The RBNZ today released another article on digital currencies, this time looking at the pros and cons of a central bank issuing a digital currency.

The article focuses on how a public digital currency might affect four key central bank functions:

- Currency distribution

- Payments

- Monetary stability

- Financial stability

The article makes 6 assumptions in looking at a central bank issued digital currency.

- The digital currency is available to the public without restriction.

- The digital currency could take different forms based on either existing payment infrastructure technology or new cryptotechnology.

- The digital currency co-circulates with cash, and other forms of digital currencies issued by the private sector.

- The digital currency is convertible into cash at a fixed rate (par value).

- The public cannot borrow from the central bank (they cannot have negative holdings of the digital currency).

- The central bank does not pay interest on balances of its digital currency.

Overall the report finds that,

“on balance, the pros and cons are mixed across the range of central bank functions; and there is a clear need for central banks to better evaluate and understand the implications for both monetary policy and financial stability, relative to any digital currency they might issue.”

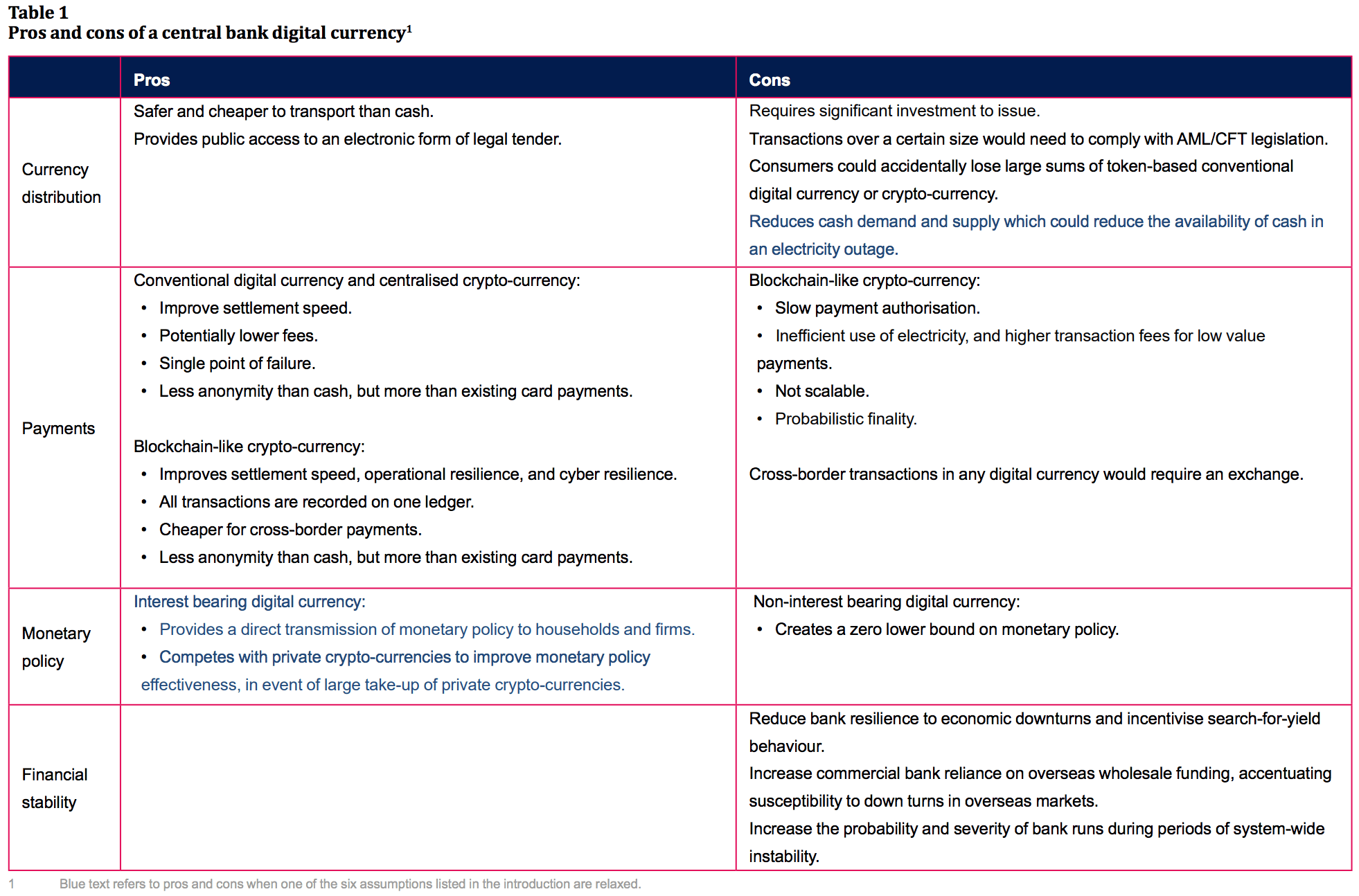

The pros and cons are summarised in the table below.

The author is careful not to make any definite conclusions. The RBNZ press release in fact expressly says:

“These articles do not propose a design for a digital currency or suggest the RBNZ will issue one itself.”

But we’d say there are some clear takeaways from this final of three RBNZ reports on digital currencies.

Read more: RBNZ Cryptocurrency to Replace NZ Physical Currency with a Digital Alternative?

Why Might Cash Disappear?

The report outlines how a “digital currency would ensure public access to legal tender if cash were phased out.”

The question “why might cash disappear?” is answered with 2 reasons:

-

- Cash demand falls due to costs.

“Cash can be a burden to retailers and bank branches due to the costs of balancing endof-day cash receipts, transporting cash to and from bank branches, and the risk of theft. Therefore, if demand for cash falls significantly, retailers and bank branches may no longer see benefits in maintaining cash infrastructure.”

- Cash is removed due to negative externalities.

“Cash is difficult to trace, which makes it attractive for tax evasion, money laundering and illegal transactions.2 Governments might remove cash to reduce crime and improve tax receipts.”

- Cash demand falls due to costs.

Negative Interest Rates and Central Bank Digital Currency

Another key point we think is that the RBNZ looks at the implications if one of their initial assumptions was relaxed and a central bank digital currency could be interest bearing. Why would they do this?

If a central bank digital currency was not interest bearing, let’s say central bank policy called for negative interest rates. Then consumers could simply transfer their savings from a standard commercial bank into the zero interest central bank-issued digital currency and escape the effects of negative interest rates.

The “problem” here (for central bankers anyway), would be that if negative interest rates were implemented, consumers could still escape the clutches by transferring deposits into cash.

But the article points out that this “problem” could be solved by a number of methods. Including:

- Removing high denomination notes

- Implementing a tax on cash notes

- A managed non-par exchange rate between cash and digital currency (this means converting your central bank digital currency to cash wouldn’t be done at a 1:1 rate, but rather cash would be at a lower exchange rate. So you would be penalised for exchanging into cash.)

Read more: RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

Crypto-currencies: If You Can’t Beat Them Join Them

The report also states that another potential benefit to monetary policy is that it provides a way for a central bank to compete with private crypto-currencies if necessary.

“Central banks are maintaining a watching brief on the uptake of private crypto-currencies by the general public. Private crypto-currencies do not interact with the existing banking system and so are not influenced by the policy rate. Therefore, if crypto-currencies grow in popularity it is possible a large number of deposits could move outside of the influence of monetary policy. To maintain monetary policy effectiveness, a central bank could either regulate the use of private crypto-currencies or issue its own crypto-currency to compete with the privately issued cryptocurrency.”

So central banks are carefully watching the impact of crypto-currencies and will likely either attempt to regulate crypto-currency use. Or otherwise central banks will adopt an “if you can’t beat them join them” approach and implement their own directly issued digital currency to compete.

Where We Are Heading – The Removal of Cash

It doesn’t take much reading between the lines to see there are more warnings that the aim is to remove the use of cash. As we’ve said repeatedly the war on cash is being waged because it allows the government to do a number of things:

- Track and tax every payment you make or receive – there is no “cash economy”, no “cash jobs”

- Freeze deposits and then bail-in deposits in case of a failing bank – see here for more on what happens to your deposits in a bank failure in New Zealand

- Enact negative interest rates without people escaping to cash

- No bank runs – Once all money is digital, there can’t be a run on a bank anymore. You won’t be able to remove your money even if you see it coming in advance.

So it’s a good idea to get some of your wealth outside of the financial system while you still can. Buy gold or buy silver today.

Read more: How to Buy Gold and Silver with Bitcoin

Pingback: RBNZ: Too Early to Say for Central Bank Digital Currency – Reading Between the Lines - Gold Survival Guide

Pingback: Update on the War on Cash: Australia Moving to Cashless Society? + RBNZ on Digital Currency - Gold Survival Guide