Prices and Charts

USD Hits New All-Time High – Hardly Anyone Notices

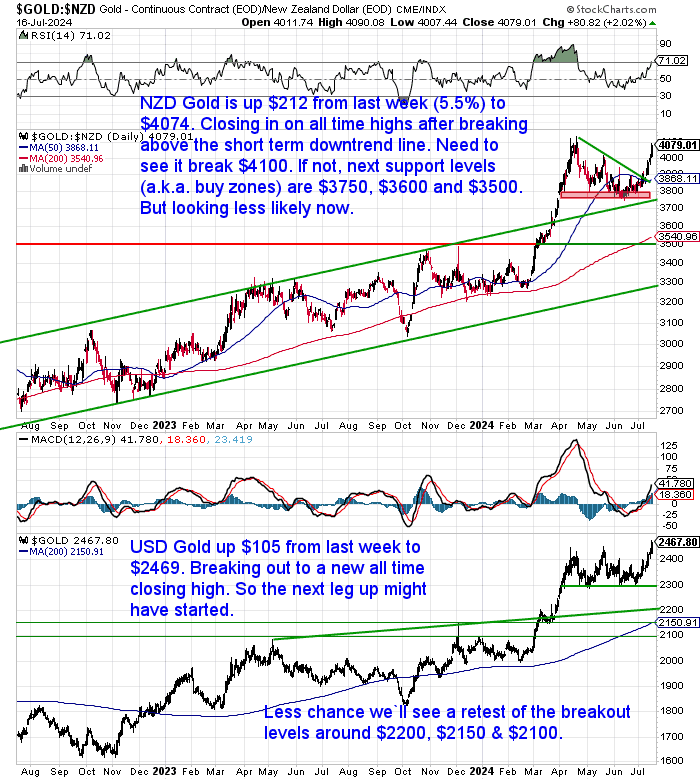

This renewed gold bull market continues to confound. USD gold has surged higher, up $105 (4.4%) to a new all-time high at $2469.

While in NZ Dollars gold is closing in on all-time highs too. Up $212 or 5.5% to $4074. We need to see it break $4100 now as it edges into overbought territory on the RSI.

So the next leg up in gold may have already started. So far today we’ve seen little mention of the all-time highs in the mainstream press. Even on the likes of X/Twitter, it’s been pretty quiet.

Interestingly July so far has been one of the quietest months we’ve had in recent times as far as purchases of gold and silver go. It seems most people expected gold and silver to head even lower during this correction. So they have been sitting on the sideline looking for a better entry point.

Of course, there is still a chance gold could turn back lower from here. But a new all-time high ups the odds that a further leg up has now started. The next few days will be interesting to see what happens.

Silver Also Up, But Lagging Gold

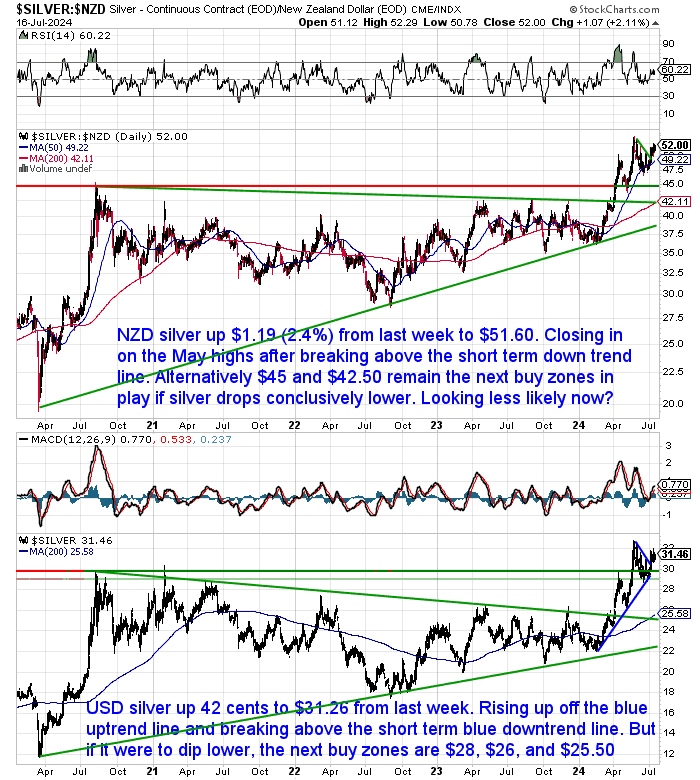

Silver in NZ Dollars was up $1.19 (2.4%) from last week to $51.60. It is closing in on the 12-year highs from May, but is lagging gold and so not quite there yet.

While in USD silver was up 42 cents to $31.26 from a week ago. It has risen up off the blue uptrend line and broken above the blue downtrend line. So it looks to have made another higher low. Although we need to see Silverhead above the May highs now.

Early this year when gold broke out silver lagged then too. So it’s not a big surprise to see it doing the same here too. The odds of lower prices have dropped. But we’ve still left the support lines in the charts just in case of a dip.

Kiwi Dollar Dips Down 1%

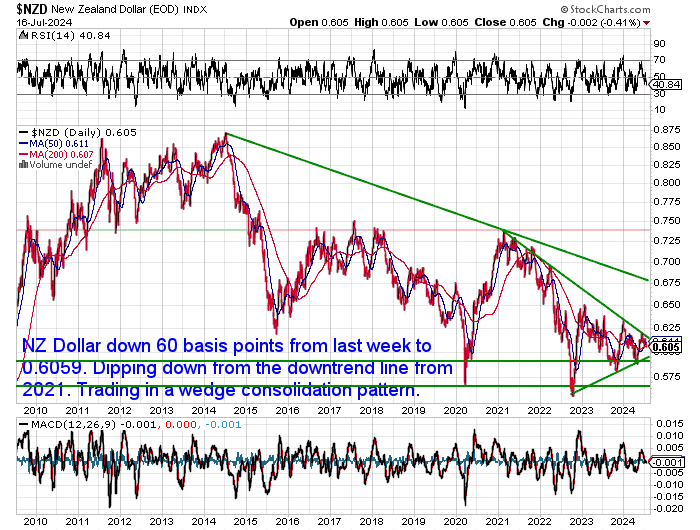

The NZ dollar has again turned down from the downtrend line. Falling 60 basis points in the past 7 days to 0.6059. It continues to trade in this wedge or flag pattern which is getting narrower and narrower.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Gold vs. Silver: Picking the Perfect Precious Metal for You

Feeling drawn to the world of precious metals but unsure where to start? This week’s featured article ignites the gold vs. silver debate, exploring 7 key factors to consider when choosing between the two metals.

In this article, you’ll discover:

- Key factors to consider when choosing between gold and silver, include their historical performance, risk profiles, and potential for future growth.

- Why factors like affordability, historical price movements, and industrial applications play a role

- The potential benefits and drawbacks of each precious metal

Feeling torn between the “king” and the “poor man’s gold”? This comprehensive guide sheds light on the strengths and considerations of each precious metal, so you can choose the one that best suits your investment strategy.

As noted earlier, with USD gold breaking out the odds are leaning towards the next leg up having started. So it might be a good time to take a position at least in case there isn’t a further pullback.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Survival Guide Q&A Call Recording: Analysing the Silver Breakout

In case you missed our recent Q&A call there is a recording available.

The theme was: “Analysing the silver breakout”.

We delved into various charts and looked at:

- Why this current breakout in silver is so significant

- What levels to look for as possible buying zones in the current consolidation or pullback

- Some potential price targets to look towards in the future

- Timing for these targets

- Plus we answered over 30 questions from our readers

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|