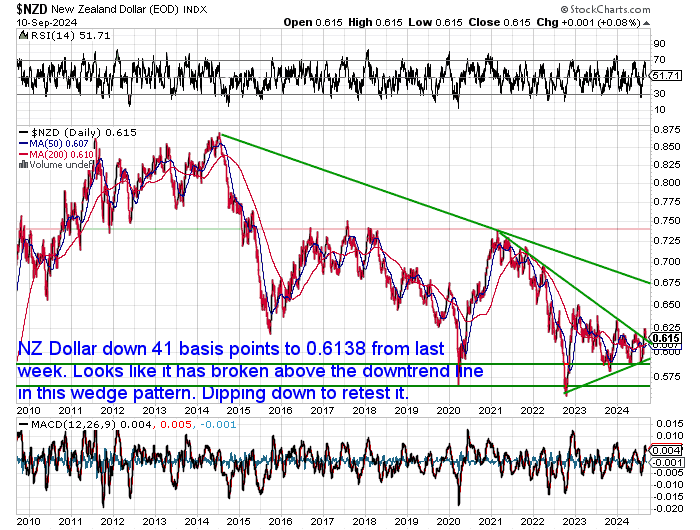

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3895 |

| Buying Back 1kg NZ Silver 999 Purity | $1378 |

Gold Bouncing Back This Week

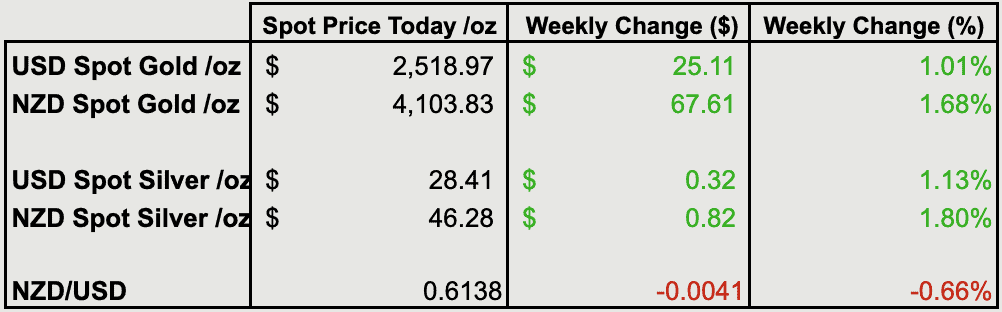

Gold in NZ dollars was up $68 from a week ago. Back above $4100. It has risen up off the 50 day moving average (MA). Seems to be consolidating at the start of the next leg up.

While in USD dollars gold was up $25 to $2518. It’s not far from the recent all-time high (see the table down the page for how NZD gold compares to other currencies in 2024). We’ve seen a few dips under $2500 but these have only lasted for a day before bouncing back. So $2500 is looking like pretty strong support.

Any corrections have been quite shallow. It’s looking pretty unlikely that we’ll see a return down to the breakout levels at $2100-$2200.

NZD Silver Also Rising

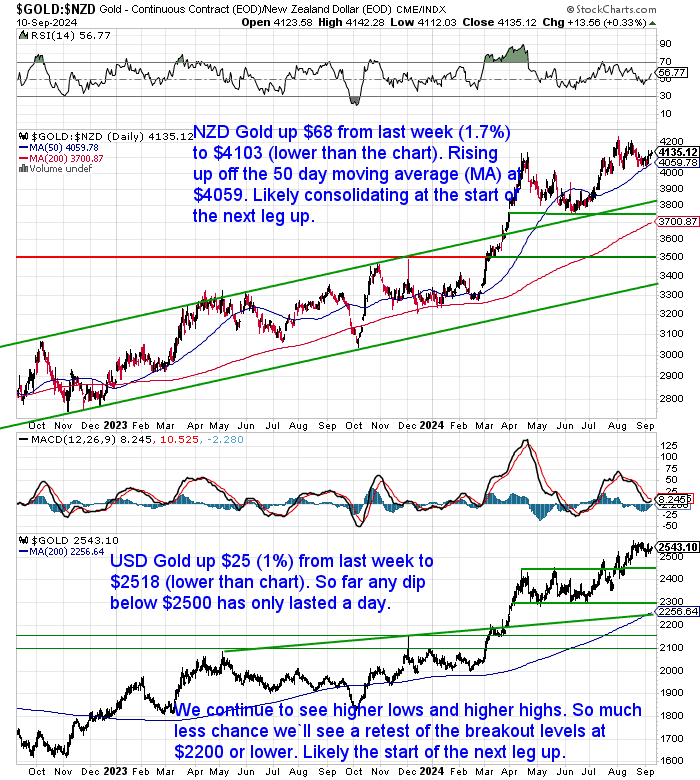

NZD silver was up a little more than gold. Rising 82 cents (1.8%) to $46.28. So far it has been unable to get back above the 50 day MA at $48.10. But with support holding around $44, NZD silver looks to be building for a retest of the highs around $52. Our guess is that any dip down to the 200 day MA will be a very good buying opportunity.

While in USD terms, silver was up 32 cents (1.1%) to $28.41 from 7 days ago. Again it looks like buying on any dip to the 200 day MA ($26.75) will be a decent long term move.

Kiwi Retesting the Breakout

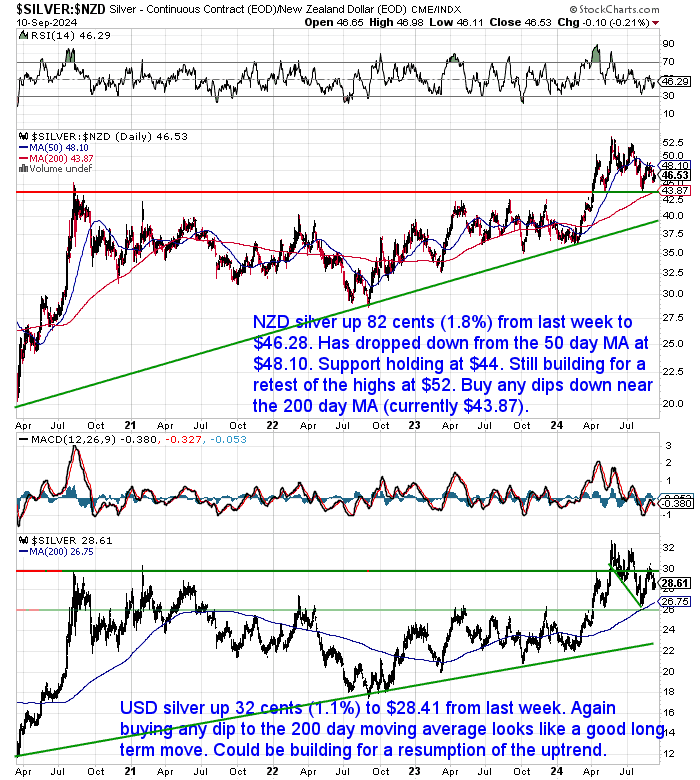

The Kiwi dollar was down 41 basis points from a week ago. It seems to have broken out of the wedge or pennant pattern and is now dipping down to retest that level. Seems likely that the Kiwi is switching to the trend being up against the USD.

The NZD gold performance comparison we show down below reflects this stronger Kiwi dollar.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Beyond the Shine: Unveiling Silver’s Potential as an Investment

Silver’s affordability and unique characteristics make it a compelling option for investors. This week’s feature article explores the reasons why more people are considering silver as a valuable addition to their portfolio.

The article examines:

- How silver’s affordability makes it accessible to a wider range of investors compared to gold

- Silver’s dual role as a precious metal and an industrial commodity, potentially influencing its price movements

- Why some experts believe silver has the potential for significant price appreciation in the future

Intrigued by the possibility of adding a glittering asset to your portfolio, but put off by gold’s price tag? This article explores the potential benefits of silver ownership, helping you decide if this affordable precious metal deserves a place in your investment strategy.

Why Buy Silver? Here’s 21 Reasons to Buy Silver in 2024

Become a Gold Survival Guide Partner

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Doug Casey on NZ’s Reality Check Radio

It was Casey Research that led to the meeting of the founders of Gold Survival Guide. So we like to keep an eye on what they’re up to. Here’s an interview with Doug Casey with Maree Buscke on Reality Check Radio. Worth a listen as Doug gives some thoughts on NZ, Argentina and where we might be heading.

DOUG CASEY: Libertarian, Commentator & Writer: Global Unrest And The Global Financial Situation. Is This The Calm Before The Storm?

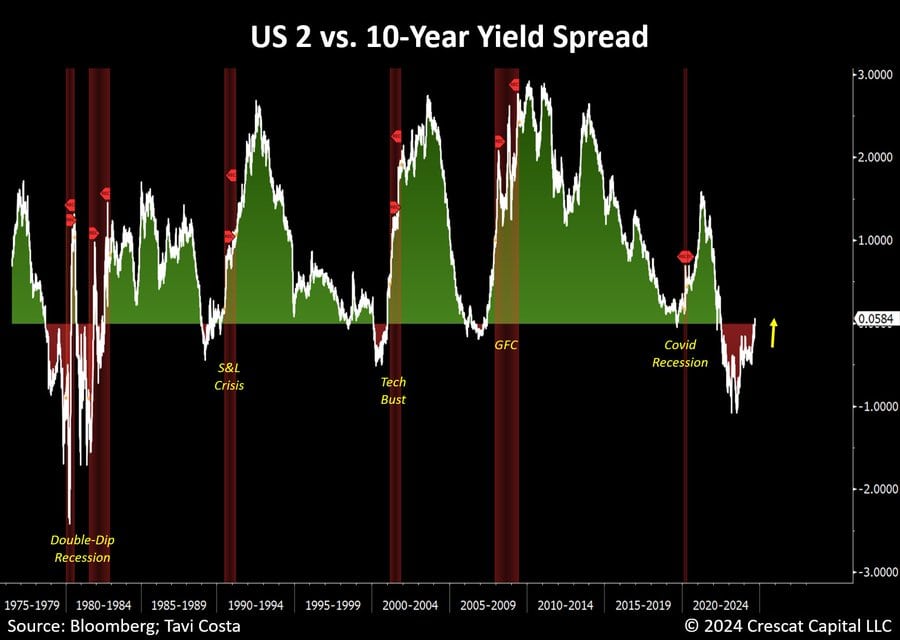

Yield Curve “Un-inversion” = US Recession Ahead

We’ve written previously on the yield curve as an indicator of a recession. It is a long term leading indicator. The chart below shows that a US recession actually usually starts when the curve returns to positive. Something that it just did…

The 2 vs. 10-year yield spread turning positive this week is likely one of the most critical macro events we are experiencing.

Historically, these “un-inversions” tend to happen abruptly, and the current situation has been no different.

These types of macro setups occur only occasionally, and I believe the steepening of the US yield curve still has a long way to unfold.

Gold’s performance in Recessions

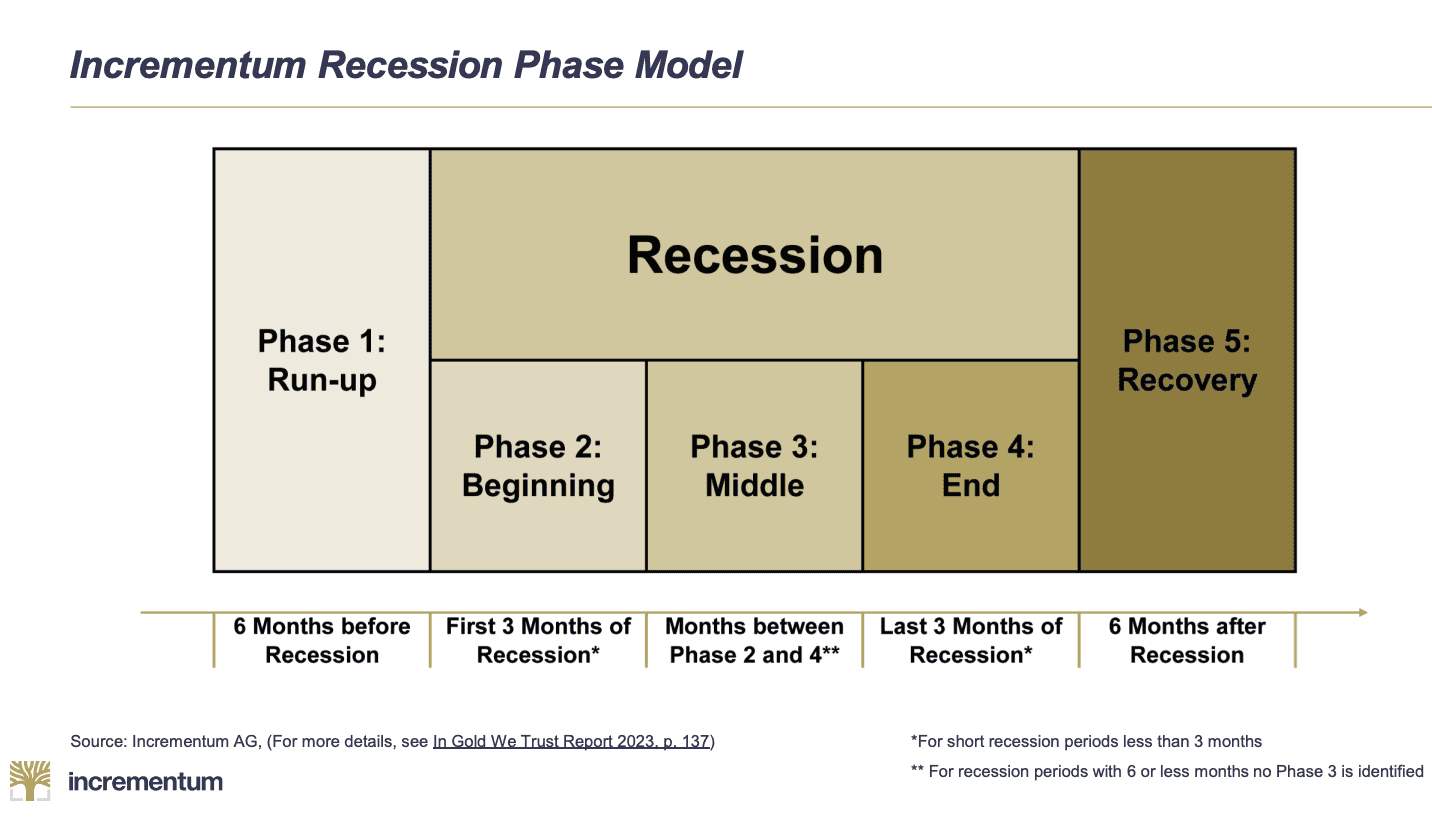

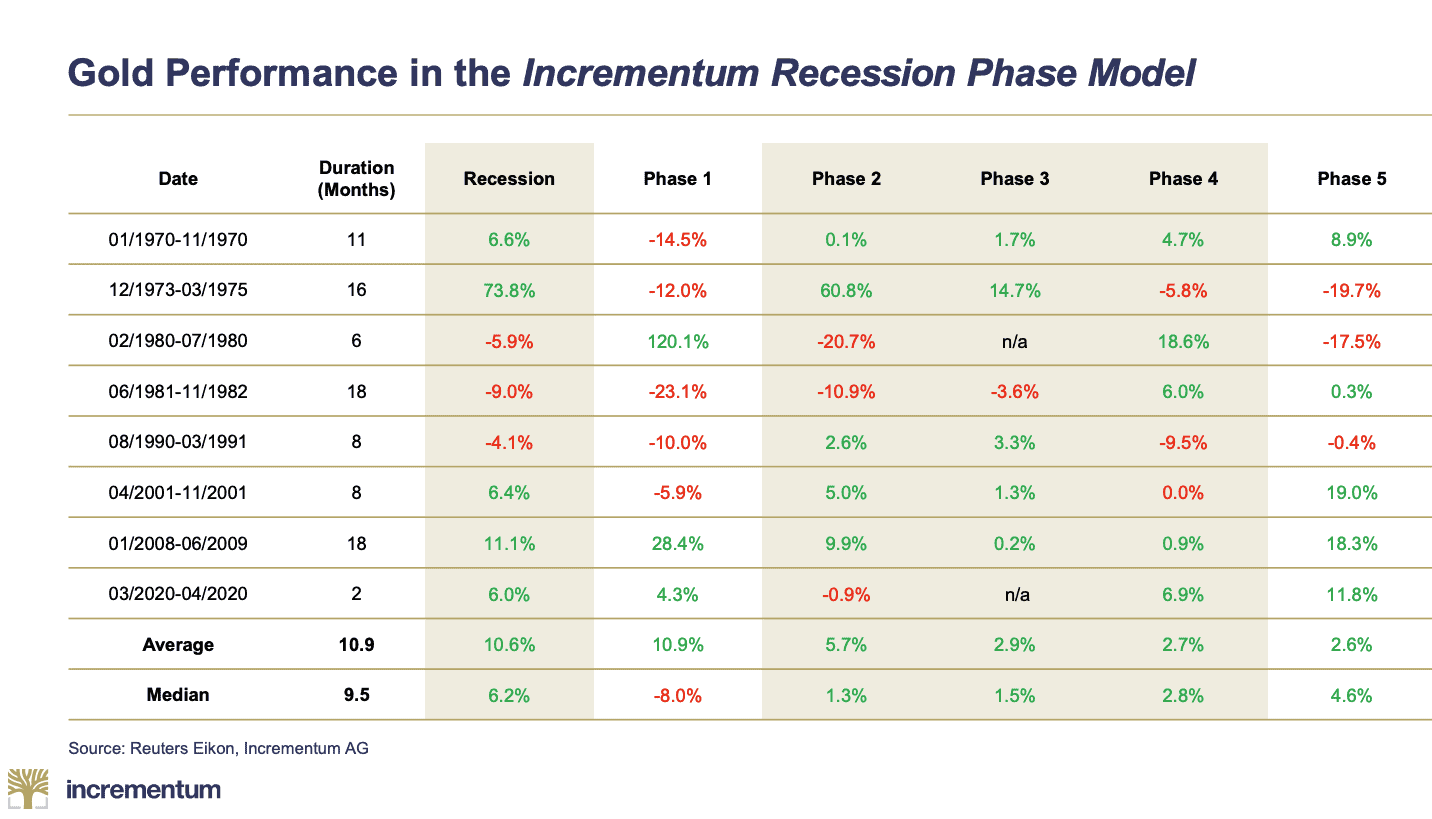

The latest Incrementum Monthly Gold Compass shows that recessions are when gold does very well historically.

Here is Incrementum’s phases of a recession:

Next here is how gold has performed during these phases. We can see that in the post 2000 recessions gold has performed incredibly well.

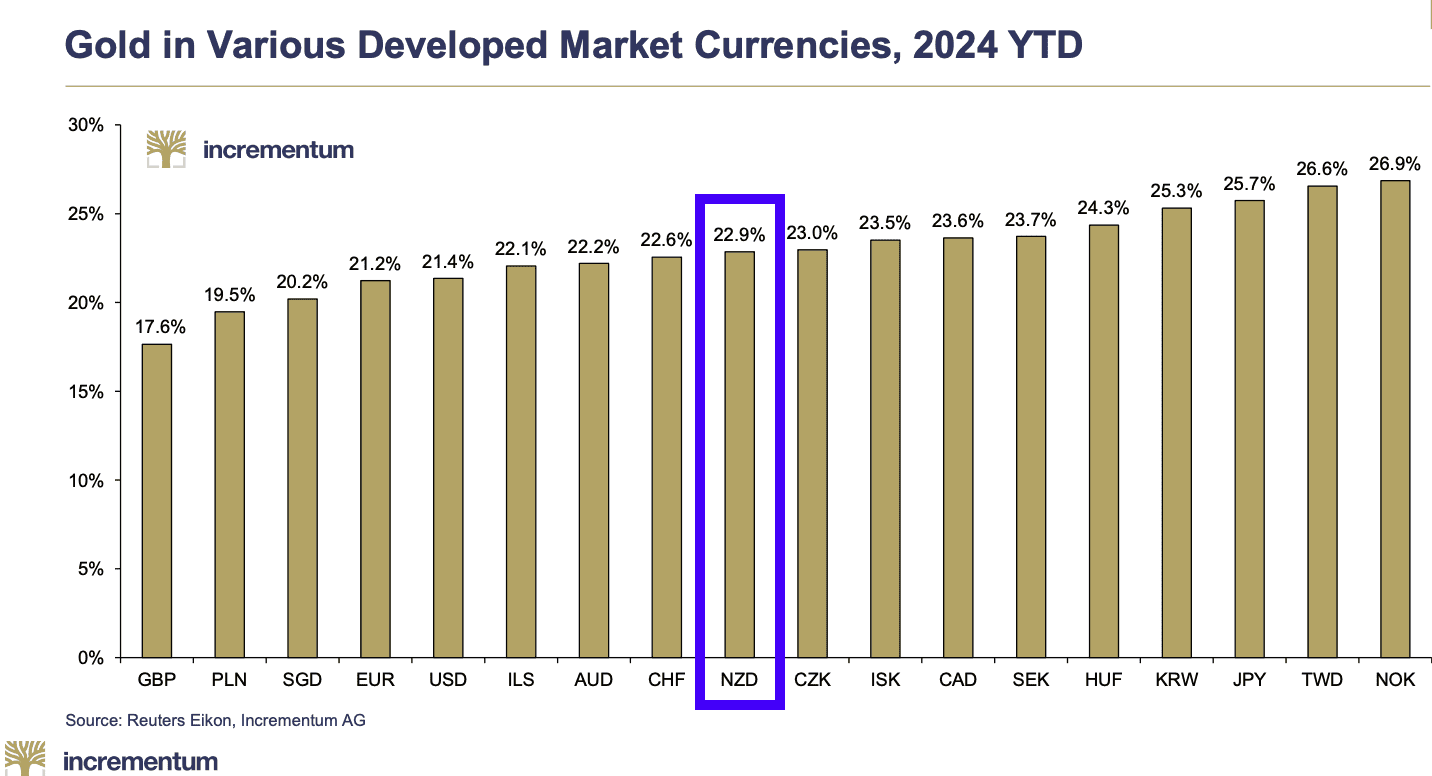

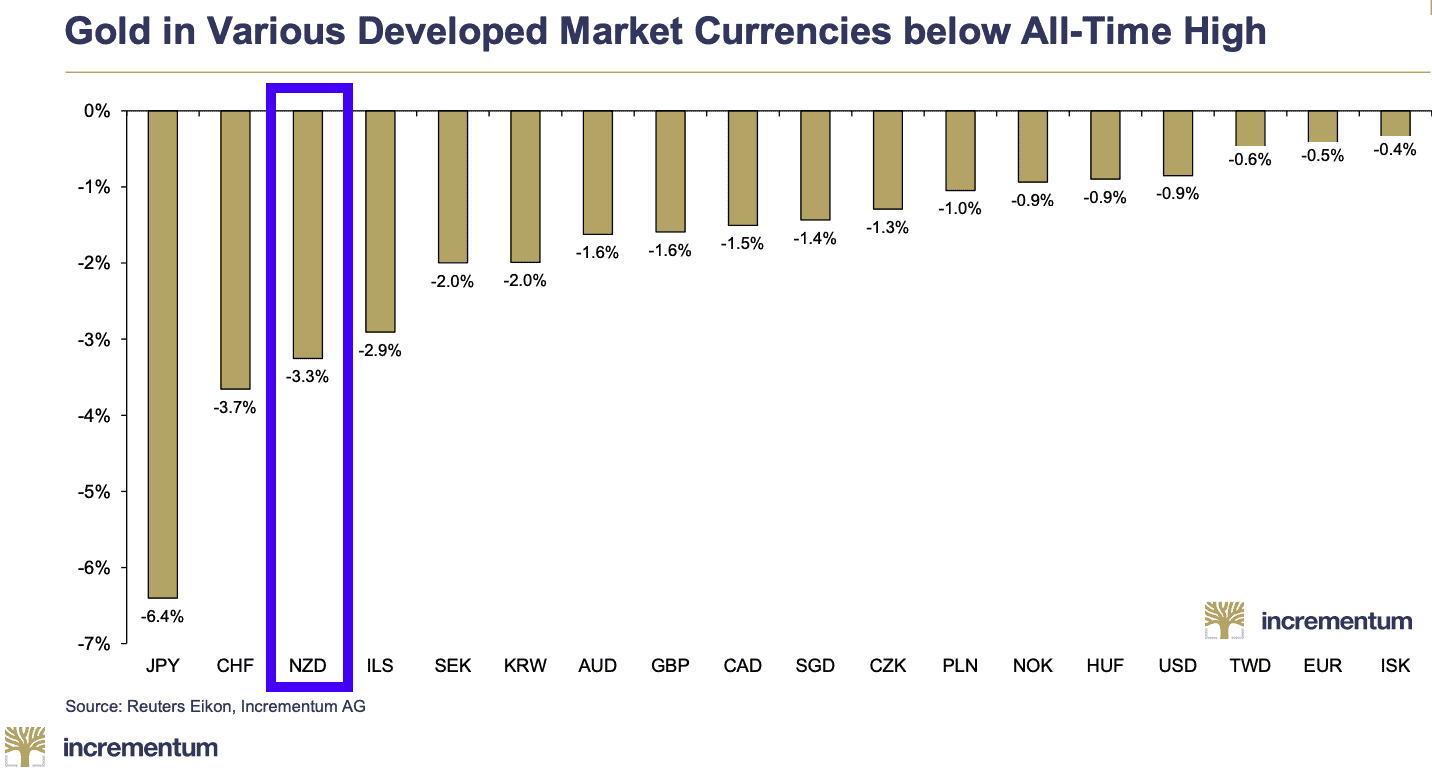

NZD Gold Price vs Other Developed Market Currencies

The Monthly Gold Compass also compares the gold price in various developed economies.

The NZ dollar gold price gets a mention. NZD Gold, as in most currencies, is up over 20% year to date. About middle of the pack:

NZD gold, also like most other currencies, not far off it’s all time high price.

US Banking Crisis Still to Come?

Meanwhile US banking stocks have taken a pounding today. The selection below was down between 4% and 16%.

🚨BANK CRISIS 🧨$ALLY warns of consumer defaults 📈

$JPM warns of recession

$GS is heavily leverage on the wrong side of the Yen carry trade & $nvda

JP Morgan lead them lower after comments from its president:

JPMorgan Tumbles After Bank’s President Says Analysts Are “Too Optimistic”

The stock of the largest US bank is tumbling this morning after Daniel Pinto, JPMorgan’s president, said that analysts were too optimistic in projecting next year’s expenses and net interest income, sending the shares down more than 6%, and tumbling to 1 month lows..

The current NII estimate of $89.5 billion is “not very reasonable” given interest-rate expectations, Pinto said at the Barclays annual financial services conference Tuesday. The figure “will be lower,” he said, which is surprising because the bank’s own latest outlook just two months ago forecast $91 billion in net interest income.

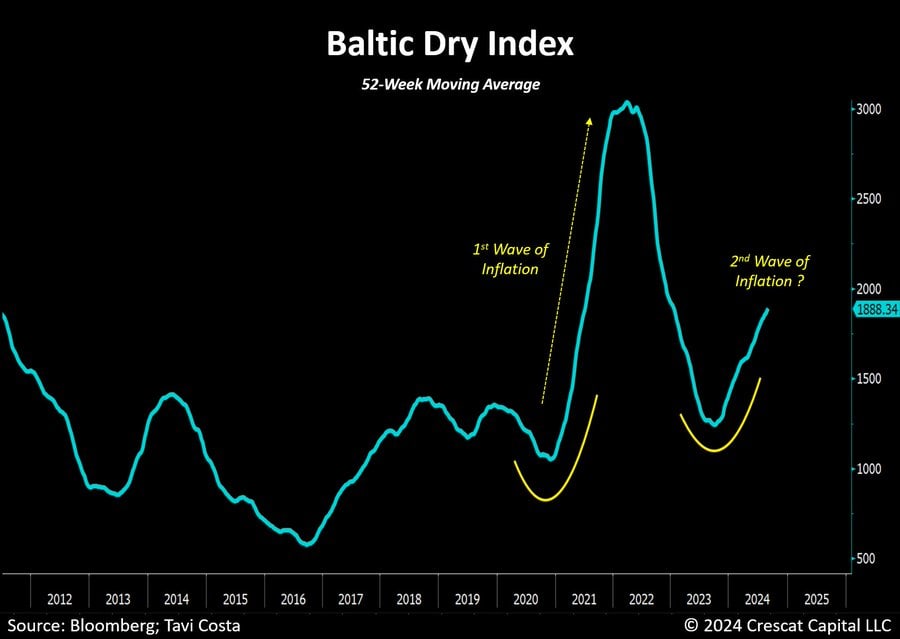

Broken Record – Next Inflation Wave?

We keep reporting these multiple waves of inflation theories. Because to us it seems very likely.

Tavi Costa points out how this global measure of shipping costs, the Baltic Dry Index, has been ticking higher recently…

The Baltic Dry Index is inflecting higher again, much like it did during the initial wave of inflation following the COVID-19 lockdowns.For those who may not know, this index reflects the average cost of transporting dry bulk goods, including coal, iron ore, and grains, across over 20 global shipping routes.

This increase also aligns with today’s stronger-than-expected prices paid in the ISM Manufacturing Index.

As the chart points out, could this be the beginning of a second wave of inflation?

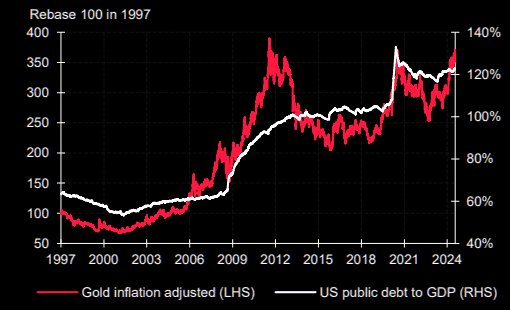

Gold and US Debt

We’ve been reporting on the astronomical levels of US government debt in recent months. So here’s a reminder that gold has historically tracked this debt. Hard to see the debt going anywhere but up, so gold will go where do you think?

Gold and US debtUS public debt to GDP and inflation adjusted gold prices moving in close relationship since the GFC.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles:

Why Buy Silver? Here’s 21 Reasons to Buy Silver in 2024

Tue, 10 Sep 2024 8:54 AM NZST

We recently looked at all the reasons we could think of as to why to buy gold. So it seems […]

The post Why Buy Silver? Here’s 21 Reasons to Buy Silver in 2024 appeared first on Gold Survival Guide.

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: $1475.50 (pick up price – dispatched in 2 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $26,699.17

Backdated coins: $26,585.36

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.