghai to the US West Coast ports are down 33%, and the rates to East Coast ports are down 41%.

Dot #2: Air Cargo Volume Shrinks. Container ships are just one transportation option. What about trucks, rails, and airplanes?

According to the International Air Transport Association (IATA), global air freight was down 0.7% in July from a year ago.

“The disappointing July freight performance is symptomatic of a broader slowdown in economic growth,” IATA Director General Tony Tyler said.

Dot #3: Asian Air Freight Is Even Worse. The Association of Asia Pacific Airlines (AAPA) echoed that slowdown by reporting a year-over-year drop of 1.8% in international air cargo across the region in July.

“Air cargo demand began the year quite strongly but has lost momentum as a result of a slowdown in global trade and weaker demand for Asian exports,” said Andrew Herdman of AAPA.

Dot #4: Less Freight, Less Demand for Airplanes. Nippon Cargo Airlines, Japan’s biggest cargo carrier, canceled a $1.5 billion order for four 747-8F freighters from Boeing. Not passenger planes—cargo planes.

Dot #5: Don’t Forget About Truckers. The Cass Freight Index tracks North American trucking volume, and as you can see, the trucking business is definitely slowing down.

The number of freight shipments fell 1.2% in August on the heels of another 1.2% percent drop in July.

The August decline is a diversion from the normal pattern seen at this time of year. Generally, retailers are stocking up for fall sales, so the August drop is a big red flag.

…I believe that the transportation industry provides an early canary-in-the-coal-mine warning signal for the rest of the US economy.”

Changes to NZ Bank Disclosure Rules Could Increase the Likelihood of a Taxpayer Bailout

Here’s some changes the RBNZ are making to bank disclosure rules that have attracted little coverage, but could have a big impact:

But even more concerning was the central bank’s shift toward collecting information privately.

“There is, as a result, a growing gap – and a major inconsistency – in the system,” Reddell said.

If the central bank had revealing information not available to the public, depositors could argue it was responsible for losses in the event of a collapse, he said.

“Such arguments, correct or not in some narrow economic sense, will strengthen the (already high) likelihood of government bailouts.”

If you’d like to learn more about how your savings are at risk in a New Zealand Bank failure then check out this article of ours:RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

If you’d like to learn more about how your savings are at risk in a New Zealand Bank failure then check out this article of ours:RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)Download a Robert Kiyosaki Book for Free

We received an email this week with a free download of an excellent Robert Kiyosaki book: Conspiracy of the Rich. So grab that if you’d like something easy to digest but quite informative about the global monetary system. Download here.

More on the “Silver Shortage”

Following on from last week’s comments on the silver shortage, we’ve read quite a few differing opinions on this.

Here’s a few of them:

Dave Kranzler argues in this silver doctors interview that the bullion banks are purposefully causing the retail shortage. Read More.

Andrew Hoffman believes a precious metals shortage is approaching.

OCCAM’S RAZOR, AND THE UPCOMING, HISTORIC SILVER SHORTAGE

While Bix Weir is pretty unequivocal in his views:

“Just a note to all of you that think this “retail silver shortage” is just another ordinary shortage based on a shortage of coin blanks (planchets) and that soon everything will return to normal…

IT WILL NOT!!!

The retail shortage has been going on for 3 months now with no end in sight. The US Mint is still massively rationing with only 2M coins sold in September after they have cutback production by 40%…

Weekly Allotment of American Silver Eagle Bullion Coins Lowered

http://www.coinworld.com/news/

Those that have ordered silver coins for delivery weeks or months from now are being fooled. The whole concept of a retail planchet shortage means that the mints and refiners are only waiting on the processing of metal into retail forms. One would think that the planchet makers, 3 months into the shortage, would be producing at full capacity in order to take advantage of the higher prices but the backlog keeps growing and the time frames for delivery extended.

And yet WHERE are the massive volumes of retail silver that caused this backlog being delivered? Where is this new increase in production being sold? Certainly not from the US Mint or the Canadian Royal Mint or even at the Perth Mint that still claims this is just a retail silver shortage problem.

IF this were only a retail problem then by now the market should be FLOODED with planchets to alleviate the backlog but from what I am hearing – the backlog and time frames are growing with very few planchets available.

Yes, you can still buy silver at high premiums but there is something else going on this time.

My advice: go to your local silver coin shop and load up!”

What do we reckon?

After depressed demand for a few years precious metal refiners, fabricators and coin blank producers have reduced staff levels and so their level of production has also been severely reduced. So they have not been able to respond to the increased demand of late. And getting reliable and trustworthy staff on board is easier said than done.

Our industry sources from both the US and Canada indicate that premiums have not risen on wholesale bars (1kg and 400oz gold, and 1000oz silver) and these are still available for immediate purchase to anyone with enough cash to buy them.

So that indicates it is a retail shortage.

However the flip side to this is that in a free market there should not be a shortage. That is before too long the price should rise enough to attract sellers so supply exists again.

That as Bix alludes to is not happening.

We understand that it is the major distributors of the likes of the US and Royal Canadian Mints that are making the money here. As the mints have not raised their prices significantly, but the major wholesale distributors have.

So, perhaps the truth is somewhere in the middle. No one can really say.

But if this demand keeps up, it is not an impossibility to see an impact in the wholesale market too. Things would get really interesting then.

There are still delays on various products. Both imported and locally refined, but there are some items in stock or available with a short wait. So get in contact if you’d like to know what is available. The market is very fluid currently and availability is changing day to day.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $15,165 and delivery is now about 4-5 weeks.

Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

Pingback: NZ Dollar 4th worst performing fiat currency so far in 2015 - Gold Survival Guide