This Week:

- Correction Over Already?

- A Model for Tracking Gold’s Short-Term Fundamental Fair Value

- Support Building to Abolish NZ$100 Note

- Other Plans to Attack Cash

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1664.03 | + $12.05 | + 0.72% |

| USD Gold | $1209.25 | + $9.09 | + 0.75% |

| NZD Silver | $24.12 | + $0.71 | + 3.03% |

| USD Silver | $17.53 | + $0.52 | + 3.05% |

| NZD/USD | 0.7267 | + 0.0002 | + 0.02% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1598 |

| Buying Back 1kg NZ Silver 999 Purity | $738 |

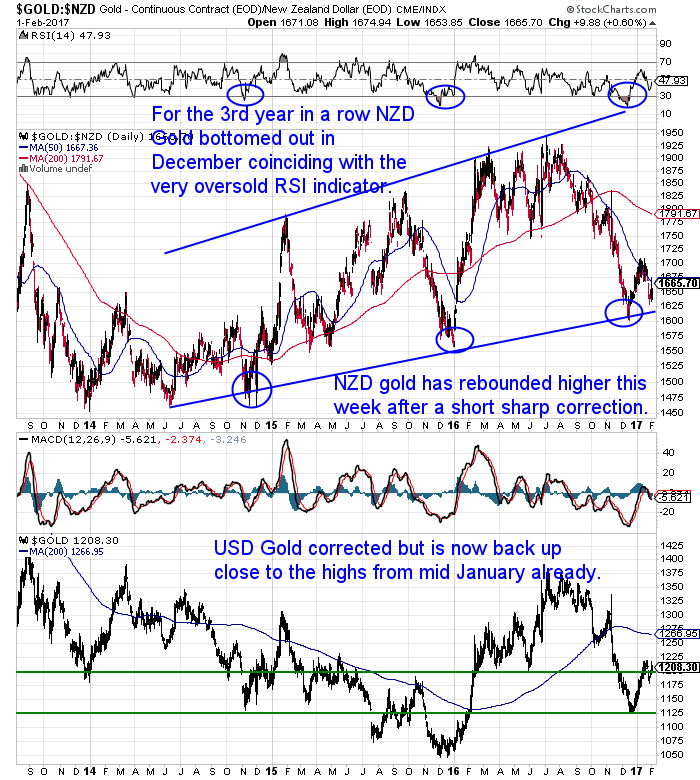

Correction Over Already?

It appears the correction after the sharp New year move higher may be over already. It was short but sharp for gold in NZ Dollars. The price dipped down below $1640 briefly this week but then abruptly bounced higher. Today it is right on the 50 day moving average again.

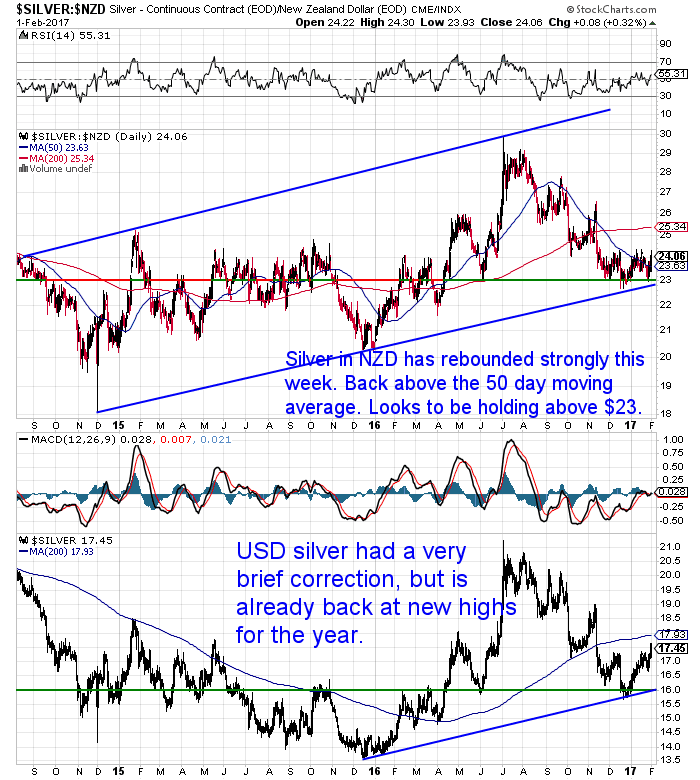

NZD silver also only pulled back for a few days. It held above the $23 support line and also stayed above the longer term rising blue trendline. Today the price is up 3% on what it was a week ago.

The NZ dollar may well help to nudge the local gold and silver prices higher now too. The Kiwi has powered higher all January. Now though it may be turning back down after such a strong move up.

Both metals are in potentially low risk purchase zones now. Having spent 6 months correcting lower, gold and silver look to have bottomed out. They are now not too far above their rising support lines. So a good place to be taking a position in either metal.

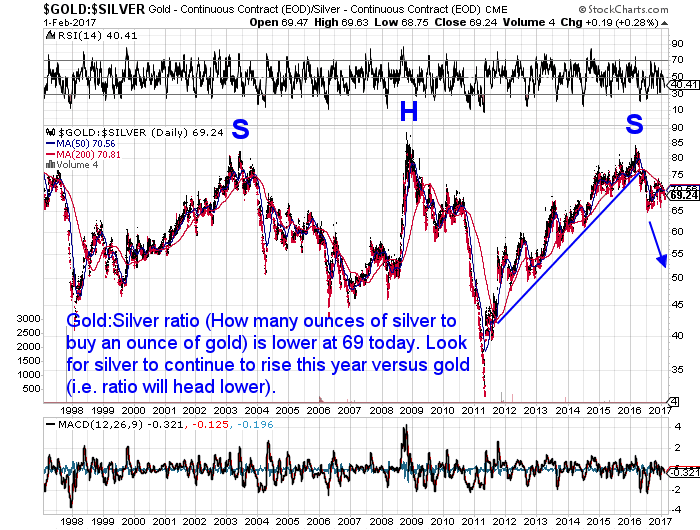

But particularly in silver we’d say. The Gold/Silver Ratio remains pretty high historically (the number of ounces of silver it takes to buy an ounce of gold). But even after falling from the highs of early 2016, it still has a long way further it could come back yet. So if gold keeps rising, then silver looks likely to rise even more.

A Model for Tracking Gold’s Short-Term Fundamental Fair Value

Here’s something worth keeping an eye on. The NIA’s gold undervalued/overvalued ratio was back in the undervalued zone 2 days ago.

It tracks the difference between the forward 5-year price inflation rate minus the forward 24-month Fed Funds Rate. Basically how well interest rates are tracking expected changes in inflation rates.

The NIA model for gold price movements seems to be working pretty well. On Tuesday they issued the following comment that gold was set to rise by $59 per ounce. Yesterday gold spiked up above US$1200 again. So it looks like this move higher is underway?

“Gold Ready to Rise by $59 Per Oz

On December 27, 2016, NIA predicted with gold at $1,132 per oz that it was about to make an explosive short-term rally of $78 per oz to $1,210 per oz. Over the following 13 trading days, gold soared by $87 per oz to a high on January 17th of $1,219 per oz!

Since January 17th, gold has dipped to $1,188.40 per oz but gold’s fundamentals have continued to rapidly strengthen – with the forward 5-year price inflation rate rising 13 basis points to a new multi-year high of 1.96%! Meanwhile, the forward 24-month Fed Funds Rate has only risen by 4 basis points to 1.58% – a sign that the Fed is continuing to fall dangerously behind on inflation, a best case scenario for gold! Click here to see for yourself!

The difference between the forward 5-year price inflation rate minus the forward 24-month Fed Funds Rate has increased since January 17th by 9 basis points to 38 basis points – causing gold’s short-term fundamental fair value to rise to $1,248 per oz!

NIA’s exclusive one-of-a-kind gold undervalued/overvalued ratio is back in the undervalued zone – with gold now due to rise by $59 per oz in the days ahead! Click here to see NIA’s brand new exclusive gold charts!”

Support Building to Abolish NZ$100 Note

Two weeks ago we posted this article: In the Banker War on Cash, New Zealand and Canada Are the Next Major Countries on the Banker Hit List

The writer JS Kim postulated that New Zealand and Canada were the likely targets amongst the major nations to have plans hatched to crack down on the use of cash.

This week we were forwarded an interesting article (thanks Roger!), that would seem to add weight to this idea that the New Zealand government will soon implement some kind of crack down on cash.

It is written by a compliance company that specialises in getting businesses compliant with anti-money laundering (AML) legislation. They make the argument that:

“Cash is still the most efficient way to launder money. It is less traceable than Bitcoin, much more widely accepted than precious stones, and less volatile than property.

…Countries will need to work together to reduce the money laundering threat of cash. With an increasingly global economy, cash can easily be transferred to a different currency or carried over borders. It’s such a hot topic that presidential candidate Bernie Sanders is calling for the US to join Canada and Singapore in abolishing larger value notes. The 500 euro, 100 US dollar and 50 pound notes are tipped to go next; could the 100 NZD note follow suit?

Compared to most other developed nations, New Zealand has the ability to be an almost cashless financial system. Eftpos and credit cards are accepted almost universally, with Smartphone-supported payment apps rising in popularity. Despite this, there is more cash in circulation than ever before: the Reserve Bank reports there is as much as $5 billion in circulation. Offering electronic alternatives to cash has clearly not decreased the perceived necessity of cash. Perhaps getting rid of the $100 note will?

While there would inevitably be some downsides to doing away with cash, the advantages to combatting money laundering in New Zealand outweigh them. So what is stopping the New Zealand government from getting rid of the $100 note? It’s up to the policy makers to make the next move.”

We’ve been warning people here in NZ of this possibility over the past year.

As we said back in this article, Not Long Until the “War on Cash” Comes to New Zealand, we think if you are holding any cash as an emergency reserve, it would pay to stick to $50 or perhaps even $20 notes instead of $100.

As we commented in the above article, the IRD has been cracking down on tradespeople doing cash jobs for the past couple of years, so removing cash will also be used as an excuse to make them pay their “fair share” of tax too no doubt.

Other Plans to Attack Cash

It seems that further moves are afoot in Europe to attack cash too. While individual countries have imposed various restrictions, there is now legislation in the pipeline to make a crack down on the use of cash European Union wide.

Of course it’s the same old chestnut that cash is just used by criminals and money launderers. The article above, reasoning why the NZ government should do away with cash, says:

But would they really? If they remove the $100 note, crims will just use $50’s and so on. If cash is removed altogether the crims will come up with other means.

It’s more likely that the average person will be significantly affected. The below article gives some interesting data (albeit for the USA), on just what cash is used for:

– 52% of grocery purchases, along with personal care products, are made in cash

– 62% of purchases up to $10 are made in cash

– But even at much higher amounts over $100, nearly 1 in 5 purchases are still made using physical cash

This doesn’t sound life nefarious criminal activity to me.

It seems that perfectly normal, law-abiding citizens still use cash on a regular basis.

But that doesn’t seem to matter.”

Here’s the low down on the EU plan.

The -Other- “Ban” That Was Quietly Announced Last Week

Plus see this Zerohedge article, For more detail about what is planned:

Europe Proposes “Restrictions On Payments In Cash”

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare? For just $290 you can have 4 weeks emergency food supply.

For just $290 you can have 4 weeks emergency food supply.

—–

An Interesting Perspective on the War on Cash

Simon Black of sovereignman.com also published some other interesting research a couple months ago on countries that use high denomination notes. It goes completely against what the establishment is saying about cash and corruption:

“Rogoff, like most of his colleagues, contends that large bills like the $100 or 500 euro note are only used in “drug trade, extortion, bribes, human trafficking. . .”

In fact they jokingly refer to the 500-euro note as the “Bin Laden” since it’s apparently only used by terrorists.

Give me a break.

My team and I did some of research on this and found some rather interesting data.

It turns out that countries with higher denominations of cash actually have much lower crime rates, including rates of organized crime.

The research was simple; we looked at the World Economic Forum’s competitive rankings that assesses countries’ levels of organized crime, as well as the direct business costs of dealing with crime and violence.

Switzerland, with its 1,000 Swiss franc note (roughly $1,000 USD) has among the lowest levels of organized crime in the world according to the WEF.

Ditto for Singapore, which has a 1,000 Singapore dollar note (about $700 USD).

Japan’s highest denomination of currency is 10,000 yen, worth $88 today. Yet Japan also has extremely low crime rates.

Same for the United Arab Emirates, whose highest denomination is the 1,000 dirham ($272).

If you examine countries with very low denominations of cash, the opposite holds true: crime rates, and in particular organized crime rates, are extremely high.

Consider Venezuela, Nigeria, Brazil, South Africa, etc. Organized crime is prevalent. Yet each of these has a currency whose maximum denomination is less than $30.

The same trend holds true when looking at corruption and tax evasion.

Yesterday we wrote to you about Georgia, a small country on the Black Sea whose flat tax prompted tax compliance (and tax revenue) to soar.

It’s considered one of the most efficient places to do business with very low levels of corruption.

And yet the highest denomination note in Georgia is the 500 lari bill, worth about $200. That’s a lot of money in a country where the average wage is a few hundred dollars per month.

Compare that to Malaysia or Uzbekistan, two countries where corruption abounds.

Malaysia’s top cash note is 50 ringgit, worth about $11. And Uzbekistan’s 5,000 som is worth a paltry $1.57.

Bottom line, the political and financial establishments want you to willingly get on board with the idea of abolishing, or at least reducing, cash.

And they’re pumping out all sorts of propaganda to do it, trying to get people to equate crime and corruption with high denominations of cash.

Simply put, the data doesn’t support their assertion. It’s just another hoax that will give them more power at the expense of your privacy and freedom.”

So make some noise about any plans that get brought up here in New Zealand. The forced removal of cash is NOT a good thing by any means. It will likely have little to no effect on criminals, but it will affect you.

Of course the other way to protect yourself from a war on cash is to own physical gold and silver. Like cash they offer privacy. Unlike cash they preserve your purchasing power in the long run. And considering a kilo of gold is about the size of a smartphone and is today worth $55,054, it also takes up a lot less space.

Given the lack of counter-party risk when you hold physical precious metals and the technical set-up, there is not too much downside to buying at the moment.

Of course, we offer much less than 1 kilo gold bars too! Get in touch for a quote for an ounce up.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

This Weeks Articles:

The -Other- “Ban” That Was Quietly Announced Last WeekWed, 1 Feb 2017 12:24 PM NZST  The “War on Cash” is steadily gathering steam in its advance. The European Union now looks to be hatching a plan to restrict the use of cash across the whole of Europe… The -Other- “Ban” That Was Quietly Announced Last Week By Simon Black – Originally posted at Sovereignman.com Most of the world is […] The “War on Cash” is steadily gathering steam in its advance. The European Union now looks to be hatching a plan to restrict the use of cash across the whole of Europe… The -Other- “Ban” That Was Quietly Announced Last Week By Simon Black – Originally posted at Sovereignman.com Most of the world is […]

|

Bill Bonner: Trump Is No Match for the Deep StateWed, 1 Feb 2017 11:45 AM NZST  Bill Bonner is a joy to read. Often controversial, always witting and entertaining. Lately he has been riling his readers with his negative views on Trump – or at least his chances of making “America Great Again”. Here’s why he thinks Trump will in the end prove no match for the Deep State… Weekend Edition: […] Bill Bonner is a joy to read. Often controversial, always witting and entertaining. Lately he has been riling his readers with his negative views on Trump – or at least his chances of making “America Great Again”. Here’s why he thinks Trump will in the end prove no match for the Deep State… Weekend Edition: […]

|

20/20Wed, 1 Feb 2017 11:26 AM NZST  The U.S. stock market index, the Dow Jones Industrial Average, recently got over 20,000 for the first time ever. However when measured in other ways the index is still a long way from it’s peak. But one thing that is definitely at a peak is US Government debt. Read on to see what the year […] The U.S. stock market index, the Dow Jones Industrial Average, recently got over 20,000 for the first time ever. However when measured in other ways the index is still a long way from it’s peak. But one thing that is definitely at a peak is US Government debt. Read on to see what the year […]

|

Inflation Rates Edging Higher – Impact?Thu, 26 Jan 2017 4:17 PM NZST  This Week: Big Mac Index: NZ Dollar Overvalued Inflation Rates Edging Higher Trump and a New Gold-Backed Dollar Axis of Gold to Overthrow the US Dollar Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1651.98 – $40.13 – 2.37% USD Gold $1200.16 – $4.79 – 0.39% NZD […] This Week: Big Mac Index: NZ Dollar Overvalued Inflation Rates Edging Higher Trump and a New Gold-Backed Dollar Axis of Gold to Overthrow the US Dollar Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1651.98 – $40.13 – 2.37% USD Gold $1200.16 – $4.79 – 0.39% NZD […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2017 Gold Survival Guide. All Rights Reserved. |

Pingback: Here’s Proof the NZ Government is Following the IMF’s “War on Cash” Doctrine - Gold Survival Guide