Prices and Charts

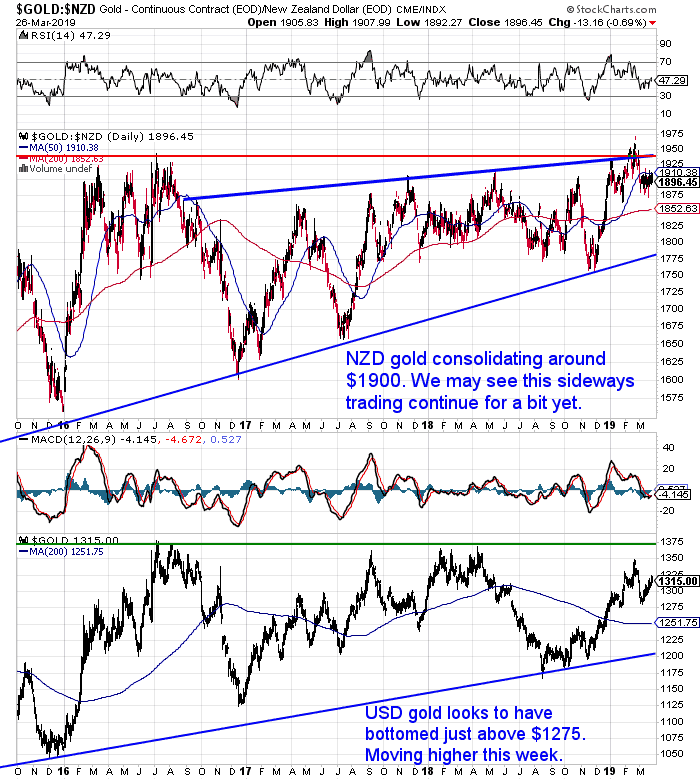

Gold Consolidating

Very little change in the price of gold in New Zealand dollars this past week. Gold is consolidating around the $1900 mark.

It is holding up surprisingly well. After the strong run up since December, it would not have surprised us to see a larger pull back than we have seen to date.

Of course that doesn’t mean it still won’t happen. But this remains a good level to at least take an initial position.

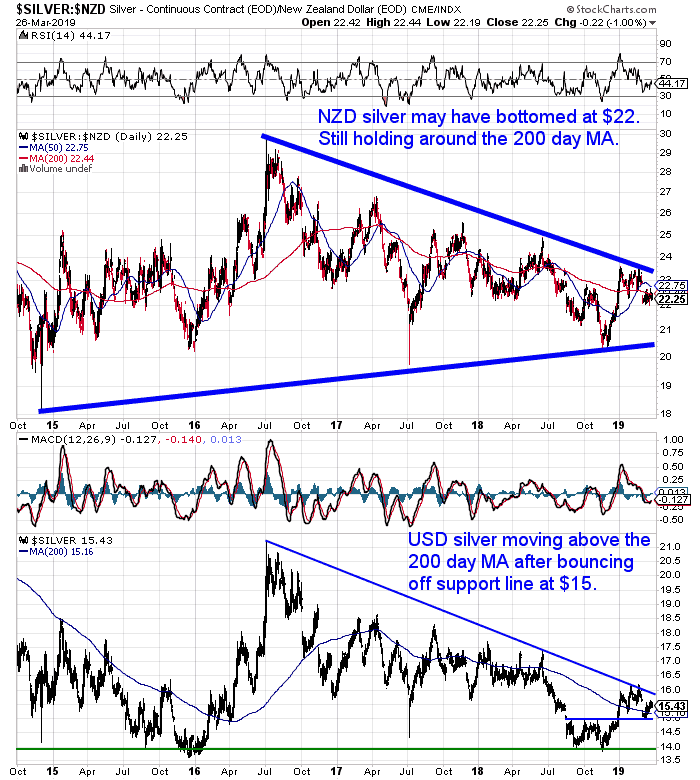

Silver Also Treading Water

NZD silver is down slightly from a week ago. But it too continues the sideways consolidation pattern around its 200 day moving average.

As with gold, right now is a good place to take an initial position. Silver looks to be basing to move higher (although to be fair we have thought that for a while!).

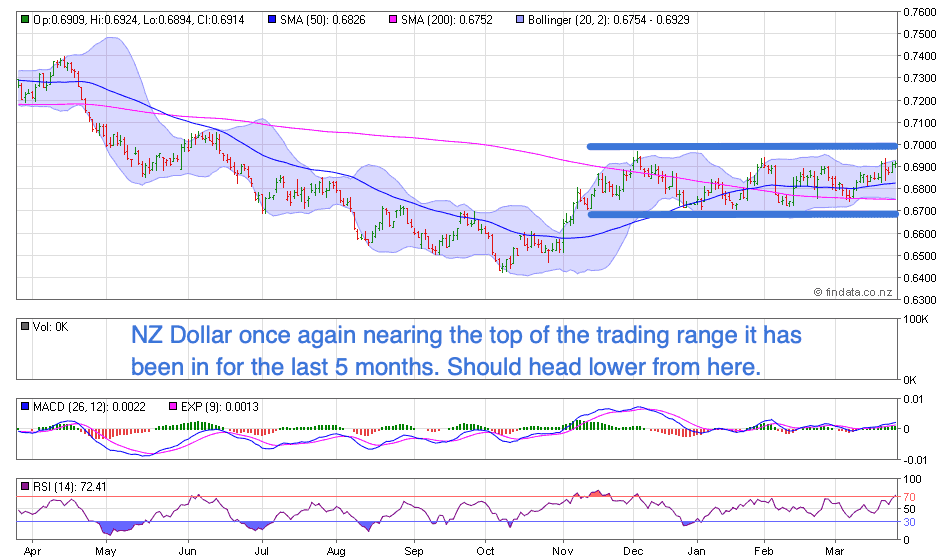

The NZ dollar is once again sitting near the top of the sideways trading range it has been in for the past 5 months. With the RSI close to overbought levels, we’d expect to see the dollar turn down once again from here. So that should be supportive of local gold and silver prices in the near term.

The NZ dollar is once again sitting near the top of the sideways trading range it has been in for the past 5 months. With the RSI close to overbought levels, we’d expect to see the dollar turn down once again from here. So that should be supportive of local gold and silver prices in the near term.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

New Zealand Dollar Third Best Performing Currency Since 2001 – So Why Does it Still “Suck”?

We came across an interesting table showing the little old New Zealand Dollar had been the third best performing currency since 2001.

But we dig a little deeper into this table and it shows that the NZ dollar hasn’t really been so crash hot after all.

Read on to learn why…

UK Economist: NZ Central Bank Will Sacrifice the New Zealand Dollar

Speaking of the New Zealand Dollar…

UK-based economist Andrew Hunt spoke this week at an investment conference in Wellington organised by Nikko Asset Management.

“Concerns about liquidity in wholesale interest rate markets globally is one of the reasons the Reserve Bank is proposing to nearly double banks’ minimum tier 1 capital, to ready the banks to withstand a one-in-200 year catastrophe, Hunt says.”

Since regulators in the United States and Japan have acted to stop banks from lending in emerging markets, the world has gone from a glut of credit to a shortage.

He cited a number of risks currently including:

- How the world is already in a trade and industrial production recession as a result of this credit squeeze.

- Asian nations will export deflation via their cheaper goods offsetting the inflationary impact of rising wages in the US.

- Due to tax incentives, US corporates repatriated US$220 billion, within 10 days of last November mid-term US elections.

- There is US$750-800 billion of Treasuries to be issued in April and May. Who will buy them? Given three-month yields are now higher than on 10-year Treasuries,

- The wider economy in China is feeling a credit crunch and its economic growth is slowing. Growth likely to drop to about 3 percent this year. Down from 6.6 percent in 2018, which was already the slowest pace in 28 years.

- Growth is also slowing in Japan and Europe and all this means the IMF forecast of 3 percent world growth in 2019 “is a joke,” Hunt says.

“All these events have fed into the Reserve Bank of New Zealand’s calculations and Hunt says the central bank will sacrifice the New Zealand dollar – by cutting interest rates – to ensure nominal GDP growth.

“If you’re a small, open economy, the easiest way to maintain GDP growth is through your currency – if your terms of trade remain quite consistent, it works very well,” he says.”

Source.

So according to Hunt, the points we made last year in The Number One Reason to Buy Gold in New Zealand Today, still look to be in play today.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Central Banks Unorthodox Policies Have Become the Norm

Central Banks are realising troubles are around the corner.

As the Daily Reckoning reported after last weeks Federal Reserve announcement:

“From the Fed’s “Open Market” Committee:

In light of global economic and financial developments and muted inflation pressures, the committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

In fact… the august ladies and gentlemen of the FOMC project no rate hikes at all this year.

In December they were projecting two 2019 rate hikes.

Moreover, the committee as a body projects just one single rate increase in 2020… and none in 2021.

The committee also announced it would halt quantitative tightening in September — far ahead of schedule.

Is this the conduct of an organization expecting blommosing [sic] growth ahead?

It is not.

The committee now forecasts 2.1% growth for 2019.

It further expects growth to slip to 1.9% in 2020.”

The Fed has not gone back to quantitative easing. But it has announced it is giving up on its attempt to return its balance sheet to any semblance of normality.

So what was once unorthodox monetary policy has become the norm.

As Greg Canavan from Rum Rebellion points out:

“The thing is, when unorthodox policy becomes the norm, central banks are no longer the last report [resort]. Gold is the last resort. That may not be apparent now. And it may still take some time to dawn on the broader market.

But physical gold is the only safe haven monetary asset that is not debt. That is, it doesn’t come with counterparty risk. When central banks decide it’s normal to create money at will to ‘monetise’ existing debt in the system, gold will catch a bid.

What’s the difference between now and back in 2010–15 when all the central banks are doing just this, and the gold price actually fell after peaking in 2011?

Well, back then, the market thought they were emergency measures and correctly assumed these measures would revive the economy. As such, there was no need to hold insurance in the form of gold.

The market will tell us what it thinks of this latest episode soon enough. But it appears to me as though central banks are saying what was once an emergency is now just normal policy. If that is the case, gold should react very differently this time around.”

Make sure you have your no-counterparty-risk financial insurance in place before the markets conclusion is obvious.

Get it touch if you have any questions or would simply like to have a chat.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Just One Left – Shop the Range…

—–

|