Prices and Charts

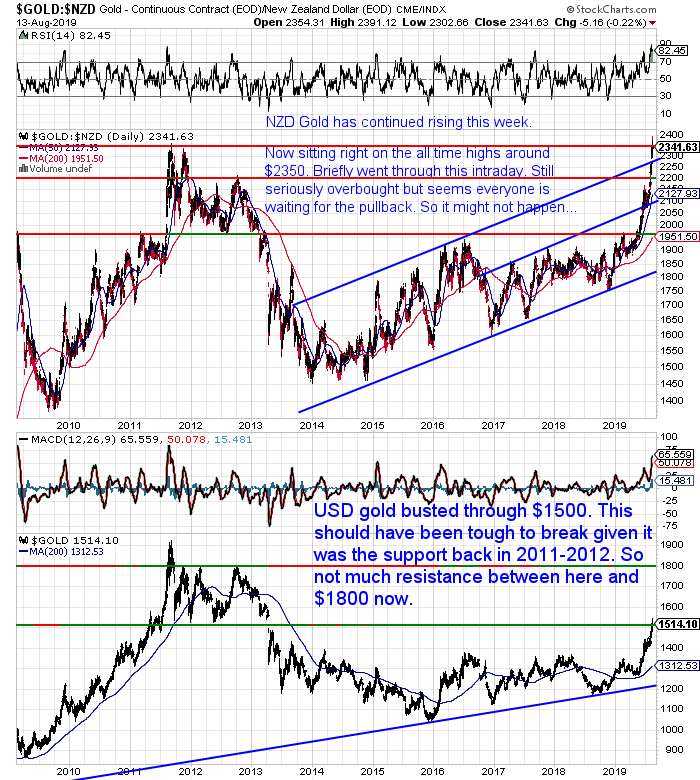

NZD Gold Makes New All Time High

The New Zealand dollar gold price just keeps on trucking north. Overnight it reached a new all time high above $2350 before pulling back to be up $7 from a week ago.

There doesn’t seem to be much selling in the futures markets so any pause or pullback seems to be heavily bought. More on that soon.

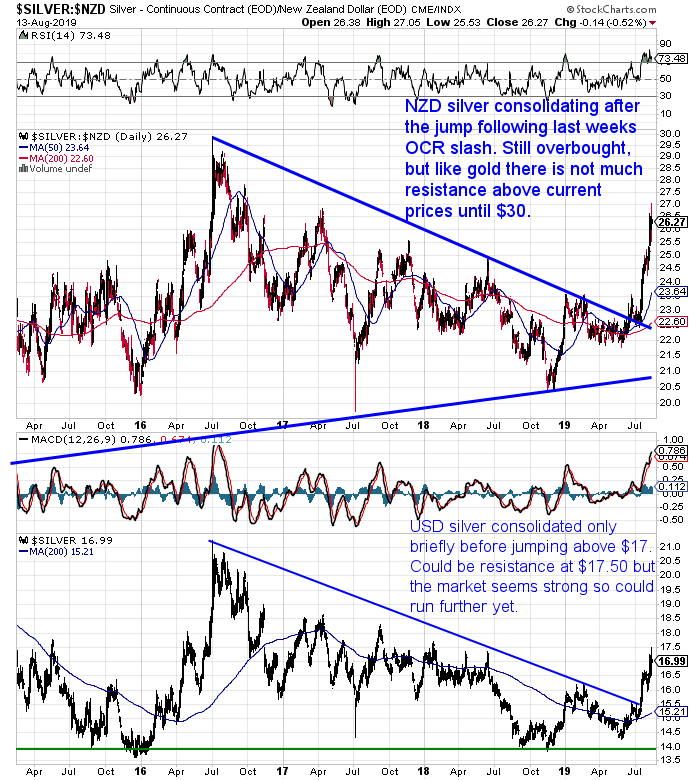

Silver Consolidating After Last Week’s Big Jump

NZD silver is up 0.65% on last week. Silver looks to be consolidating the recent jump higher as we suspected it might last week.

There doesn’t appear to be too much resistance between current prices and $30 per ounce. That 2016 high could be in trouble before too long.

The beaten up Kiwi dollar is up about 0.50% from last week. But it is only just above the lows from 2016. The 2015 low near 0.62 looks likely to be tested at some stage. Especially if the RBNZ keeps surprising with further rate cuts.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Futures Markets Are Interestingly Poised

The futures markets are still where the price of gold and silver is set (see: What Does Gold Spot Price (Or Silver Spot Price) Mean? for more on this).

The futures data is interesting. The weekly Commitment of Traders (COT) report summarises the positions of various traders.

Ed Steers reports:

“The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, August 6, showed a big positive surprise in silver…

…In silver, the Commercial net short position decreased by 8,650 contracts, or 43.2 million troy ounces of paper silver. [GSG note: The commercials are actual users and hedgers of silver as opposed to speculators. They are often the smart money].

…The Commercial net short position in silver is down to 376.3 million troy ounces, which is still very bearish on its face.

With the latest Bank Participation Report in hand, Ted estimates JPMorgan’s short position in silver at no more than 20,000 contracts — and most likely a bit less. In last week’s COT Report, he had estimated that JPMorgan’s short position was in the 25-28,000 contract range — and was delighted that it turned out to be much less than that.

…With JPMorgan’s short position this low, Ted is still of the opinion that they could let the price rip any time — and leave the other Big 7 traders holding the bag…including Citigroup.

…In gold, the commercial net short position increased by 36,358 contracts, or 3.64 million troy ounces of paper gold — and virtually all of that amount was at the hands of the Big 4 traders, as the traders in the ‘5 through 8’ category didn’t do much.

…But the bullish surprise in gold came in the Producer/Merchant and Swap/Dealer categories, as the former category [read JPMorgan] only increased their net short position by 4,739 contracts — and the latter did the real work, as they increased their net short position by 31,619 contracts. The sum of those two numbers equals the commercial net short position, which they must do, because these two categories are the commercial traders.

The commercial net short position in gold is now up to 32.43 million troy ounces…which is very bearish.

…Although the COT Report in gold is hugely bearish on its face, the fact that it appears that JPMorgan was almost a no-show during the past reporting week, has Ted sniffing a double cross in this precious metal — and even the Bank Participation Report shows that something out of the ordinary is going on.

Could ‘da boyz’ smash gold and silver lower at any time, you ask? Sure, in a New York minute, as both are overbought and in bearish territory from a COT perspective. But I expect any attempt at that to be short-lived, but potentially violent.”

Source.

We’d say Ed’s analysis sound about right. The futures data is showing to expect a correction. But if one eventuates it might not last long. So picking the bottom of such a correction will be tough. So what to do? See below…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold and Silver Keep Rising With Hardly a Pause – What to Do?

Gold and silver both seem to be pushing higher with hardly a breather. What we wrote a few weeks ago in Why Gold and Silver Won’t Correct From Here: Two Contrarian Indicators looks to be playing out.

It still seems many people are sitting on the sidelines waiting for a pullback that so far hasn’t eventuated.

It could be that we see some consolidations rather than big falls. This might be all that is needed to work off the current overbought conditions.

Or if we do see a sharper pullback we get the feeling this might not last long. Could be just days rather than weeks or months.

So what to do if you are looking to buy?

As we say in the article above, this is why we recommend splitting your purchase into a number of tranches.

Then buy at regular intervals. Spreading the purchases out over a series of weeks or even months.

The early stages of a bull market can move fast and take people by surprise. The trouble is the human psyche eventually fears missing out (FOMO). So people buy after a very big run up. Which is when the bigger fall happens. So splitting your purchases stops you trying to bottom pick and second guess.

You have a position but you also have spare funds in case of a fall.

Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years?

With the US stock market correction over the past few weeks, we thought it worthwhile looking at comparing shares to gold.

You ‘ll see:

- What is the Dow/Gold ratio and why it’s the best way to value shares/stocks.

- How gold compares to shares over the past 100 years.

- How might gold do versus stocks over the next decade or so?

Some Responses to the RBNZ “Slash and Burn” Rate Cut Last Week

Here’s a few responses to last weeks 0.50% rate cut from the RBNZ.

ASB had this to say:

“The RBNZ has front-footed the journey to a 1% OCR, a move markets had widely expected – just not until the end of the year. In the newly-started interest rate race to the bottom, the RBNZ is cutting a Burt Munro figure amongst central banks. And kudos to the Monetary Policy Committee (MPC) for getting on with it, given the economic forecasts called for around 60bp in total of OCR cuts.”

Kudos!?

For setting New Zealand on the road to negative interest rates?

For reducing the value of our currency?

For destroying the ability to save?

I guess we shouldn’t expect much else from mainstream bank economists.

But the RBNZ head doesn’t think low interest rates are a big deal for savers either…

“Reserve Bank governor Adrian Orr downplayed concerns that depositors will be hard hit by the latest rate cut, arguing that investors need to put their money to work better.

“When you have lower interest rates you have to be thinking much harder around the form of investment,” he told Parliament’s finance and expenditure select committee after cutting the official cash rate by 50 basis points to a record low 1 percent on Wednesday.

“The form of investment means putting your capital more to work, which is about creating real investment rather than just sitting in the bank account with all of the returns going to the owners of the bank,” he said.”

Source.

We know of one way to protect your money from next to nothing in the bank. Actually we know two. One is shiny and yellow, the other is shiny and grey.

Here’s a comment from Bernd Struben of Port Phillip Publishing in Australia:

“RBNZ channelling Trump

We left off with our mates across the Ditch.

The latest economic picture out of New Zealand came in surprisingly strong this week. Unemployment is down. And wages are up…albeit largely due to a legislated increase in minimum wages.

From Bloomberg:

‘The jobless rate fell to 3.9% from 4.2% in the previous three months, Statistics New Zealand said Tuesday in Wellington — the lowest level since mid-2008 and significantly below economists’ 4.3% estimate. Hiring jumped 0.8% from the first quarter while non-government wages also increased 0.8%, the most in more than a decade.’

These are the kinds of figures you’d expect to put upwards pressure on the Kiwi’s already sky high property prices. And perhaps help to usher in that elusive beast we call inflation.

Not, then, the scenario where you’d expect your central bank to slash interest rates by a full 0.50%.

But with the US–China trade war threatening to turn into a global currency war, the Reserve Bank of New Zealand’s governor Adrian Orr sees it differently. Hence the RBNZ’s decision yesterday to cut rates from 1.50% to 1.00%.

Speaking at a press conference later in the day, Orr said (as quoted by the AFR):

‘It remains within the remit of monetary policy to do whatever it takes to meet our mandate with our tool set. We are looking at the full tool suite. Without a doubt, globally when you’re looking at Europe, Sweden and Japan, all with negative interest rates and us at 1 per cent, it’s easily within the realms of possibility that we might have to use negative interest rates.’

‘Whatever it takes.’ Sound familiar? (Hint, think ECB.)”

And the “whatever it takes” is now being actively discussed in New Zealand mainstream media. Such as:

What would happen if interest rates fell to zero or negative?

“With New Zealand’s Official Cash rate now at 1 percent, current global uncertainty begs the question of what would happen if it were to drop further… even fall below zero. “

Source.

As we said earlier, if you’re thinking of buying consider not doing it all in one hit.

But be very careful about being caught on the sidelines as prices run higher.

The gold (and silver) bull is back and likely to have much higher to run yet.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Is a Big Move Brewing in Silver? - Gold Survival Guide