This Week:

- Problems with the RBNZ Bank Stress Tests

- The Problem with a Central Bank as Sole Issuer of Currency

- Maybe A Cashless Society is Still a Way Off

Prices and Charts

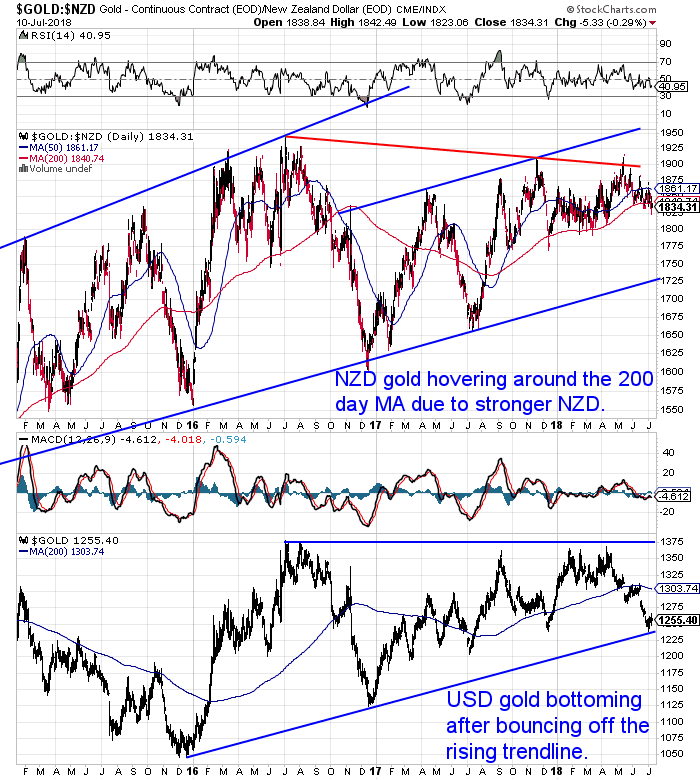

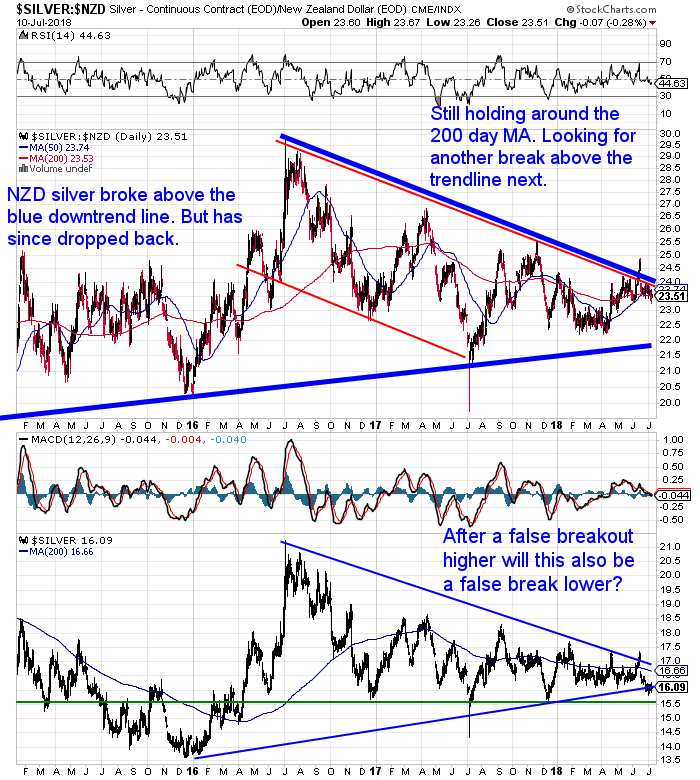

NZD Gold Down Due to Stronger Kiwi Dollar

Gold priced in New Zealand dollars fell a little under 1% for the week. Solely due to the New Zealand dollar finally bouncing higher.

NZD gold is hovering just below the 200 day moving average (MA). So far in 2018 it has spent very little time below this indicator. With the US gold price bouncing off the uptrend line and the kiwi dollar remaining in a downtrend overall (see chart further down), odds favour NZD gold not dipping too much lower than this.

Silver in NZ dollars also sits just on the 200 day MA. Getting cramped between it and the falling downtrend line. It remains to be seen if the brief breakout last month will be a false move higher, or the start of a larger move up.

Kiwi Dollar Finally Bouncing Higher

As noted already, the Kiwi dollar did finally bounce higher this week. But it remains in a clear downtrend. It could face resistance at the 0.69 level. A round number and also where the downtrend line since April sits.

Overall for local gold and silver prices we could see a little further weakness if the NZ dollar continues rising a little higher. But this could be tempered by the offshore gold and silver prices rising.

However if the NZ dollar weakness persists and we get a bit of strength in US gold and silver prices, we could see some new highs in local precious metals prices in the months ahead.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Problems with the RBNZ Bank Stress Tests

Did you know the Reserve Bank of New Zealand conducts stress tests of New Zealand banks?

We wouldn’t blame you if you didn’t as the latest results have received little publicity.

Find out what the results of the stress tests were and why they won’t help you determine the soundness of your individual bank.

The Problem with a Central Bank as Sole Issuer of Currency

There’s been a lot of talk in recent months about why we should have central banks as the sole issuer of currency. Switzerland even had a referendum and vote on whether commercial banks should be stopped from lending money into existence.

Find out what the problems are with “sovereign money” and why money for the people won’t be as great as its proponents would like you to believe.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Reminder: Why Gold Bullion is Your Financial Insurance

This post from last week proved popular. So just a reminder in case you missed it.

The idea of gold as “financial insurance” is a good way to explain the need for precious metals to the uninitiated.

So if you have trouble convincing anyone of the need to hold gold, then this may help. We compare gold to a standard insurance policy for your house or car, and see how similar it is.

Although there is also a key difference and advantage with gold…

Have you got your financial insurance yet? Remember it’s too late to buy insurance once the “house is on fire”.

Maybe A Cashless Society is Still a Way Off

We’ve reported plenty on the move towards a cashless society and the war on cash.

It seems kind of inevitable to us.

Although maybe a cashless society will take longer to arrive than we think. Herald business editor Liam Dann thinks so:

Liam Dann: Predicting the end of money is bananas

“Lately the most fashionable target for predicted extinction is money – at least the hard cash variety.

The rise of digital payment technologies like mobile banking and pay wave as well as the investment boom in digital blockchain currencies has some predicting we’re approaching a cashless society.

A survey out last week from accounting software company MYOB found 78 per cent of small to medium-sized businesses predicted the local economy will be cashless within 20 years and 36 per cent think it will be gone in a decade.

I hardly ever use real cash so I find it a tempting forecast to believe. As with all these trends, it might come true one day.

But despite the arrival of Eftpos more than 30 years ago the Reserve Bank has to print more cash than it ever did – the amount in circulation continues to grow by about five per cent a year.

The Reserve Bank notes New Zealand is not unique – this is a global trend.

The Reserve Bank also put out a report on the future of money last week. It took a look at the threat blockchain currencies pose to the financial system and considered whether New Zealand needed to issue its own.

The conclusion: not yet.

I don’t doubt the tech experts who tell me blockchain technology has the potential to change the world one day. But I doubt digital currency will be in common usage any time soon. In fact, I’d bet a bunch of bananas on it.”

He may have a point too. Latest research from the RBNZ shows that surprisingly about a third of physical currency is held outside New Zealand. The RBNZ governor Adrian Orr said the changeover to their new series seven bank notes is progressing slower than expected, as the reserve bank isn’t seeing as many notes returning to them.

“Six is being destroyed at a slower rate than perhaps what we thought so seven is being circulated at a slower rate,” he said. “I think a lot of currency goes out and stays out.”

The central bank has just completed a research programme looking at the wider currency cycle and has found that while the majority of New Zealand’s cash stays in the country, about a third is held outside of the country.

“A lot of the cash that exists doesn’t necessarily come back so it’s being used as a store of wealth and a means of exchange in other countries,” he said. While this was a sign of confidence in our currency, it left open the question of what it was being used for, he said.”

The report went on to say:

“Part of the Reserve Bank’s research was looking at how to forecast future demand for cash. Despite the increased use of electronic payments, the amount of physical currency in circulation continues to grow every year as the economy expands and people still like to hold something tactile, particularly following events like earthquakes.”

Source: NZ BANKNOTES STAYING IN CIRCULATION LONGER THAN EXPECTED, RBNZ’S ORR SAYS

More Cash is Being Hoarded NOT Circulated

Although perhaps the report isn’t quite worded correctly to say the amount of physical currency in circulation grows each year. Maybe more correct wording would be to say the amount of physical cash being hoarded grows each year.

This is why the notes don’t make their way back to the Reserve Bank. As they are not actually in circulation in the economy and therefore don’t return to the commercial banks to recycle to the Reserve Bank.

Of course the central planners would have us believe this is all drug dealers and criminals using cash.

While having some cash on hand is definitely advised, we’d prefer to hoard bullion than cash for the long run.

With cash you’re guaranteed to lose purchasing power in the long run. Whereas with goldyou will maintain your purchasing power over the long run. You may even increase it in the years ahead.

If you need to hoard some metal, there are plenty of deals going currently.

So head over and see all the new products available today.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Big Berkey Water Filter

Only 2 Remaining in the New Shipment – Learn More NOW….

—–

|