This Week:

- Large Online Retailer Stockpiling Food and Gold for the Next Financial Crisis

- Doug Casey Answers Five of Today’s Biggest Investment Questions

- Putin Preparing for Russian Gold Standard!

- Gold Company Founder: “I think gold has bottomed and the bear market has finally come to an end”

- LBMA Conference: Gold Bears Ready to Turn?

|

LIMITED QUANTITY GOLD SPECIALS GOLD KIWI 1 oz COIN

1oz NZ Mint 99.99% Gold Kiwi Coins Normally priced at Spot + 5.7% at NZ Mint. Through us: Packaged Gold Kiwis: (Approx $1814) (40 in Stock) ***** PERTH MINT 1 oz GOLD BARS 1oz Perth Mint 99.99% Gold Bars In Black or Green Packaging Approx $1835 (12 green in Stock; A couple of black) Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

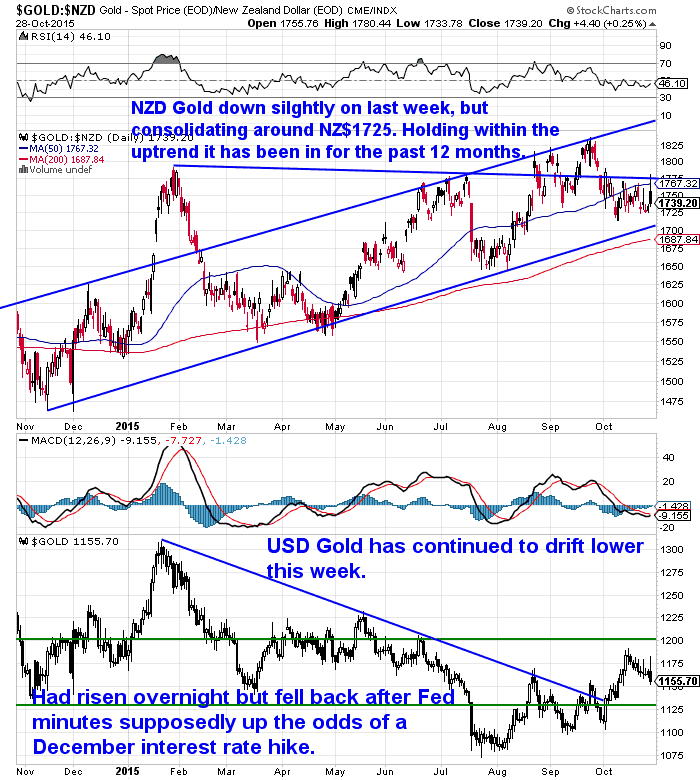

| NZD Gold | $1726.49 | – $14.67 | – 0.84% |

| USD Gold | $1156.40 | – $10.70 | – 0.91% |

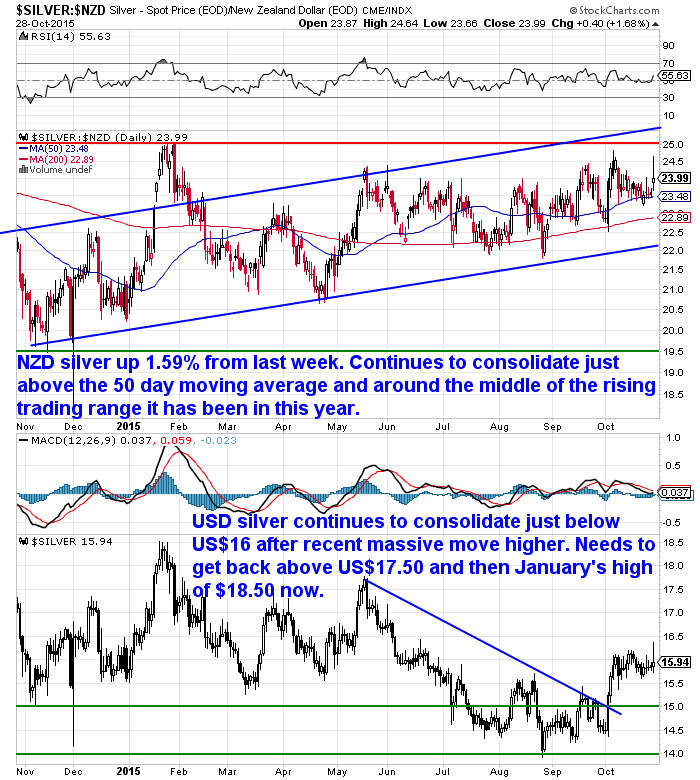

| NZD Silver | $23.84 | + $0.39 | + 1.66% |

| USD Silver | $15.97 | + $0.25 | + 1.59% |

| NZD/USD | 0.6698 | – 0.0005 | – 0.07% |

NZD gold was down slightly for the week. With the NZ dollar fairly flat the main driver was the US Dollar gold price falling. However NZD gold still remains in the solid uptrend it has been in for the past 12 months.

NZD silver on the other hand was up 1.59% for the week. It continues to consolidate above the 50 day moving average line. Remaining in the very definite uptrend it has been in since the start of 2015.

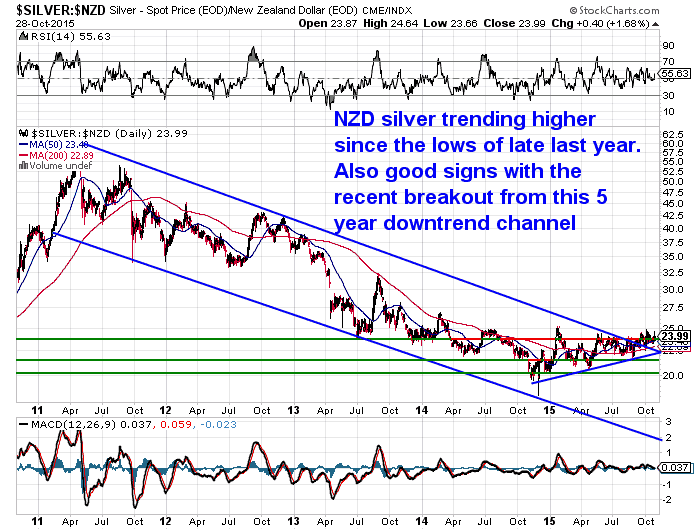

If we cast our eye back 5 years, we can see that NZD silver has clearly broken out of the 5 year downtrend it had been in until a couple of months ago. Another positive sign.

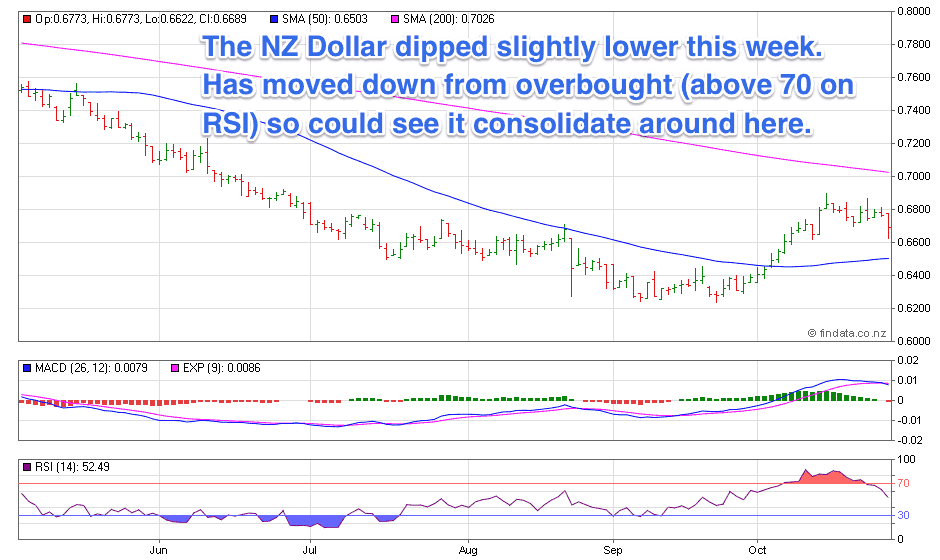

The NZ Dollar had a volatile night, plunging on the back of the release of the last US Federal Reserve meeting minutes. However after the RBNZ interest rate decision this morning it moved higher to end with just a tiny fall from last week.

The blabber about the Fed minutes was that they increased the odds of a US interest rate hike in December. We continue to have serious doubts about that though.

Our guess remains more monetary intervention to come. The European Central Bank gave hints that they have more meddling to do in December which gave stocks a boost during the week.

China also cut their interest rates this week. So the over-riding trend to us appears to be down still for rates. Odds are the RBNZ will follow them before too long, even though there was no rate cut today.

Large Online Retailer Stockpiling Food and Gold for the Next Financial Crisis

This weeks feature article and video gives what some might think to be shocking comments from the CEO of one of the USA’s largest online retailers. Specifically, that they as a company, are stockpiling gold and food in preparation for what they expect to be another financial crisis.

This weeks feature article and video gives what some might think to be shocking comments from the CEO of one of the USA’s largest online retailers. Specifically, that they as a company, are stockpiling gold and food in preparation for what they expect to be another financial crisis.

Large Online Retailer Stockpiling Food and Gold for the Next Financial Crisis

Actually on the topic of food storage, our sister site Emergency Food NZ is once again finally back in stock with all long term freeze dried food packages. We also have a few new emergency preparedness products in stock too. You can learn more about them here.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

The Seven Biggest Lies Told (and Believed) About Gold

The seven biggest lies told about gold in the eyes of Guy Christopher are:

- Gold is a barbarous relic;

- Gold pays no interest;

- Gold will be confiscated, just as in 1933;

- Gold is not money;

- Gold is useless in a crisis because merchants cannot make change;

- Gold has no practical uses beyond adornment;

- Gold cannot be created in the lab.

Some good arguments made debunking each of these commonly heard statements about gold. Check it out here.

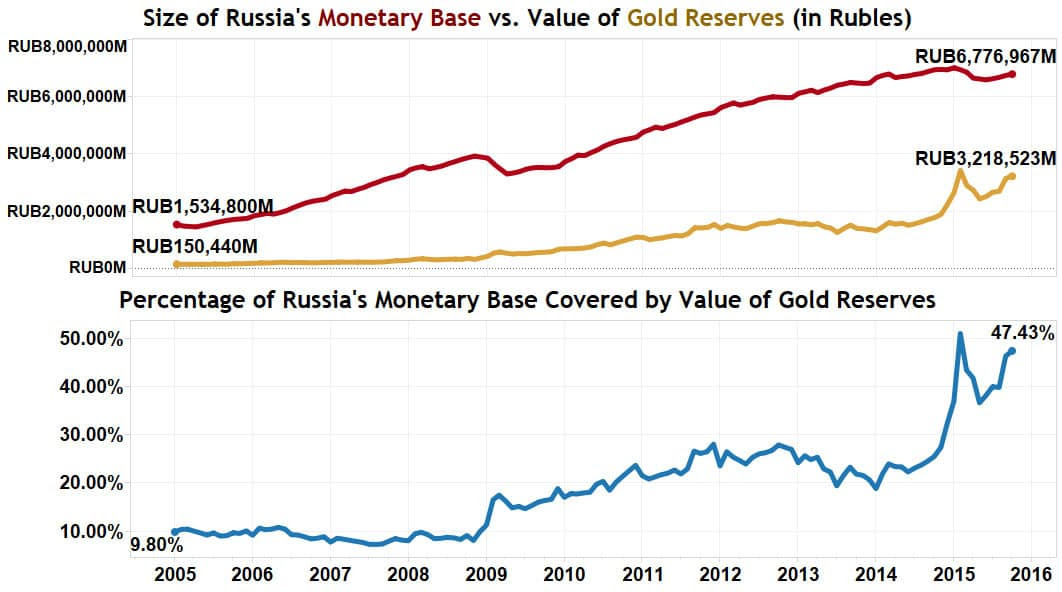

Putin Preparing for Russian Gold Standard!

For all the talk in the mainstream about how poor shape the Russian economy is in, here is a very interesting statistic about how much gold Russia has a percentage of its monetary base.

The NIA reported this week that…

“Russian President Vladimir Putin appears to be preparing to launch his own gold standard – a move that could lead to the complete and total destruction of the US dollar. In September, Russia accumulated another 1.1 million ounces of gold – increasing its total gold reserve to 43.5 million ounces. Over the last three months, Russia has added a total of 2.51 million ounces of gold to its reserve – its largest three month gold reserve increase in history!

Historically, for a country to implement a gold standard for its currency – it was required to maintain a physical gold reserve equal to 40% of the value of it monetary base. Based on the latest gold price, Russia’s gold reserve is currently worth enough to cover 47.43% of its monetary base – meaning that Russia now owns enough gold for Putin to launch a gold standard today!

Gold Company Founder: “I think gold has bottomed and the bear market has finally come to an end”

3 weeks ago we shared a report from gold company Seabridge Gold where they stated:

“We continue to expect that we will see more Quantitative Easing before we see a Fed rate hike. And we think that a new round of monetary stimulus will do much more for gold than equities because markets are losing confidence in the Fed.”

From what we’ve seen over the years the company and in particular the co-founder Rudi Fronk seem to have their finger on the pulse. The fact they started the company in 1999 at the beginning of the current gold bull market speaks for itself.

Seabridge is not a miner as such but rather a hoarder of gold in the ground. Quite different from most other gold stocks.

We read an excellent interview with co-founder Rudi Fronk this week that is worth checking out. A few of the highlights from it are below:

“Gold miners are always seeking to turn a superior currency, gold, into an inferior one, the dollar. At Seabridge, we like to think of ourselves as modern alchemists, turning cash into gold. Over the last 16 years, we have used cash to fund acquisitions and exploration of gold projects in Canada.”

“…the valuation of financial assets such as stocks and bonds relative to gold was unreasonably high due to inflationary monetary policies. These things go in cycles. In the 1970s, hard assets were overvalued against financial assets. Then we got the reverse. We formed Seabridge at the height of enthusiasm for financial assets. The day we launched, in late 1999, it took 44 ounces of gold to buy the Dow… the highest ever. Since then the ratio has gone as low as 6. It’s now about 15 but we think it will get to a ratio of 1 to 1 yet again, as it has done twice in the last hundred years, the last time in 1980 when the Dow and gold crossed at $850.”

“…As a political tool of government, the dollar cannot be trusted to preserve wealth. That is the role of gold. You can keep the dollar for its usefulness as a medium of exchange and meanwhile you can go on your own gold standard to protect your wealth. Now, I know that nobody thinks history means anything anymore. We are told that we are in a new era where the old rules no longer apply. But we should all note that at the end of World War Two, nearly half of the world’s currencies went to zero. Gold did not. I’m not predicting a new world war. But I note that the global debt market now has about $225 trillion outstanding while equities total about $75 trillion. So, we have about $300 trillion in financial claims against a global GDP of about $75 trillion. How is that going to work out? Lots of people are going to lose value. Meanwhile, there is about $7 trillion in above-ground gold to back these claims, which are really liabilities, not assets. As the only asset that backs itself, gold is going much higher.”

“…Anthony Wile: Seabridge is partially dependent on metals market prices for its share valuation. Can you give us a sense of where you see the general gold market headed pricewise?

Rudi Fronk: I think gold has bottomed and the bear market has finally come to an end. I see gold going to new highs over the next two years as it becomes clear that the world’s financial obligations are heading towards default, probably by way of inflation. The debt load cannot be carried. My sense is that it will be inflated away. Analysts point out that inflation is low despite QE but that’s because the monetary easing to date has been centered on banks and financial assets so that’s where the inflation has gone. If central banks want consumer price inflation, and they do, they can create it through channels other than buying debt and increasing bank reserves, which haven’t worked so far.

Anthony Wile: How about the dollar?

Rudi Fronk: In my view, the dollar will continue to lose value – perhaps not against other fiat currencies but certainly against the world of real things. That’s what the authorities want and I believe they will stop at nothing to get it. Anthony Wile: Do you really think the US is headed for recovery?

Rudi Fronk: No. The data is not good. The trumpeted job creation in the Establishment Report is contradicted by the data in the Household Report, wage data, output data, retail sales and so on. Inventories are high and rising while sales are stagnant or falling at the manufacturing, wholesale and retail levels. I think the US economy is definitely slowing down and likely headed into recession in the short term.

Anthony Wile: Yes, it is not a real recovery from what we can tell, and sooner or later that should have an impact on gold prices, shouldn’t it?

Rudi Fronk: That’s right. The bear argument on gold depends on a strong US economic recovery, a credible Fed and rising short-term interest rates. The market is losing confidence in all three. Where is the recovery the Fed has promised? And what has happened to the normalization in interest rates that the Fed keeps telling us is just around the corner? Jim Grant makes the point that the gold price is the inverse of confidence in central bankers. From that perspective, the Fed is gold’s best friend because they are doing a fine job of demonstrating that they have no idea what they are doing.”

LBMA Conference: Gold Bears Ready to Turn?

Bullionvaults Adrian Ash this week reported on the recent London Bullion Market Association (LBMA) conference. He noted that the overall tone was bearish but perhaps with some ready to turn:

These specialists from within the bullion market itself show no conviction for much sharper falls. Away from the conference podium’s forecasts for maybe $800 gold (and $8 silver)…the conference room’s average price forecast poll was only mildly bearish.And as Swiss bank (and bullion market-maker) UBS notes today, “There were also more people than we would have expected who were starting to warm up to gold.”

How so? Private investors buying and owning precious metals have long thought the US Fed would create more QE money before it ever got round to raising interest rates from zero. And now “what surprised us most” in the Vienna Hilton’s chit-chat, says UBS, “was that the possibility of Fed easing and negative interest rates has become part of the conversation of late, albeit clearly viewed as a tail risk.”

The bullion market discovers prices, of course, instead of setting them. But if bullion-bank analysts have finally found other market players thinking that the Fed may cut and print…instead of raising…the big ship of sentiment could perhaps be turning around amongst professional investors.

It’s their money which counts in the end.”

Alisdair Macleod of GoldMoney also had some thoughts on the LBMA conference with similar conclusions:

“In last Friday’s market report I stated that bulls would have to overcome attempts to mark down prices by banks and swap dealers to trigger stops. There was some evidence of that this week, but the real battle has yet to really start.

There is a line drawn in the sand on this issue. At the LBMA conference in Vienna this week, analysts’ consensus was for lower gold prices, with some major houses even talking gold down as far as $900 (BNP Paribas – 2017 average). This suggests that they are prepared to ride short positions, though they will obviously trade round them. Given that their shorts are not excessive at the moment, there is unlikely to be a concerted effort to move prices lower – yet.

The danger to the bullion banks is either their shorts become worryingly large from here, or alternatively they change their mind about the bearish outlook. They are still assuming that US interest rates will rise, even though the rise has been deferred. The risk for them is if the rise appears increasingly unlikely, and if there is talk of negative rates. For what it’s worth, the signals from bond markets do not suggest rising interest rates any time soon; and yesterday the euro fell 2c against the dollar when the ECB chairman raised the prospect of extended quantitative easing.

Negative rates would obviously make physical gold and silver very attractive, and the trouble this would create for bullion banks, which are both short in futures and running unallocated accounts, is immense. It is too early to seriously entertain this possibility, but it is notable that Goldman Sachs is on the turn. Yesterday, their analyst wrote:

“While our base case remains for higher US real rates and lower gold prices, there are significant risks that our forecast for gold price weakness is pushed out….”

This is called hedging one’s bets. But it is important, and suggests that Goldman actually senses a better outcome for gold. In which case, there is a reasonable possibility the other mainstream bears will turn as well.”

So we are perhaps edging into the next bull phase in the precious metals market. Actually here in New Zealand we think it quietly already began a year ago. But odds are we’re still early in the phase, so let us know if you’d like to get on board.

Free delivery anywhere in New Zealand

With demand dropping off lately the premiums above spot for silver maples have come down.

So the price for a monster box of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured is $14,725. Delivery is now about 3 weeks away.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|