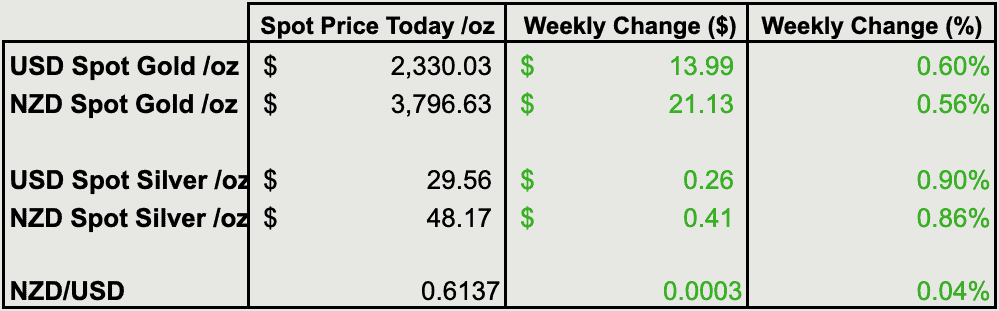

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3629 |

| Buying Back 1kg NZ Silver 999 Purity | $1434 |

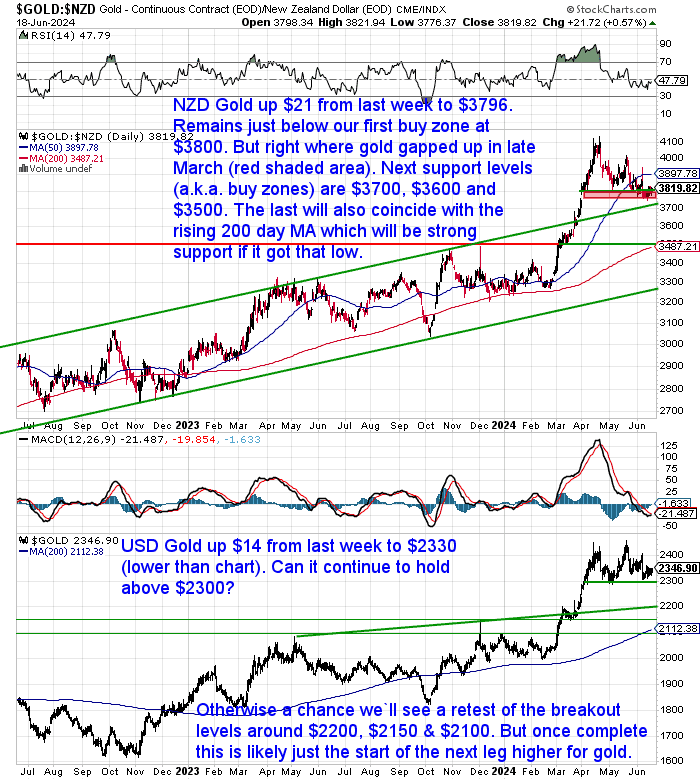

Gold Still Hovering Around Support Levels

Gold in NZ dollars is up $21 (0.5%) from last week to $3796. It remains just below our first buy zone at $3800. But so far it is holding right where it gapped higher back in late March (indicated by the red-shaded area in the chart). So the fact that it has backfilled this gap was not a big surprise as this often happens. But now if it can’t hold there, then the next support level is not far below at $3700. Then below that are $3600 and $3500 which also will coincide with the rising 200-day moving average (MA). So we could expect very strong support there if it got that low.

While in USD terms, gold was up $14 to $2330. So far it has managed to hold above the support line at $2300. Can it continue to do so? Otherwise, the next support would be down at $2200, then $2150 and $2100.

Once this current consolidation plays out we can expect to see prices run even higher.

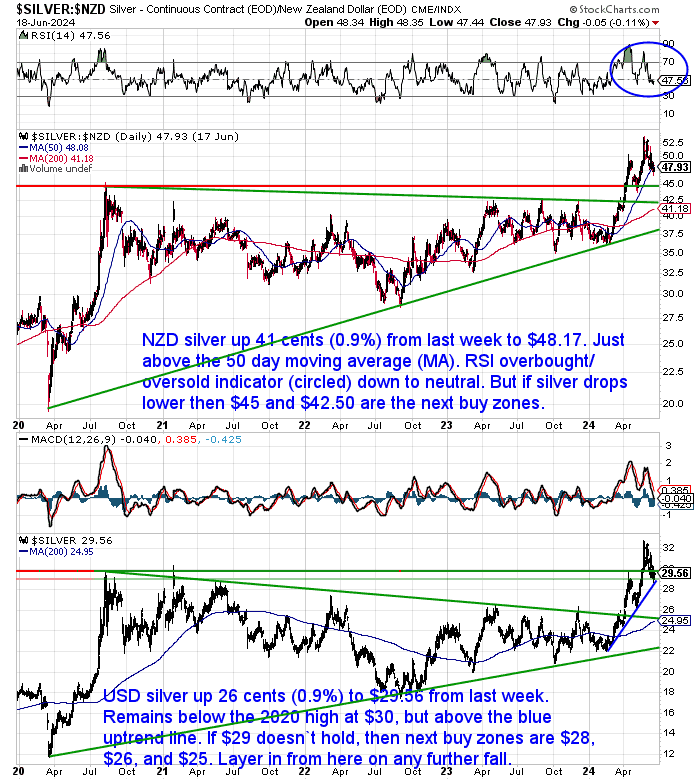

Silver in New Zealand dollars was up 41 cents from last week to $48.17. Back just above the 50-day MA. If silver drops clearly below that mark, then the next buy zones to watch for would be $45 and $42.50. The rising 200-day MA is also heading towards $42.40, so just like with gold there should be strong support around there.

USD silver is in a similar place. Up 26 cents and rising off the blue uptrend line, it remains above $29. But if that doesn’t hold then buyzones are $28, $26, and $25.

With the RSI overbought/oversold indicators down just below neutral (50), both gold and silver are delicately poised and could go either way from here. So we think it could be a good idea to layer in. If you’re looking to buy, split your funds up into say 3 or 4 tranches, buy some now and some more on any pullbacks. If that doesn’t happen at least you’ll have a foothold at lower prices.

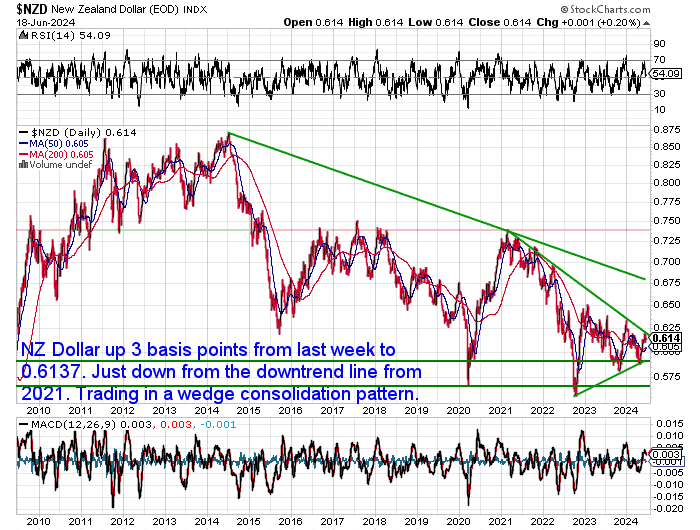

NZ Dollar Continues in Wedge Consolidation Pattern

The NZ dollar was up just 3 basis points from last week to 0.6137. It’s down just a touch from the downtrend line dating right back to 2021. So it continues to trade in this narrowing wedge consolidation pattern.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

(BYOB) Be Your Own Bank: This Week’s Take on Financial Independence

Feeling disillusioned with the traditional financial system? This week’s feature article introduces a radical concept – becoming your own central bank!

The article explores the idea of:

- Taking control of your personal finances and achieving a level of financial independence

- Using precious metals like gold and silver as a foundation for this self-directed approach

- The potential benefits and challenges associated with this unconventional strategy

- Why you might want to do this even if your nation’s central bank has large gold reserves

Intrigued by the idea of breaking free from reliance on central banks and building your own financial security? This article explores this thought-provoking concept and offers insights for those seeking alternative paths to financial freedom.

Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Become a Gold Survival Guide Partner

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Survival Guide Q&A Call Recording: Analysing the Silver Breakout

In case you missed our recent Q&A call there is a recording available.

The theme was: “Analysing the silver breakout”.

We delved into various charts and looked at:

- Why this current breakout in silver is so significant

- What levels to look for as possible buying zones in the current consolidation or pullback

- Some potential price targets to look towards in the future

- Timing for these targets

- Plus we answered over 30 questions from our readers

Q&A Call Recording: Analysing the Silver Breakout

Silver: In a Similar Stage to 2009?

As we’ve alluded to in the charts already, gold and silver could go either way here, in the short term anyway. But Bob Coleman makes a good point about paying too much attention to short term trading advice. His comparison to the 2008-2209 low is very interesting too. Along with what we covered in the Q&A call, this is more support for the idea that much higher silver prices are ahead of us…

“I posted this thread on #silver last August of 2023. When investing, stick to a plan whether long-term or short-term. I provided a longer-term forecast for silver and the path I believe it is following.

I have seen many on social media calling for a top in precious metals, telling people to lock in profits, or expecting a large pullback. For physical owners, we tend to have a long-term perspective. Trading and subscription services have their place, however, do not let their opinions sway you from your longer-term plan.

“I will now compare the 2008 chart and 2023 chart side by side. Look at the similarity or fractal between these charts. I also inserted Silver’s chart from 2008-2011 to show the potential move that may be coming if the fractal or repeating pattern comes to fruition.”

Lessons From a Silent [NZ] Housing Crash

An interesting article this week from Greg Smith, Head of Retail at Devon Funds.

He points out that despite the dip in NZ real estate prices it remains very expensive on international comparisons. Could they therefore struggle to gain much in the next decade?“…with property prices remaining extended in terms of various valuation and affordability metrics, it is not a stretch to conceive of a scenario where New Zealand has a decade of no real increases in house prices. History can repeat, and possibly the most extreme example of a property market taking decades to recover is Japan – in 1989 the bubble got to a point where the Japanese Imperial Palace was worth more than the State of California.

This is an extreme suggestion perhaps, but against this backdrop, is there a case for much greater, and somewhat more urgent diversification by Kiwi investors?”

Of course, being a funds manager he then goes on to expand on the benefits of investing in the sharemarket. Diversification of course makes sense. However we’d also ask the question is there a chance that shares do something similar to property and to what they did in the 1970’s? That is, to go up in nominal or dollars terms but in real (after inflation) terms they don’t go anywhere?

So by all means put some money into the sharemarket. But first we’d suggest making sure you have a foundation of real no counterparty risk assets of gold and silver. That way you should be covered if other assets go nowhere in real terms.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles:

Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves

Mon, 17 Jun 2024 11:56 AM NZST

Why should you become your own central bank? Does it depend on how much gold your own home country’s central bank holds? You’ll discover the answer in this article. Along with other ways to mimic central banks in protecting your finances. RBNZ Doesn’t Have Any Gold, RBA Doesn’t Have Much Either How much gold does […]

The post Why You Should Become Your Own Central Bank – Even if Your Nation’s Central Bank Has Gold Reserves appeared first on Gold Survival Guide.

Read More…

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: $1517.49 (pick up price – dispatched in 2 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $27,523.90

Backdated coins: $27,197.65

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon.

Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.