Prices and Charts

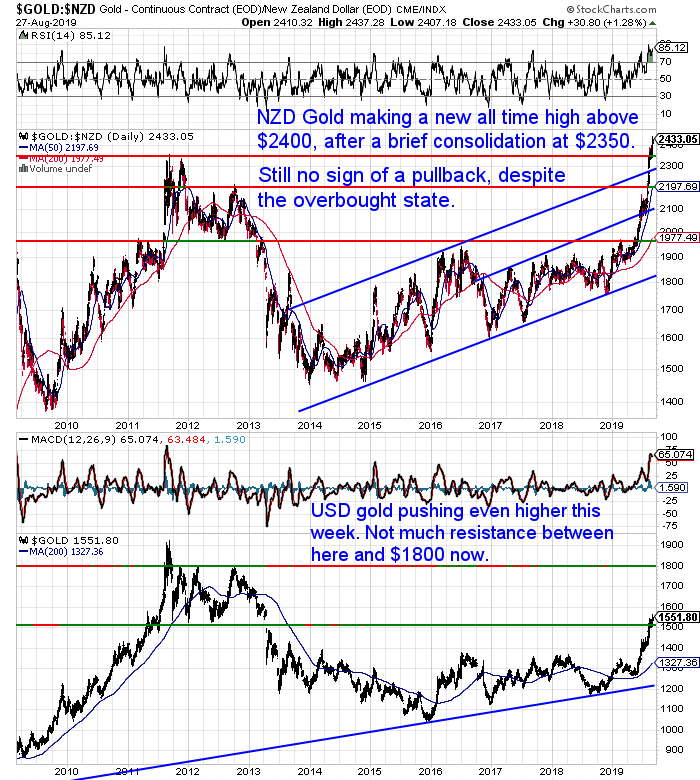

NZD Gold at Yet Another All Time High

Despite the overbought condition on the NZD gold chart, the price continues to push even higher. This week we saw a brief consolidation around the previous all time high. But then gold has surged higher yet again. Now well above $2400.

So the pullback that many expected has yet to eventuate. What we wrote at the end of July has been the case. Where we said that a number of…

“…factors point to there being no – or very little – correction in gold and silver in the immediate future.

What might happen instead?

We think there could instead be a sideways consolidation to build a base of support. Before we then witness the next run higher.

We also wonder whether this next move higher might happen faster than most would expect.

A bull market likes to run with as few people on board as possible. So perhaps most potential buyers will sit on the sidelines waiting for a correction that never arrives.”

But even we have been surprised by how fast and strong the move up has been. At some point we will see a correction. But the unknown is how much higher the price might move before that happens?

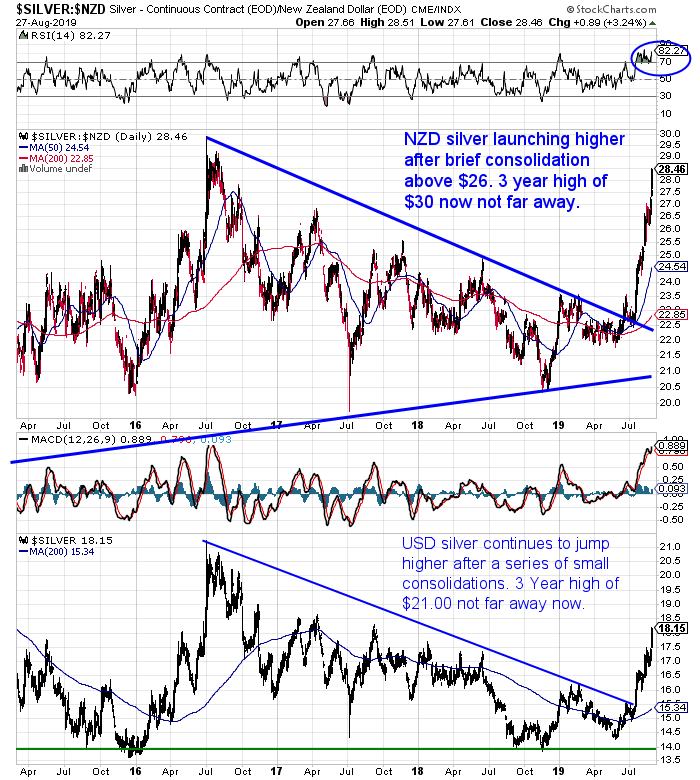

Silver Joining the Party

This week the silver price has really launched higher. Up over 6.5% in the past 7 days alone! So far in August we have just seen a couple of brief pauses before silver has jumped higher.

Silver is now the highest it has been since the mid 2016 high. And more importantly silver is starting to play catch up to gold. Outperforming gold in August.

The gold/silver ratio is now down to 85. But historically that figure is still very high. So silver is still incredibly cheap compared to gold.

This could well be the start of the out-performance of silver compared to gold.

Plus with many catalysts, like the US-China trade war and the threat of recessions in many countries including here and the USA, there are any number of reasons for gold to move higher still.

There is more uncertainty currently than in previous years. So despite the recent run ups in price, it’s not too late to buy. Even if we get a decent correction soon, in the long run the current prices are likely to look a bargain in years to come.

NZ Dollar Dropping Again

Despite its oversold state the Kiwi dollar dipped even lower this past week. It’s now very close to the 2015 low just above 0.6200. The odds are that level will be tested before too long. Even if we see a bounce higher in the shorter term.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

It’s Societal Collapse and Doomsday Week!

We try not to be peddlers of doom and gloom here. But every now and then you have to look at the worst case scenario.

So in this weeks articles we’ve got a bit of a societal collapse doomsday theme!

Partly prompted by a recent reader question asking…

“In the event of fiscal breakdown causing a collapse of society, would you advise holding smaller denominations of gold. i.e 1/10 ounce coins?”

Here’s what we reckon is the best type of gold to buy for trading in a currency collapse scenario…

Here’s another question that is not uncommon for people to ponder. It’s sort of along the lines of the “you can’t eat gold, so why buy it?” thinking…

“Considering the variety of things that might become tradable in the event of a breakdown of society, I wonder what might be the advantage of gold or silver coins over other tradable items such as tools, water or bottles of wine (for example), since the average person could not be expected to have all the technology required to authenticate the purity of materials claimed to be silver or gold but might easily recognise basic tools, clean water or wine?”

So should you just buy tradeable everyday items instead? Our answer includes…

- What You Should Buy Before You Buy Gold or Silver

- What is the Advantage of Gold and Silver Over Tradeable Everyday Necessities?

- How Would Purity of Gold and Silver Coins Be Authenticated in a Societal Breakdown?

- When Exactly Are Gold and Silver Most Important and Useful?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Following on from the above article is a closer look at silver coins and how useful would they be in a currency collapse.

We have never experienced a serious currency collapse in New Zealand. So we look at:

- What Happened Elsewhere During a Currency Collapse?

- Why a Currency Collapse in New Zealand is More Likely to be Result of Global Monetary Breakdown

- Why Gold and Silver Would be the Better Bet to Own Than US Dollars

Federal Reserve (and RBNZ) Trying to Increase Inflation

The latest US Federal Reserve minutes show that the US central bank is looking at ways to crank up inflation. Bernd Struben writing in the Port Phillip Publishing Insider this week pointed out:

In a six year period, ending in 2014, the Fed snapped up some US$3 trillion in US Treasuries and mortgage-backed securities. The dip in 2018 shows their best efforts at unloading some of that burden. But with a little prodding from Donald Trump the so-called quantitative tightening phase has come to a premature end.

And since US$3 trillion of QE and eight years of near-zero interest rates didn’t unleash inflation, the boffins at the FOMC are confident the next rounds won’t either. So confident they’re ready to do even more…and do so proactively.

As Bloomberg reports:

‘Federal Reserve officials… took a little victory lap over their crisis-era bond purchases and suggested they may use the practice even more aggressively next time.’

Here’s a snippet from the minutes:

‘The committee could proceed more confidently and preemptively in using these tools in the future if economic circumstances warranted… A number of participants commented that, as many of the potential costs of the committee’s asset purchases had failed to materialize, the Federal Reserve might have been able to make use of balance sheet tools even more aggressively over the past decade.’

Now that was off-putting enough to read over breakfast this morning.

And it’s not even the really scary part.

…So what is the scariest news of the day?

It entails central bankers’ frustration over entrenched low inflation. After all, if the cash in your pocket is worth the same next year as it is today, they’re not doing their job.

Not to worry. They have a makeup strategy ready to roll.

From Bloomberg:

‘[O]fficials have discussed whether they might seek to deliberately overshoot their 2% inflation objective after an extended period of below-target inflation, referred to by economists as a makeup strategy. Annualized price rises in the U.S., as measured by the Fed’s preferred gauge, have run consistently below 2% since January 2012.’

The minutes note that, ‘In principle, such makeup strategies could be designed to promote a 2% inflation rate, on average, over some period.’

Let’s break this down.

The US — like Australia, the EU, Japan and others — is struggling to revive inflation.

In fact, the US Fed hasn’t met its inflation target in more than seven years. Now let’s say it takes another year before that target is reached.

After eight years of below target inflation the makeup strategy could see the Fed — and other central banks across the world — willingly push inflation to, say, 5% for a few years…just so it all balances out to 2% in the long run.

Now even if you believe central bankers are magicians of the highest order, why on earth would they want inflation running at 5% just so they can raise interest rates in a debt addled world to prepare to combat the next downturn?

The answer lies in negative interest rates.

We’ve covered this here before.

If central banks can force negative rates onto the everyday consumer, they’ll be able to stoke spending and investment in a way that’s not available today. That’s because we have cash. Good old cash that’s losing less than 2% of its value each year. Meaning even a term deposit paying 2.5% is delivering a positive real rate of 0.5%.

But if inflation is running at 5% even a term deposit paying 4% will be delivering a negative real rate of -1%. Success! Now the central bankers have prodded consumers to run out and spend their money before it loses its value. And they can raise the cash rate to give them ammunition to fight the next crisis.

Even if you’re comfortable with this level of manipulation, the unfortunate fact is central bankers are not magicians of the highest order. Or any order. They’re ordinary men and women. Highly educated, to be sure. But that very education has served to remove them from reality and focus on their models. Models that depict how things are supposed to work out. Not how they really will.

The central bankers, folks, are playing with fire.

To take that analogy a step further, for seven years the US Fed has been blowing on glowing embers. When the fire didn’t burn as hot as they’d like (2–3% inflation) they piled on more kindling. Still smouldering? More kindling!

At some point all of that kindling is going to catch. And the very real risk — especially with the makeup strategy — is that it burns far hotter and far longer than its creators ever intended. And, wouldn’t you know it, someone forgot to refill the fire buckets!

Now, I don’t think the US or Aussie dollar is looking at hyperinflation. At least not akin to what they’ve been going through in Venezuela, where inflation topped 160,000% last year.

But if this one gets away from the central bankers, which is quite likely, we could be looking at a return to the late 1970s. Inflation topped 13% in the US in 1979. And it ran over 16% in Australia in 1975.

That’ll lead to a massive increase in interest rates. I’ll let you decide how that will affect debt addicted consumers and businesses. Not to mention the housing market.

…Like I said above, you can’t fight or flee this threat. But you can prepare yourself.

One asset that’s almost sure to benefit from a central bank driven catastrophe is gold.

So the Fed is mulling over how to increase inflation. Our central bank also seems keen to do the same thing. A press release from the RBNZ this week stated:

“The Reserve Bank and the International Monetary Fund are hosting a conference in Wellington next week to discuss broad issues around monetary policy, the labour market, and the future of inflation targeting.

Inflation Targeting: Prospects and Challenges has attracted delegates from around the world. It will be co-hosted by the Bank and the IMF’s Regional Office for Asia and the Pacific, and will be held at Te Papa Tongarewa on August 28 and 29.

While inflation targeting has had a history of success in delivering low, stable inflation and substantial macroeconomic stability over the past several decades, the last 10 years have proven to be challenging for monetary authorities.

RBNZ Assistant Governor and General Manager of Economics, Financial Markets and Banking Christian Hawkesby says: “We are now faced with stubbornly low inflation and low interest rates, driven by structural and cyclical factors. If monetary policy is to be successful for a further 30 years, we need to confront these challenges.

“This is what this conference is about — understanding the big questions about inflation targeting and considering how we need to adapt to continue being as successful as possible.”

It doesn’t take too much reading between the lines to see that our central bank is also looking at what else it can unleash to give inflation a boost. Maybe negative interest rates and money printing?

These are warning signals of what’s to come.

Got gold (and silver) yet?

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Silver is Flying - Gold Survival Guide