This Week:

- A Precious Metals Correction Must Come Now? Mustn’t It?

- Ronni Stoeferle: Gold “A lot of institutional money on the sidelines”

- Financial Fault Lines Developing – But Not Needed For Gold to Still Rise

Bulk Canadian Silver Maple Leaf Coins Deal5 x Monster Boxes (2500oz) of 1oz Canadian 9999 purity Silver Maples delivered to your door via UPS, fully insured until you sign for them. Special deal today of $74,450 (equates to a per box price of $14,890) Delivery in approx 7-10 business days to your door or to a vault of your choice. Call David on 0800 888 465 or 0274 401113 to discuss or order or reply to this email up to 10pm NZ time. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1863.87 | + $64.63 | + 3.59% |

| USD Gold | $1281.60 | + $37.25 | + 2.99% |

| NZD Silver | $25.31 | + $0.40 | + 1.60% |

| USD Silver | $17.40 | + $0.17 | + 0.98% |

| NZD/USD | 0.6876 | – 0.0040 | – 0.57% |

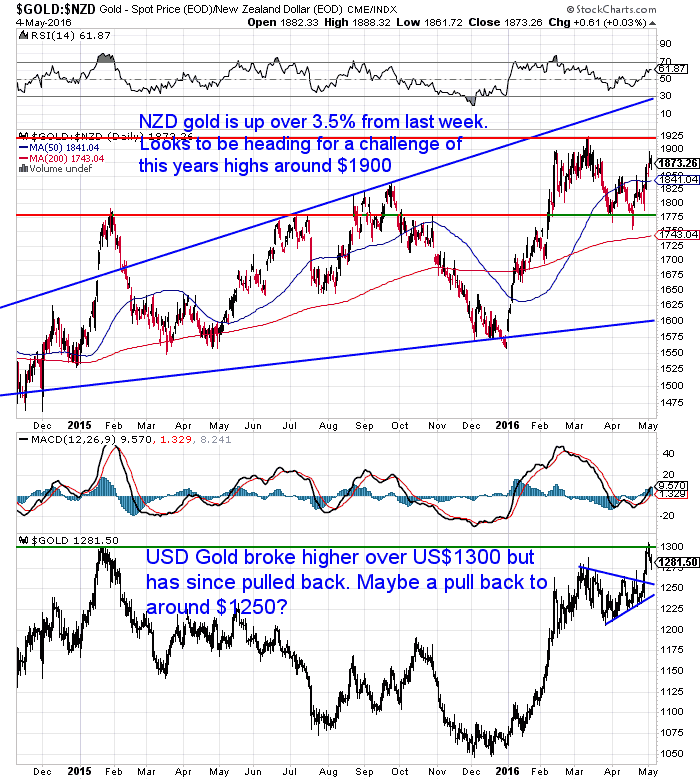

A change from the past few weeks saw gold outperform silver this week. Gold in NZ Dollars surged higher by 3.59% and looks to be mounting a challenge of the highs from March around the $1900 mark. We get the impression most people have been expecting a significant correction in precious metals after their strong start to the year (more on this soon).

Perhaps instead we will see gold consolidate between the 2 red horizontal support/resistance lines for a little while now?

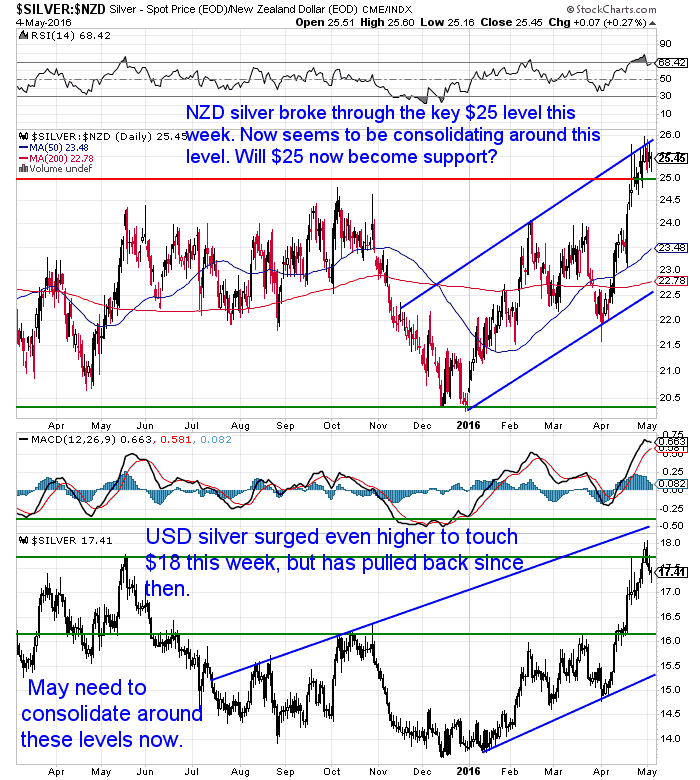

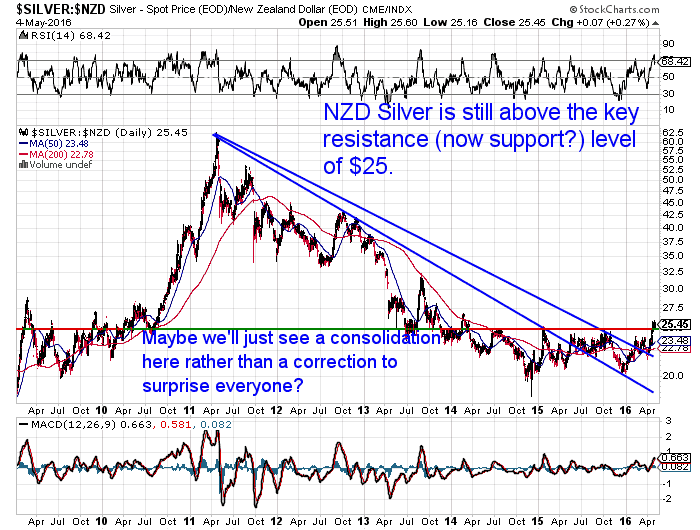

Significantly NZD silver broke through the key $25 overhead resistance this week. We’ve been writing about this line on the sand for a while now.

Why is this $25 zone so important?

Well, the movement above this level indicates a change from a sideways trading pattern to an upward trend, that becomes clearer in the multi year chart below. Silver had been trading sideways since 2014 between $20 and $25. Now that it has broken above this level it augurs well for higher silver prices ahead.

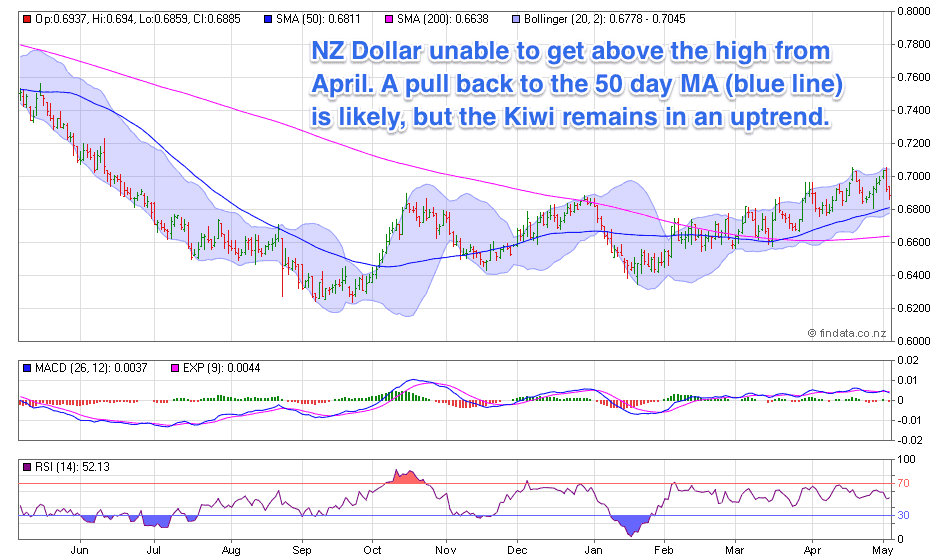

Turning to the Kiwi Dollar now. After extending upwards it has turned lower the past 3 days. No real change here, it continues in its slight uptrend. But not enough to put too much of a dent in local gold and silver prices.

A Precious Metals Correction Must Come Now? Mustn’t It?

As already noted there seems to be a lot of people expecting a correction in gold and silver after such a powerful start to the year.

As already noted there seems to be a lot of people expecting a correction in gold and silver after such a powerful start to the year.

We tackle this question in this weeks feature article. We back up our reasoning with what money is actually doing. Where it is going and where it is leaving. We also gives thoughts on what to do about it if you are on the sidelines looking to buy.

A Precious Metals Correction Must Come Now? Mustn’t It?

Ronni Stoeferle: Gold – “A lot of institutional money on the sidelines”

Yesterday we received the latest Advisory Board Meeting minutes from Ronald Stoeferle of Incrementum entitled: A New Bull Market in Gold?!

It features a special guest Brent Johnson as well Incrementums regular board members Jim Rickards, Heinz Blasnik, Frank Shostak, Mark Valek and Ronald Stoeferle. They discussed the following topics:

- Turning tides: have we seen the end of the dollar bull market?

- Jim Rickards’ new book: “The New Case for Gold”

- Equity markets: Are we going to see a classical sell in May?

- An impeding US recession,

- Their inflation outlook

- And the very tight correlation between rising gold prices and Jim Rickards’ book releases!

We’ll highlight a few of the most interesting points made for you.

But you can access the full document here.

Ronni made a couple of points which we were pleased to see backed up much of what we had to say in the feature article just mentioned on the possibility of a precious metals correction.

“When it comes to gold, institutional clients and bankers and that like tell us that they’re waiting for this kind of correction. So there seems to be so much money on the sidelines that no bigger correction is happening – everybody is just buying the smallest dips.”

“They are buying every dip, as they have not participated in the gold rally in Q1.”

“What I feel while talking to a lot of asset managers in the gold space, which really suffered during the last 4-5 years, is that many of them are still extremely cautious and most of them don’t really believe that we’ve seen the end of the correction and have entered a new bull market. But the price behavior and the development of mining stocks make me pretty convinced these days that this is the beginning of the next stage of the bull market of gold. But I think this cautious attitude is of course a product of the last 4 years, when we have seen quite a number of bear market rallies – when it comes to the sentiment within our space, I think it’s still slightly bearish.”

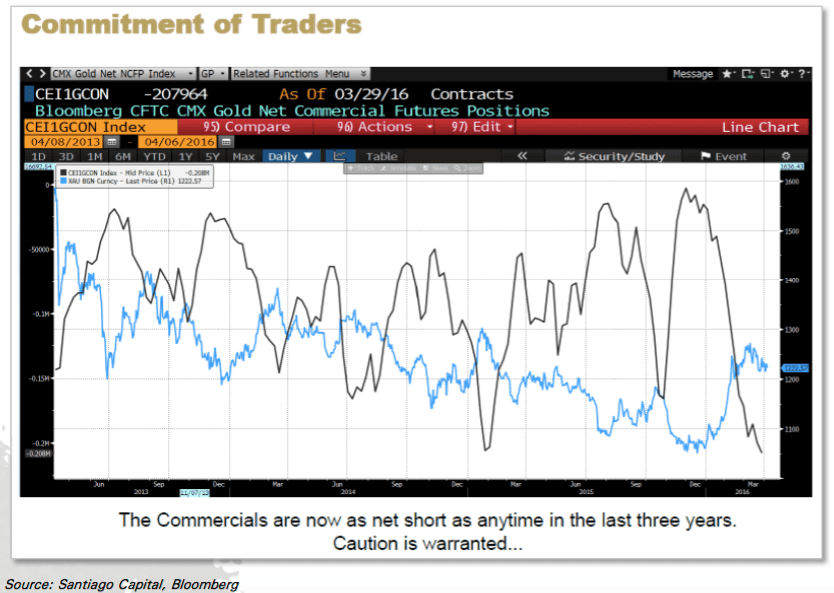

Brent Johnson discussed the Commitments of Traders data for gold:

“The other thing that I think leads to being somewhat cautious is the Commitment of Traders. This chart goes back to 2013, and this chart has worked like clockwork as far as gold rallying and gold pulling back. The Commitment of Traders looks at the different market participants. What I’ve charted here is the futures positioning of the Commercials. These are the big banks and their customers, who actually deal in the gold world, use it as a product. They in my mind have more knowledge, are better informed, and they to a certain extent tend to be the smarter people in the market as opposed to just the pure speculators. And so it’s kind of worked like clockwork. And the Commitment of Traders has not been more net-short than now since the bear market started. There’s been one other time when it was at this level, but it hasn’t been deeper than this as far back as I can see. So caution is warranted.”

We’d reiterate what we said a few weeks ago:

This chart is looking at what has happened with gold futures over the past 4 years. This has obviously been a bear market in gold and silver.

But it seems to us that the tables have turned and we are back into a bull market. This looks to have been driven of late by big money, institutional investment. Evidenced by the rise in holdings in the gold ETF GLD.

So perhaps the same rules may not apply and it might be this new money that decides the trend, rather than the commercial traders this time?

A correction looks overdue and would be expected. But maybe that is just it. It is expected by many people. We may instead see the opposite occur with an ongoing consolidation instead.

Heinz Blank made a good point about the gold silver ratio:

Heinz also had a comment on the COT report which is a bit long to reproduce but did say:

Which is similar to our comments repeated above from a couple of weeks ago, in that the positions being discussed have only been during the bear market of the past few years since 2012.

If we are in a new bull market in gold, then it could be the speculators who impact the price more than the commercial traders.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

Learn More.

—–

How Gold and Silver Can Protect Your Money from the Coming “Bank Account Tax”

How Gold and Silver Can Protect Your Money from the Coming “Bank Account Tax”

Did you hear what Deutsche Bank are proposing the ECB implement?

How Gold and Silver Can Protect Your Money from the Coming “Bank Account Tax”

We’ve also got a couple of not so directly precious metals related articles on the site this week. One dealing with financial privacy and the other with do we actually need government?

These both tie in to a great quote from Jared Dillon on economic freedom:

“Part of economic freedom is the ability to transact anonymously. Take the extreme example where cash is eliminated altogether. Everything goes on a credit or debit card. Your whole purchasing history is stored on the Internet. Well, if you’re not doing anything wrong, you have nothing to hide, right?

Part of freedom (including economic freedom) is the ability to do bad things. Do you want to eliminate the option for people to do bad things, or do you want to give people the choice to do the right thing? All morality is meaningless if people are given no choice of whether to behave or misbehave. This is a deep philosophical issue.

Again, some people think a perfect world is a world without crime, but that’s not true. A perfect world is where people have the ability to commit crimes, but don’t.

But this talk about large-denomination bills is really gaining momentum, and honestly, I think it is at least half responsible for the run up in gold prices over the last couple of months.”

Financial Fault Lines Developing

After the number of significant earthquakes lately Jim Rickards commented on some of the financial fault lines they are monitoring right now:

“What are the new data points that are going into the Bayes model to update our forecast of a financial meltdown?

Here’s a list of the main fault lines leading to disaster:

- Brazil is undertaking impeachment proceedings to remove President Rousseff from office. Brazil is the ninth-largest economy in the world. It is a major energy exporter and an important member of the BRICS, G-20 and other key multilateral organizations. Uncertainty in Brazil means uncertainty for the entire global economy

- A June 23 referendum in the U.K. is heading toward the U.K. leaving the EU. This will cause shock waves in Europe and may lead to a complete loss of confidence in pounds sterling. Spillover effects include Scotland leaving the U.K. once the U.K. leaves the EU. In that case, Scotland may join the eurozone, which, ironically, could make the euro stronger despite the U.K.’s departure

- On April 15, The New York Times reported that Saudi Arabia threatened to dump hundreds of billions of dollars of U.S. Treasury securities on the market if the U.S. Congress proceeds with a vote to allow 9/11 victims to sue the Kingdom of Saudi Arabia in court. (Right now the Kingdom enjoys certain immunities, which make such lawsuits impossible.) This dumping could cause liquidity to dry up in the Treasury market, with a potential spike in interest rates and investor losses that would make the panic of 2008 look like a picnic.

Here’s a few others to consider though. From Charles Hugh Smith – Of Two Minds Blog comes this list of crazy stuff going on across the planet:

“Signs of financial craziness abound:

— 25% of all stock market gains occur after Federal Reserve meetings: in other words, central banks “own the market.”

— The Swiss central bank admitted to spending $470 billion on currency market manipulation since 2010.

— Other central banks have intervened in the stock and bond markets to the tune of trillions of dollars/yen/euro/yuan.

— The central bank of China has spent over $100 billion in a few months propping up the yuan.

— China has made it easier to borrow money again, sparking yet another housing bubble in First Tier cities like Shanghai and Beijing–as if another housing bubble will fix what’s broken in China’s economy.

— U.S. corporations have borrowed billions of dollars at 1% to buy back their own shares–a dynamic that may account for 50% of the current rise in the stock market.

— ObamaCare has added costs to the healthcare system rather than reducing costs; though healthcare spending adds to GDP, it is a form of consumption, not production.

— Cheap credit enabled energy companies to boost production to the point that oil is now in over-supply–and the need for revenues to fund the debts taken on to expand production force producers to keep pumping.

— Sweden has dropped its interest rate to negative territory, a policy that has sparked an insane housing bubble.”

That sure looks like a lot of potential troubles.

However here’s an important point to note.

A financial collapse or major financial shockwave isn’t required for gold and silver to rise though. Recall that from 2001 through to 2008 there really weren’t any major financial shockwaves, yet gold and silver rose mightily up until the Global Financial Crisis.

That said gold’s role as financial insurance should not be underestimated. As Heinz Blasnik said in the Incrementum board meeting:

“To keep the system going, central banks must print – people are probably realizing that by now. So there are plenty of reasons to buy gold as insurance.”

Got your insurance yet?

Bulk Canadian Silver Maple Leaf Coins Deal5 x Monster Boxes (2500oz) of 1oz Canadian 9999 purity Silver Maples delivered to your door via UPS, fully insured until you sign for them.

Special deal today of $74,450 (equates to a per box price of $14,890) Delivery in approx 7-10 business days to your door or to a vault of your choice. Call David on 0800 888 465 or 0274 401113 to discuss or order or reply to this email – up to 10pm NZ time. |

** Urgent Message for All Car Owners **

A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

This Weeks Articles: |

|

|

|

|

|

|

|

|

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices Spot Gold |

|

| NZ $ 1863.87 / oz | US $ 1281.60 / oz |

| Spot Silver | |

| NZ $ 25.31 / oz NZ $ 813.71 / kg |

US $ 17.40 / oz US $ 559.51 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.Have a golden week!David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Gold Survival Guide

PO Box 74437

Greenlane Auckland 1546

New Zealand

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: Why Isn't Gold Correcting Like Previous Moves Higher? - Gold Survival Guide - Gold Survival Guide