Prices and Charts

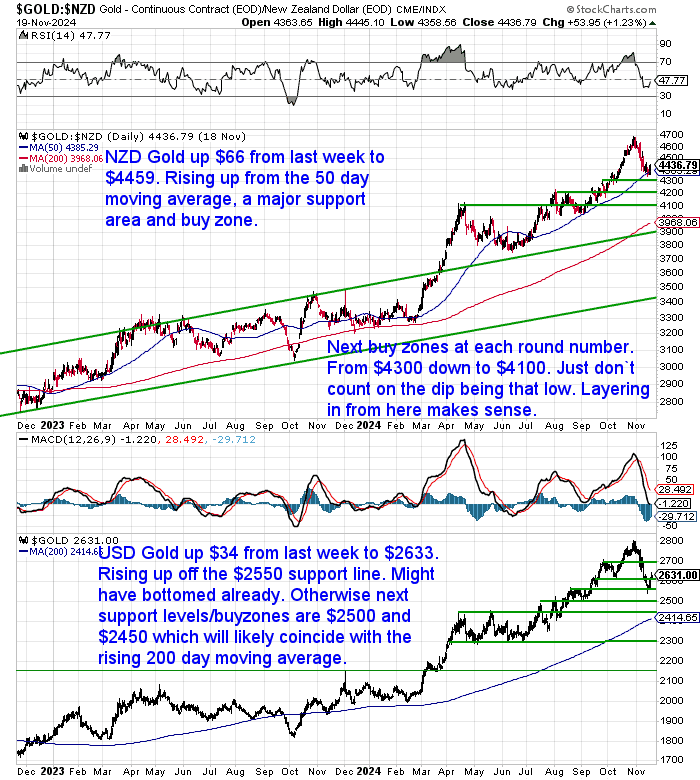

Gold Correction Over?

Gold in New Zealand dollars is down $66 from last week. But over the last couple of days NZD gold has risen up off the key 50-day moving average (MA) line ($4385). Gold has only dipped below this a few times this year. So there is a very good chance that the correction may be over.

But if not then the next buy zones to watch for are all the round numbers from $4300 down to $4100.

USD Gold was up $34 to $2633. It has risen up from the $2550 horizontal support line. If the bottom isn’t already in then the next buy zones are $2500 and $2450 which would coincide with the rising 200-day moving average.

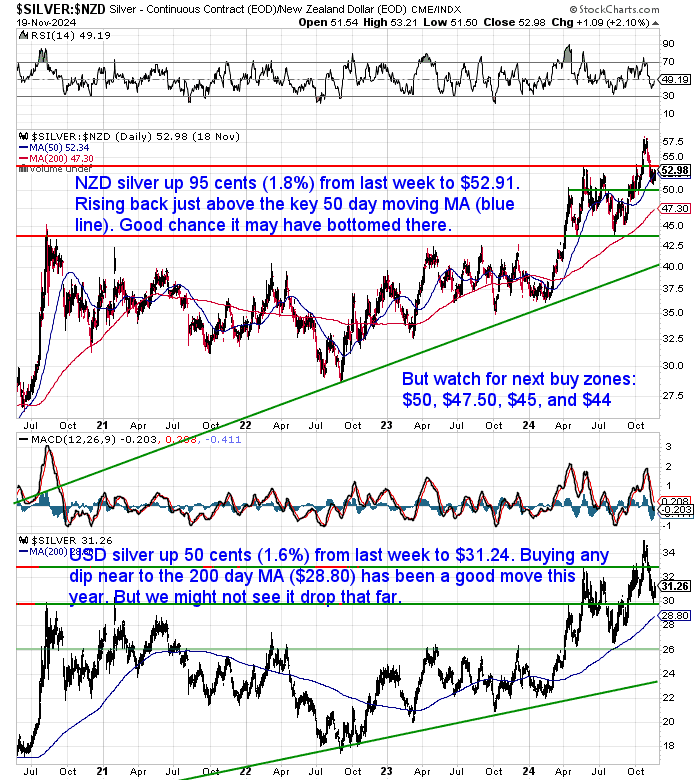

NZD Silver Also Back Above 50 Day MA

Silver in NZ dollars is up 95 cents (1.8%) from last week to $52.91. Like gold it is back above the 50-day moving average and a good chance that it has bottomed there. If not, the next buy zones are $50 and $47.50.

While USD silver is up 50 cents to $31.24. If it hasn’t bottomed there, the 200-day MA would be the next major support zone to keep an eye on.

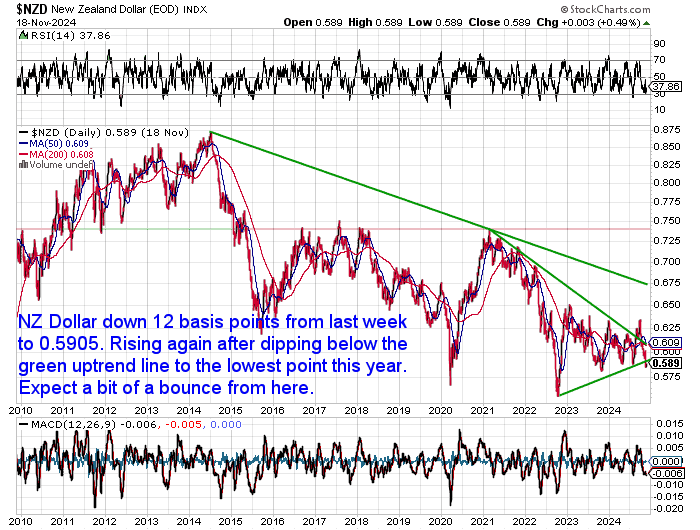

Kiwi Dollar Also Bottoming Out?

The Kiwi dollar was down 12 basis points from last week. But looks like it might have bottomed out. At the very least it’s likely to see a bit of a bounce from here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Can Silver Outshine Property? Examining NZ’s Housing to Silver Ratio

In this week’s feature article, we explore the NZ Housing to Silver Ratio, a measure of how many ounces of silver are needed to purchase the median New Zealand house. By examining data from 1968 to 2024, we uncover significant trends and shifts in this ratio, offering a unique perspective on the relationship between silver prices and the housing market.

Discover how historical events have influenced this ratio and what it might indicate for future investment opportunities. Whether you’re interested in precious metals, real estate, or economic trends, this analysis will give you valuable insights into the interplay between silver and housing prices in New Zealand.

Check out the full article below…

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

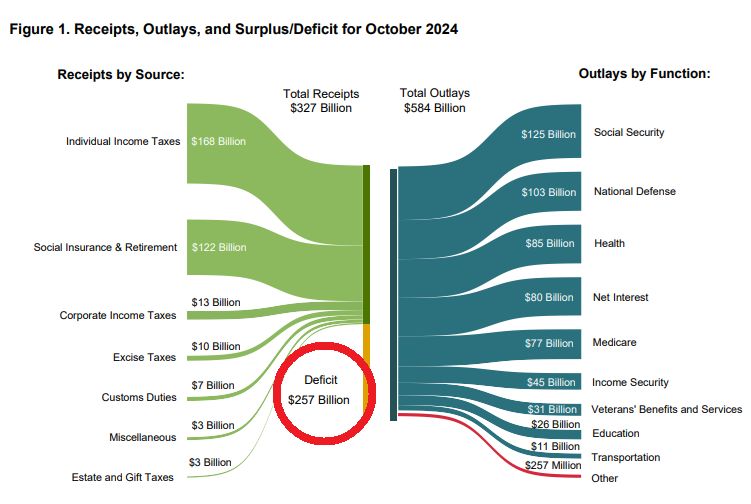

What Won’t Change Despite the US Election?

There seems to be a fair bit of positivity surrounding the US election results from the markets. US stock markets up. The US dollar is up. However regardless of who is in power, there are some things that will be very difficult to overcome.

Massive government borrowing due to a huge government deficit is one of them…

“US GOVERNMENT BORROWING EXPLODED IN OCTOBER

US budget deficit hit a STAGGERING $257.5 BILLION in October.

This is up nearly 400% year-over-year versus $66.6 BILLION last year.

This was also the 2nd highest deficit in the entire US history.

Source: Global Markets Investor”

Source.

There are sure to be some savings that can be made. However our secret investment advisor Chris Weber pointed out yesterday that:

“90% of all U.S. federal expenses are found in three things: interest on the debt, entitlements like Social Security, and defense. The first is impossible to cut, or even cut back when market interest rates are rising, as they have been since the election: In the last month, the 30-year bond yield has jumped from 4.29% to 4.63%.

This is one market one can understand. The bond market is seeing nothing but much larger debt to come, and that market is the most sophisticated of them all. This market is flashing that rates are going higher. And that means that servicing the national debt, which will grow by trillions, will take ever more money.

As for entitlements, people will not enjoy having their monthly checks reduced. Most people today believe that they are entitled to government payments: they see them as a refund they’ve gotten back after paying so much in taxes.

And as for defense spending, this is theoretically the easiest to cut back, but it still has many very powerful opponents to oppose any reduction.”

Here’s Why the US Govt Interest Bill Will Likely Continue to Rise

If foreign holders of US debt continue to dump it, interest rates will need to rise inorder to attract more buyers…

“Two of the world’s biggest foreign holders of US government debt offloaded a pile of Treasuries in the third quarter as they rallied before the presidential election.

Japanese investors sold a record $61.9 billion of the securities in the three months ended Sept. 30, data from the US Department of the Treasury showed on Monday. Funds in China offloaded $51.3 billion during the same period, the second biggest sum on record.”

Source.

Inflation Isn’t Likely to Go Away

“[T]he new administration has its work cut out for it when it comes to subduing the inflationary forces which have been driving metals prices higher in recent years.

The portion of the U.S. budget available for wholesale cuts is called “discretionary spending.” It represents just a small portion of overall spending. It was only 27% of the total federal budget in 2023. It includes:

- National Defense: Approximately $742 billion in 2023

- Nondefense: Approximately $935 billion in 2023 for categories including:

- Education and workforce development

- Science and researchInfrastructure and transportation

- Healthcare and social services

- Law enforcement and public safety

Last year, the U.S. government forked out approximately $1.7 trillion on discretionary spending. How much of that can be eliminated? Even relatively small, proposed cuts will be greeted with angry opposition by special interests and their allies in Congress.

Nobody in Washington, including the president-elect, has announced plans to touch entitlements – Social Security, Medicare, and other government assistance programs.

The trouble is deficits are forecasted at $2 trillion per year for the next 10 years. If Elon Musk and Vivek Ramaswamy, through their newly created Department of Government Efficiency, are able to trim $1 trillion from federal spending, the deficit will still be $1 trillion per year.

The incoming regime is also an advocate for Fed stimulus – lower interest rates and other inflationary monetary policy.

The infamous U.S. Debt Clock isn’t going to start spinning in reverse any time soon. If it is possible to balance the federal budget, some very hard political choices will have to be made. Until then, the Federal Reserve note “dollar” will likely continue to weaken relative to tangible goods, especially gold and silver.”

Source.

Instead, Are Higher Inflation Rates Coming Back?

In fact the latest US data shows higher inflation might be coming:

“This week, we got higher CPI, PPI, and retail sales, and the incoming data continues to be strong.

Combined with the observed acceleration in average hourly earnings in recent months, the risks are rising that inflation could begin to move higher again”

Source.

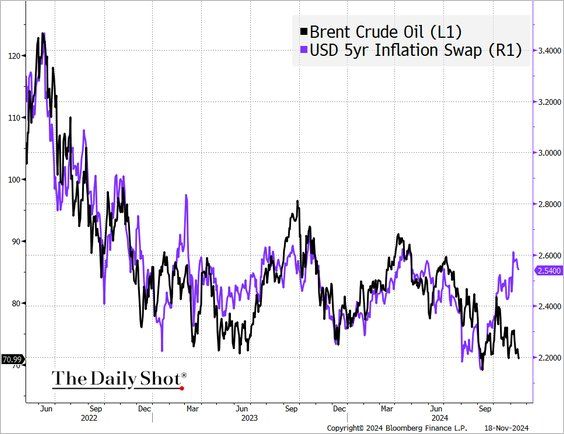

Plus Inflation expectations have diverged from crude oil prices. So crude prices may play catch up at some stage soon.

Source: The Daily Shot

Inflation Also Surprising in Canada

ASB today reported:

“Canadian yields and the Canadian dollar rose after Canadian CPI prices surprised to the upside for headline (0.4% mom, 2.0% yoy), the core measures (2.5% yoy core median, 2.6% yoy trim core). Bank of Canada rate cut odds were trimmed, with markets paring back the odds of a 50bp cut next month.”

While Back Here in NZ:

“Actual inflation as measured by the Consumers Price Index (CPI) has dropped to 2.2% – but the households of New Zealand are having difficulty believing the inflation monster has been beaten.

According to the latest quarterly Household Expectations Survey for the Reserve Bank (RBNZ), kiwi households see inflation (mean measure) at 4.1% in a year’s time.

That’s unchanged from the previous quarter’s survey – even though the latest actual inflation figures showed inflation dropping to 2.2% for the September quarter, from 3.3% as of June. It means that inflation is now back within the targeted 1% to 3% range for the first time since mid-2021.”

Source.

Gold Bull Market: Still Early in “Public Participation Phase”

Incrementum’s Ronnie Stoeferle points out how:

“It’s fascinating to see the sheer level of bearish sentiment surrounding #gold right now. Seems that market sentiment has completely flipped…The correction should not suprise anyone, after a run of nearly $800 in just 12 months…”

Source.

However this chart from Incrementum’s latest excellent chart book shows:

“This bull market for gold is far from over.”

Source.

Current levels will likely prove to be an excellent buying zone a year or 2 from now.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|