Prices and Charts

NZD Gold Down 2% From Last Week’s All-Time High

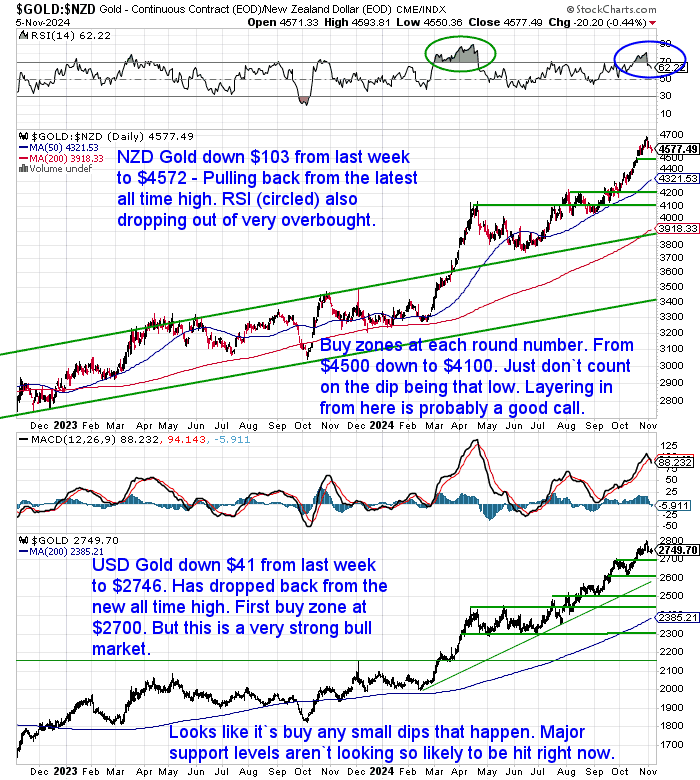

Gold in New Zealand Dollars was down $103 from last week to $4572. The fall from last week’s all-time high has seen the RSI overbought/oversold indicator drop down from very overbought. The next buy zone to watch for would be $4500. Then all the round numbers down from that. But we just wouldn’t count on all those levels being seen again right now. So taking an initial position here might not be a bad idea. Then layer in if any further falls take place.

While in USD terms gold was down $41 to $2746. The next buy zone below here is $2700. We remind you that this is a very strong bull market. So it’s looking like it’s simply a case of buying any dips. As major support levels aren’t looking so likely to be hit right now.

NZD Silver Down 3.7%

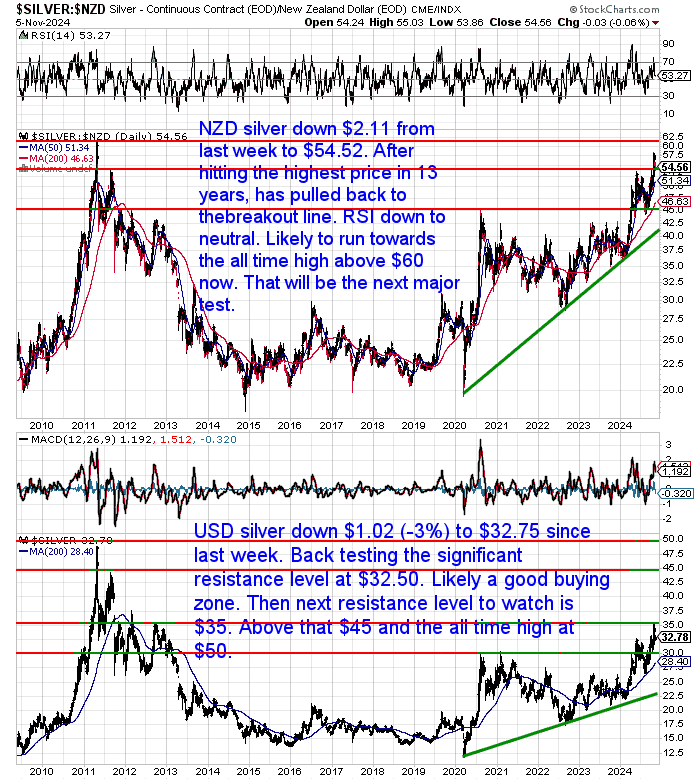

NZD Silver had a decent fall this week. Down $2.11 to $54.52. After rising to the highest price in 13 years, NZD silver has now pulled back to retest the breakout at the horizontal support line around $54.50. The RSI indicator has also dipped down from overbought to neutral. So to us this is looking like a pretty good buy zone. We could see a move up towards the all time high above $60 from here.

In USD silver was down 3% or $1.02 to $32.75. It is back down testing what was the resistance level at $32.50. This could likely be the support level with a further rise from here up towards $35, $45 and the all time high at $50. Likely a good place to be buying today.

NZ Dollar Uptrend Resuming?

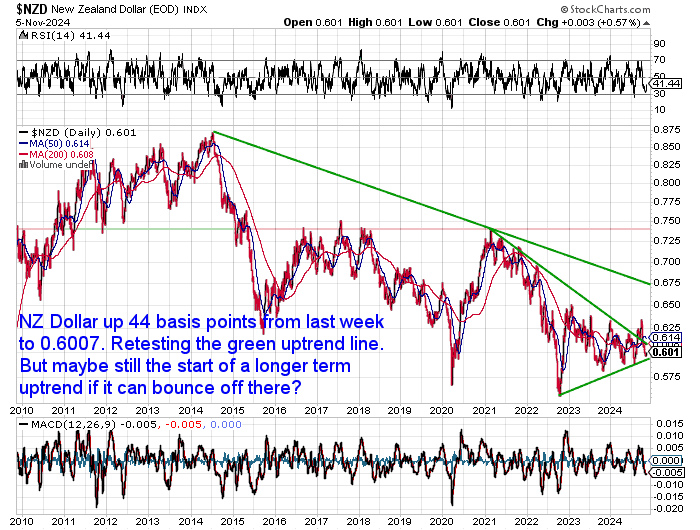

The Kiwi dollar was up 44 basis points from last week to be back just above 0.6000. It looks to be retesting the green uptrend line. So if it can bounce off there this could be the start of a longer term uptrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

If Inflation Looms: Gold or Classic Car?

In our latest article, we explore an interesting question: Should you sell collectibles, like a classic car, to buy gold if inflation is rising? We discuss how both collectibles and gold perform under different economic scenarios such as inflation, deflation, and stagflation. With each of these economic situations, gold shows some unique advantages as a hedge.

The article also dives into the benefits and risks of each asset type and why many see gold as a safer, more liquid option for wealth preservation. However, it also acknowledges the personal satisfaction and enjoyment that come with collectibles.

For a closer look at the pros and cons of gold versus collectibles, check out the full article below.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way! We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support. Interested? Contact us today to learn more!

US Elections: How Will The Result Affect Precious Metals?

Even here in New Zealand the media today will be dominated by US election talk.

We’ve read different theories on who will be good or bad for various investment sectors. So how will a Trump or Harris win impact precious metals?

We think it likely won’t make much difference either way.

Neither candidate is discussing the US debt position or level of interest payments.

The only feasible way out for the USA is to inflate the debt away. As a result we think more and more central banks, wealthy individuals and then finally everyday people will steadily come to realise this. Therefore moving into assets like gold and silver to protect themselves.

So both candidates are likely to be very positive for the price of gold and silver.

Gold Breaking 45-Year Monthly Resistance Line

We saw this long term monthly gold price chart a few weeks ago. At the time we thought it was a sign that gold would likely be due a pullback. However it looks like just the opposite happened…

Gold now above the longest monthly resistance I have seen.

It’s what happens when central banks go on a buying spree for the metal, desperately trying to improve the quality of their international reserves.

Game on.

Below is a monthly logarithmic chart of spot gold going back to 1979.

Look closely and what do you see?

Gold: 41 New All-Time Highs for 2024

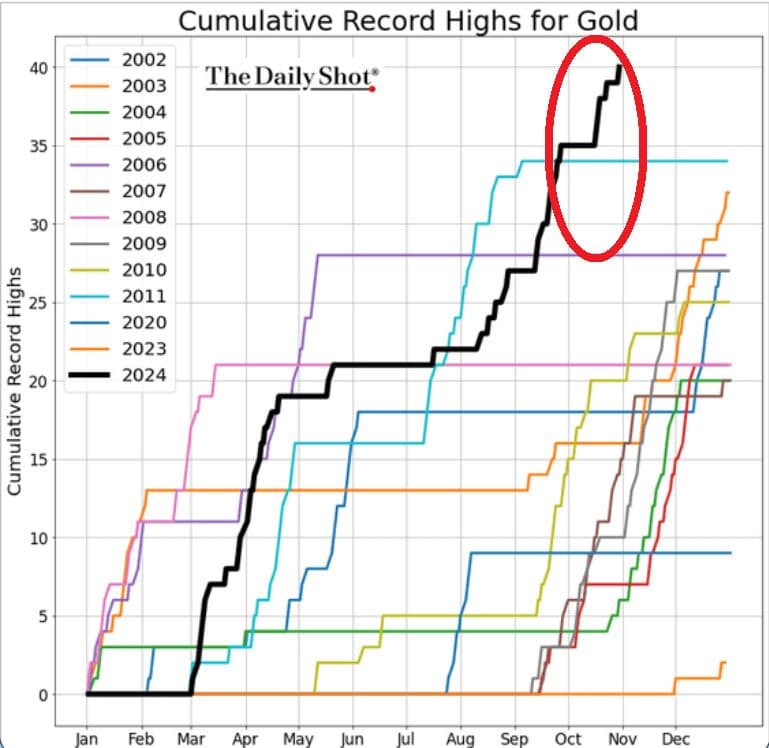

We’ve written the words “new all time high” many times in relation to gold this year. But even we were surprised it has been as many as this.

“After today, I believe that would make 41 new all time highs for the year so far as Gold reached $2,800. Gold is up nearly 70% in 2 years. This rally seems different as Gold has ignored higher interest rates, and a stronger dollar, etc. The largest buyers appear to be central banks, which may make this price increase more stable longer term. We will see. Central Banks are buying for several reasons, but regardless they are the biggest money in the world. So what is it that they know?

GOLD RALLY HAS BEEN TRULY UNSTOPPABLE

Gold prices have hit 40 all-time highs so far in 2024, marking the best year this century.

The so-called barbarous relic has rallied 33% year-to-date and is on track for the best annual performance since 1979.

Source: Global Markets Investor, The Daily Shot

Source.

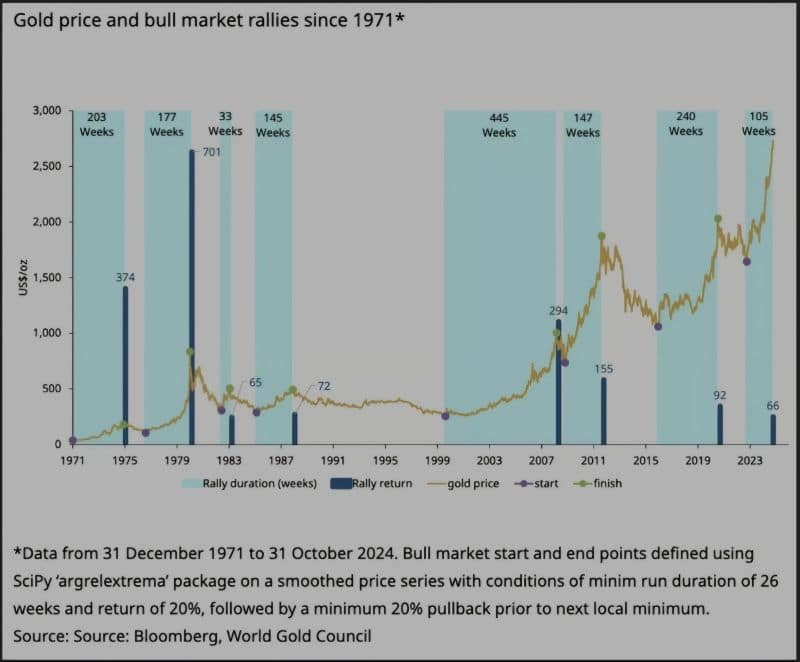

But – 2024: Second Worst Rally Since 1971

While the above chart shows this has been the best year for hitting multiple all-time highs this century, this next chart actually shows this has been the second-worst performance in a rally since 1971. An indicator that it likely has much longer and higher to run yet.

Astonished by the GOLD rally? Don’t be… This is the worst rally so far!!!

If you were to look at the present gold rally and compare the returns to all other historical Gold bull rally; then other than 1983, 2024 is the second worst rally.

So, then is the rally over and what should investors do?

Gold appreciation is a by-product of disastrous result of irresponsible governments. Governments never tell their people that they consistently destroy value of people’s money, Gold does tell this!!

And no, it’s not the Ukraine or Israel war that’s affecting prices, it’s the Global (read U.S) Debt war!! Global debt of $350 trn is the weapon of mass destruction, reducing the value of paper money.

Asset Allocation call – This Gold rally has probably just started, prefer hard/physical precious metals over paper assets.

Source.

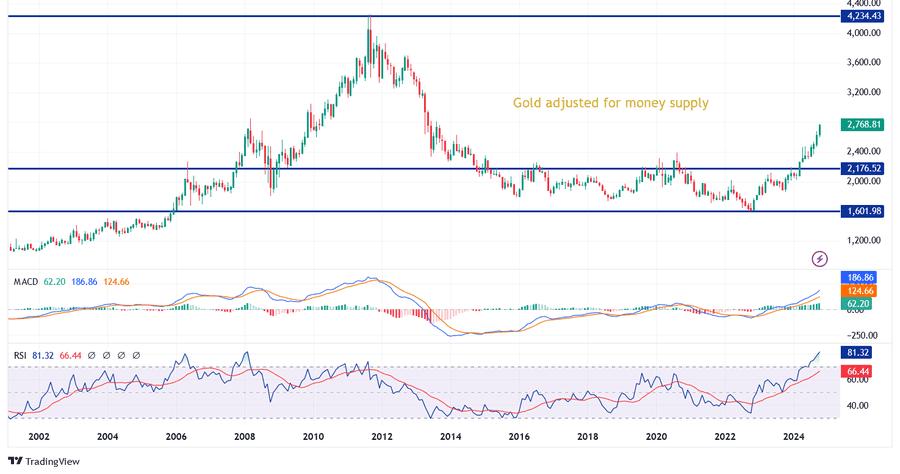

Gold Adjusted For Money Supply Above US$4000

Also when adjusted for money supply, gold also has much higher to run to match its 2011 peak.

Adjusted for money supply, we can see that the next major resistance is above $4’000. But this doesn’t mean that we cannot have any short-term selloff in the meantime.

While #gold is flying, it would still need a 50% increase to reach its 2011’s peak, once adjusted for money supply.

Source.

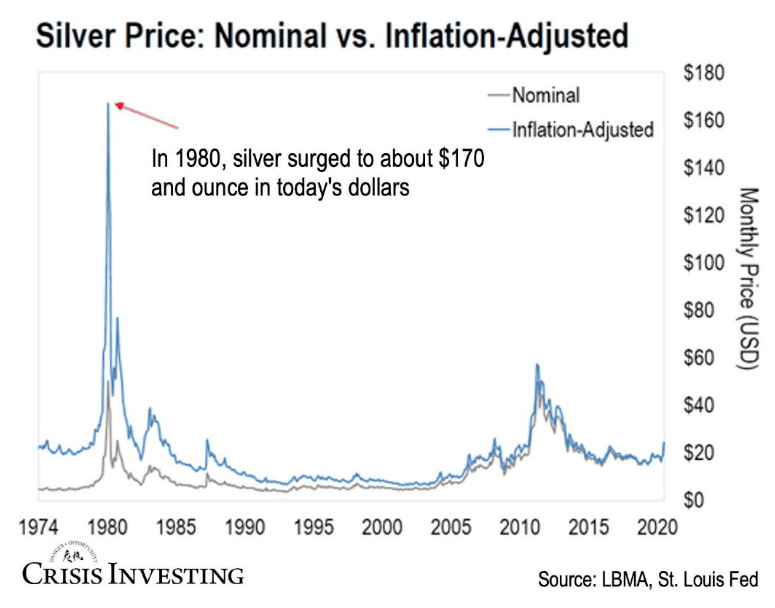

Silver Adjusted for Inflation

While for silver, it has much much higher to go to reach the 1980 high when adjusted for inflation. We are looking at US$170 versus the current price of $32.69.

NZ Inflation Below 3%- PM Takes Credit

Speaking of inflation, the NZ Prime Minister is patting himself and his government on the back due to inflation being back under 3%. Short video here.

But we think he is likely to regret taking credit for inflation dropping.

Why?

Because the odds look pretty high that there will be a second wave of inflation coming during this government’s term. And if you take credit for the fall then you’ll also have to take the blame for any rise!

We have been sharing why we think a second wave of inflation is likely for many months.

Interest rates will likely have to continue to be cut both at home and abroad for the same reasons. To make it easier for both governments and citizens to pay their interest bills.

In our view, this will likely help fuel this next inflationary wave.

But is Inflation That Low Really? Depends How You Measure It

The Prime Minister states how inflation is back below 3%. The Consumer Price Index [CPI], was 2.2 percent in the September 2024 quarter. However according to Stats NZ:

“The cost of living for the average household increased 3.8% in the past year.

The 3.8% increase in the September quarter, measured by the Stats NZ household living-costs price indexes [HLPIs], was thanks to interest payments increasing 18.2%, insurance increasing 16.4% and rent increasing 4.8%.”

Source.

Why are these 2 measures different?

According to Stats NZ:

“The two measures of inflation are typically used for different purposes. A key use of the CPI is for monetary policy, while the HLPIs provide insight into the cost of living for different household groups.

One important difference between the two is the treatment of housing. The CPI captures the cost of building a new home, while the HLPIs capture mortgage interest payments.

In the HLPIs, interest payments increased by 18.2 percent for the average household in the 12 months to the September 2024 quarter. In the CPI, the cost of building a new home increased by 2.5 percent in the same period.

Source. Stats NZ

Are you prepared for another wave of inflation and higher costs of living?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|

| |

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Plus we accept BTC, BCH, Visa and Mastercard

|

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.

|

|