This Week:

- What “unconventional monetary policy” may look like in New Zealand

- How Will the Global Monetary System Change Take Place?

- The Night That Is Upon Us and the Dawn of a New Era

- Dollar – The Greatest Pyramid Scheme Of All Time

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1818.94 | + $4.51 | + 0.24% |

| USD Gold | $1316.18 | – $8.17 | – 0.61% |

| NZD Silver | $25.84 | + $0.38 | + 1.49% |

| USD Silver | $18.70 | + $0.12 | + 0.64% |

| NZD/USD | 0.7236 | – 0.0063 | – 0.86% |

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1737 |

| Buying Back 1kg NZ Silver 999 Purity | $789 |

Gold in NZ dollars continued its pullback this week. It is once again closing in on the 200 day moving average. This is a key area to watch. Since gold got above this line in the first few days of 2016 it has managed to stay above it apart from 2 brief dips in June. So this is indicative of a healthy uptrending market.

We could also see it dip to once again test the horizontal support/resistance line at $1775.

However the odds favour any purchase around these levels working out pretty well in the long run.

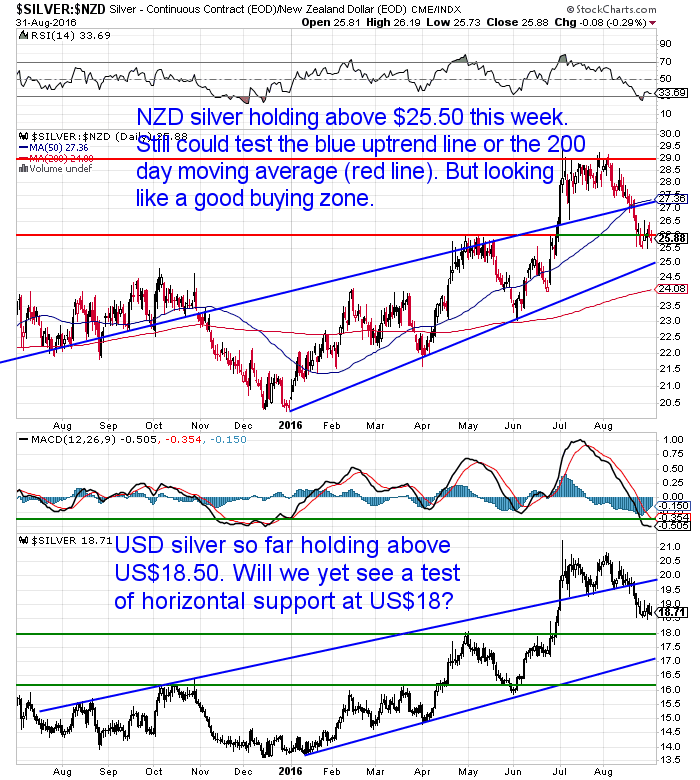

Conversely silver has actually managed to edge up higher this week. It is holding above $25.50 for now. We may still see it test the rising trend line at $25.00. Or even the 200 day moving average at $24.

But like gold we could be entering a good long term buy zone at these levels.

The NZ Dollar managed to close above 0.73 this week but has since pulled back. The longer term trend certainly remains up though.

How Will the Global Monetary System Change Take Place?

There is a theme connecting a number of the articles on the website this week. That is the global monetary system.

First up we have a video that runs through how the monetary system has changed over the past 100 or so years.

Dollar – The Greatest Pyramid Scheme Of All Time

Then our “favourite billionaire” looks at the impact of these changes and the way the world and in particular humanity itself now behaves as a result.

The Night That Is Upon Us and the Dawn of a New Era

Then finally, our feature article looks at a few very recent changes that are taking place behind the scenes that are steadily lessening the importance of the global reserve currency that is the US dollar.

We also attempt to answer a reader’s question as to how the end of the US Dollar as reserve currency will take place. No easy question!

How Will the Global Monetary System Change Take Place?

Central Bankers Getting Even More Desperate

We noted last week that the central banker gathering at Jackson Hole may impact gold prices in the short term. Traders still seem to take way too much notice of what these bureaucrats have to say.

But this gathering shows that they are getting more desperate in their dastardly plans:

- “Buried in the hyperventilating about Janet Yellen’s “will she or won’t she” speech last Friday was a far more important development…

- It happened at the same Federal Reserve conference Yellen spoke at in Jackson Hole, Wyoming. But it received almost zero attention.

- And the monetary criminals pulling levers at global central banks want to keep it that way.

- You see, the conference was titled “Designing Resilient Monetary Policy Frameworks for the Future”…

- But the influential central bankers in attendance veered from that script to issue a desperate plea for help that few in the mainstream media picked up on…

- …At Jackson Hole, Yellen, Bank of Japan governor Haruhiko Kuroda, and European Central Bank board member Benoit Coeuré pleaded for “bold” fiscal stimulus from developed countries to help produce the growth they couldn’t.

- …Monetary policymakers have no solutions to spur growth. That’s out in the open now. That’s why they are now “off script” and begging for a fiscal rescue.

- And global governments have no fix either. The structural changes that might spur growth, like lowering personal and corporate taxes and reducing inane regulations, are not any leader’s agenda.

- But perhaps the biggest issue to hinder growth is the complete and utter lack of personal responsibility we see on a global scale…”

- Source.

So more evidence that we are edging closer to the possibility of “helicopter money”. Government spending – likely on “infrastructure” – funded by money printing.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $190 you can have 4 weeks emergency food supply.

For just $190 you can have 4 weeks emergency food supply.

What “unconventional monetary policy” may look like in New Zealand

In light of the talk at Jackson Hole about unconventional “monetary policy”, this week we saw an opinion piece published by the head of fixed interest at Harbour Asset Management on just this topic for New Zealand.

Now granted he was not making recommendations as to what the RBNZ should do here. He even states “It is not our central view that the RBNZ will need to apply unconventional monetary policy. “

However the fact we have someone actually looking at what “unconventional monetary policy” in New Zealand may look like is quite telling we think. Only a year or so ago this thought would not have entered the mainstream psyche at all. Here is an excerpt:

- “It is not our central view that the RBNZ will need to apply unconventional monetary policy. However, with the OCR already at all-time lows, it seems timely to consider this tail risk as part of considering a range of plausible outcomes.

- In this scenario, we suspect that the RBNZ would stop cutting the OCR somewhere between 0.25% and 0.10%, judging that negative interest rates are potentially more troublesome than they are worth.

- If the RBNZ were to undertake a QE program, New Zealand Government bonds would be the obvious assets to purchase. With $75bn bonds outstanding, there is no other NZ dollar market with the same scale, liquidity, or credit quality. This is the simplest approach.

- If the RBNZ were having to loosen monetary policy aggressively in response to sharp deterioration in the housing market, it is also likely that mortgage-backed-securities (MBS) would play a role in an asset purchase program. While the MBS market is not currently a large, liquid part of the local financial market, banks would be in a position to quickly structure these securities specifically to sell to the RBNZ. In effect, the banks would be liquidising their balance sheets, exchanging mortgage assets for reserve balances at the RBNZ.

- There may also be a practical reason for the RBNZ buying MBS as part of a QE program. The RBNZ would need to be careful that their NZ Government bond purchases weren’t so large that they removed so many bonds that it harmed secondary market liquidity. In that case, the sheer scale of banks’ mortgage assets could become an alternative source of assets to purchase as part of a QE program. (By way of comparison, household debt to GDP is around 160% of GDP, compared to Government debt to GDP of around 30%).

- As a small open economy, the RBNZ has an additional tool in its armoury: the NZ dollar exchange rate. If the RBNZ were to ease policy more aggressively than its trading partners (through a lower OCR and/or QE programme), there is plenty of scope for the NZ dollar to fall from its current elevated level. In practice, this could be where the economy receives the most stimulus and immediate impulse to lift inflationary pressures.

- An asset purchase program from the RBNZ could be even more potent if accompanied by an expansion in government spending, with monetary and fiscal policy working in tandem. With one of the lowest levels of Government debt to GDP in the developed world, New Zealand has the luxury of having real room to manoeuvre with fiscal policy. Implementing this approach would require a significant change in mind-set or circumstances. At the moment, the NZ Government is still focused on reducing (not increasing) Government debt to GDP.

- However, the government has shown flexibility in the past in times of crisis, like the Canterbury earthquakes, to let the fiscal stabilisers (higher benefit payments and lower tax income) kick in to support the economy.

- In other words, while the New Zealand Government appears hesitant to pre-emptively loosen the fiscal purse strings, if a recession causes the RBNZ to embark on unconventional monetary policy, it is likely that those same circumstances would also result in more supportive fiscal policy.”

- Source.

We think the likelihood of the RBNZ resorting to the desperate measures of money printing, negative interest rates or helicopter money is not actually that remote.

If the rest of the world continues to languish with slow to no growth (and this is quite likely as these very same “cures” put into place elsewhere seem likely to be actually exacerbating the financial ills. For example negative interest rates encourage people to hoard cash rather than to spend). Then if more and more other nations resort to these measures, it ups the odds dramatically of such measures occurring here too.

One of these “tools” in the RBNZ “armoury”, namely the exchange rate, will actually likely be pressured higher if these same drastic measures spread steadily across the globe. This is exactly what we are seeing currently with the NZ dollar still rising even with an interest rate cut.

It is not the cut that matters or whether the rate ends up negative or not, but simply how New Zealand compares to the rest of the world. While they are all heading lower or coming up with even more “ingenious” ways of intervening in markets, the odds of us following grow larger.

The likes of negative interest rates are likely to continue to make gold and silver attractive to more and more people. The way the charts are shaping up currently points to now being a pretty decent time to be buying in the long run too.

Or if you’ve been thinking of buying and want to keep a close eye on the price in the coming days, you can let us do that for you: Sign up for our daily price alert.

Or if you’re ready to buy now then get in touch for a free quote. Feel free to have a “test run” and request a quote to see how the process works, even if it’s a few days before you’re ready to buy.

Faster Delivery & Lower Prices

As we said last week with prices coming off, there has been a slow down in retail demand for gold and silver lately. The upshot is the delivery for the likes of Royal Canadian Mint 1oz silver maples is the fastest it has been for some time. We still have free shipping on these boxes of 500 x 1oz Canadian 9999 purity Silver Maples delivered to your door via UPS, fully insured until you sign for them.Price today is $15,320.

Delivery in approx 7-10 business days.

Lastly, don’t forget to check out all the articles posted on the site this week linked below.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

How Will the Global Monetary System Change Take Place?Thu, 1 Sep 2016 8:48 AM NZST  In the past week or so we’ve seen evidence as to how the monetary system is continuing to change shape. Slowly but surely the US Dollar is losing its global dominance. The Daily Bell commented on reports out of Russia where they may change how the Russian Central Bank operates: “Here’s an excerpt from yet another […] In the past week or so we’ve seen evidence as to how the monetary system is continuing to change shape. Slowly but surely the US Dollar is losing its global dominance. The Daily Bell commented on reports out of Russia where they may change how the Russian Central Bank operates: “Here’s an excerpt from yet another […]

|

Dollar – The Greatest Pyramid Scheme Of All TimeWed, 31 Aug 2016 1:11 PM NZST  We’ve written previously about the gold standard and it’s various guises over the past century and a bit. For example this article touches on the classical gold standard and our thoughts on what the “ideal” would be. While in module’s 2 and 3 of our ecourse we give a quick run through of 100 years […] We’ve written previously about the gold standard and it’s various guises over the past century and a bit. For example this article touches on the classical gold standard and our thoughts on what the “ideal” would be. While in module’s 2 and 3 of our ecourse we give a quick run through of 100 years […]

|

The Night That Is Upon Us and the Dawn of a New EraWed, 31 Aug 2016 12:17 PM NZST  Our “favourite Billionaire” Hugo Salinas Price has somewhat “old school” values. You may not quite agree with all of them. However his big picture view for a more balanced world is hard to argue with. The following speech he recently gave outlines what he sees as “wrong with the world” and interestingly how the behaviour of […] Our “favourite Billionaire” Hugo Salinas Price has somewhat “old school” values. You may not quite agree with all of them. However his big picture view for a more balanced world is hard to argue with. The following speech he recently gave outlines what he sees as “wrong with the world” and interestingly how the behaviour of […]

|

How You Can Make 49% on a Gold Stock in Just One DayMon, 29 Aug 2016 1:13 PM NZST  We see physical gold and silver as “financial insurance” rather than as investments. Our theory is to remove some of your wealth from assets that have counterparty risk and place this into physical gold and silver. But if you’re looking for a gold and silver “investment”, then gold and silver miners offer some significant upside […] We see physical gold and silver as “financial insurance” rather than as investments. Our theory is to remove some of your wealth from assets that have counterparty risk and place this into physical gold and silver. But if you’re looking for a gold and silver “investment”, then gold and silver miners offer some significant upside […]

|

Will Your Bank Survive the Coming Financial Crisis?Mon, 29 Aug 2016 12:53 PM NZST  At first glance what happens to banks in the USA and Europe may not appear to matter much to us here down under. However a large percentage of NZ bank funding still comes from offshore. So a major dislocation to the financial system in other parts of the world will have a flow on effect […] At first glance what happens to banks in the USA and Europe may not appear to matter much to us here down under. However a large percentage of NZ bank funding still comes from offshore. So a major dislocation to the financial system in other parts of the world will have a flow on effect […]

|

Silver Tumbles – Buying Opportunity ArrivesThu, 25 Aug 2016 1:17 PM NZST  This Week: Silver Tumbles – Buying Opportunity Arrives Gold: All Eyes On Jackson Hole Why mortgage interest rates in Australia & NZ may rise even while central Banks cut their official interest rates Storing Precious Metals: Will Gold & Silver Survive a House Fire? Prices and Charts Spot Price Today / oz Weekly Change ($) […] This Week: Silver Tumbles – Buying Opportunity Arrives Gold: All Eyes On Jackson Hole Why mortgage interest rates in Australia & NZ may rise even while central Banks cut their official interest rates Storing Precious Metals: Will Gold & Silver Survive a House Fire? Prices and Charts Spot Price Today / oz Weekly Change ($) […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9amClick here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis - Gold Survival Guide