Prices and Charts

NZD Gold Consolidating Before Next Move Higher?

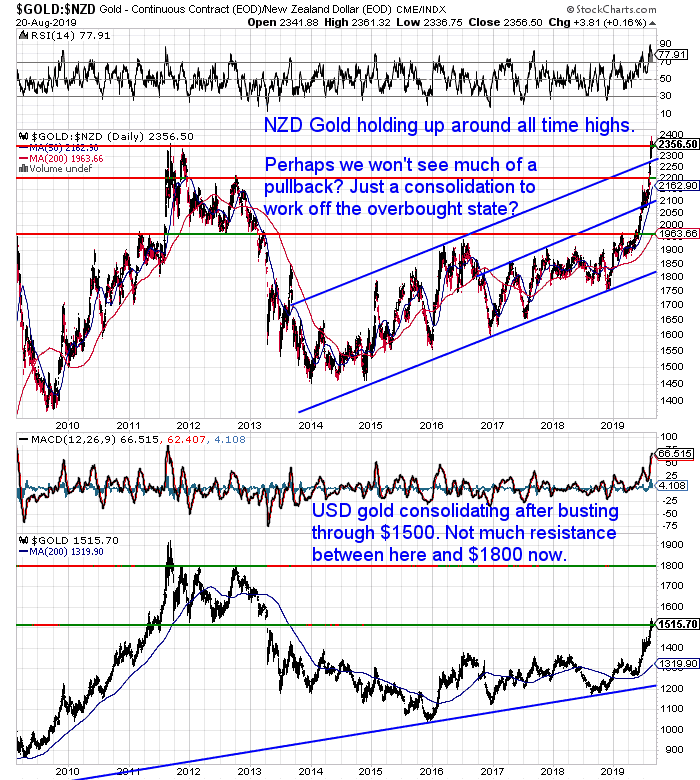

After making a new all time high last week, Gold in New Zealand dollars is consolidating around those levels. Sitting just above $2350 today.

Looking at the long term chart below a couple of key things stand out to us.

- NZD Gold has broken above the rising blue uptrend line which has contained it since 2014.

- It has also broken above the overhead resistance line at $2350

What does this mean?

Most likely that even higher prices are now to come.

There are still plenty of people on the sidelines waiting for a decent pullback to buy.

NZD gold is still seriously overbought. The chart is also looking quite vertical. So it is logical to expect a decent pullback from here.

However markets are often not logical!

So we could instead just see a sideways consolidation to work off this overbought state.

In the early stages of a bull market such as this, prices can often run higher (and faster) than people expect.

So beware sitting on the sidelines for too long.

It’s important to note that gold has broken out to a significant new high in 13 of the world’s top 20 currencies. Source: Daily Wealth. So the bull market is global.

NZD Silver Consolidating Near 27 Month Highs

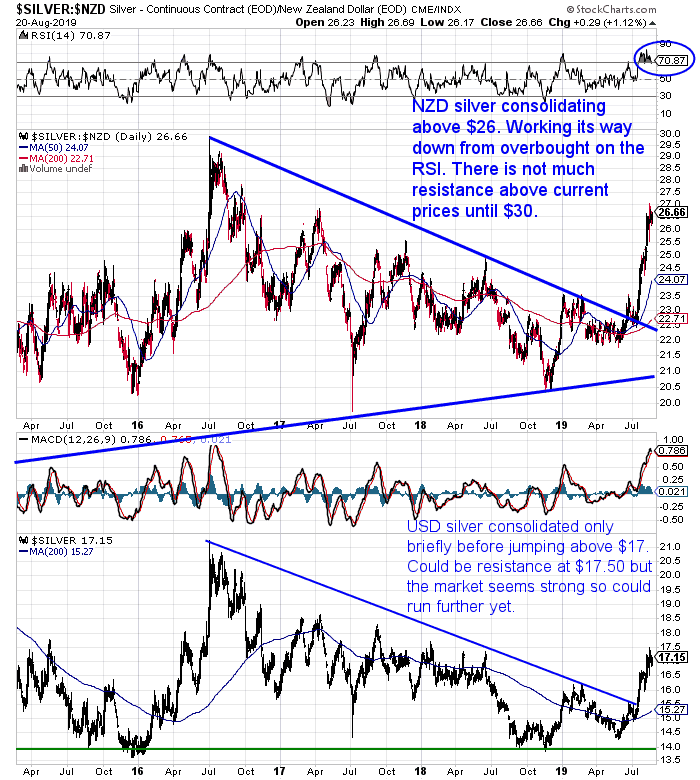

Silver in NZ dollars is also consolidating around 27 month highs.

Our guess is we may see a short consolidation around these current levels.

The same caution applies as to gold. Because there is now not much overhead resistance until the 2016 high of $30. Higher prices are likely not too far away.

This video from Steve St Angelo of SRSrocco runs through some charts that point to a big move brewing in silver too. Notably the “smart money” commercial traders in the futures market have been reducing their short positions as the silver price rises. This is a significant change. Worth a watch:

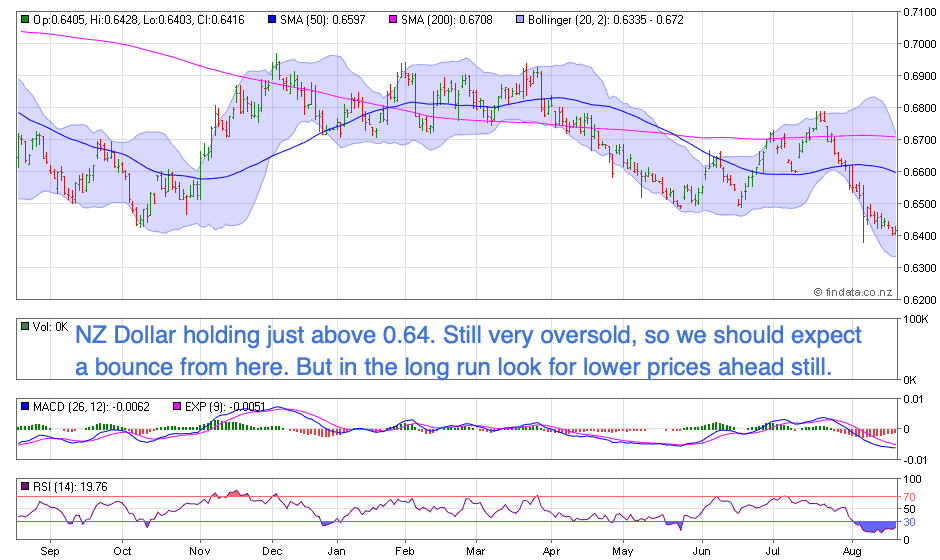

NZ Dollar Looking to Find Support at 0.64

The Kiwi dollar headed lower this week. It now sits just above 0.64. The same level it dipped to following the RBNZ 0.50% OCR slashing 2 weeks ago.

But for now the Kiwi is seriously oversold. So we should expect a bounce higher.

However in the longer term there are reasons to believe even lower prices could be ahead for the NZ dollar. More on that below in our feature article this week.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

NZ Dollar Falls – Why Has the NZ Dollar Weakened and Where to Now?

With the NZ dollar plummeting following the RBNZ rate cut 2 weeks ago, we thought it time to take a closer look at the good old Kiwi. Take a look at the chart going back to 2009…

Plus you’ll see:

- Why Has the NZ Dollar Been Falling?

- Why Might the NZ Dollar Stay Low or Go Lower Too?

- What Does the Weaker NZ Dollar Mean For New Zealanders?

- How the NZ Dollar Sideways Trend Has Been Broken – Where to Now for the Kiwi Dollar?

- What to Do About a Weaker NZ Dollar?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Update: The Yield Curve Recession Predictor: Impact on Gold?

We’ve been tracking the yield curve since March last year. But this past week it really made the news. The yield curve inversion was cited as the cause of the plunging US stock market last week.

While conversely gold boosted higher.

So what is all this fuss about the yield curve? Read on to see:

- What is the Yield Curve?

- What is the Yield Curve Saying Today?

- How Far Away Might the Next Recession Be?

- The Yield Curve and Gold and Silver Investing

Only Bonds and Precious Metals Up Over Past Year

Here’s a cool site Finviz – short for Financial Visualizations.

It has charts of every asset class over the past few months. All plotted on one page so you can compare them.

What stands out?

Only government bonds and precious metals are rising. Everything else is falling or stagnating. (Note: bond prices rise when their yields fall).

We are in the early stages of a bull market in precious metals. Silver in particular is still very early – and cheap. It remains our best buy.

Be very careful about being caught on the sidelines as prices run higher.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: It’s Societal Collapse and Doomsday Week! - Gold Survival Guide