See how retail gold investors have been behaving quite differently to big money investors. Discover how this compares to what’s happening in the New Zealand bullion market. Plus what the current headwinds and tailwinds for gold are.

It’s been awhile since we shared any thoughts from the excellent Ronni Stoeferle of Incrementum and the In Gold We Trust Report.

Back in March he commented on gold’s prospects:

“For the short term, it’s in a bit of a technical no-man’s land, we also see that seasonality is not really favorable,” Stoeferle said in an interview in Singapore on Tuesday. “The real pick up in momentum might start beginning of summer. It’s in the very early stages of the bull market, so everybody is still kind of cautious or slightly negative, but this will improve.”

This has been the case since then, with gold struggling to get much higher (in US Dollar terms) and then more recently pulling back. But as we are edging closer to the northern hemisphere summer we may see this change.

There were some interesting and varied comments in the just released Incrementum Advisory Board Meeting featuring Ronni and the likes of Jim Rickards too.

See the full transcript of the meeting here.

Retail Gold Demand Collapsing

In the meeting Ronni made a very good point. One which backs up what we are experiencing in the retail bullion market here in New Zealand.

“I attended a conference last week and I talked to a lot of bullion dealers and they were astonished to see physical demand collapsing. They all said, and I talked to four different dealers (big players in the German market), that their sales were down between 70% and 90%. One company said they didn’t have any orders for 20 hours and normally they have up to 50 orders per minute. I think it’s a consequence of price action, but it’s still very surprising to see.”

We are also seeing a large fall in the numbers of transactions here in New Zealand this year. Where we may not see any purchases for a number of days. Somewhat surprising given gold and silver have overall so far this year been trending up, and generally in the west we see more people purchase on a rising price.

(Check out this article from March for specific numbers in terms of falling demand in NZ)

We believe this fall in the number of buyers demonstrates a lack of belief in any long term rising trend in precious metals. Confoundingly such a pervading sentiment is exactly what generally sends a market higher!

Ronni went on to say:

“In my most recent keynote (the Denver Gold Show, European Forum) I said that there are probably two main triggers that would make gold pick up momentum: one would be a further weakness in US economic data, which we have seen lately, and the other would be further weakness in credit growth. I point to these two triggers because they would both make the Fed reverse their tightening policy.

Heinz, what are your thoughts regarding this?”

Heinz Blasnik:

Currently most of the macroeconomic factors that usually drive gold are not looking too good. Money supply growth is slowing considerably, and that has to do with the decline in credit growth because there is no QE.

…Another important factor, apart from the slowing money supply growth, is that the dollar index does not look too bearish right now. If we look at real interest rates, in the form of TIPS yields, in the near term there’s a divergence compared to gold. Real interest rates trended up, but gold did not come down, which is interesting because there is usually a strong negative correlation.

Therefore we can state that the gold price has currently decoupled a bit from its fundamentals. Credit spreads are also very tight, which is not bullish for gold. So why then is gold holding up so well? On the one hand you can say it’s supported by geopolitical events, however experience shows that these events have only a fleeting impact. So I think the better explanation is that big buyers are holding or buying gold at the moment, outweighing weakness in retail demand. The reason why the big money is buying is probably because they are looking beyond the current economic backdrop; they are looking at the future reaction of the Fed, i.e. the Fed might currently be on a tightening path, however the big money believes the Fed will reverse this policy at some point.”

How Does Gold Demand Compare in New Zealand?

This view also gels with what we are experiencing locally.

When Heinz says “big money buyers” he is likely talking about Exchange traded Fund (ETF) and futures buyers – that is investment funds and the like purchasing in the millions and more.

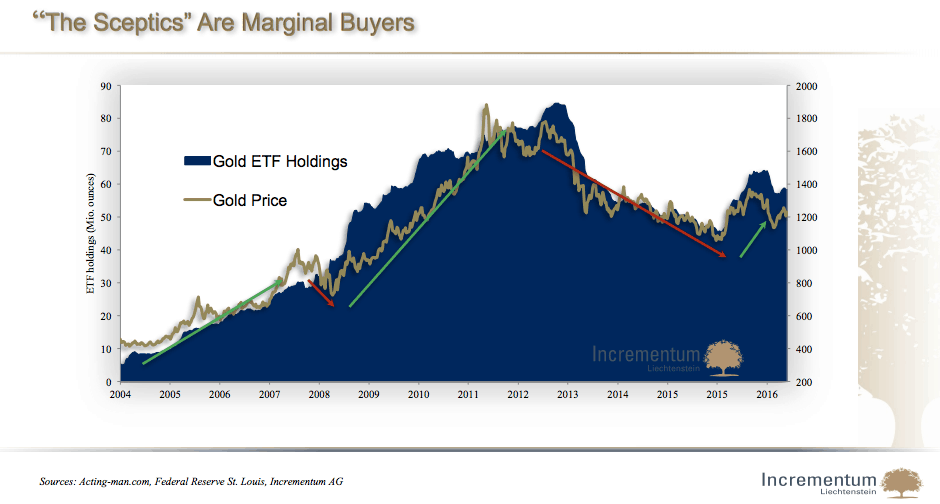

This chart shows that the ETF buying often drives the gold price.

Over the past few months almost the only buyers we have seen here in New Zealand are “big money” retail buyers. So those purchasing gold and silver in the vicinity of $100,000 to $500,000.

Perhaps these “big buyers” here in New Zealand are also the “smart money” buying?

Maybe taking a forward view of rising inflation as Ronni expects? Or alternatively of the Fed reversing their tightening path as Heinz believes? Rather than just reacting to current news only.

Current Headwinds and Tailwinds for Gold

Here are Ronni’s notes from his recent presentation at the Denver Gold Show, European Forum.

In the presentation he points out what the current headwinds and tailwinds for gold likely are:

Headwinds

► Oil rolling over

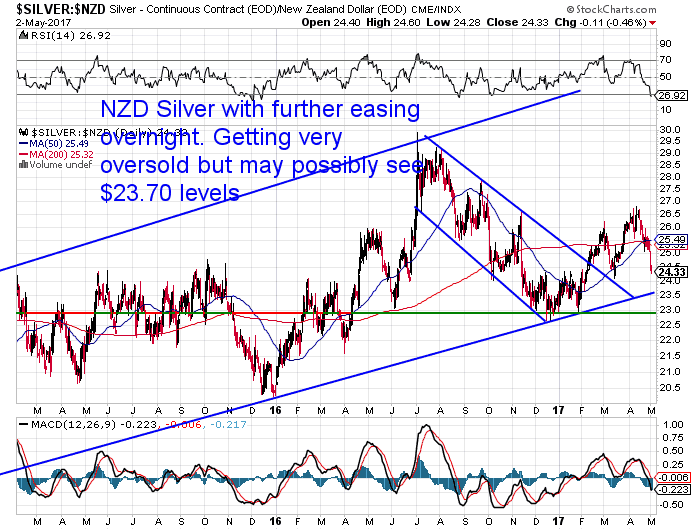

► Silver relatively weak (GS-Ratio should be falling stronger)

► Complete lack of volatility in financial markets – if this continues – gold may struggleTailwinds

► Very strong start to the year – Gold up 8 % in USD terms,

► ETF inflows picking up

► Inflation momentum starting to stir:

► Eurozone inflation was at 2% (highest level in four years)

► US inflation + 2.7% – highest rate of change in 5 years, ex food/energy +2.2%

► Consensus view: “market pricing for inflation is flat for the next 30 years”

► No shortage of policy uncertainty – Global Policy Uncertainty Index is at 17 year highs

Which Winds Will Prevail?

Our best guess is that gold is close but silver is likely bottoming out right now.

In New Zealand dollar terms silver looks to be trying to form a higher low. Or if it were to fall further, it isn’t very far to the rising trend-line, stretching back over 2 years. But look for a bounce higher from here we reckon.

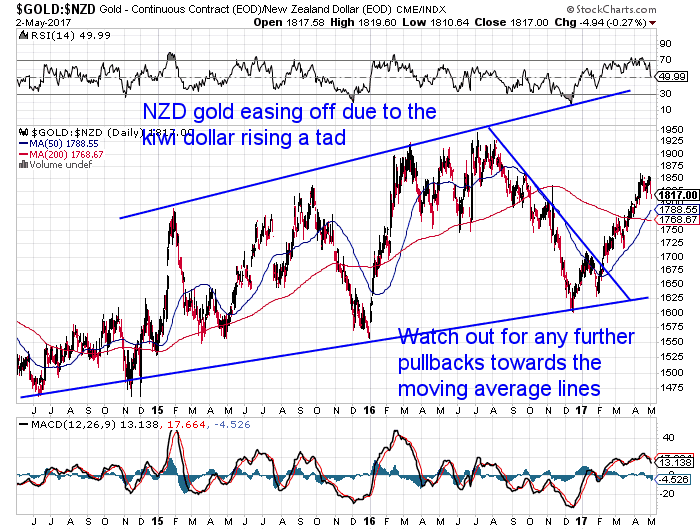

Gold may need to pull back a little further yet. Perhaps look out for the moving average lines at $1788 and $1768.

So the “Big Money” has been buying while smaller retail investors have not. That’s been the case in the USA and Europe and our experience here in New Zealand has been the same.

If you want to join the “big money” buyers then go here to get a quote.

Pingback: NZD Silver Bottom is Here - Technical and Sentiment Analysis - Gold Survival Guide