Gold Survival Gold Article Updates

Oct. 9, 2013

This Week:

- What Good is a Bar of Gold When the Shelves are Empty?

- More mumbo jumbo from the Central Bankers.

- Why Bill Gross thinks interest rates will stay low

It doesn’t seem like gold has done much over the past week, however it is actually up 2.20% in NZ dollars from our last email, sitting at NZ$1593 today.

Silver has fared even better up 5.15% in a week at NZ$26.94.

As mentioned last week, the NZ gold chart is sitting at a crossroads at the moment. The price is hovering around the lows of April but above the lows of June. Over the past week it has only moved up slightly, so from here we could still see a reverse head and shoulders pattern play out, meaning prices would head higher. But likewise if the opposite happens we will see long term horizontal support broken and then lower prices will be ahead.

Silver is in much the same position as well with a reverse head and shoulders pattern still in play also.

We are still seeing very low interest in both precious metals so until proven otherwise we continue to hope the bottom may well be in.

Debt Ceiling Debacle

It seems it may take an outcome one way or the other with the US debt ceiling to propel gold out of the current tight range. As for what that outcome may be? We wouldn’t have thought it likely that they’ll let the October 17 deadline pass by but now who knows?

Although from what we’ve read the US Treasury has enough funds coming in each month to pay its interest bill so they won’t necessarily default on any debt. But, they would have to prioritise what else to pay for after meeting their interest payments. Shock horror – Just like a normal person / family / business! What a crazy world when the norm is the usual.

What Good is a Bar of Gold When the Shelves are Empty?

We received an email from a reader this week asking the above question. It’s sort of along the lines of the old adage of you can’t eat gold. Anyway, we thought it might be of interest to others so have turned it into an article and so it is this weeks feature article.

We received an email from a reader this week asking the above question. It’s sort of along the lines of the old adage of you can’t eat gold. Anyway, we thought it might be of interest to others so have turned it into an article and so it is this weeks feature article.

What Good is a Bar of Gold When the Shelves are Empty?

Coincidentally this video linked below we posted also partly touches on the same topic. It’s by Chris Duane of the Silver Bullet Silver Shield, also coincidentally in answer to an email he got from someone with the subject line: Buying Silver Was The Stupidest Move I Ever Made! It’s a good recap of the fundamentals for buying silver and at the 10:20 min mark also looks at how silver might perform in a collapse.

Coincidentally this video linked below we posted also partly touches on the same topic. It’s by Chris Duane of the Silver Bullet Silver Shield, also coincidentally in answer to an email he got from someone with the subject line: Buying Silver Was The Stupidest Move I Ever Made! It’s a good recap of the fundamentals for buying silver and at the 10:20 min mark also looks at how silver might perform in a collapse.

Buying Silver Was The Stupidest Move I Ever Made!

The final article this week is an interview with investment industry stalwart Don Coxe. He has some quite different views on what will drive gold but some different perspective is always useful…

The final article this week is an interview with investment industry stalwart Don Coxe. He has some quite different views on what will drive gold but some different perspective is always useful…

Why Don Coxe Expects Gold to Soar on Good Economic News

More Mumbo Jumbo from the Central Bankers

This week the RBNZ deputy gave a speech discussing “neutral interest rates” which is supposedly where the price of money should be set to not have stimulatory or negative impacts on the economy. Quite how the RBNZ determines this is a mystery to us? It obviously requires an advanced mathematics degree. Anyway, supposedly we are near the point where this rate should be neutral according to the RBNZ deputy. Source.

Given low interest rates are very stimulatory at the moment (rising house prices would show this), the consensus seems to be they will have to rise in the next year or 2. And that was the inference in central banker speak from the deputies speech. We’ve read a number of articles also referencing higher rates ahead over the past week or so. Such as these:

Get ready to pay more on your mortgage – Governor

OCR set to rise but extent still unclear

But as we said a couple of weeks ago, we wonder if this meme of rising interest rates is as much of a given as they would have us believe. Just this past week Bill Gross, head of massive bond fund PIMCO, said in his latest Investment Outlook:

—–

“If you want to trust one thing and one thing only, trust… that Fed Funds [interest rate] will stay lower than expected for a long, long time.

Right now, the market (and the Fed forecasts) expects the Fed Funds [interest rate] to be 1% higher by late 2015, and 1% higher still by December 2016. Bet against that.”

—–

But his boldest call was in relation to how long a “long, long time” might be…

—–

“The U.S. (and global economy) may have to get used to financially repressive – and therefore low policy rates – for decades to come.”

—–

As Gross points out the Fed funds rate is the main driver for interest rates everywhere else in the world too. So if he is right, then interest rates here in NZ could stay low for much longer than analysts here imagine.

Something else to consider is a recent report by reuters of PIMCO front running the Fed while having some of their staff seconded to the Fed to do bond buying on the Feds behalf – but supposedly “walled off” from the rest of the company.

So while there may be “no evidence of illegality or impropriety in Pimco’s actions. Pimco says that it kept its employees who were helping the Fed at arm’s length from those investing for its funds, and that its bond-buying bet was conceived before the Fed’s program was begun. The Fed says it implemented and enforced strict controls over the trading done by the firms.”

But we’d say PIMCO might have an inclination as to what the Fed is up to regardless of how “walled off” its staff are.

So, if we had to make a bet we’d side with Gross rather than local bank analysts on what interest rates might do. So don’t believe the hype about rates rising next year.

(Late Update: We just stumbled across this interesting post by Mish Shedlock looking at Gross’s comments too that is worth a read…

Case for Gold vs. the Case for Treasuries; Is Bill Gross Talking His Book or Talking Reality?)

So why does Gross think interest rates will stay low?

Because the US economy is still too weak to handle higher rates. He argues that interest rates rising at the mere mention of possible tapering in recent months shows this to be the case.

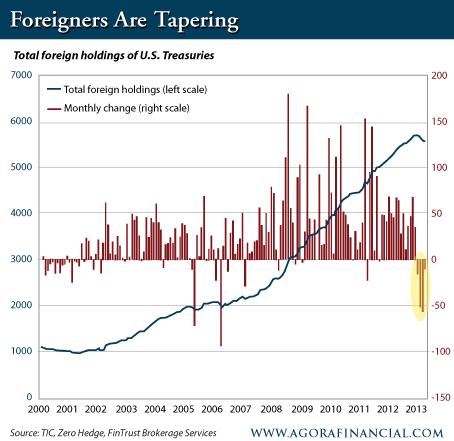

We also reckon it might be as much to do with the chart below showing that foreigners are selling US government debt at a steady pace:

Why does this matter?

Well, if no one else is buying US debt then the Fed will have to continue to do so. And if they keep on buying more and more of it, they can likely keep interest rates low for much longer than many people expect.

Greg Canavan in the Daily Reckoning Australia points out that the ongoing declining purchases of US treasuries by US creditors will eventually lead to major problems. And his warnings for Australia would seem to apply just as much to us here in NZ so are worth reprinting verbatim…

—–

“If foreign investors have deserted the Treasury market, you may be wondering why the US dollar is not weaker. Well, so far, foreigners have just shifted their assets from long term debt securities to short term cash type deposits. We don’t really know what to make of it, other than to say cash is less risky than a highly inflated bond market where a central bank is the primary buyer.[…]

[…] In order to maintain control [of their various “colonies” in the middle east] though, they need to continue spending large amounts on a military presence. When you rely on foreigners to provide you with credit to do that though, it becomes a difficult task when your foreign creditors pull back.

We’re not sure whether the hard core Republicans actually understand this, or if they’re just trying to use the debt ceiling and shutdown to achieve their own short term political aims. But it is clear that Obama doesn’t understand (or doesn’t care) about the US’ looming financing difficulties one little bit. It’s a spend, spend, spend administration and damn the consequences.

Well, at some point, there will be consequences. And we think that point is approaching quicker than most people realise.

So what will the consequences be for Australia? We really don’t know. If the credit of the world’s most powerful nation comes under scrutiny, we would guess the result would be a lot of confusion and volatility.

Countries like Australia [and New Zealand! – Ed.], who also rely on foreigners to finance our deficits, might come under particular pressure as foreign capital becomes nervous. That last happened during the height of the credit crisis.

Only this time the government won’t have as many levers to pull to insulate us from the volatility. And China won’t be able to pull out another massive stimulus to boost our national income. In short, when the next crisis hits we’ll be defending ourselves from a position of relative weakness.

How this all plays out is anyone’s guess, but it is becoming increasingly clear that the age of American empire is over. The transition will take years still to play out, but they will be increasingly uncertain years.

Which is the problem with the stock market and asset prices in general now – especially Aussie residential property. These assets are pricing in a very certain future. Certainty of income and capital growth and certainty of economic stability to provide this growth. But more than at any time in the past few years, the future is murky and fraught with danger.

After all, the world’s biggest spendthrift doesn’t get its credit card cancelled every day. And while it might be happening in slow motion, the data tells you that is exactly what is happening.”

—–

India and Thailand vs NZ and Australia

India and Thailand also have current account deficits. Like us and Aussie they import more than they export. However our deficit is caused by importation of consumer products and gadgets. Whereas India and Thailand’s are caused or at least greatly impacted by importing significant amounts of gold and silver. So unlike India and Thailand the residents of Australia and New Zealand will only have iPads, cars and over-valued and indebted property to protect them.

However there is a difference also between India and Thailand. While the Indian government’s determined efforts to stop it’s citizens buying gold are well documented, in Thailand their finance minister is doing the exact opposite according to one readers reports in the latest issue of our favourite investment newsletter, Chris Weber’s Global Opportunities Report.

Here is what the Thai Finance Minister Korn Chatikavanij said in response to critics of Thailand’s current account deficit on September 26: “It is a good thing that we import gold and that people accumulate gold for savings.”

We couldn’t find the quote via Google so it was probably from a local Thai publication. Nonetheless we can’t imagine Bill English ever saying such a thing!

So if you agree with Mr Chatikavanij that it’s a good thing to accumulate gold for savings then you know where to find us.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| US Govt Shutdown vs the Debt “Ceiling” |

2013-10-02 02:56:42-04 2013-10-02 02:56:42-04

Gold Survival Gold Article Updates: October 02,2013 Note: We have a late notice today only special on Canadian Silver Maples. Jump to the end of the email if you want to see that before 5pm. This Week: US Govt shutdown vs the debt “ceiling” How Likely is a Taper Really? See John Butler of […] |

| Why Don Coxe Expects Gold to Soar on Good Economic News |

2013-10-02 21:19:43-04 2013-10-02 21:19:43-04

Don Coxe has been around for 40 years in the investment industry and in this interview he gives some interesting opinions on when and why gold will rise. To be honest we’re not sure we would agree with a few of them but then we don’t have 40 years experience either! Regardless it’s worth a […] |

| Buying Silver Was The Stupidest Move I Ever Made! |

2013-10-07 18:47:09-04 2013-10-07 18:47:09-04

This new video from Chris Duane provides some food for thought if you’ve bought precious metals at higher prices than todays. He responds to a readers email who said that “Buying silver might be the stupidest move I ever made“. His average price of purchase was US$37.75 and he asks the question “How do I […] |

| What Good is a Bar of Gold When the Shelves are Empty? |

2013-10-07 22:57:05-04 2013-10-07 22:57:05-04

This week we received the following question from a reader and we thought it worth sharing our response in case it is of interest to you too… Thanks for the course, I am 5 modules completed. [Our free ecourse begins here – Ed.] Q – can you tell me or point me to resources […] |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1593/ oz

|

US $1319.64/ oz

|

|

Spot Silver |

|

| NZ $26.94/ oz

NZ $866/ kg |

US $22.31/ oz

US $717.39/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$940.42

(price is per kilo only for orders of 5 kgs or more)

(fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Gold Prices | Gold Investing Guide Live Report from the Gold Symposium Sydney