The Reserve Bank of New Zealand (RBNZ), issued a bulletin on 4 May 2018. The bulletin outlined 5 unconventional monetary policy plans the RBNZ could implement in case of a crisis. Including that the RBNZ is prepared to print money.

The bulletin entitled “Aspects of implementing unconventional monetary policy in New Zealand” outlined these 5 potential tools:

- Negative interest rates: the OCR could be cut to as low as -0.75%

- Forward guidance: the RBNZ would clearly signal its intentions

- QE: the RBNZ would consider buying large amounts of government and corporate bonds on the secondary market, and potentially foreign government bonds

- Interest-rate swaps: the RBNZ could use this market to influence broader interest rates

- Term lending facilities for banks: the RBNZ would lend to banks against collateral, guaranteeing them liquidity

The authors noted:

“While there is no need to introduce unconventional monetary policies in New Zealand at this time, it is prudent to learn from other countries’ experiences and examine how such polices might work in New Zealand if the need arises.”

Probability of Needing Money Printing and Negative Interest Rates “Higher Than it Ever Was in History”

The report looked at the experiences of other countries who engaged in money printing and negative interest rates in the wake of the global financial crisis.

The authors then considered the implications of implementing each of these 5 unconventional policies in New Zealand.

The RBNZ Assistant Governor John McDermott was interviewed by Bloomberg following the release of the report [emphasis added is ours].

“This is all about planning for the future,” McDermott said. While there’s “no imminent prospect” of using such measures, “the probability of needing them at this point in the cycle is higher than it ever was in history” and “it would be silly of us not to be ready just in case.”

Source.

McDermott also commented on the likely need for government support if such a crisis arose:

“If we felt this was necessary to protect New Zealand, we can do any of this, but the more we’re supported by the government, the more effective this would be,” McDermott said. “Maybe the government would give us more capital or indemnify us against any risk of losses we’d take on, or maybe they would just do more fiscal policy. In that kind of world, I think coordination would be important.”

We reported on this topic a couple of years ago (see: What “unconventional monetary policy” in NZ may look like).

We said then, the odds of tools such as money printing or negative interest rates being implemented by the RBNZ is not as far fetched as some would have you believe. The report from the Reserve Bank adds weight to this statement.

Related: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

Why Money Printing by the RBNZ is Not as Far Fetched as You Might Think

While money printing measures may not be just around the corner, the odds are not infinitesimal of them being implemented.

Interest rates are at historic lows, despite what has meant to have been a period of steady growth here in New Zealand.

So should another significant crisis occur, this could likely take place while rates still remain historically low. Therefore if there is no room left to cut rates, the central bank will need to look at other options.

Options such as negative interest rates and money printing in the form of direct purchase of large amounts of government and corporate bonds on the secondary market, could be what the central bank turns to.

Read more: RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)

RBNZ Would Cut Interest Rates by 1% if Growth Under 3% in 2019

In its August 2018 Monetary Policy Statement (MPS) the Reserve Bank outlined a scenario where the OCR would be cut 100 basis points (1%).

“Growth is expected to recover in our central projection. However, with surveyed business confidence falling and continued softness in the housing market, GDP growth may not recover as expected.”

They stated that if annual GDP growth stays below 3% over 2019 and it’s clear growth is not picking up as expected, “the OCR would need to be reduced by around 100 basis points” by mid-2020.

That would take the OCR down to just 0.75% (based on the 1.75% level at the time of the statement). The OCR is now at 1.50%. So we are a quarter of the way there already in and it’s only mid 2019.

Also bear in mind this 100 basis point cut would be in response to growth staying below 3% and “not picking up as expected”. Lower growth is hardly a financial crisis situation.

Then from an OCR of 0.75% it is not a massive leap to get to a negative interest rate or even quantitative easing scenario. This is one of the “what if” scenarios, reserve bank governor Adrian Orr outlined to MPs in in the Finance and Expenditure Select Committee in August 2018.

Orr told the committee these planning scenarios also consider unconventional monetary policy or as he put it:

“which I actually believe is more conventional monetary policy.”

Quantitative Easing is Being Looked at by RBNZ

In August 2018, RBNZ Head of Economics John McDermott said a scenario where policies, such as quantitative easing, would have to be adopted by the Reserve Bank is “not on the horizon”.

“But, you can never say never and things can happen in the world that you can’t control and you can’t anticipate.” If New Zealand were to be hit by a large external or global shock – “we think as an institution we need to be ready for it, just in case,” he says.

Source.

ANZ: “Very Real” Chance Monetary Policy Will Run Out of Ammo

In June 2019 we have economists at the largest bank in New Zealand, ANZ, saying there is a “very real” chance that the Reserver Bank of New Zealand’s monetary policy will run out of conventional ammunition.

They also suggested the central bank look at a series of unconventional measures, including quantitative easing.

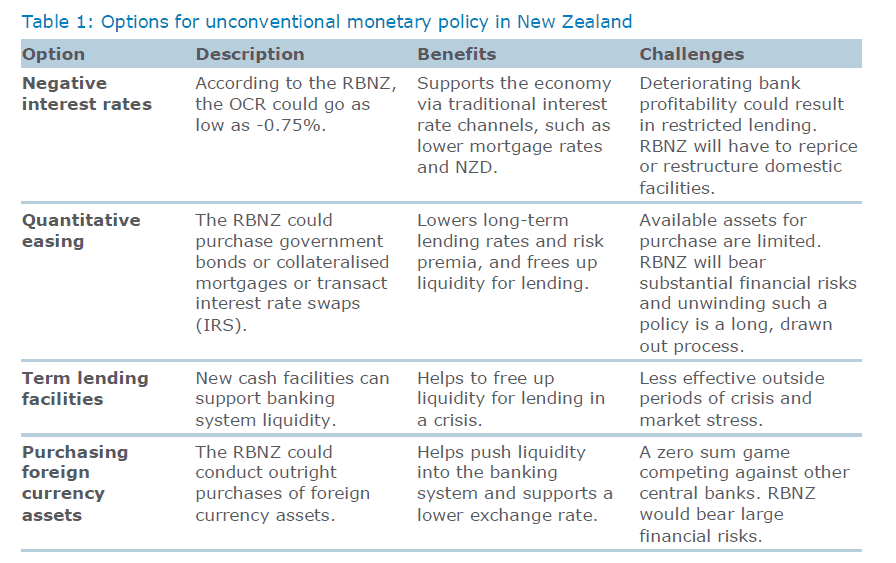

This table summarises the options they discussed:

RBNZ Review Panel Asking For Public Input on Quantitative Easing

Then on 25 June 2019, a panel set up to review the Reserve Bank’s governing legislation wants broader public input on the decision-making around quantitative easing.

Such as feedback on:

- How quantitative easing (where the Reserve Bank would inject money by buying government bonds or other financial assets) should be conducted.

- Would the central bank need ministerial consent to buy assets beyond government debt, and;

- Are there other issues the group should consider?

Source: RBNZ review seeks wider input on quantitative easing

So the once crazy notion of money printing in New Zealand seems to be getting a lot more seriously considered.

Reserve Bank is Planning for Situations Requiring Quantitative Easing – So Should You

While the reserve bank may use terms like “not on the horizon” to refer to quantitative easing plans. They are nonetheless still making them. We also now have bank economists openly discussing such plans.

Perhaps if they are then so should you.

Buying gold and silver is one way to protect your wealth from loss of value caused by negative interest rates and quantitative easing or money printing.

Learn more:What type of gold and silver to buy.

Editors Note: This article was first published May 2018. Updated 14 August 2018 with content from August 2018 RBNZ monetary policy statement. Updated again 19 June 2019 with ANZ bank economists comments on quantitative easing.

Thanks. You putting the time into these NZ based commentaries is appreciated by me, and I’m sure by others too. Scary stuff if it happens, but the wise always prepare for what could happen, even while hoping it doesn’t. Its called insurance, and widely understood.

The fact depositors in NZ could get “The Haircut” too, was a great thing to raise.

Anyone who has gone camping and forgotten matches, bugspray or a torch will agree that when you don’t have those things when you really need them, you sorely regret not being better prepared. But its too late when you need something and cant get it! To hold some gold silver & cash is hardly a burden. But if it was ever critically needed – it would be invaluable! Cheers Colin

Hi Colin, Thanks very much to you for taking the time to leave a comment. We appreciate getting feedback. Glad what we have written has been of help. As you say being prepared is not that difficult but does take some initial effort. Cheers.

Pingback: RBNZ on Central Bank Digital Currency and Negative Interest Rates - Gold Survival Guide

Pingback: RBNZ: Too Early to Say for Central Bank Digital Currency – Reading Between the Lines - Gold Survival Guide

Wow. If this plays out with lower interest rates and/or QE, the housing crisis (eg housing affordability) will get much worse before it “corrects”, and the “correction” will be much more painful for property owners with a mortgage. On the other hand, for those of us who are waiting patiently to buy into (or buy back into) the housing market, the fire-sale deals will be incredible.

Yes it is actually a quite extreme statement for the NZ central bank to make. We’ve never had a governor say such things before. And yes lower interest rates would likely send more people into property as well. As you say the day of reckoning will be that much worse as a result.

Pingback: The RBA is Destroying The Australian Economy…and No One Cares. Is the RBNZ Destroying the New Zealand Economy Too? - Gold Survival Guide

Pingback: Gold in NZ Dollars Hits New 6 Year Record High - Gold Survival Guide

Pingback: Could Negative Interest Rates Be in Store for New Zealand? - Gold Survival Guide

Pingback: How Might the RBNZ Respond to the NZ Economy Weakening Further? - Gold Survival Guide

Pingback: What Use Will Silver Coins be in New Zealand in a Currency Collapse? - Gold Survival Guide

Pingback: It’s Societal Collapse and Doomsday Week! - Gold Survival Guide

Pingback: Real Interest Rates in New Zealand | What Can They Tell Us About When to Buy Gold?

Pingback: Gold - Once Again Best Friend in a Bear Market - Gold Survival Guide

Your Kiwi PM is a great talking head during a crisis, but like many politicians with little business sense she is a dud. Promised much, including affordable housing but failed. New Zealand,s economy will be stuffed without tourism, get ready to become another state of Austrlia