Prices and Charts

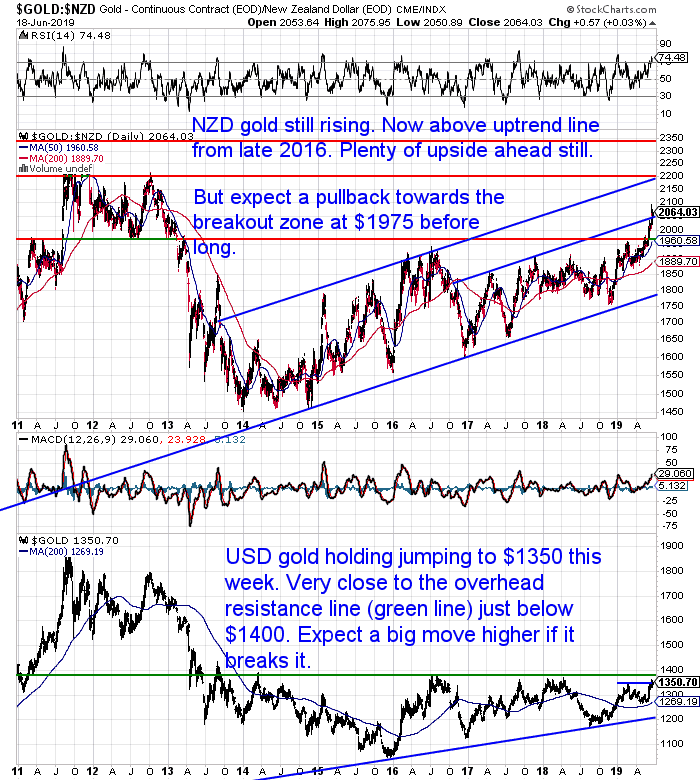

NZD Gold Still Rising

Gold in New Zealand Dollars has defied gravity this week. It continues to push higher helped by a further weakening NZ dollar exchange rate.

The price of gold in NZD now sits just above the blue uptrend line dating back to late 2016. However, the RSI is well into overbought territory. So we are overdue a pull back.

How low? Potentially right the way back to the area it broke out from. Just below $2000.

But now that NZD gold has clearly broken out any pullback is likely to be short lived. Odds now favour higher prices ahead. As the chart below shows there is plenty of upside ahead yet.

Watch for $2200 and then the all time high of $2350 is not too far above that.

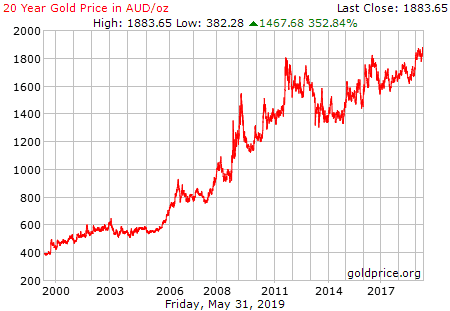

Perhaps we won’t be too far behind Australia who this week hit another all time record high for AUD gold?

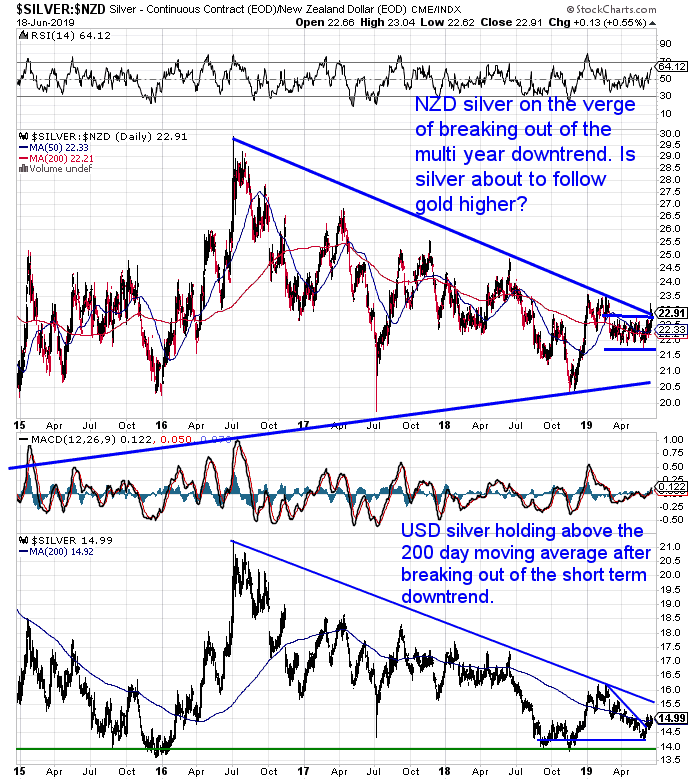

Silver Also Up Sharply This Week

For once silver also followed gold up this past week. In fact, today NZD silver sits right on the downtrend line dating back to 2016. But we have seen silver do this many times since then.

However, we get the feeling that this time could be the one.

We may be close to a breakout in silver. But, because it has been going sideways for most of this year, silver remains cheap. As a result, buying on the expectation of a breakout from here means there is likely not too much downside. Even if the breakout doesn’t happen.

We’re leaning towards the notion that silver will.

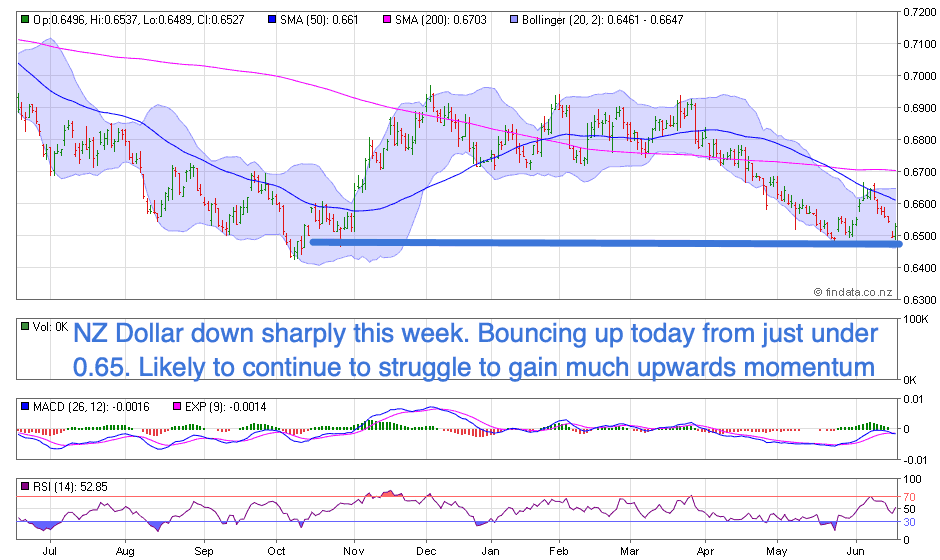

NZ Dollar Fall Continues

The New Zealand Dollar is down 0.81% this week. It again dipped just below 0.65 and looks like it will be tough to gain too much upward momentum.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Gold Backed Digital Currency: Is This Why Central Banks Are Buying So Much Gold?

We’ve been tracking the purchase of gold by central banks over the years. Russia has been the leader in recent times. Here’s one possibility why they have been buying so much gold…

In our feature article this week we cover:

- What Are Central Banks Scared of?

- What Gold Backed Digital Currencies Are Already Available?

- What to Look for in a Gold Backed Digital Currency?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

NZ Economy Close to Slipping into Reverse

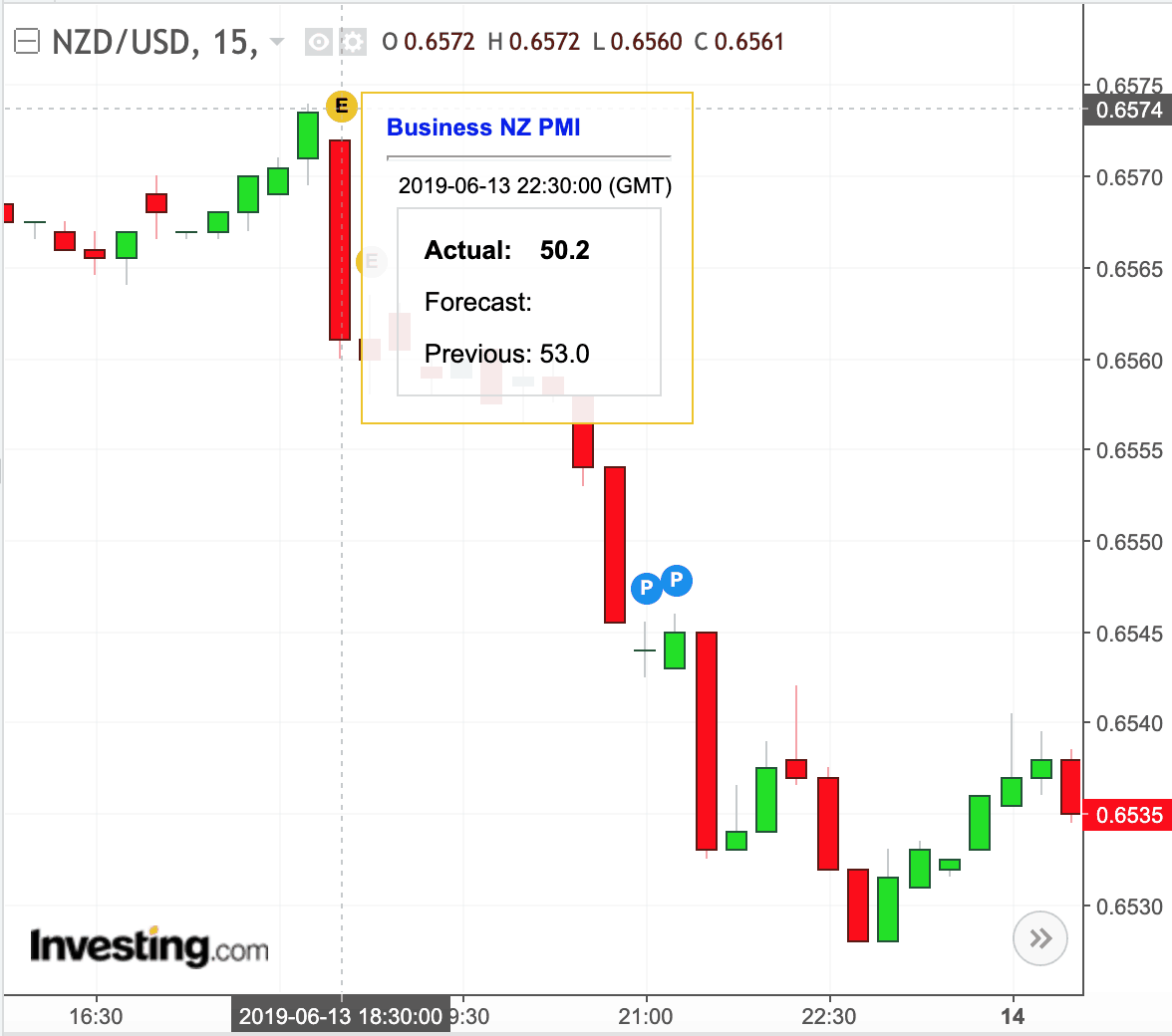

The NZ dollar dropped sharply following the release of the BNZ / Business NZ Performance of Manufacturing Index (PMI) on Friday.

The PMI was 50.2, far below the market estimate for a reading of 53.0. Any PMI reading that comes in below 50 signals contraction. So this result suggested the New Zealand economy’s manufacturing sector is very close to slipping into reverse.

Source: New Zealand Dollar Under the Hammer: PMI Data Confirms “Leading Indicators are Getting more Worrisome by the Day”

“BusinessNZ’s executive director for manufacturing Catherine Beard said that the drop in activity to its lowest point in over six years was obviously a concern, especially when the sub-index values are examined.

“Production (46.4) was at its lowest value since April 2012, while the other key sub-index of new orders (50.4) only just managed to stay in positive territory. Given the latter feeds through into the former, it does not instil a strong belief that the sector will show solid improvement over the next few months”.

Source.

Kiwibank Economists: Further interest rate cuts needed here and overseas to stimulate demand

“On the same day as the manufacturing figures were released, Kiwibank’s economists issued equally downbeat predictions.

In a note which drew heavily on the lyrics of British rock group Radiohead, Kiwibank said talk that the global economy was showing green shoots of recovery was nothing more than “fake plastic trees”. Further interest rate cuts needed here and overseas to stimulate demand.

Kiwibank now sees New Zealand’s GDP growth dropping to 2 per cent in the middle of the year, with lower growth rates over the next two years. Growth peaked at around 4 per cent in 2017.

Low inflation and plans to require banks to hold more capital would force the Reserve Bank to continue to cut interest rates, Kiwibank said. Economists Jarrod Kerr and Jeremy Couchman see the Reserve Bank cutting the official cash rate to 1.25 per cent, with a healthy chance of two further cuts to a low of 0.75 per cent.”

Source.

How Might the RBNZ Respond to the NZ Economy Weakening Further?

The NZ economy certainly looks to be slowing even further.

The question is how might the central bank respond to this?

Earlier this month we asked the question:

Could Negative Interest Rates Be in Store for New Zealand?

This isn’t as outlandish as it might first sound.

As this week we have bank economists openly discussing such moves and more.

Economists at the largest bank in New Zealand, ANZ, say there is a “very real” chance that the Reserve Bank of New Zealand’s monetary policy will run out of conventional ammunition.

They also suggested the central bank look at a series of unconventional measures, including quantitative easing.

Australia also openly discussing money printing

Here’s a report from this morning from across the Tasman too:

“Reserve Bank must consider quantitative easing, economists argue — so what is it?

Economists say the policy of large-scale money printing by the Reserve Bank is now on the table, and it needs to be discussed more openly.”

Source.

Read on to see why money printing in New Zealand is looking more and more likely.

The smart money is slowly moving into gold for protection against a slowing global economy.

If you want to join them please get in touch. We have just 10 gold maple coins left. They’ll probably be gone this week so get in quick.

Or let us know any questions you have:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: USD Gold Breakout - 6 Year High Above $1400 - What Happens Now? - Gold Survival Guide

Pingback: Massive 5% Rise in NZ Gold This Week - Gold Survival Guide